Montana Affidavit of Heirship - Descent

Description

How to fill out Affidavit Of Heirship - Descent?

Choosing the best legitimate file design could be a battle. Needless to say, there are a variety of web templates available on the Internet, but how can you get the legitimate kind you will need? Use the US Legal Forms website. The assistance gives a huge number of web templates, like the Montana Affidavit of Heirship - Descent, which can be used for organization and personal needs. Every one of the forms are examined by specialists and fulfill federal and state requirements.

In case you are previously authorized, log in to your bank account and click the Obtain button to find the Montana Affidavit of Heirship - Descent. Utilize your bank account to appear through the legitimate forms you may have purchased formerly. Proceed to the My Forms tab of your bank account and obtain one more copy in the file you will need.

In case you are a fresh consumer of US Legal Forms, here are easy instructions for you to stick to:

- Initially, ensure you have selected the proper kind for your personal city/state. It is possible to look through the shape utilizing the Preview button and read the shape explanation to make certain it is the right one for you.

- In the event the kind fails to fulfill your preferences, take advantage of the Seach area to get the appropriate kind.

- Once you are certain the shape is acceptable, click the Get now button to find the kind.

- Pick the rates strategy you desire and enter the necessary details. Make your bank account and pay money for the order making use of your PayPal bank account or charge card.

- Choose the submit formatting and download the legitimate file design to your gadget.

- Full, revise and produce and indication the obtained Montana Affidavit of Heirship - Descent.

US Legal Forms may be the greatest collection of legitimate forms in which you can see different file web templates. Use the service to download skillfully-manufactured files that stick to status requirements.

Form popularity

FAQ

Under Montana's probate laws, you can distribute certain types of property and assets without a probate court's approval. They include: Accounts with a named beneficiary, such as life insurance policies and retirement funds. Assets and property that is held in a living trust. When Is Probate Not Necessary? - Silverman Law Office Silverman Law Office ? FAQs Silverman Law Office ? FAQs

If you are unmarried and die without a valid will and last testament in Montana, then your entire estate goes to any surviving children in equal shares, or grandchildren if you don't have any surviving children. If you die intestate unmarried and with no children, then by law, your parents inherit your entire estate. Montana Inheritance Laws: What You Should Know | SmartAsset smartasset.com ? financial-advisor ? montana-inhe... smartasset.com ? financial-advisor ? montana-inhe...

Each county in Texas has a different filing fee, but the cost of filing an affidavit of heirship runs from $50 to $75. You will likely also need to pay a notary public to witness the document signing.

The entire estate of the person who died, after subtracting liens and encumbrances, is not worth more than $50,000. No application or petition for the appointment of a personal representative for this estate is pending or has been granted by any court. How to Use an Affidavit to Get Personal Property from an Estate mt.gov ? collection_personal_property mt.gov ? collection_personal_property

Under Oklahoma law, successors (usually children) can file an affidavit of heirship if the deceased individual's estate qualified as a ?small estate.? The affidavit of heirship must contain specific information if its to be used to avoid the probate process.

Under Montana statute, where as estate is valued at less than $50,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to to demand payment on any debts owed to the decedent. Montana Requirements: Montana requirements are set forth in the statutes below.

$50,000 Collection of Personal Property by Affidavit ? This procedure may be initiated 30 days after a person dies, if the value of the entire estate (less liens and encumbrances) does not exceed $50,000. Probate in Montana - MSU Extension msuextension.org ? montguide ? guide msuextension.org ? montguide ? guide

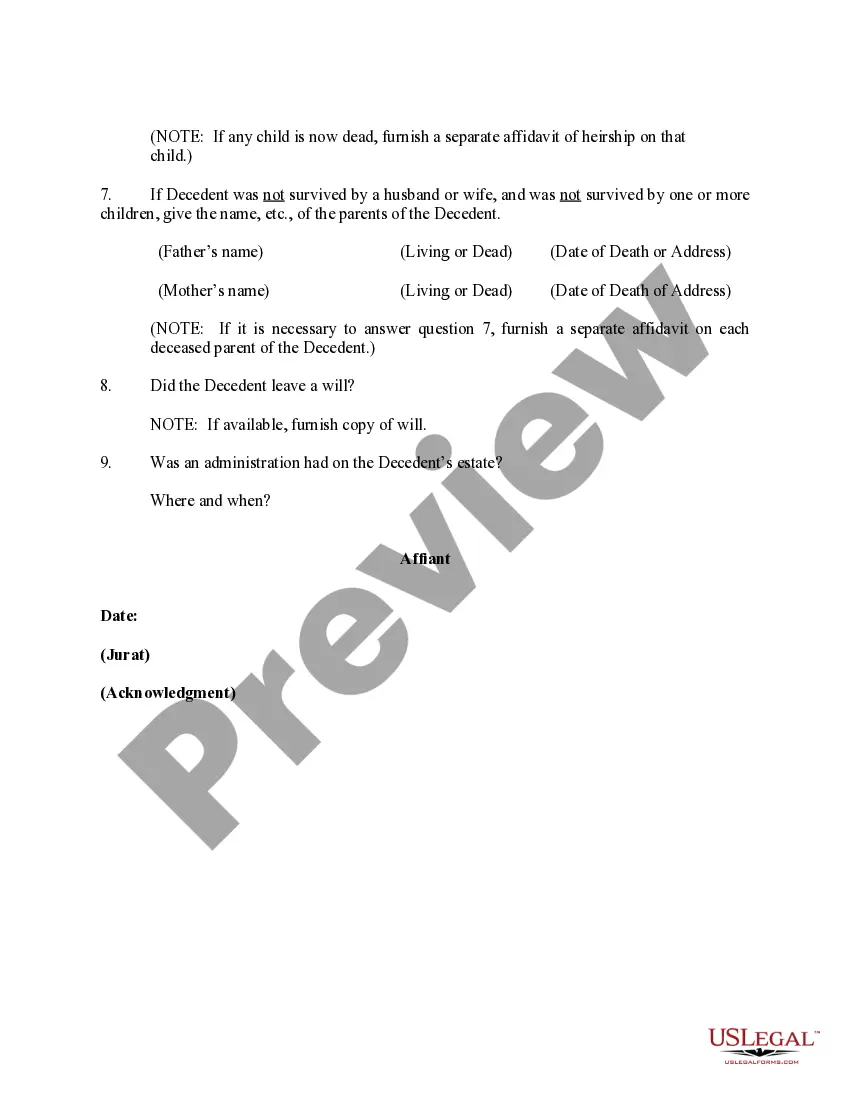

Specific information is needed to determine the identity of the Heirs at Law of the Heir Property. A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death.