Montana Clerical Staff Agreement - Self-Employed Independent Contractor

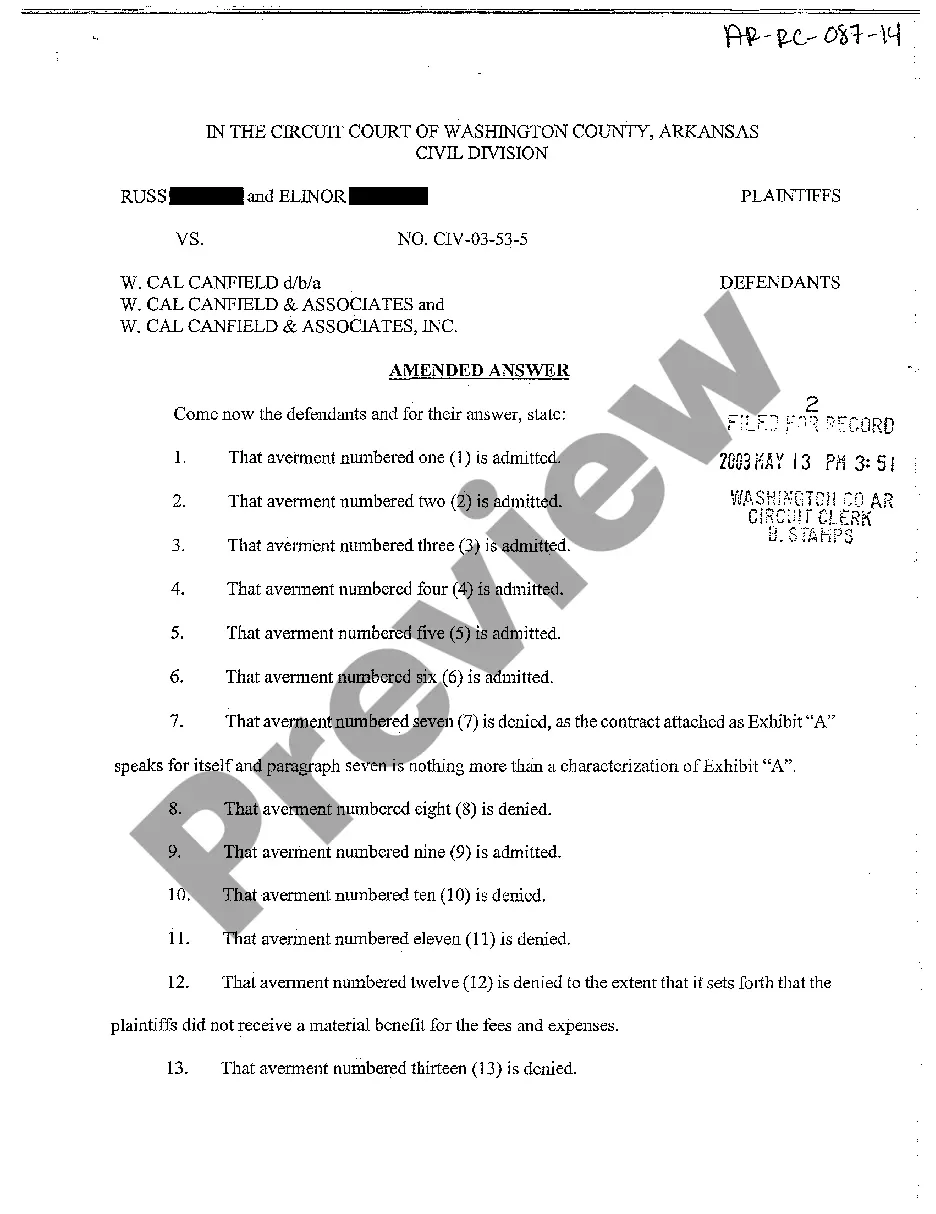

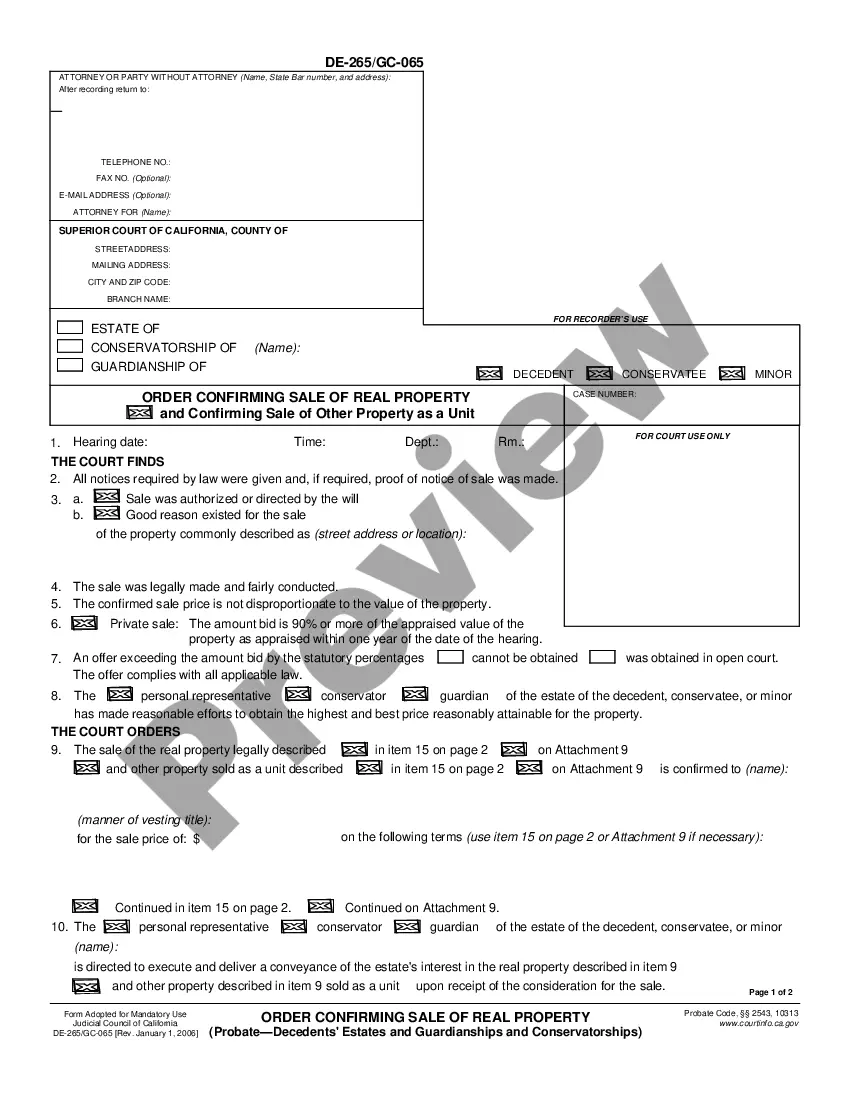

Description

How to fill out Montana Clerical Staff Agreement - Self-Employed Independent Contractor?

Choosing the right lawful record web template might be a struggle. Obviously, there are a lot of layouts available on the net, but how do you get the lawful form you require? Utilize the US Legal Forms web site. The assistance delivers a huge number of layouts, such as the Montana Clerical Staff Agreement - Self-Employed Independent Contractor, which can be used for business and personal requirements. All of the varieties are checked by specialists and satisfy state and federal specifications.

If you are already authorized, log in to the profile and click on the Download option to have the Montana Clerical Staff Agreement - Self-Employed Independent Contractor. Use your profile to appear with the lawful varieties you have bought earlier. Proceed to the My Forms tab of the profile and have one more duplicate of your record you require.

If you are a brand new end user of US Legal Forms, allow me to share basic recommendations that you can comply with:

- Very first, make certain you have selected the proper form for your town/county. You may look over the form using the Review option and read the form description to make certain it will be the best for you.

- If the form will not satisfy your expectations, make use of the Seach field to discover the right form.

- Once you are certain that the form is suitable, select the Buy now option to have the form.

- Choose the pricing strategy you desire and type in the essential information and facts. Create your profile and buy an order using your PayPal profile or bank card.

- Pick the file formatting and download the lawful record web template to the gadget.

- Full, modify and print and indicator the received Montana Clerical Staff Agreement - Self-Employed Independent Contractor.

