Montana Accredited Investor Veri?cation Letter - Individual Investor

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

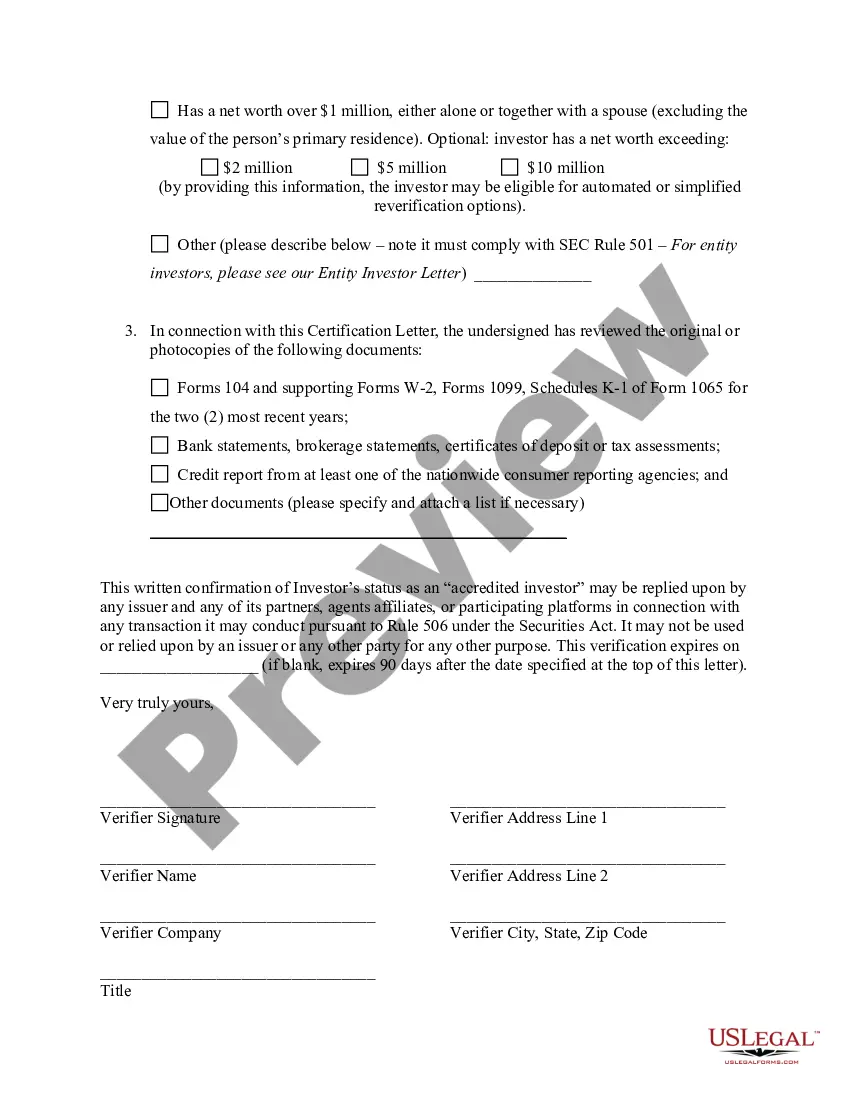

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Veri?cation Letter - Individual Investor?

Are you in a position in which you need files for sometimes enterprise or person functions virtually every day? There are plenty of legitimate file templates accessible on the Internet, but locating versions you can depend on is not easy. US Legal Forms offers thousands of form templates, like the Montana Accredited Investor Veri?cation Letter - Individual Investor, that happen to be written to meet federal and state requirements.

If you are already acquainted with US Legal Forms internet site and get your account, merely log in. Afterward, it is possible to acquire the Montana Accredited Investor Veri?cation Letter - Individual Investor format.

Unless you offer an bank account and would like to begin using US Legal Forms, adopt these measures:

- Get the form you want and make sure it is to the right city/state.

- Use the Preview option to review the form.

- Browse the outline to ensure that you have chosen the right form.

- In the event the form is not what you`re trying to find, use the Research field to discover the form that fits your needs and requirements.

- If you get the right form, simply click Buy now.

- Choose the costs strategy you need, submit the specified information and facts to create your bank account, and buy an order utilizing your PayPal or bank card.

- Choose a hassle-free paper format and acquire your duplicate.

Find each of the file templates you possess bought in the My Forms food list. You can aquire a more duplicate of Montana Accredited Investor Veri?cation Letter - Individual Investor anytime, if needed. Just go through the needed form to acquire or printing the file format.

Use US Legal Forms, the most extensive assortment of legitimate forms, in order to save time as well as stay away from faults. The assistance offers professionally manufactured legitimate file templates which you can use for a variety of functions. Make your account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.

Non-accredited investors are limited by the SEC from some investment opportunities for their own financial safety. The SEC also set regulations on the disclosure and documentation of the investments available to the investors. For example, non-accredited investors are eligible to invest in mutual funds.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

Both are designations of investors that are permitted to invest in non-public investments. The difference between the two is that accredited investors must meet certain income, net worth or securities licensing criteria, while a qualified purchaser must simply have more than $5 million to make a large investment.

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.