Montana Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company

Description

How to fill out Distribution Agreement Between First American Insurance Portfolios, Inc. And SEI Financial Services Company?

It is possible to spend hrs on the Internet attempting to find the authorized record format that suits the state and federal demands you will need. US Legal Forms offers a huge number of authorized kinds that happen to be evaluated by specialists. You can easily obtain or print out the Montana Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company from your support.

If you already have a US Legal Forms accounts, it is possible to log in and click the Download key. Following that, it is possible to total, modify, print out, or indicator the Montana Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company. Every authorized record format you get is your own for a long time. To acquire one more duplicate of any bought type, check out the My Forms tab and click the related key.

If you work with the US Legal Forms website initially, keep to the simple instructions below:

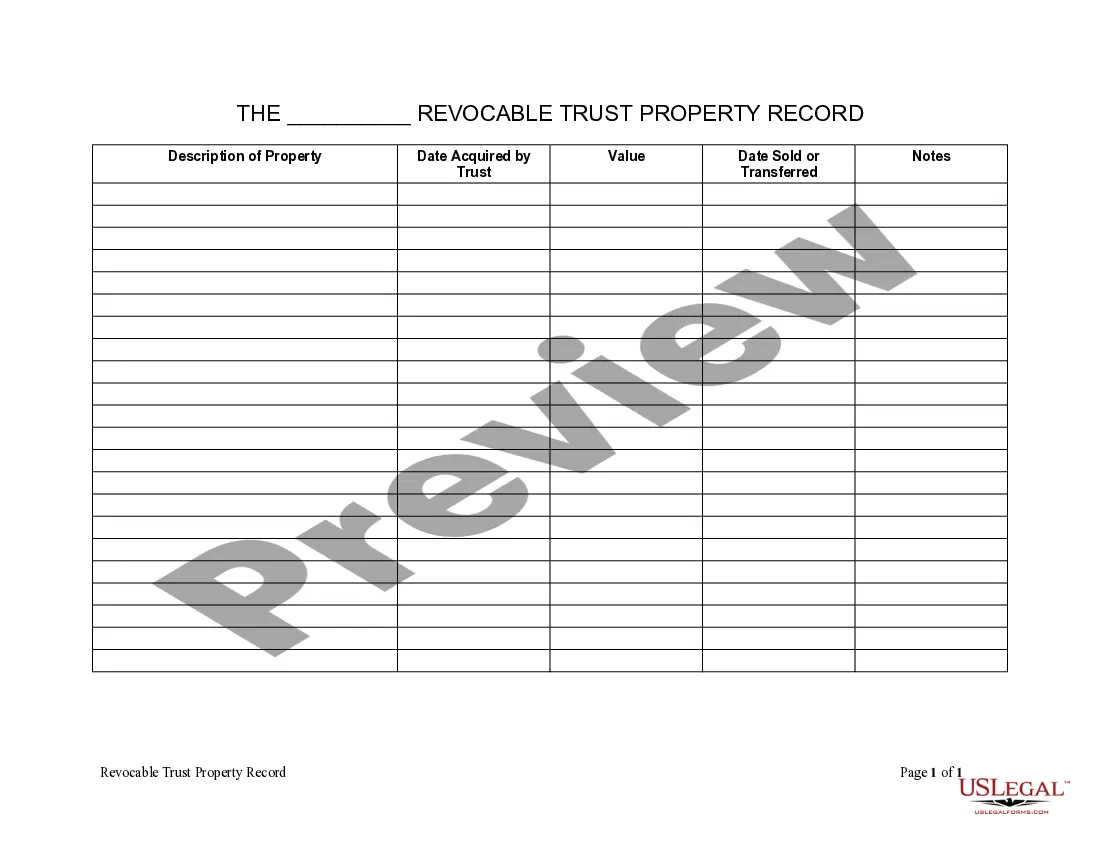

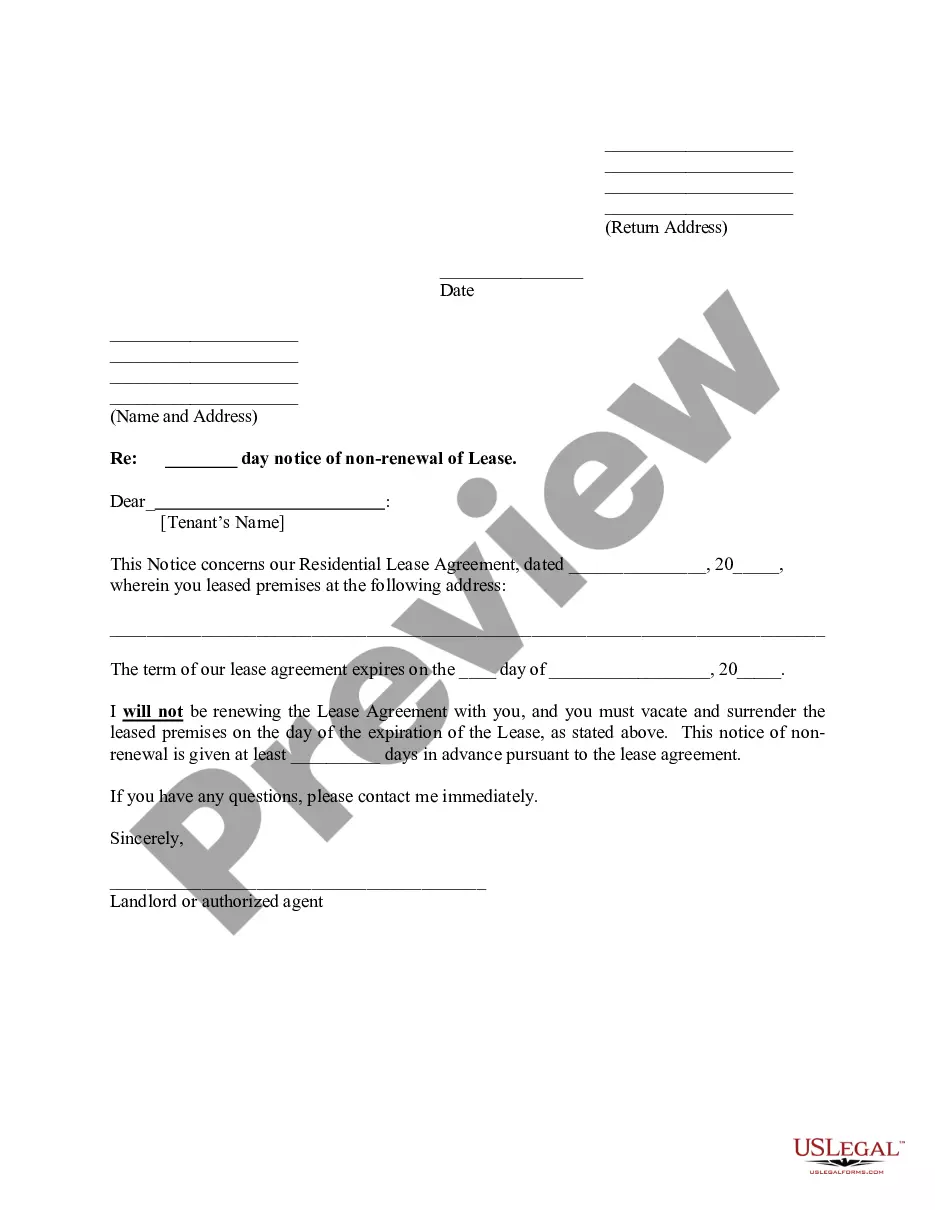

- Initial, ensure that you have selected the proper record format for your state/town that you pick. See the type explanation to ensure you have selected the proper type. If accessible, make use of the Preview key to check from the record format as well.

- If you wish to discover one more variation from the type, make use of the Research discipline to get the format that suits you and demands.

- After you have found the format you desire, click on Get now to carry on.

- Choose the pricing strategy you desire, enter your accreditations, and sign up for a free account on US Legal Forms.

- Total the transaction. You may use your charge card or PayPal accounts to fund the authorized type.

- Choose the formatting from the record and obtain it in your gadget.

- Make adjustments in your record if necessary. It is possible to total, modify and indicator and print out Montana Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company.

Download and print out a huge number of record templates while using US Legal Forms site, that provides the largest selection of authorized kinds. Use professional and state-particular templates to handle your business or individual requirements.