US Legal Forms is the biggest local library of lawful varieties for which you can discover numerous record layouts. Utilize the service to download skillfully-created documents that comply with condition specifications.

Form popularity

FAQ

Montana law requires construction contractors with employees, corporations or manager-managed limited liability companies in the construction industry to register, which is the same as a license.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

To perform contractor work in the state of Montana, you will need to obtain a business license to do so. Furthermore, you will need to acquire the proper permits and additional paperwork to bid or perform contractor work in the state of Montana.

Independent contractor's licensesFirst, prove you independently own a business.Get a Montana Tax Identification Number with the Montana Department of Revenue.Then fill out an independent contractor exemption certification.Fill out and mail in the application form.

General contractors, including handymen, are not required to hold a license to work in Montana. However, if you have employees, you will be required to register with the Department of Labor and Industry, Contractor Registration Unit. To register, you must show proof of workers' compensation insurance.

Self Employed, Contractors, and other individuals may qualify for Pandemic Unemployment Assistance (PUA). The user-friendly application can be accessed by going to mtpua.mt.gov and clicking on Apply for Pandemic Unemployment Assistance or by clicking on the blue button below.

More info

Employee is the employee that is under your immediate supervision. Independent contractor is the self-employed person who is under your exclusive control. You make arrangements with employee under the supervision of you. An independent contractor is the only employee that you have. However, you could also see employee as the person who provides services to you under contract.