Montana Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

Choosing the right legitimate document design could be a have difficulties. Naturally, there are tons of layouts available on the Internet, but how can you get the legitimate develop you will need? Make use of the US Legal Forms web site. The assistance delivers 1000s of layouts, including the Montana Summary of Terms of Proposed Private Placement Offering, that can be used for organization and personal requires. All of the kinds are inspected by pros and fulfill state and federal requirements.

Should you be presently authorized, log in to your accounts and then click the Down load button to get the Montana Summary of Terms of Proposed Private Placement Offering. Use your accounts to search through the legitimate kinds you possess bought formerly. Check out the My Forms tab of your own accounts and acquire one more backup of your document you will need.

Should you be a whole new consumer of US Legal Forms, allow me to share basic recommendations that you should follow:

- Initially, make certain you have chosen the right develop for your personal area/region. You can look over the shape using the Preview button and study the shape description to make certain this is basically the right one for you.

- In case the develop fails to fulfill your expectations, take advantage of the Seach field to get the right develop.

- When you are certain the shape would work, go through the Buy now button to get the develop.

- Choose the rates plan you desire and enter the essential information and facts. Make your accounts and buy an order using your PayPal accounts or charge card.

- Choose the file format and obtain the legitimate document design to your system.

- Total, edit and print out and signal the received Montana Summary of Terms of Proposed Private Placement Offering.

US Legal Forms is the largest collection of legitimate kinds in which you can find a variety of document layouts. Make use of the service to obtain appropriately-manufactured documents that follow condition requirements.

