Montana Assignment of Overriding Royalty Interest (By Owner of Override)

Description

How to fill out Assignment Of Overriding Royalty Interest (By Owner Of Override)?

Choosing the right legal papers web template can be quite a battle. Naturally, there are a lot of templates available on the net, but how would you find the legal develop you need? Use the US Legal Forms internet site. The support gives 1000s of templates, such as the Montana Assignment of Overriding Royalty Interest (By Owner of Override), which can be used for organization and private requirements. All the kinds are examined by pros and satisfy federal and state demands.

In case you are previously listed, log in to your accounts and click on the Obtain button to get the Montana Assignment of Overriding Royalty Interest (By Owner of Override). Make use of accounts to look from the legal kinds you have purchased formerly. Visit the My Forms tab of your respective accounts and acquire an additional duplicate in the papers you need.

In case you are a brand new consumer of US Legal Forms, here are straightforward instructions so that you can comply with:

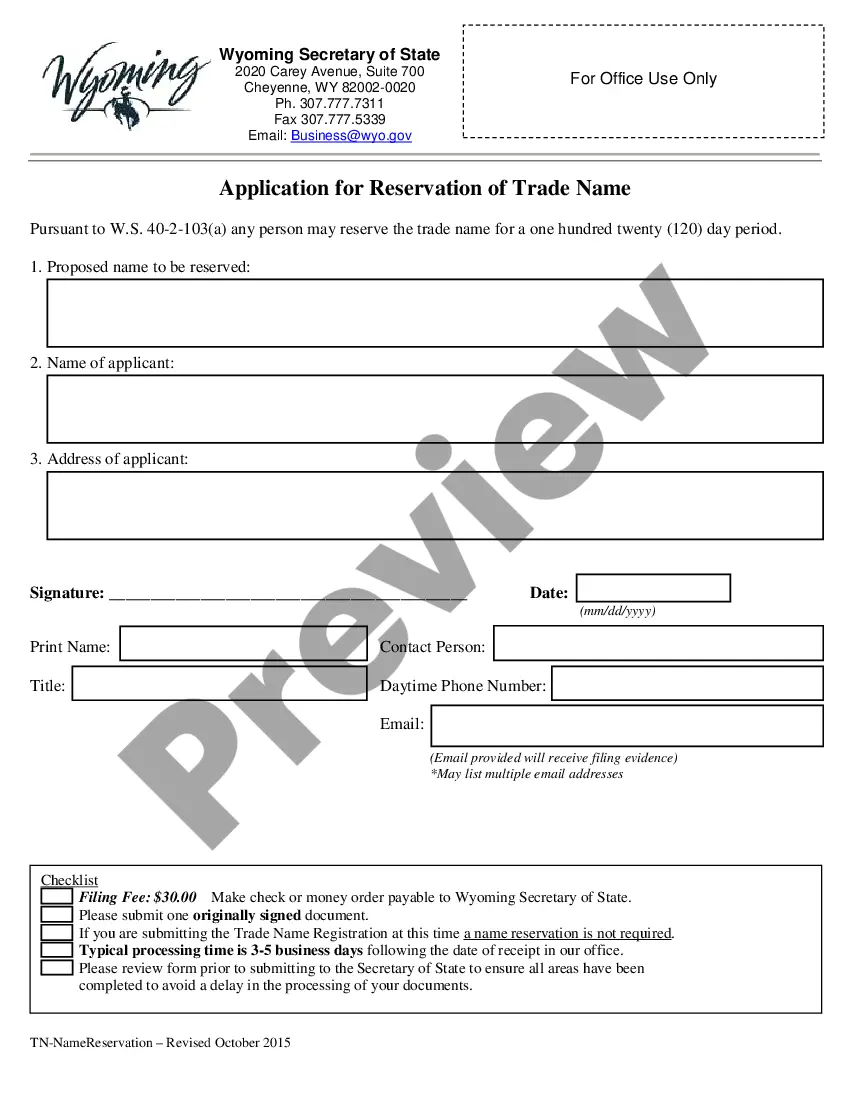

