Montana Class C Distribution Plan and Agreement is a comprehensive framework established for the distribution of mutual funds, specifically between Putnam Mutual Funds Corp and Putnam High Yield Trust II. This plan and agreement outline the terms, conditions, and procedures for the distribution of Class C shares of mutual funds offered by these entities. The Montana Class C Distribution Plan and Agreement is designed to ensure a smooth and efficient distribution process, facilitating the investment and redemption of shares for investors. Through this agreement, Putnam Mutual Funds Corp and Putnam High Yield Trust II strive to meet the needs and expectations of their clients, while complying with regulatory standards and industry best practices. The agreement covers various aspects related to the distribution of Montana Class C shares, including sales charges, fees, commissions, and distribution expenses. It outlines the responsibilities and obligations of both parties involved and provides guidelines for the fair and transparent distribution of the fund's shares. Under the Montana Class C Distribution Plan and Agreement, the details of different types of Class C shares may be specified, offering investors flexibility and options based on their investment preferences and objectives. These variations could include different fee structures, redemption terms, or load options that cater to the diverse needs of investors. The agreement typically outlines the procedures for the purchase and sale of Class C shares, including the payment process and the timeline for settling transactions. It may also outline any specific requirements or restrictions that apply to the distribution of these shares, such as limitations on certain types of investors or minimum investment amounts. Moreover, the Montana Class C Distribution Plan and Agreement may detail the responsibilities and obligations of each party involved in the distribution process. This includes the role of Putnam Mutual Funds Corp as the fund distributor and Putnam High Yield Trust II as the issuer of the mutual funds. The agreement ensures that both parties adhere to applicable laws, regulations, and ethical standards, promoting investor protection and confidence. In summary, the Montana Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II provides a comprehensive framework for the distribution of mutual funds. It establishes guidelines, terms, and conditions that govern the distribution process, ensuring a fair and efficient experience for investors. The agreement may encompass different types of Montana Class C shares, offering flexibility and options based on investors' preferences and objectives.

