This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Montana Notice of Harassment and Validation of Debt

Description

How to fill out Montana Notice Of Harassment And Validation Of Debt?

Are you presently within a placement the place you require files for both organization or individual purposes just about every day time? There are a variety of lawful document layouts available online, but discovering kinds you can rely on isn`t straightforward. US Legal Forms offers thousands of develop layouts, such as the Montana Notice of Harassment and Validation of Debt, which are composed to satisfy federal and state requirements.

When you are presently acquainted with US Legal Forms website and also have your account, basically log in. Following that, you are able to download the Montana Notice of Harassment and Validation of Debt web template.

Should you not have an profile and wish to begin to use US Legal Forms, abide by these steps:

- Find the develop you require and make sure it is to the right city/region.

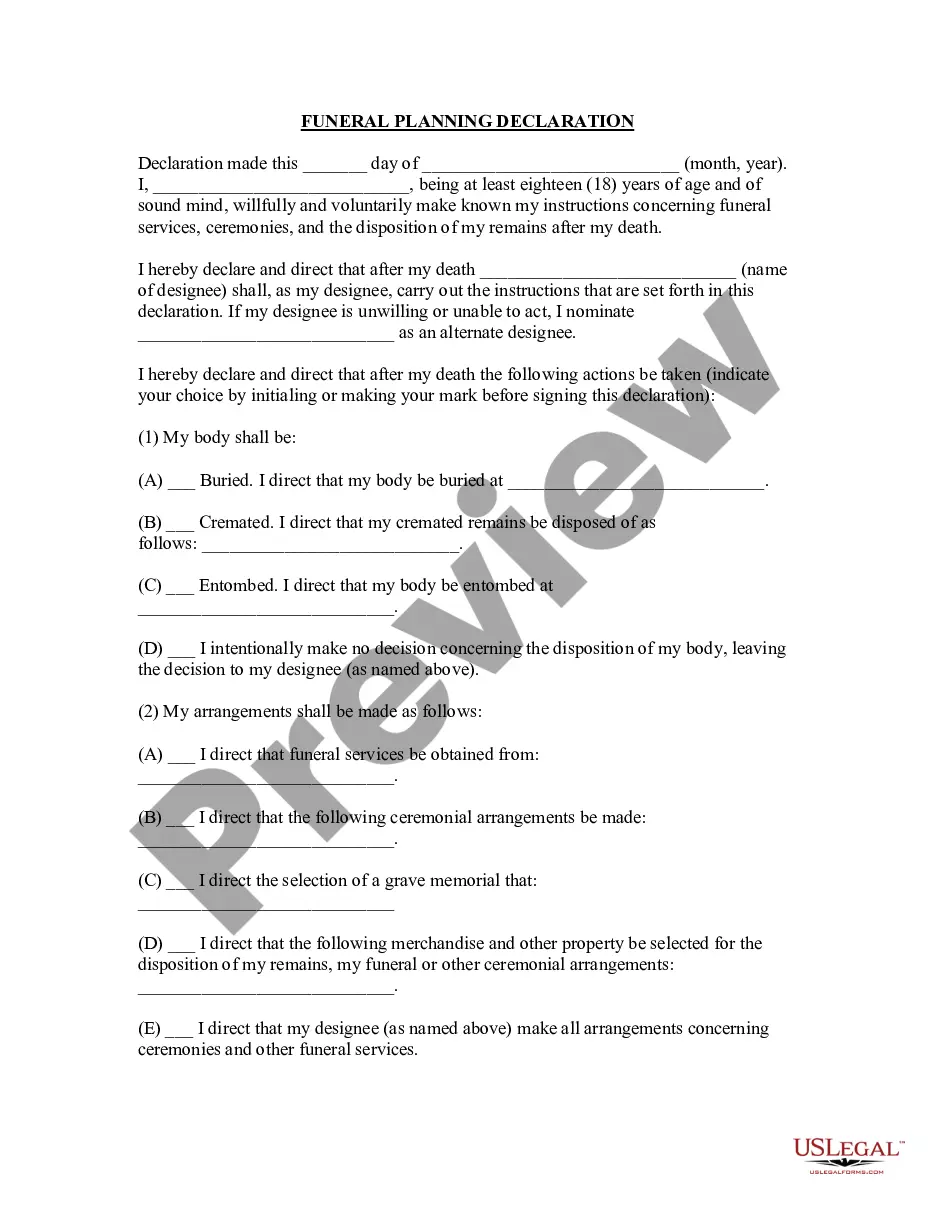

- Utilize the Review button to examine the shape.

- Browse the description to ensure that you have selected the proper develop.

- When the develop isn`t what you`re searching for, use the Lookup field to get the develop that suits you and requirements.

- Whenever you discover the right develop, click on Purchase now.

- Choose the rates prepare you want, complete the required info to generate your bank account, and buy the transaction using your PayPal or credit card.

- Pick a handy file formatting and download your backup.

Discover all the document layouts you may have purchased in the My Forms food selection. You may get a more backup of Montana Notice of Harassment and Validation of Debt at any time, if possible. Just select the required develop to download or print the document web template.

Use US Legal Forms, probably the most substantial assortment of lawful varieties, to conserve time as well as stay away from blunders. The services offers professionally made lawful document layouts that you can use for a selection of purposes. Create your account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

Who Can Garnish My Wages in Montana? Any creditor, debt collector, or third-party debt buyer with a valid court judgment and writ of execution can garnish your wages in Montana. Certain types of debts have special wage garnishment rules and don't require a court order.

If a judgment creditor is garnishing your wages, federal law provides that it can take no more than:25% of your disposable income, or.the amount that your income exceeds 30 times the federal minimum wage, whichever is less.

Creditors have 12 years from the date of the judgment order to look for enforcement orders. Enforcement orders are usually valid for one year and can then be renewed. If more than 6 years have passed since the judgment order was issued, a Leave of the court (the court's permission) is needed to continue.

How long does a judgment lien last in Montana? A judgment lien in Montana will remain attached to the debtor's property (even if the property changes hands) for ten years.

How long does a judgment lien last in Montana? A judgment lien in Montana will remain attached to the debtor's property (even if the property changes hands) for ten years.

In Montana, the statute of limitations on written contracts, obligations, or liabilities is 8 years. Verbal contracts, accounts, or promises have a statute of limitation of 5 years. As for verbal obligations or liabilities that are not contracts, these have a statute of limitation of 3 years.

Each state has an established statute of limitations on debt collection, which outlines the time frame during which a debt collector can pursue legal action against you. In Montana, creditors have between four and 10 years to sue you, depending on the type of debt.

Exempt property (items that a debtor may usually keep) can include:Motor vehicles, up to a certain value.Reasonably necessary clothing.Reasonably necessary household goods and furnishings.Household appliances.Jewelry, up to a certain value.Pensions.A portion of equity in the debtor's home.More items...?

Your personal property is exempt up to $4,500 in total value. Personal property includes things like furniture, appliances, jewelry, clothing, books, firearms, animals, and musical instruments. To be exempt, one item cannot be worth more than $600.