Montana Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner

Description

How to fill out Ratification Of Pooled Unit Designation By Overriding Royalty Or Royalty Interest Owner?

Are you presently within a placement where you need to have papers for sometimes business or person reasons just about every day? There are a lot of authorized record layouts available online, but getting versions you can trust is not effortless. US Legal Forms provides a large number of type layouts, such as the Montana Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner, which can be written to fulfill state and federal specifications.

If you are currently informed about US Legal Forms website and have a free account, merely log in. After that, you can down load the Montana Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner web template.

Unless you come with an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the type you need and make sure it is for the right area/area.

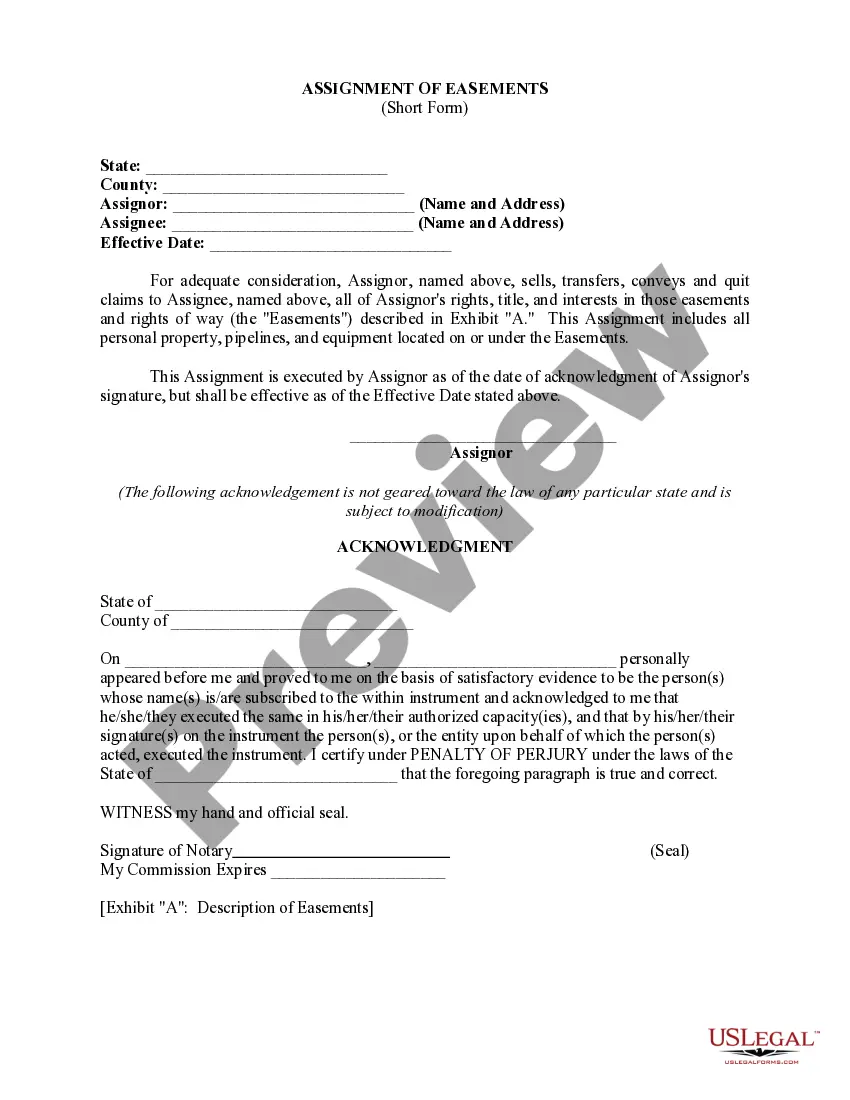

- Use the Review switch to examine the shape.

- See the explanation to actually have selected the appropriate type.

- In the event the type is not what you`re searching for, take advantage of the Research field to discover the type that meets your needs and specifications.

- Whenever you obtain the right type, click on Acquire now.

- Opt for the rates prepare you would like, complete the necessary information to make your bank account, and buy the order with your PayPal or charge card.

- Select a handy data file format and down load your copy.

Locate all of the record layouts you have purchased in the My Forms menu. You can obtain a more copy of Montana Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner at any time, if possible. Just select the essential type to down load or produce the record web template.

Use US Legal Forms, probably the most comprehensive collection of authorized varieties, to save lots of time and avoid mistakes. The services provides appropriately made authorized record layouts which you can use for a range of reasons. Produce a free account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

It really comes down to your personal decision. Figuring out whether to sell oil and gas royalties can be challenging for some. Here are some of the most common reasons for selling an oil and gas royalty: Taxes: You will save substantial money if you inherited mineral rights by selling your oil royalties.

The value of a royalty interest is derived from expected future revenues generated by leasing and/or production, which are largely determined by oil and gas market prices and the current drilling environment.

Forced pooling allows the Board of Oil and Gas to issue orders that require owners of separately owned tracts within a spaced drilling unit to pool their interests in the underlying deposit and operate as a unit.

Royalty Clause: The Lessor's only right to receive payments in addition to the Bonus Payment is through Royalties. Royalties are calculated as a percentage of the value of all minerals produced, typically 25%.

The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value.

In a few words, a pooling clause is written into a lease. This oil and gas clause allows the leased premises to be combined with other lands to form a single drilling unit. It's not uncommon for there to be a pool of oil or gas under numerous parcels of land.

Royalties on private lands are influenced by state rates. They generally range from 12?25 percent. Before negotiating royalty payments on private land, careful due diligence should be conducted to confirm ownership. Mineral ownership records are often outdated.