Montana Memorandum of Trust Agreement

Description

How to fill out Memorandum Of Trust Agreement?

US Legal Forms - one of the greatest libraries of authorized types in the USA - provides an array of authorized papers themes you can down load or print out. Utilizing the internet site, you can get 1000s of types for organization and person purposes, categorized by groups, claims, or search phrases.You can get the most recent versions of types much like the Montana Memorandum of Trust Agreement in seconds.

If you currently have a subscription, log in and down load Montana Memorandum of Trust Agreement from your US Legal Forms local library. The Download key can look on every type you perspective. You get access to all in the past delivered electronically types from the My Forms tab of your accounts.

If you would like use US Legal Forms initially, here are straightforward guidelines to help you started out:

- Be sure to have picked the right type for your personal town/region. Click on the Review key to check the form`s content. Look at the type explanation to actually have chosen the appropriate type.

- In the event the type doesn`t fit your requirements, use the Search field towards the top of the display screen to discover the one who does.

- If you are satisfied with the form, verify your selection by visiting the Buy now key. Then, opt for the prices program you favor and offer your qualifications to sign up for the accounts.

- Process the deal. Make use of your bank card or PayPal accounts to finish the deal.

- Pick the formatting and down load the form on the gadget.

- Make adjustments. Load, edit and print out and indicator the delivered electronically Montana Memorandum of Trust Agreement.

Every single web template you included with your money does not have an expiry day and is also the one you have for a long time. So, in order to down load or print out an additional duplicate, just go to the My Forms area and click around the type you require.

Obtain access to the Montana Memorandum of Trust Agreement with US Legal Forms, the most extensive local library of authorized papers themes. Use 1000s of professional and condition-distinct themes that fulfill your organization or person requires and requirements.

Form popularity

FAQ

The Trust is administered by trustees for the benefit of beneficiaries (usually the settlors and their family). The MOW's sets out the settlors wishes, and although not legally binding, is usually highly persuasive and can guide the trustee's actions.

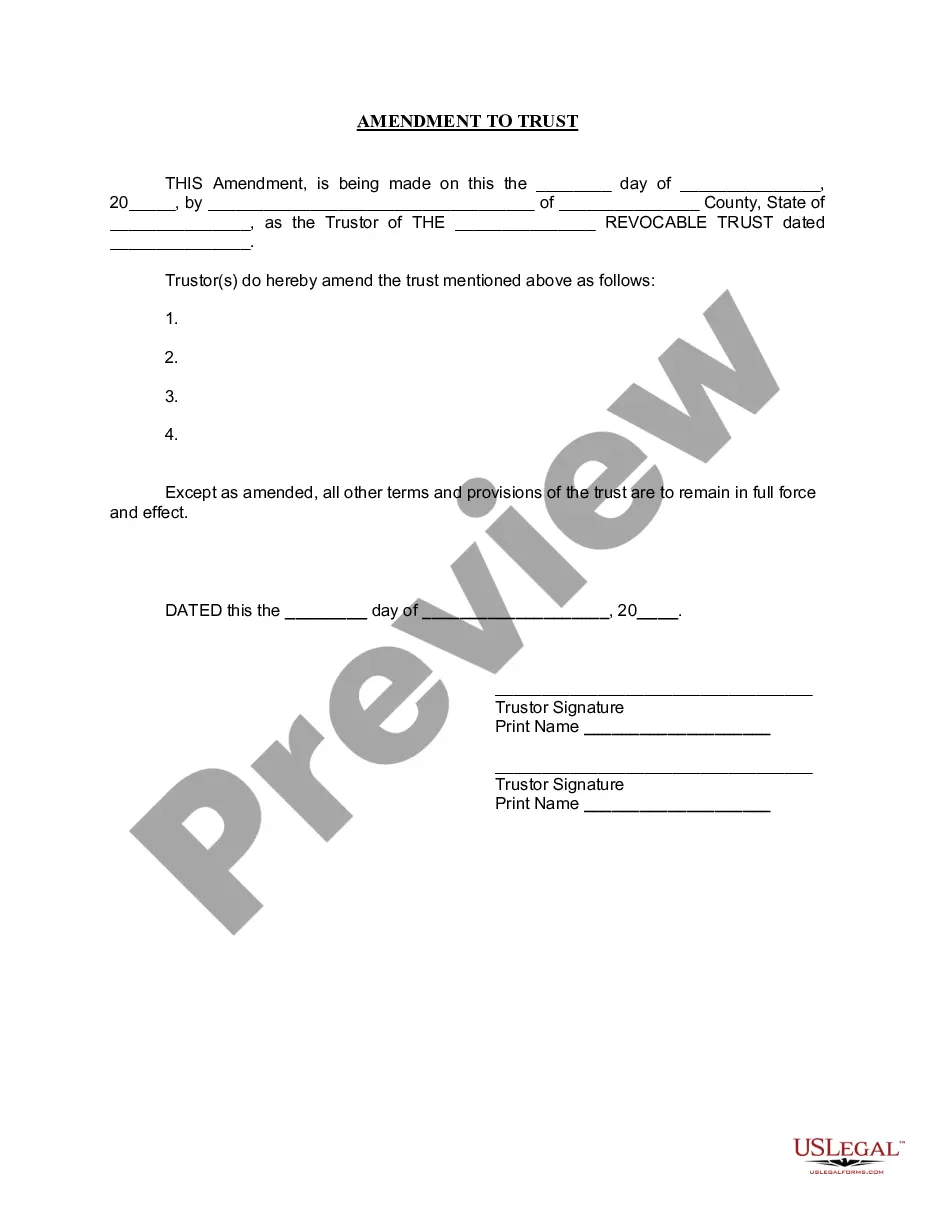

Memorandum of Trusts Are Typically Comprised of the Following The name of the Trust. The date the Trust was established. The fact that you're the Trustmaker. The name of the initial Trustee. The name of the Successor Trustee(s) The identities of those who signed the Trust Agreement. The powers given to the Trustee.

A Memorandum of Trust is a synopsis of a trust that is used when transferring real property into a trust. It's then recorded in county in which the property is owned. The Memorandum of Trust is used in place of the actual trust to identify the grantor and trustees as well as the basic details of the trust.

The letter should be written in non-technical language by you. It should communicate to the reader your heartfelt desires. A letter of intent is not legally binding like your trust. However, its contents should not contradict your trust.

A memorandum of trust is also a certification, abstract, or certificate of trust. It is a shorter version of the trust certificate. It provides institutions with information they need, but allows you to keep some components confidential. You are not required to provide the names of beneficiaries.

Call the document ?Memorandum? Write your name on it. State the date that it is written. Sign it. Identify each item as clearly as possible and put the full name of the person who is to get the item and what the person's relationship to you is.

Generally speaking, a trust indenture is a lien against the property with the buyer being the legal owner. In a contract for deed, a contact is executed between a seller and a buyer whereby a seller agrees to transfer title to the property once the amount set forth in the contract has been paid in full.

How to Create a Living Trust in Montana Select an individual or joint trust. ... Take inventory of your property to determine what to store in your trust. Select a trustee to manage your trust. ... Create a trust document by hiring a lawyer or using a computer program. Sign the document in front of a notary public.