Montana Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

US Legal Forms - one of several biggest libraries of legal forms in America - provides a wide array of legal file templates it is possible to down load or print out. Utilizing the web site, you may get a huge number of forms for company and person purposes, sorted by classes, says, or keywords.You can find the most recent versions of forms much like the Montana Term Sheet - Convertible Debt Financing in seconds.

If you already have a registration, log in and down load Montana Term Sheet - Convertible Debt Financing from the US Legal Forms catalogue. The Down load switch will show up on every single type you perspective. You have access to all in the past acquired forms inside the My Forms tab of your own profile.

If you wish to use US Legal Forms the very first time, listed below are basic directions to obtain started off:

- Be sure to have picked the right type for your personal town/area. Select the Preview switch to review the form`s content. Browse the type information to ensure that you have chosen the right type.

- In the event the type does not suit your demands, take advantage of the Research field towards the top of the screen to discover the one who does.

- When you are content with the form, validate your decision by simply clicking the Purchase now switch. Then, opt for the rates plan you want and provide your accreditations to register to have an profile.

- Approach the financial transaction. Make use of bank card or PayPal profile to accomplish the financial transaction.

- Pick the file format and down load the form on your system.

- Make modifications. Fill up, change and print out and indication the acquired Montana Term Sheet - Convertible Debt Financing.

Every single format you added to your money does not have an expiration date which is the one you have forever. So, if you would like down load or print out one more version, just check out the My Forms section and then click about the type you need.

Get access to the Montana Term Sheet - Convertible Debt Financing with US Legal Forms, the most comprehensive catalogue of legal file templates. Use a huge number of expert and express-distinct templates that satisfy your small business or person requires and demands.

Form popularity

FAQ

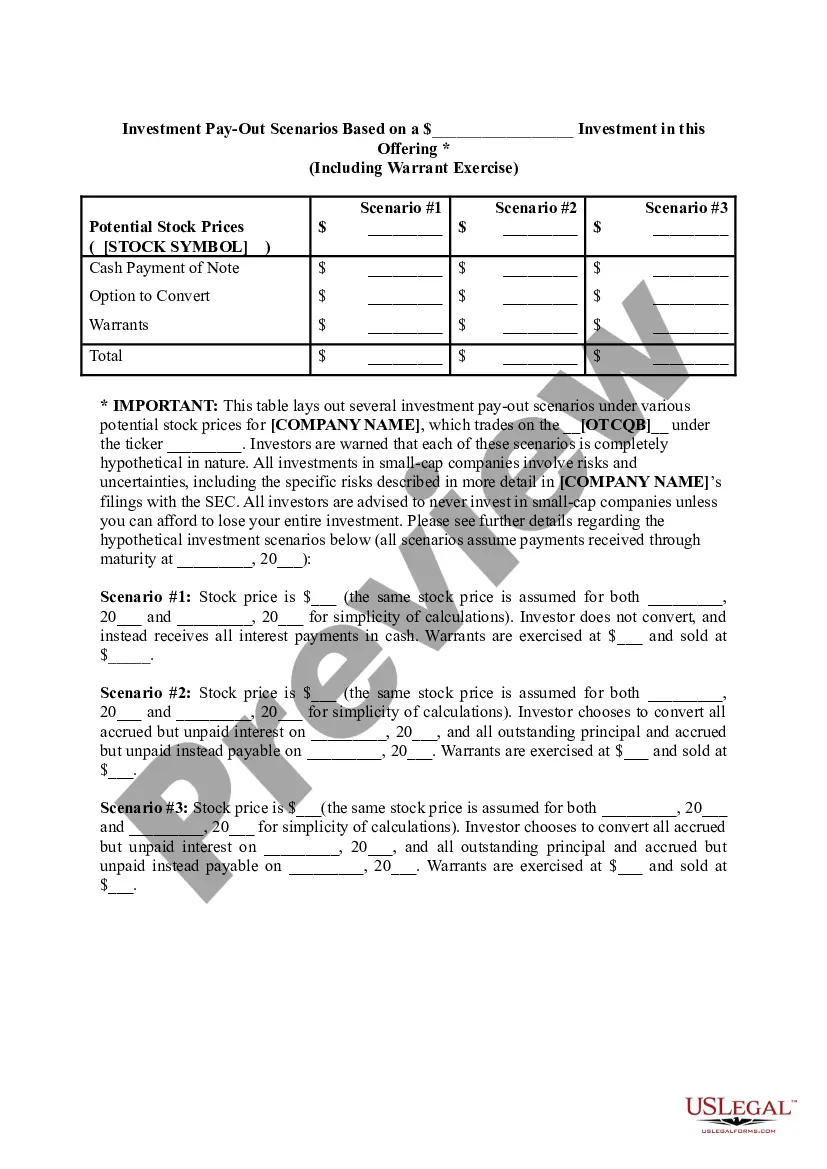

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process. Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

The Minimum amount of Investment required is Rs 25 lakhs. CCD'S can be issued at any amount. There is no minimum amount criteria. Convertible Notes can be issued without prior valuation.

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

Convertible Note - Reporting Requirements FIRC and KYC of the non-resident investor. Name and address of the investor and AD bank. Copy of MOA / AOA. Certificate of Incorporation. Startup Registration Certificate. Certificate from Practising Company Secretary.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.