Title: Understanding the Montana Merger Plan and Agreement between Charge. Com, Inc. and Para-Link, Inc. Keywords: Montana merger plan, Montana merger agreement, Charge. Com, Inc., Para-Link, Inc. Introduction: The Montana Merger Plan and Agreement between Charge. Com, Inc. and Para-Link, Inc. is a strategic collaboration aimed at creating synergies and maximizing business opportunities. This partnership combines the strengths, resources, and expertise of both companies to enhance their market positioning and drive growth. Let's dive into the details of this merger plan and agreement. 1. Montana Merger Plan: The Montana Merger Plan refers to the comprehensive strategy developed by Charge. Com, Inc. and Para-Link, Inc. to merge their operations, assets, and resources into a single entity. This plan outlines the process of integration, defining goals, ensuring operational efficiency, and creating a framework for long-term success. 2. Montana Merger Agreement: The Montana Merger Agreement is a formal document that legally binds Charge. Com, Inc. and Para-Link, Inc. together. It outlines the terms and conditions of the merger, including the exchange of shares, transfer of assets, and the governance structure of the new entity. This agreement provides a roadmap for both companies to work together smoothly during the transition and beyond. Types of Montana Merger Plan and Agreement: 1. Stock-for-Stock Merger: In this type of merger plan, Charge. Com, Inc. and Para-Link, Inc. agree to exchange shares of their respective companies' stock. This allows both companies to become shareholders in the new entity, sharing the risks and rewards of the merged company. 2. Asset Acquisition Merger: Under this merger plan, Charge. Com, Inc. acquires the assets of Para-Link, Inc. This type of merger focuses on acquiring specific tangible and intangible assets, intellectual property, or customer base of Para-Link, Inc., while not necessarily assuming its liabilities. 3. Cash Merger: In a cash merger plan, Charge. Com, Inc. agrees to acquire Para-Link, Inc. by paying cash for the shares owned by Para-Link, Inc.'s shareholders. This type of merger allows the acquired company's shareholders to receive immediate cash return on their investment. Conclusion: The Montana Merger Plan and Agreement between Charge. Com, Inc. and Para-Link, Inc. represents a significant business collaboration designed to leverage the strengths of both companies. Whether executed as a stock-for-stock merger, asset acquisition merger, or cash merger, this strategic partnership aims to create a stronger and more competitive entity that can drive growth and deliver value to shareholders.

Montana Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc.

