Montana Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Montana Design Agreement - Self-Employed Independent Contractor?

Have you been inside a position that you will need papers for sometimes organization or personal reasons almost every time? There are tons of legal file web templates available online, but getting ones you can rely on isn`t simple. US Legal Forms provides 1000s of kind web templates, like the Montana Design Agreement - Self-Employed Independent Contractor, which are written to satisfy federal and state demands.

If you are presently informed about US Legal Forms site and have a merchant account, simply log in. Following that, it is possible to obtain the Montana Design Agreement - Self-Employed Independent Contractor template.

If you do not have an bank account and want to start using US Legal Forms, adopt these measures:

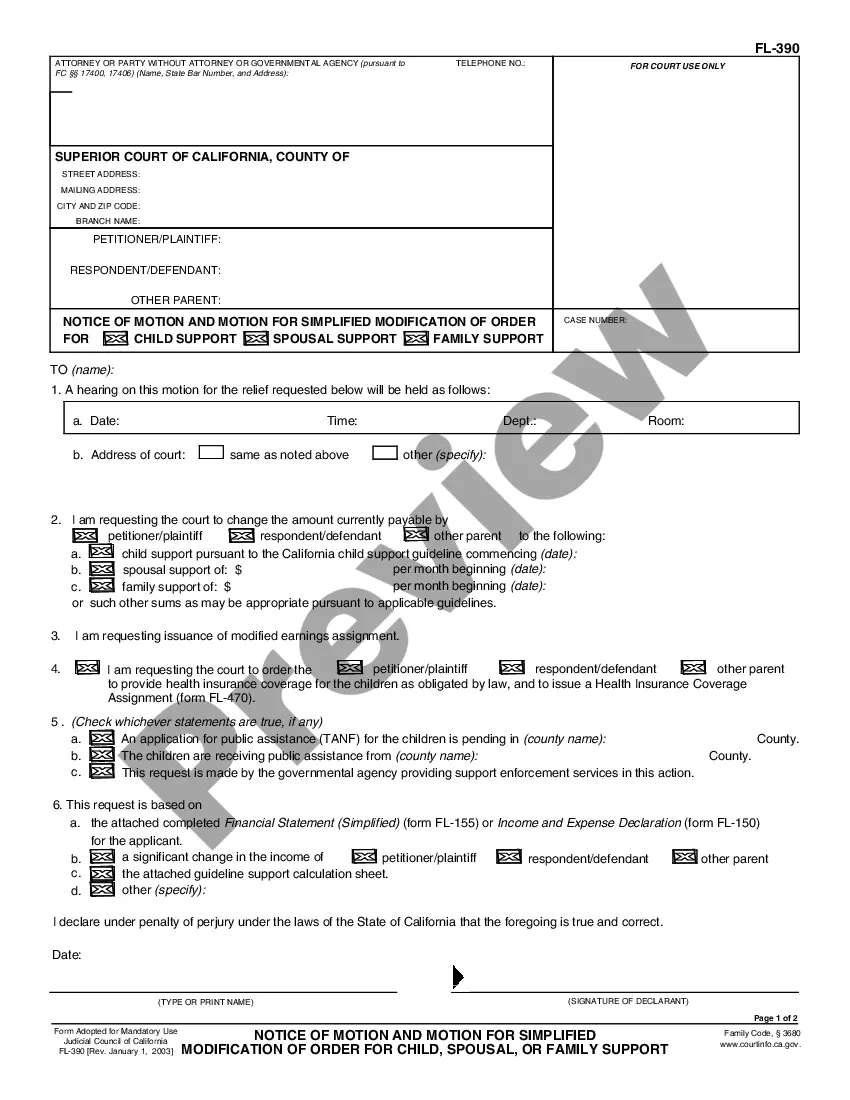

- Get the kind you need and ensure it is for the right area/area.

- Utilize the Review button to examine the form.

- Browse the information to actually have selected the right kind.

- If the kind isn`t what you are looking for, use the Research discipline to obtain the kind that meets your needs and demands.

- Whenever you discover the right kind, simply click Buy now.

- Select the costs program you would like, fill out the specified info to make your account, and buy an order utilizing your PayPal or Visa or Mastercard.

- Select a convenient paper structure and obtain your copy.

Locate all of the file web templates you possess bought in the My Forms food selection. You can obtain a further copy of Montana Design Agreement - Self-Employed Independent Contractor any time, if required. Just click on the needed kind to obtain or print the file template.

Use US Legal Forms, probably the most considerable assortment of legal varieties, to save lots of some time and avoid mistakes. The service provides skillfully made legal file web templates that can be used for a range of reasons. Produce a merchant account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

Self Employed, Contractors, and other individuals may qualify for Pandemic Unemployment Assistance (PUA). The user-friendly application can be accessed by going to mtpua.mt.gov and clicking on Apply for Pandemic Unemployment Assistance or by clicking on the blue button below.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The fee for a contractor registration application is $70, and the independent contractor registration fee is $125. Neither of these registrations requires work experience or a written exam.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

To perform contractor work in the state of Montana, you will need to obtain a business license to do so. Furthermore, you will need to acquire the proper permits and additional paperwork to bid or perform contractor work in the state of Montana.

Independent contractor's licensesFirst, prove you independently own a business.Get a Montana Tax Identification Number with the Montana Department of Revenue.Then fill out an independent contractor exemption certification.Fill out and mail in the application form.

General contractors, including handymen, are not required to hold a license to work in Montana. However, if you have employees, you will be required to register with the Department of Labor and Industry, Contractor Registration Unit. To register, you must show proof of workers' compensation insurance.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Montana law requires construction contractors with employees, corporations or manager-managed limited liability companies in the construction industry to register, which is the same as a license.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...