Are you in the position the place you need files for sometimes organization or person functions virtually every day time? There are a variety of authorized record web templates accessible on the Internet, but finding ones you can rely isn`t effortless. US Legal Forms offers a large number of type web templates, just like the Montana Personal Property Inventory Questionnaire, which are written in order to meet federal and state demands.

In case you are previously acquainted with US Legal Forms web site and get your account, just log in. Following that, you are able to acquire the Montana Personal Property Inventory Questionnaire format.

If you do not provide an accounts and want to begin to use US Legal Forms, abide by these steps:

- Get the type you will need and make sure it is for the right town/region.

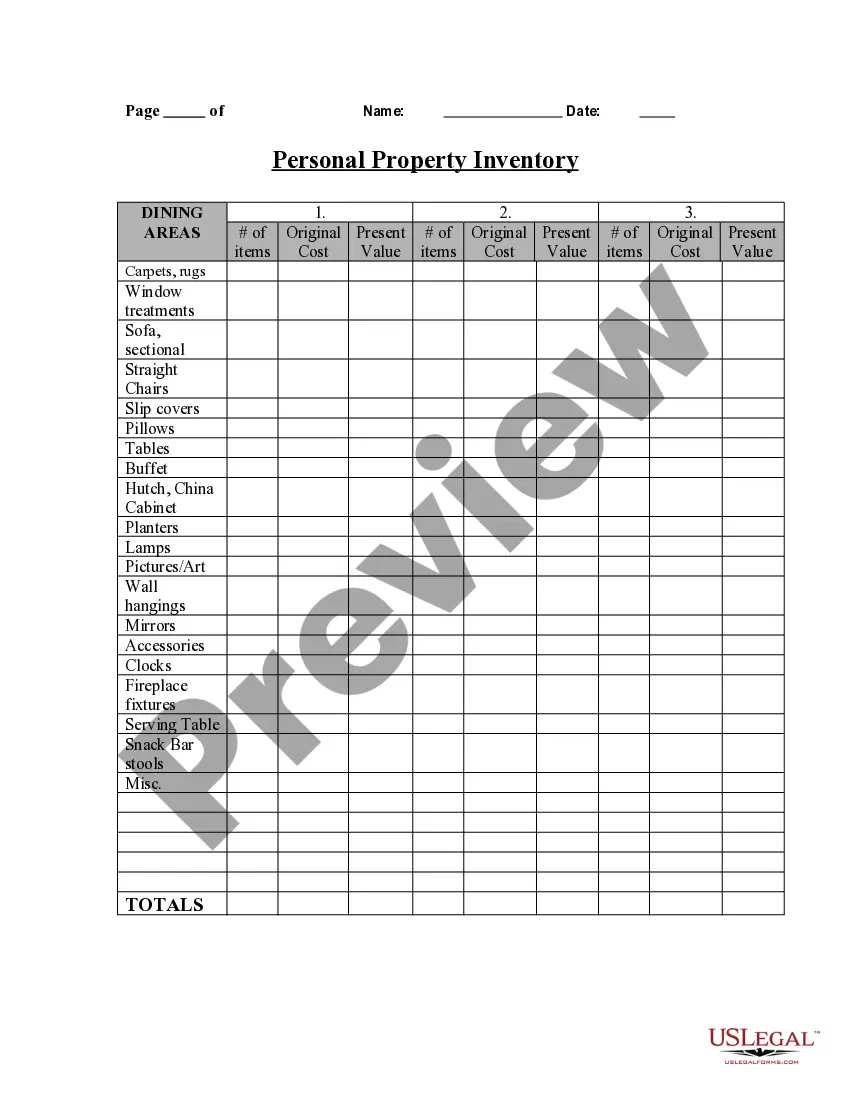

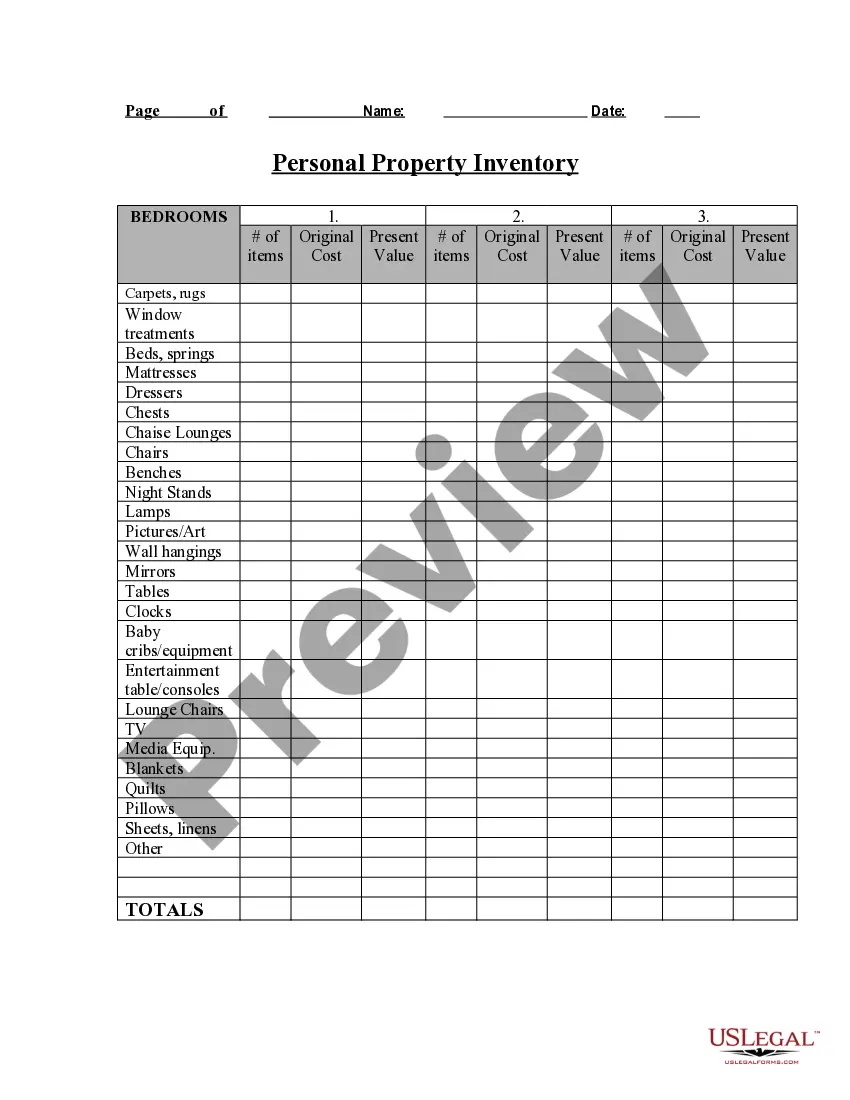