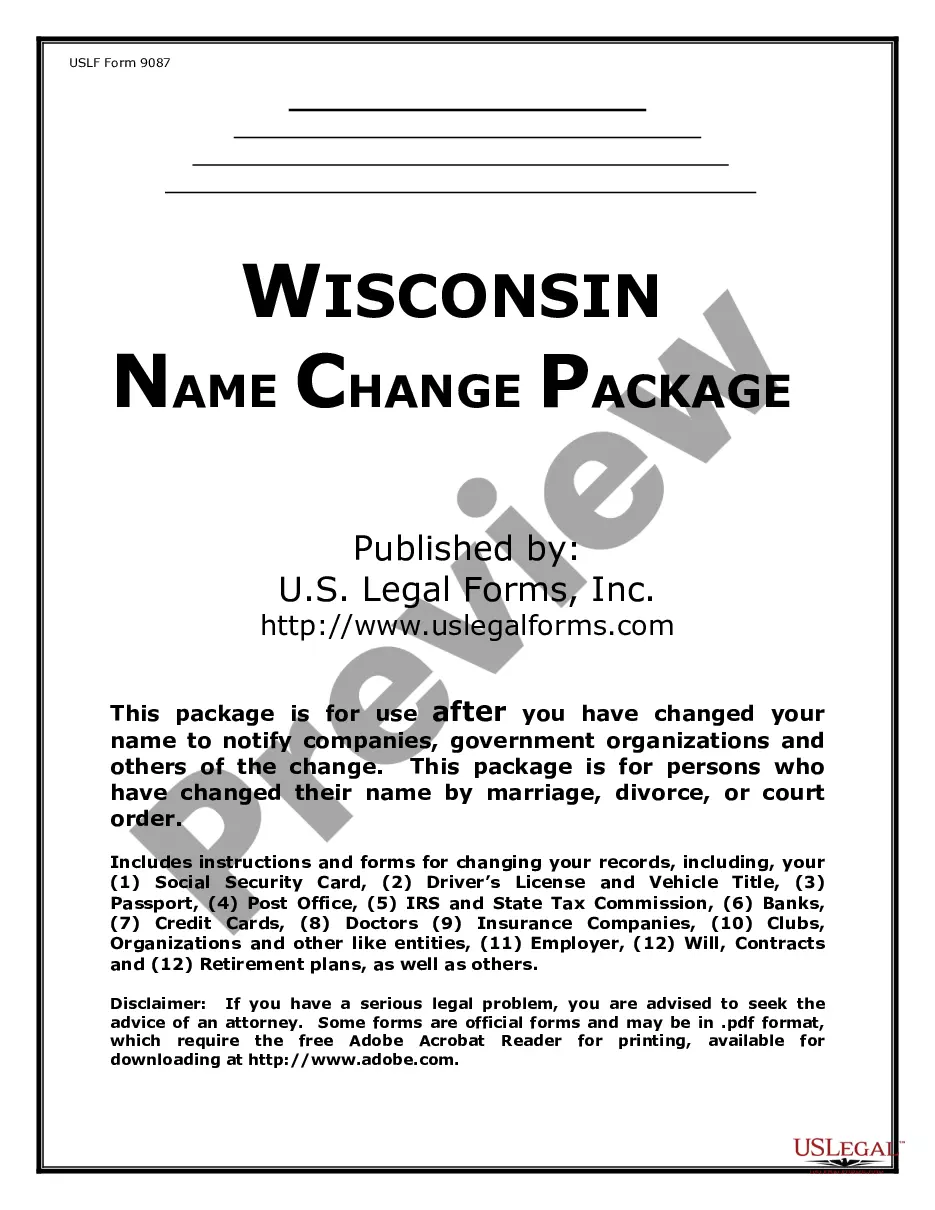

- Very first, make sure you have chosen the right develop for your city/region. It is possible to examine the form while using Preview button and read the form description to make certain this is basically the right one for you.

- In the event the develop is not going to satisfy your needs, take advantage of the Seach field to find the correct develop.

- Once you are certain that the form is suitable, select the Buy now button to get the develop.

- Select the prices program you want and type in the required information and facts. Make your accounts and purchase the transaction utilizing your PayPal accounts or charge card.

- Choose the document formatting and download the legal papers web template to your product.

- Comprehensive, edit and printing and sign the obtained Montana Assignment of Overriding Royalty Interest (By Owner of Override).

US Legal Forms will be the biggest collection of legal kinds for which you can see various papers templates. Use the service to download expertly-produced papers that comply with condition demands.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.