Montana Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files

Description

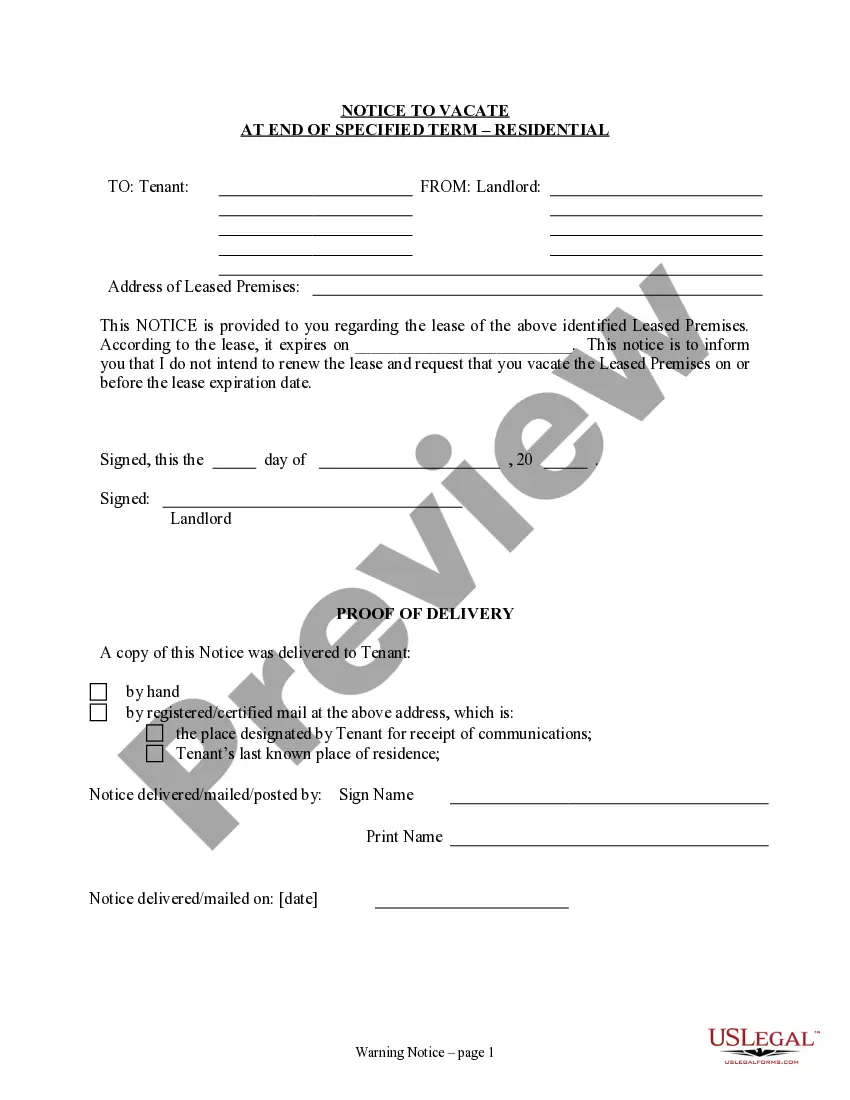

How to fill out Liens, Mortgages/Deeds Of Trust, UCC Statements, Bankruptcies, And Lawsuits Identified In Seller's Files?

If you want to total, down load, or produce lawful record layouts, use US Legal Forms, the biggest variety of lawful types, that can be found on-line. Make use of the site`s basic and hassle-free research to find the papers you want. Different layouts for enterprise and individual purposes are sorted by categories and claims, or keywords and phrases. Use US Legal Forms to find the Montana Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files with a few click throughs.

In case you are presently a US Legal Forms consumer, log in to the profile and click the Acquire option to have the Montana Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files. You can even gain access to types you previously downloaded within the My Forms tab of your own profile.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for the right city/land.

- Step 2. Use the Preview method to check out the form`s content. Don`t forget about to read through the information.

- Step 3. In case you are unsatisfied with all the type, make use of the Search area at the top of the display to get other variations of your lawful type web template.

- Step 4. After you have found the shape you want, select the Buy now option. Opt for the rates plan you favor and include your references to register on an profile.

- Step 5. Process the purchase. You can use your credit card or PayPal profile to complete the purchase.

- Step 6. Find the formatting of your lawful type and down load it on the product.

- Step 7. Complete, change and produce or indication the Montana Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files.

Each and every lawful record web template you buy is your own property forever. You might have acces to each and every type you downloaded inside your acccount. Go through the My Forms portion and pick a type to produce or down load once more.

Be competitive and down load, and produce the Montana Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files with US Legal Forms. There are many skilled and status-specific types you can use for the enterprise or individual requirements.

Form popularity

FAQ

Ask the lender to terminate the lien upon payoff. When you pay off a loan, a good rule of thumb is to immediately submit a request with the lender to file a UCC-3 form with your secretary of state. The UCC-3 will terminate the lien on your company's asset (or assets) and remove the UCC-1 filing.

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically when the security interest attaches.

You can remove a UCC filing by asking your lender to submit a UCC-3 form to terminate the lien. If you find a UCC lien listed on your credit report that shouldn't be there, you can contact the credit bureau (e.g., Experian, Dun & Bradstreet) and file a dispute to have it removed.

It can impact your business credit A UCC lien filing remains on your business credit report for 5 years. This has no negative effect on your credit score, however, when someone checks your credit report it is visible and that can play a factor in your ability to be approved for things other than just business funding.

The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default. However, in many cases, the terms UCC lien and UCC filing are used interchangeably.

UCC - Frequently Asked Questions - UCC-1 and UCC-3. Most filings last for five (5) years from the date of filing. Filings for a debtor that is a transmitting utility have no expiration date.

If the debtor name is incorrect or is misspelled, the UCC-1 filing may be invalid. This can cause creditors to lose their priority (or position) over other creditors who have filed financing statements against a borrower with the correct debtor information.