Form popularity

FAQ

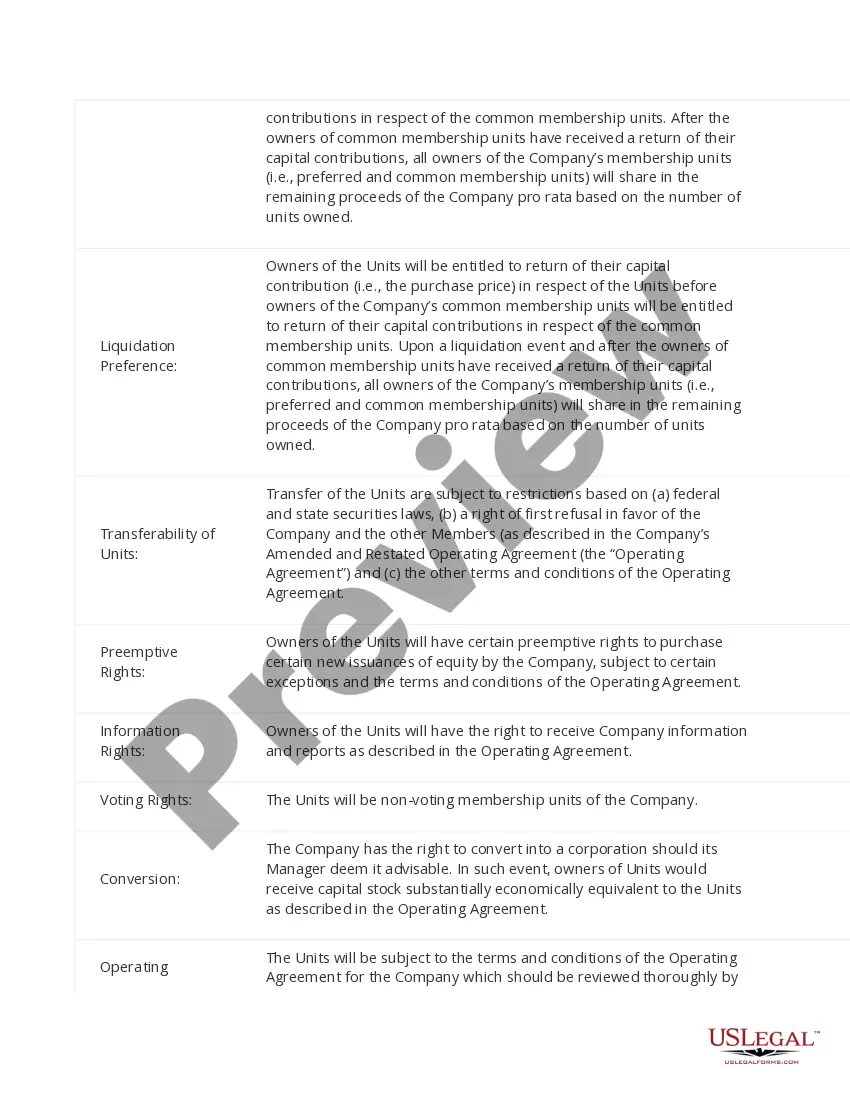

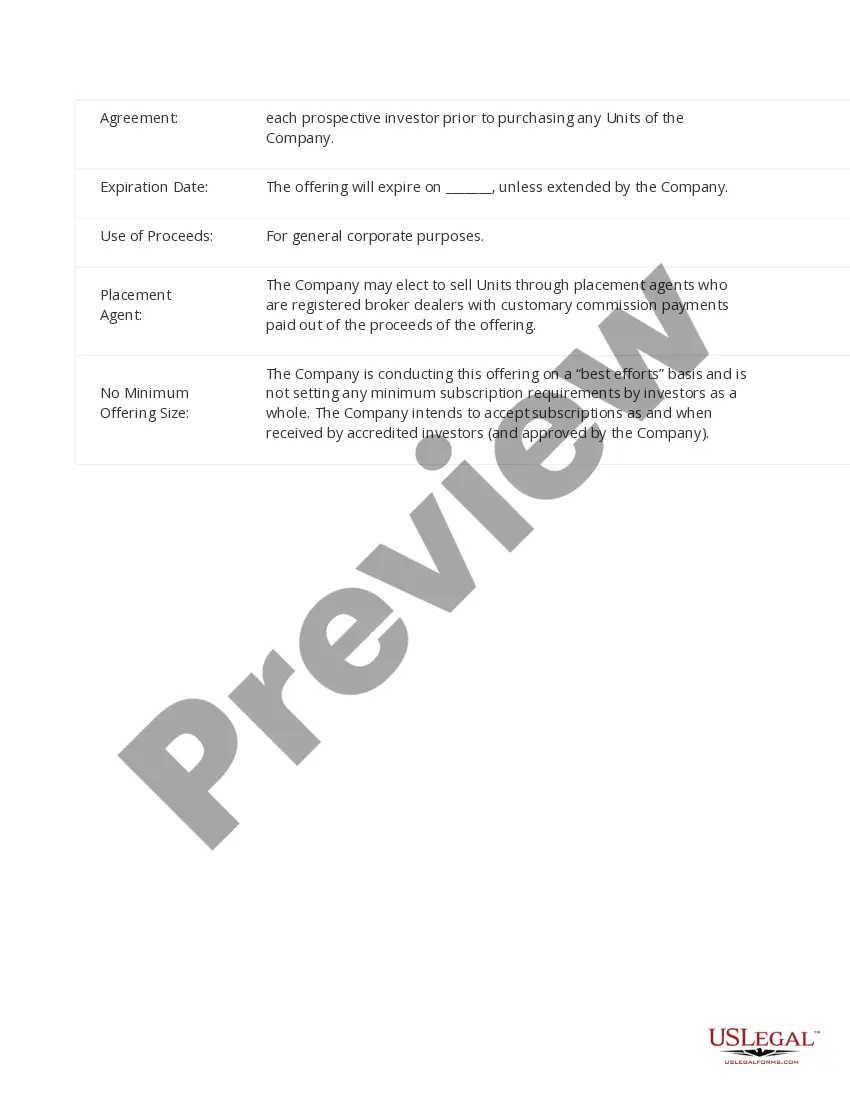

The Private Placement Memorandum (PPM) itself doesn't represent the actual ?offering.? Instead, it serves as a disclosure document that comprehensively describes the offering, encompassing its structure, strategies, regulation, financing, use of funds, business plan, services, risks, and management.

While an offering memorandum is used in a private placement, a summary prospectus is the disclosure document provided to investors by mutual fund companies before or at the time of sale to the public.

A Private Placement Memorandum (?PPM?), also known as a private offering document and confidential offering memorandum, is a securities disclosure document used in a private offering of securities by a private placement issuer or an investment fund (collectively, the ?Issuer?).

FINRA Rule 5123 (Private Placements of Securities) requires firms to file with FINRA's Corporate Financing Department within 15 calendar days of the date of first sale of a private placement, a private placement memorandum, term sheet or other offering document, or indicate that no such offerings documents were used.

Technically, when raising funds under Regulation D or any other SEC exemption, there's no strict requirement to utilize a Private Placement Memorandum (PPM).

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

Under the Securities Act of 1933, any offer to sell securities must either be registered with the SEC or meet an exemption. Issuers and broker-dealers most commonly conduct private placements under Regulation D of the Securities Act of 1933, which provides three exemptions from registration.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.