Montana Self-Employed Independent Contractor Chemist Agreement

Description

How to fill out Montana Self-Employed Independent Contractor Chemist Agreement?

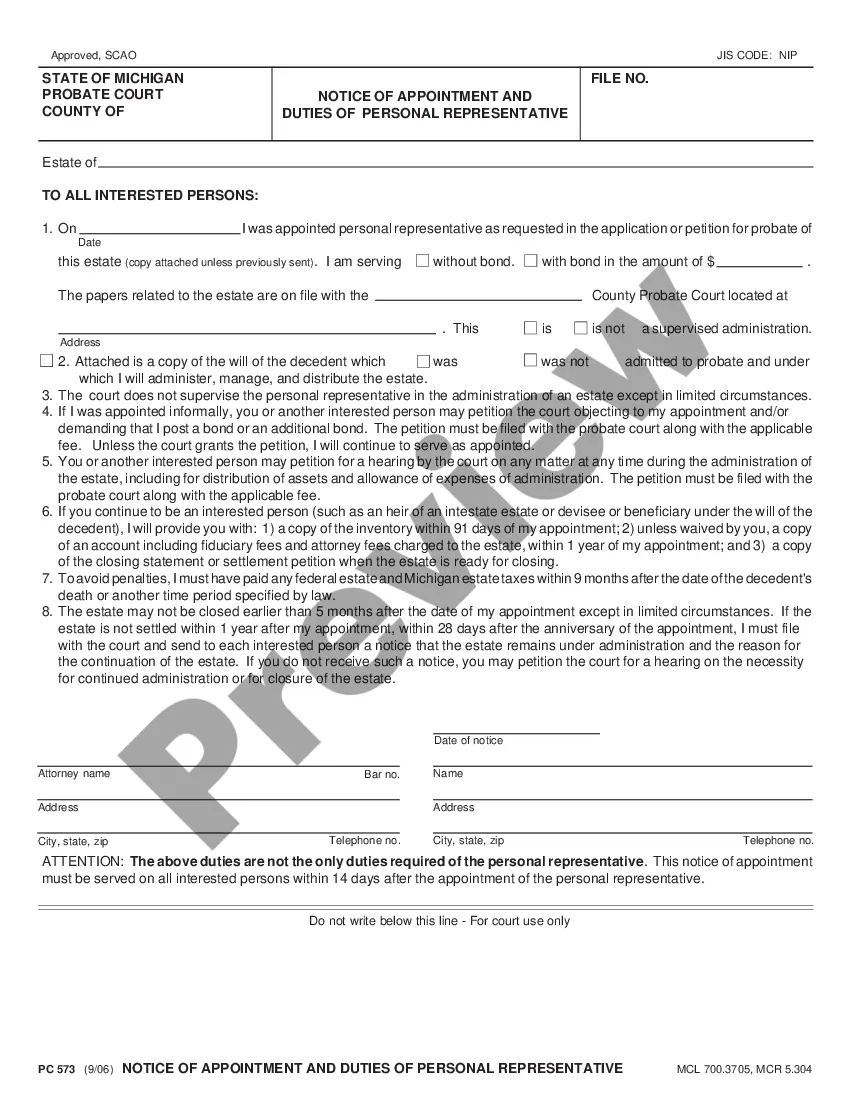

Discovering the right authorized file design can be quite a struggle. Obviously, there are tons of templates available on the Internet, but how will you obtain the authorized type you will need? Take advantage of the US Legal Forms website. The assistance delivers a huge number of templates, including the Montana Self-Employed Independent Contractor Chemist Agreement, that you can use for business and private requirements. All the varieties are checked by experts and fulfill federal and state requirements.

Should you be presently registered, log in to your bank account and click on the Download switch to obtain the Montana Self-Employed Independent Contractor Chemist Agreement. Utilize your bank account to appear from the authorized varieties you have purchased in the past. Check out the My Forms tab of your bank account and get an additional duplicate of the file you will need.

Should you be a new user of US Legal Forms, allow me to share simple instructions that you can follow:

- Initially, make sure you have selected the appropriate type for your personal town/state. You may examine the shape while using Review switch and read the shape description to ensure this is basically the right one for you.

- When the type is not going to fulfill your needs, utilize the Seach discipline to get the correct type.

- Once you are positive that the shape would work, select the Purchase now switch to obtain the type.

- Choose the rates strategy you would like and type in the essential information and facts. Design your bank account and pay money for an order using your PayPal bank account or bank card.

- Choose the file file format and obtain the authorized file design to your device.

- Full, modify and produce and indicator the received Montana Self-Employed Independent Contractor Chemist Agreement.

US Legal Forms may be the most significant local library of authorized varieties where you can see different file templates. Take advantage of the company to obtain appropriately-created files that follow express requirements.

Form popularity

FAQ

General contractors, including handymen, are not required to hold a license to work in Montana. However, if you have employees, you will be required to register with the Department of Labor and Industry, Contractor Registration Unit. To register, you must show proof of workers' compensation insurance.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

The fee for a contractor registration application is $70, and the independent contractor registration fee is $125. Neither of these registrations requires work experience or a written exam.

A worker must be:Engaged in their own independently established business, occupation, trade, or profession. Covered under a self-elected workers' compensation insurance policy or obtain an Independent Contractor Exemption Certificate (ICEC).

Self Employed, Contractors, and other individuals may qualify for Pandemic Unemployment Assistance (PUA). The user-friendly application can be accessed by going to mtpua.mt.gov and clicking on Apply for Pandemic Unemployment Assistance or by clicking on the blue button below.

Montana law requires construction contractors with employees, corporations or manager-managed limited liability companies in the construction industry to register, which is the same as a license.

To perform contractor work in the state of Montana, you will need to obtain a business license to do so. Furthermore, you will need to acquire the proper permits and additional paperwork to bid or perform contractor work in the state of Montana.

Independent contractor's licensesFirst, prove you independently own a business.Get a Montana Tax Identification Number with the Montana Department of Revenue.Then fill out an independent contractor exemption certification.Fill out and mail in the application form.

What is an independent contractor? (b) is engaged in an independently established trade, occupation, profession or business. Additionally, an independent contractor must obtain either an independent contractor exemption certificate or self-elected coverage under a Montana workers' compensation insurance policy.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.