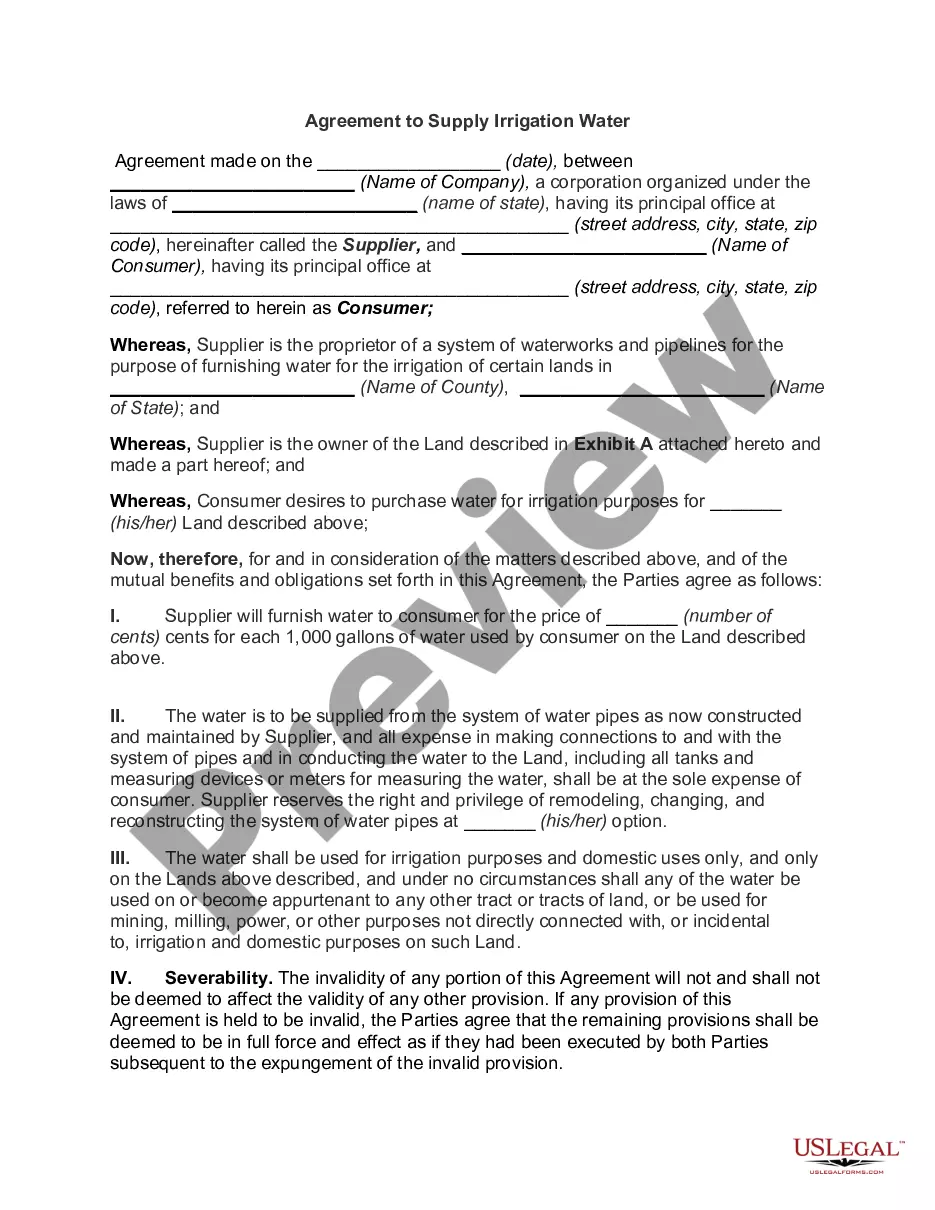

Description

How to fill out Montana Merger Plan And Agreement Between Ichargeit.Com, Inc. And Para-Link, Inc.?

US Legal Forms - among the most significant libraries of authorized forms in the United States - offers a wide range of authorized file web templates you may down load or print. Utilizing the site, you can find 1000s of forms for enterprise and personal uses, categorized by categories, states, or keywords.You can get the most up-to-date versions of forms like the Montana Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc. in seconds.

If you have a registration, log in and down load Montana Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc. in the US Legal Forms catalogue. The Acquire switch will appear on each form you view. You have accessibility to all in the past saved forms inside the My Forms tab of your respective account.

In order to use US Legal Forms the first time, allow me to share easy guidelines to get you began:

- Make sure you have chosen the correct form for your personal metropolis/region. Click the Preview switch to examine the form`s information. Browse the form information to ensure that you have chosen the correct form.

- When the form does not fit your requirements, make use of the Search area at the top of the display screen to get the one who does.

- When you are content with the shape, confirm your decision by simply clicking the Purchase now switch. Then, select the pricing prepare you favor and provide your accreditations to sign up for the account.

- Approach the transaction. Use your credit card or PayPal account to finish the transaction.

- Choose the structure and down load the shape on your own product.

- Make modifications. Load, change and print and indication the saved Montana Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc..

Each template you included with your account lacks an expiry time and is your own permanently. So, in order to down load or print yet another copy, just check out the My Forms area and then click on the form you require.

Get access to the Montana Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc. with US Legal Forms, probably the most substantial catalogue of authorized file web templates. Use 1000s of skilled and express-distinct web templates that satisfy your small business or personal requirements and requirements.