Montana Cook Services Contract - Self-Employed

Description

How to fill out Montana Cook Services Contract - Self-Employed?

Are you inside a placement that you require files for sometimes organization or specific functions virtually every day time? There are a variety of authorized document web templates available online, but discovering types you can depend on is not simple. US Legal Forms offers a huge number of type web templates, just like the Montana Cook Services Contract - Self-Employed, which can be created to satisfy state and federal needs.

In case you are currently acquainted with US Legal Forms website and have an account, basically log in. Afterward, it is possible to down load the Montana Cook Services Contract - Self-Employed format.

If you do not offer an accounts and wish to begin to use US Legal Forms, follow these steps:

- Discover the type you want and make sure it is to the appropriate metropolis/region.

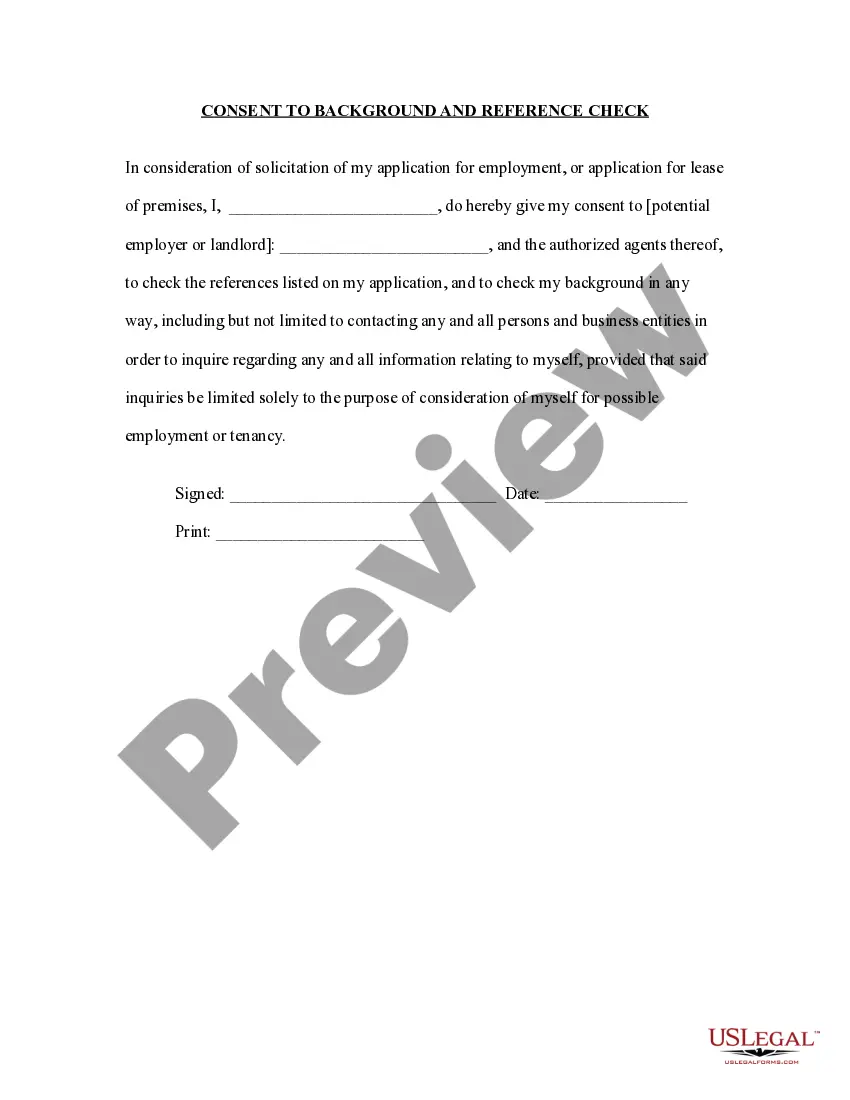

- Take advantage of the Review switch to review the form.

- See the description to actually have chosen the proper type.

- In case the type is not what you`re trying to find, utilize the Lookup discipline to obtain the type that fits your needs and needs.

- When you discover the appropriate type, click on Get now.

- Opt for the prices prepare you desire, fill in the specified information and facts to create your account, and purchase an order using your PayPal or bank card.

- Pick a hassle-free file format and down load your copy.

Get every one of the document web templates you possess purchased in the My Forms food selection. You can get a more copy of Montana Cook Services Contract - Self-Employed at any time, if necessary. Just go through the necessary type to down load or printing the document format.

Use US Legal Forms, by far the most comprehensive collection of authorized kinds, to save lots of time as well as prevent mistakes. The service offers professionally created authorized document web templates which you can use for a variety of functions. Generate an account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

Most line cooks acquire skills through job training and mentoring by more senior cooks and chefs, such as: Skilled prep work. In a professional restaurant kitchen, line cooks prepare each component of the menu's dishes in advance of the busy meal service.

Most chefs go the traditional route of working their way up in the same business over a period of years, but in recent years many chefs are exploring freelance and private work. Here we explore everything you need to know about how a career as a freelance chef for hire can work for you.

According to the Cambridge dictionary, a cook is 'someone who prepares and cooks food', while a chef is 'a skilled and trained cook who works in a hotel or restaurant'. These definitions imply that a chef is a type of cook, but they differ in that a chef has developed learned skills, and has undergone training.

A personal cook works in private homes preparing daily meals for individuals or families or menus for special occasions such as parties. They may work for one household or several if they are employed by an agency. Personal cooks could also prepare meals for businesses.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.

How is an independent contractor paid?Obtain the independent contractor's Form W-9, Request for Taxpayer Identification Number and Certification.Provide compensation for work performed.Remit backup withholding payments to the IRS, if necessary.Complete Form 1099-NEC, Nonemployee Compensation.

If you work for an employer, you're an employee. If you're self-employed, you're an independent contractor.

A chef is integral to the business of preparing food and would not be considered an independent contractor. A specialist chef, who prepares food for a one-time event for the restaurant, could be considered an independent contractor.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.