Montana Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

Description

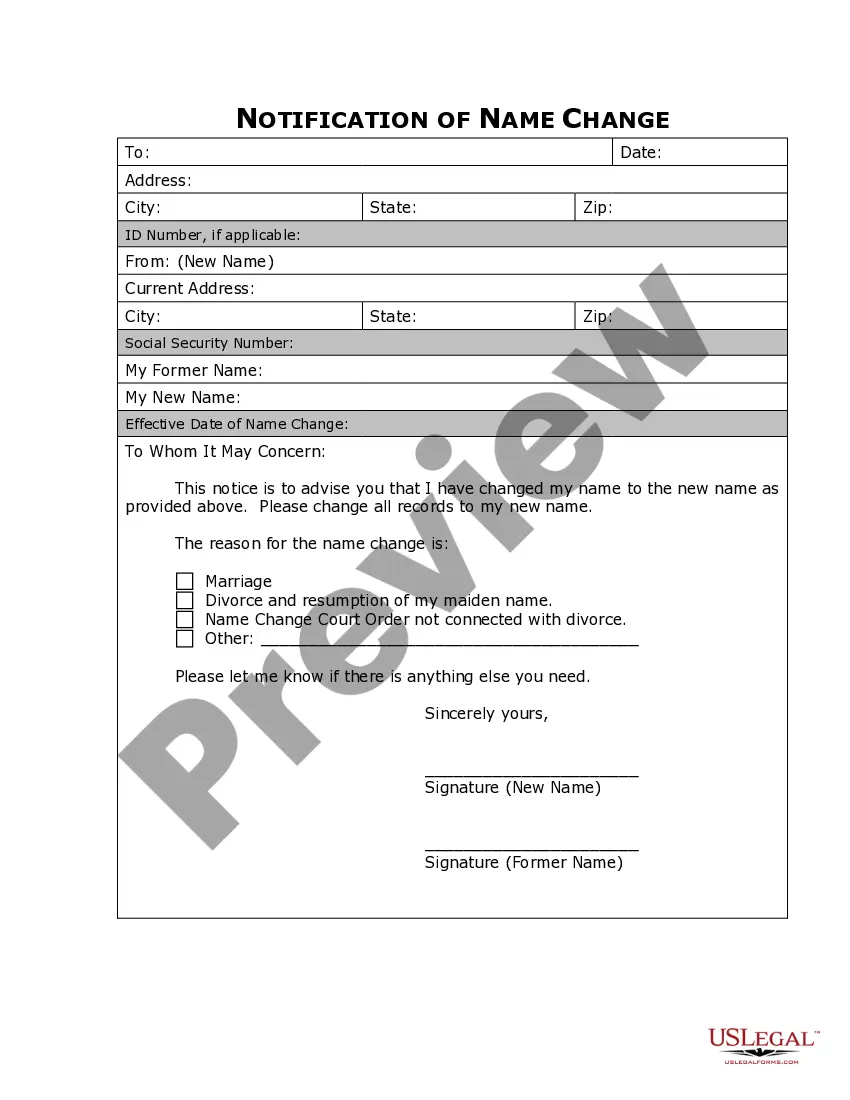

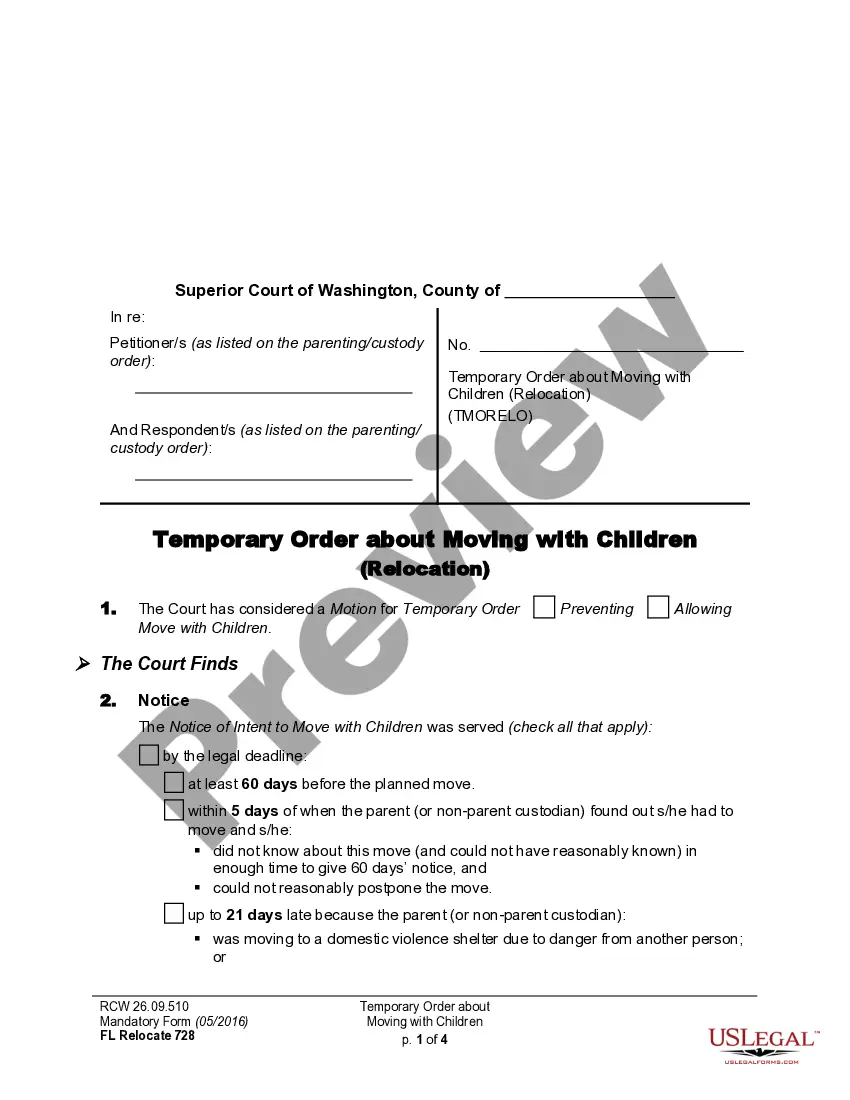

How to fill out Montana Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

Finding the right lawful papers design could be a have difficulties. Naturally, there are tons of themes available on the net, but how do you discover the lawful develop you need? Make use of the US Legal Forms internet site. The assistance delivers a huge number of themes, such as the Montana Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II, which can be used for business and private requires. All the kinds are checked by professionals and fulfill federal and state needs.

When you are already registered, log in to the accounts and click on the Down load switch to get the Montana Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II. Make use of your accounts to search throughout the lawful kinds you have ordered in the past. Go to the My Forms tab of your accounts and get yet another backup in the papers you need.

When you are a new user of US Legal Forms, listed here are basic instructions for you to comply with:

- First, be sure you have selected the appropriate develop for your area/state. It is possible to examine the shape making use of the Preview switch and look at the shape outline to ensure this is basically the right one for you.

- In the event the develop is not going to fulfill your expectations, take advantage of the Seach area to find the appropriate develop.

- Once you are certain that the shape is acceptable, go through the Get now switch to get the develop.

- Opt for the rates strategy you would like and enter in the necessary information and facts. Design your accounts and pay money for an order making use of your PayPal accounts or credit card.

- Choose the document format and download the lawful papers design to the product.

- Complete, change and produce and sign the acquired Montana Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II.

US Legal Forms is definitely the greatest library of lawful kinds where you can discover numerous papers themes. Make use of the company to download expertly-produced documents that comply with express needs.

Form popularity

FAQ

Class C shares are often purchased by investors who have less than $1 million in assets to invest in a fund family and who have a shorter-term investment horizon, because during those first years Class C shares will generally be more economical to purchase, hold and sell than Class A shares.

Putnam Investments ? ETFs, Mutual Funds, Institutional, and 529. Putnam is the only fund family ranked in the top 10 by Barron's across all time periods. Barron's list of Best Fund Families, 2023.

Class C shares are level-load shares that don't impose a sales charge unless you sell too soon after your purchase (usually a period of a year). Instead, mutual funds charge an ongoing annual fee. C shares are probably best for short term investors of beyond one year and no more than three years.

Class C shares of a Fund acquired through automatic reinvestment of dividends or distributions will convert to Class A shares of the Fund on the Conversion Date pro rata with the converting Class C shares of the Fund that were not acquired through reinvestment of dividends or distributions.

Class C shares don't impose a front-end sales charge on the purchase, so the full dollar amount that you pay is invested. Often Class C shares impose a small charge (often 1 percent) if you sell your shares within a short time, usually one year.

Class C shares are a class of mutual fund share characterized by a level load that includes annual charges for fund marketing, distribution, and servicing, set at a fixed percentage. These fees amount to a commission for the firm or individual helping the investor decide on which fund to own.

Long-term investors (more than five years, at least, and preferably more than 10) will do best with class A share funds. Even though the front load may seem high, the ongoing, internal expenses of class A share funds tend to be lower than those of B and C shares.

The trailing commission is calculated as a percentage of the entire investment brought to a fund by a particular intermediary. It is calculated on a daily basis and paid every quarter. So, higher the investment an intermediary brings to a fund, higher is the trailing commission.