Montana Nursing Agreement - Self-Employed Independent Contractor

Description

How to fill out Montana Nursing Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of many most significant libraries of legal forms in the USA - provides a wide array of legal file layouts you can down load or print. While using website, you may get a large number of forms for enterprise and person purposes, categorized by types, states, or search phrases.You will discover the most recent variations of forms like the Montana Nursing Agreement - Self-Employed Independent Contractor within minutes.

If you already possess a membership, log in and down load Montana Nursing Agreement - Self-Employed Independent Contractor in the US Legal Forms library. The Acquire button will show up on each develop you view. You get access to all earlier delivered electronically forms inside the My Forms tab of your own profile.

If you wish to use US Legal Forms the very first time, allow me to share simple guidelines to get you started out:

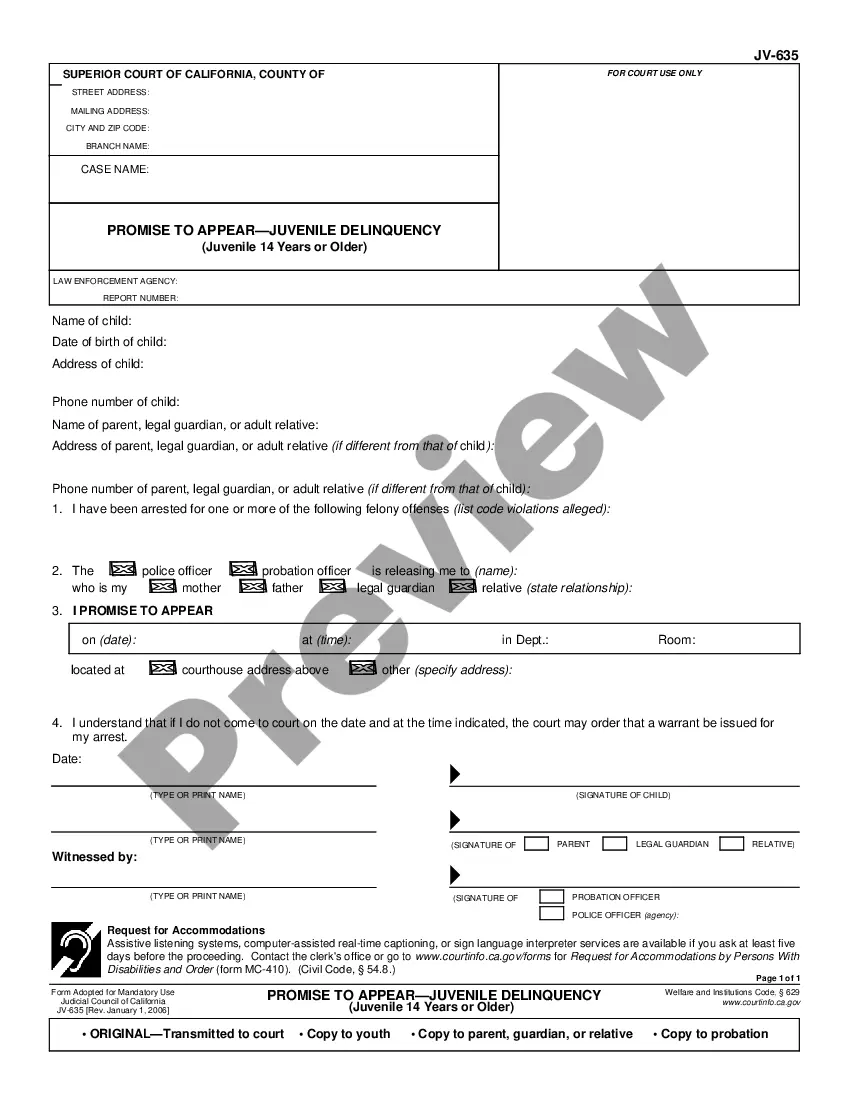

- Make sure you have chosen the best develop for the city/state. Click the Preview button to check the form`s information. Browse the develop outline to actually have selected the correct develop.

- If the develop doesn`t suit your requirements, use the Look for field at the top of the display to find the the one that does.

- Should you be pleased with the shape, verify your option by clicking the Get now button. Then, opt for the costs prepare you like and provide your references to sign up for an profile.

- Approach the financial transaction. Use your bank card or PayPal profile to perform the financial transaction.

- Pick the formatting and down load the shape on your own system.

- Make adjustments. Fill out, modify and print and signal the delivered electronically Montana Nursing Agreement - Self-Employed Independent Contractor.

Each and every format you included in your bank account does not have an expiry time and is yours permanently. So, if you would like down load or print an additional duplicate, just visit the My Forms section and click around the develop you require.

Obtain access to the Montana Nursing Agreement - Self-Employed Independent Contractor with US Legal Forms, by far the most extensive library of legal file layouts. Use a large number of professional and condition-distinct layouts that fulfill your small business or person requires and requirements.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Self Employed, Contractors, and other individuals may qualify for Pandemic Unemployment Assistance (PUA). The user-friendly application can be accessed by going to mtpua.mt.gov and clicking on Apply for Pandemic Unemployment Assistance or by clicking on the blue button below.

How to Invoice as a ContractorIdentify the Document as an Invoice.Include Your Business Information.Add the Client's Contact Details.Assign a Unique Invoice Number.Add the Invoice Date.Provide Details of Your Services.Include Your Payment Terms.List the Total Amount Due.More items...

To perform contractor work in the state of Montana, you will need to obtain a business license to do so. Furthermore, you will need to acquire the proper permits and additional paperwork to bid or perform contractor work in the state of Montana.

What is an independent contractor? (b) is engaged in an independently established trade, occupation, profession or business. Additionally, an independent contractor must obtain either an independent contractor exemption certificate or self-elected coverage under a Montana workers' compensation insurance policy.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

Independent contractor's licensesFirst, prove you independently own a business.Get a Montana Tax Identification Number with the Montana Department of Revenue.Then fill out an independent contractor exemption certification.Fill out and mail in the application form.

MontanaWorks - 1099-Gs are available to view, save or print on your MontanaWorks Dashboard in the 1099 Tax Form tile. If you don't have an account, you can create one by visiting MontanaWorks.gov. Filing Taxes For tax filing information, call the IRS at (800) 829-1040 or visit their website at irs.gov.

In general, independent contractors who are sole proprietors are to be reported to the EDD.

Montana law requires construction contractors with employees, corporations or manager-managed limited liability companies in the construction industry to register, which is the same as a license.