Montana Settlement Statement of Personal Injury Case and Receipt

Description

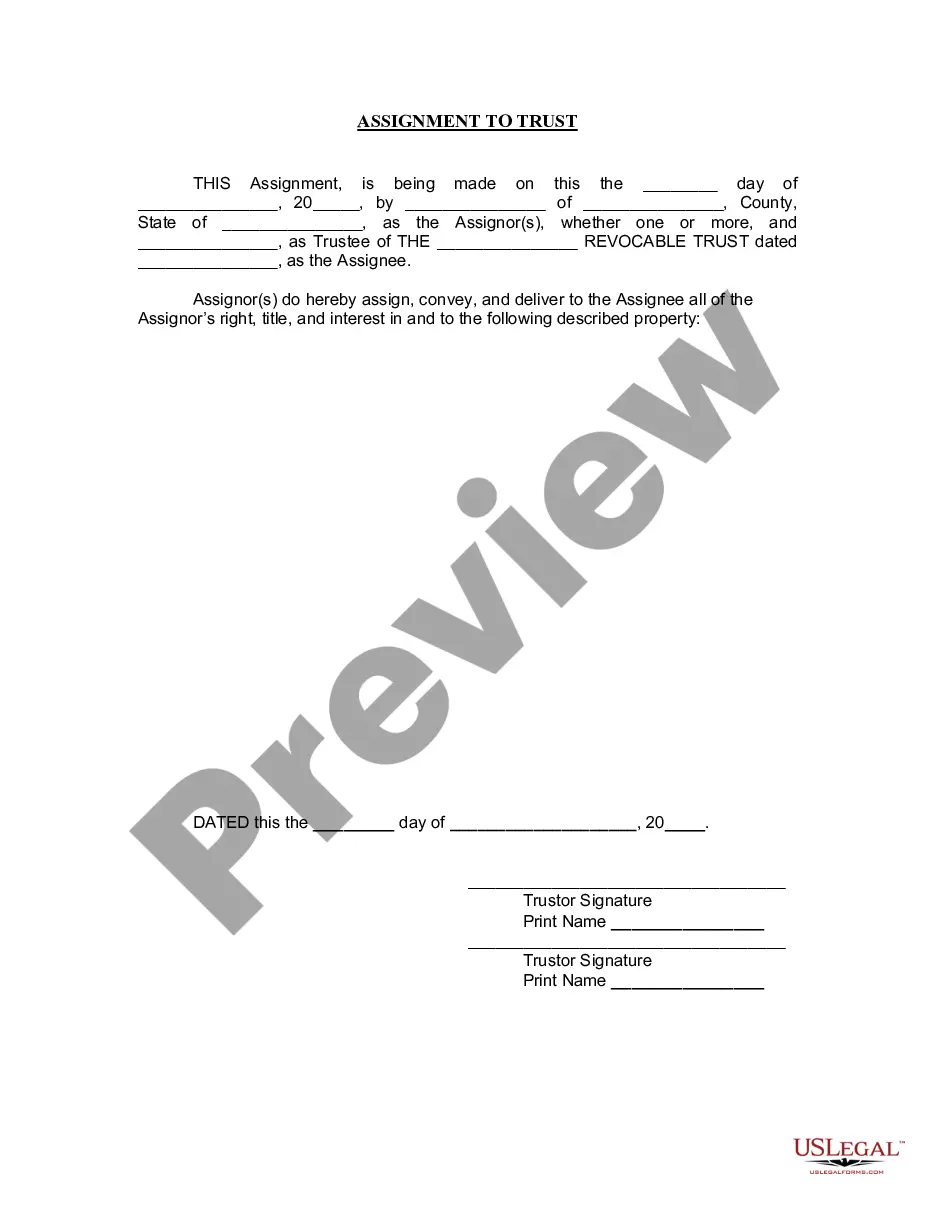

How to fill out Settlement Statement Of Personal Injury Case And Receipt?

US Legal Forms - one of the most significant libraries of legal varieties in the United States - provides a variety of legal record templates it is possible to acquire or printing. While using website, you will get a huge number of varieties for enterprise and specific purposes, categorized by categories, says, or keywords.You will discover the newest models of varieties much like the Montana Settlement Statement of Personal Injury Case and Receipt within minutes.

If you already possess a subscription, log in and acquire Montana Settlement Statement of Personal Injury Case and Receipt through the US Legal Forms library. The Download key will show up on each form you view. You get access to all in the past saved varieties from the My Forms tab of your respective account.

If you would like use US Legal Forms the first time, here are simple directions to help you get started off:

- Ensure you have selected the right form to your area/region. Go through the Review key to analyze the form`s content. Read the form outline to ensure that you have chosen the right form.

- If the form does not satisfy your specifications, utilize the Research field towards the top of the monitor to obtain the the one that does.

- Should you be pleased with the form, verify your choice by clicking the Acquire now key. Then, pick the prices program you like and provide your credentials to sign up for an account.

- Method the deal. Make use of credit card or PayPal account to finish the deal.

- Select the structure and acquire the form in your device.

- Make changes. Fill up, revise and printing and indicator the saved Montana Settlement Statement of Personal Injury Case and Receipt.

Every single web template you added to your money does not have an expiry time and is also your own property for a long time. So, if you want to acquire or printing one more version, just proceed to the My Forms area and click on around the form you need.

Gain access to the Montana Settlement Statement of Personal Injury Case and Receipt with US Legal Forms, by far the most substantial library of legal record templates. Use a huge number of specialist and condition-specific templates that meet up with your company or specific needs and specifications.

Form popularity

FAQ

(2) ?Disbursement of settlement proceeds? means the payment of all proceeds of a transaction by a settlement agent to the persons entitled to receive the proceeds.

A structured settlement is an arrangement in which the settlement payment is paid out over time, rather than in a lump sum. This can help to avoid taxes on the settlement payment by spreading out the tax liability over a longer period of time.

Since these types of damages are meant to replace the income you would otherwise have earned from work and would have paid taxes on, they are considered to be taxable by the IRS and the State of California and will need to be reported.

Montana statute of limitations law When filing a personal injury claim in Montana, tort law states that you must bring the case within 3 years of your injury. That time limit accounts for most injuries, but there are some exceptions which actually have shorter time limits.

The IRS and state agencies don't have to follow the same rules as regular creditors, so they can pursue aggressive reclamation policies and take your money. For example, the IRS can take money from your bank accounts regardless of the source of the money. Your personal injury settlement is fair game for them.

Money you receive as part of an insurance claim or settlement is typically not taxed. The IRS only levies taxes on income, which is money or payment received that results in you having more wealth than you did before.

The general rule is that lawsuit settlements are taxable, except in cases that involve an actual, physical injury (?observable bodily harm?) or illness that you suffered. In other words: personal injury settlements usually aren't taxable, while other types of settlements usually are.

Under 26 U.S. Code § 104(a)(2), compensation that you recover for your medical expenses for your physical injuries is excluded from your gross income and is generally not taxable by the IRS or the State of California.