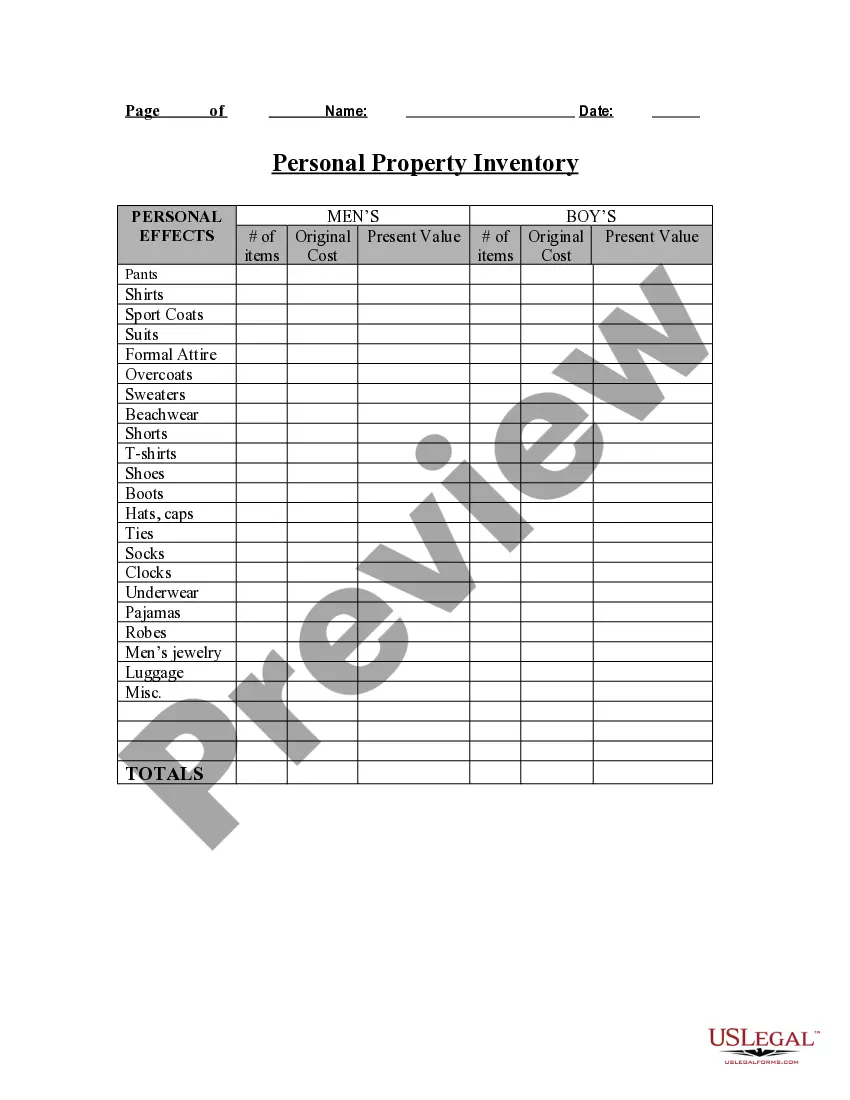

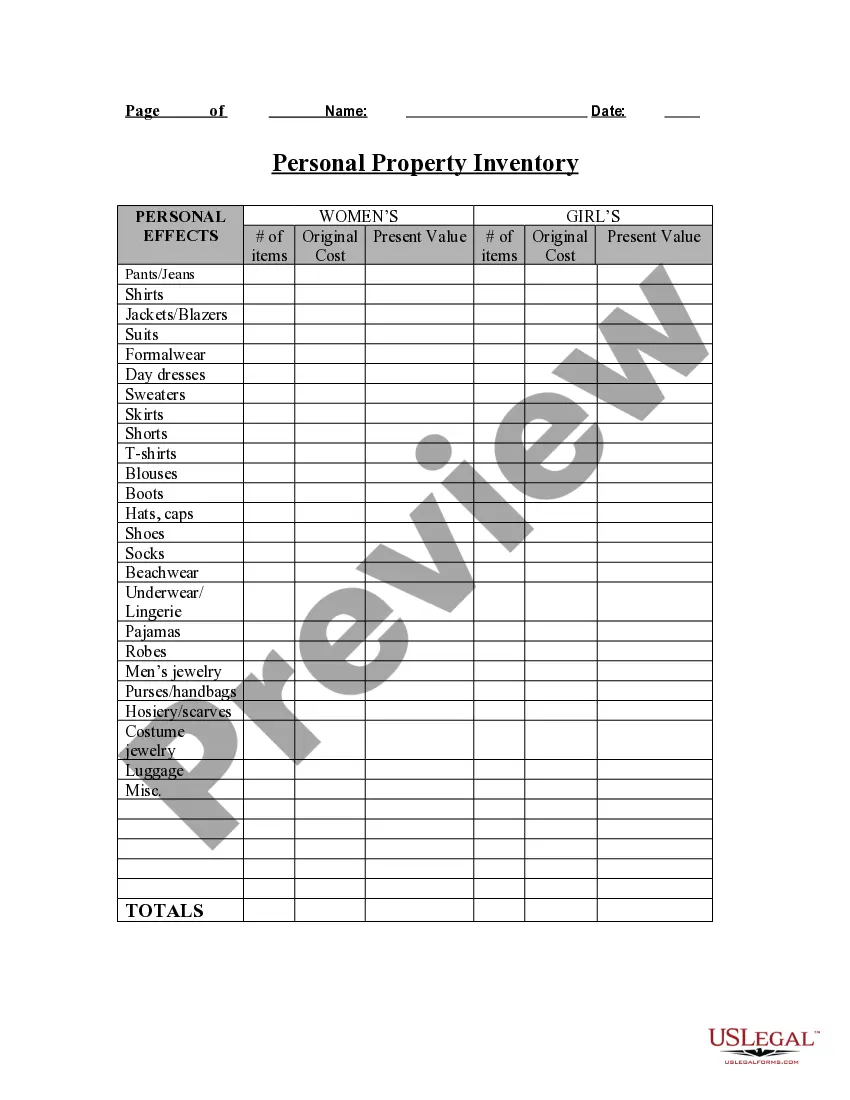

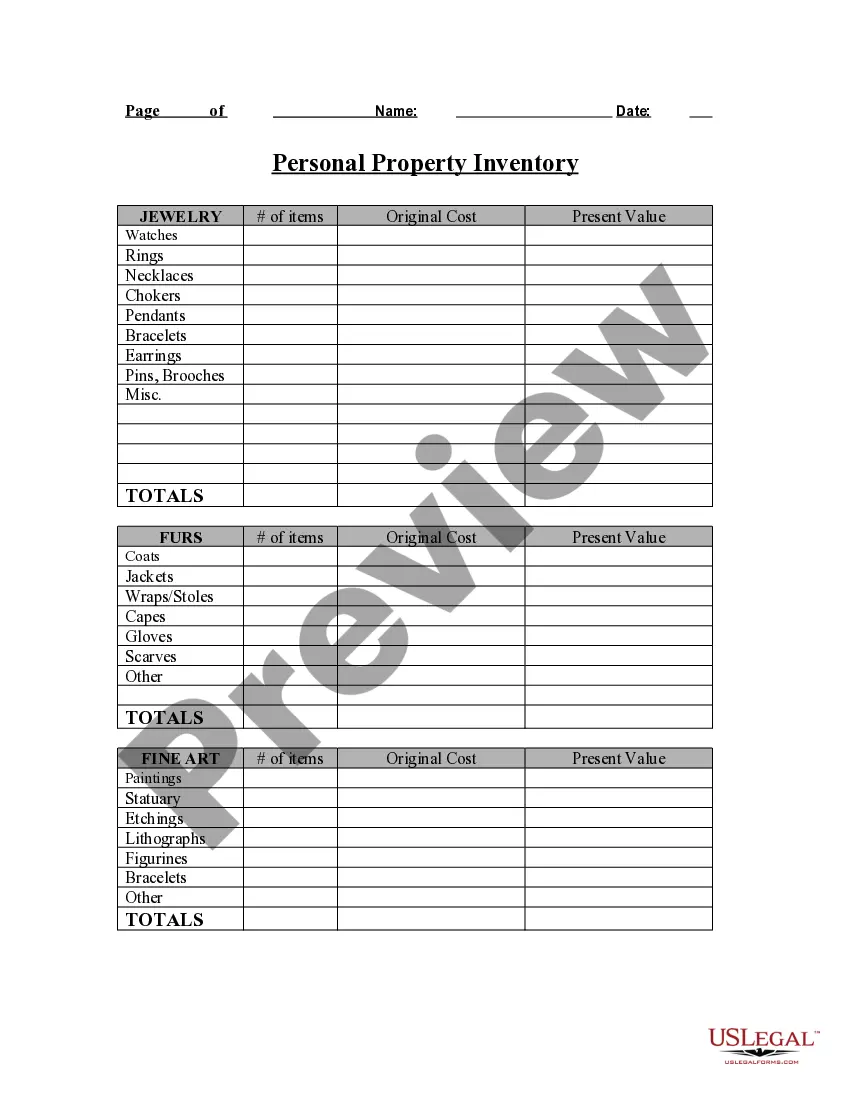

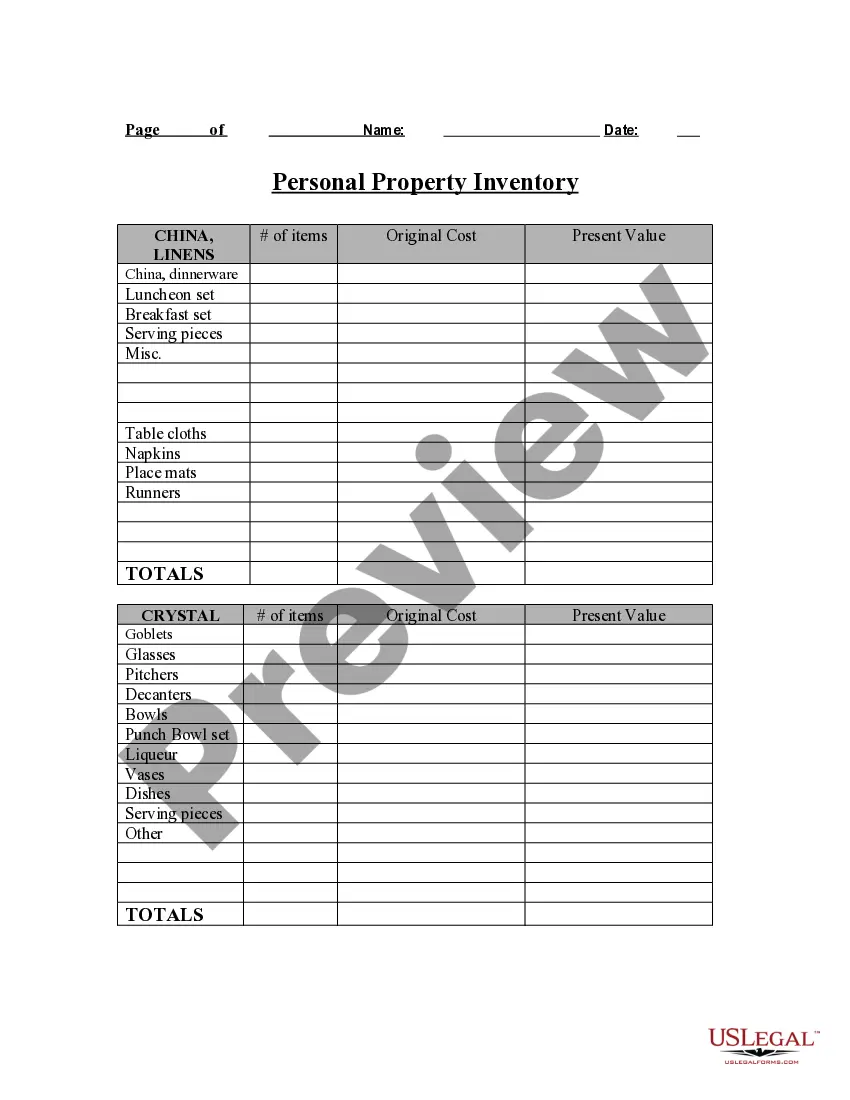

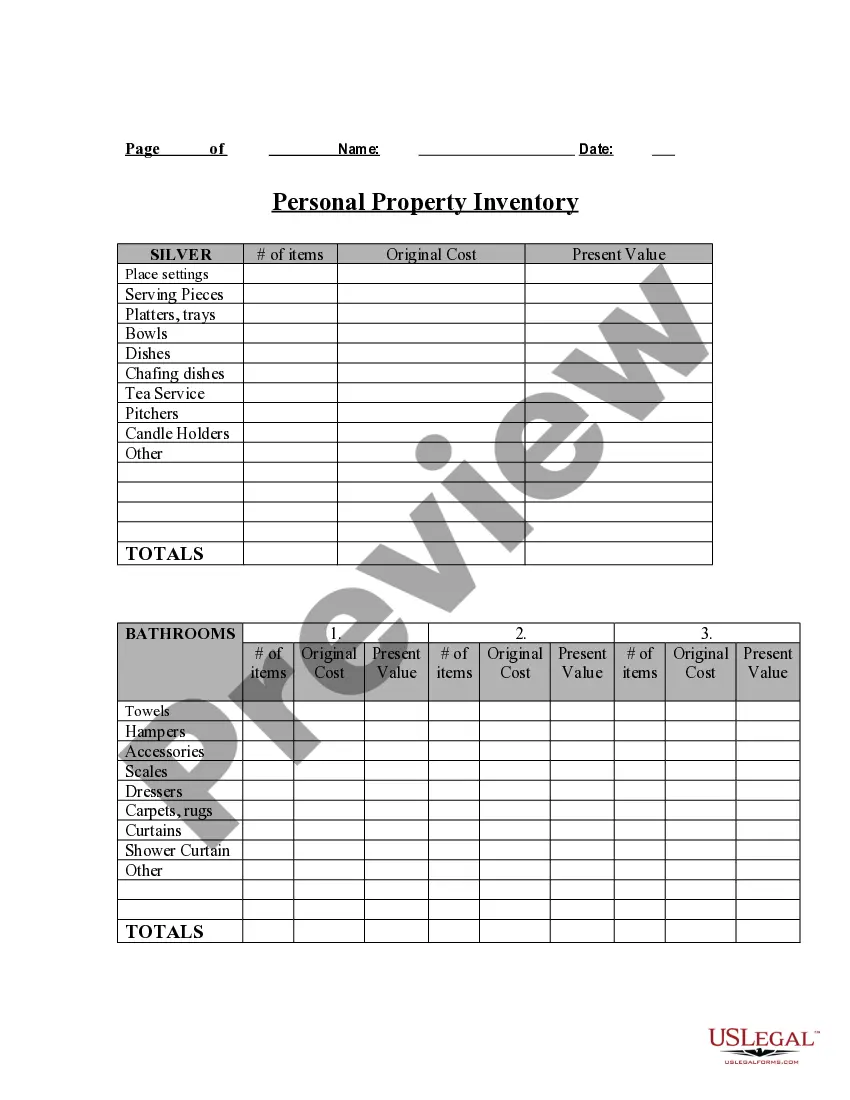

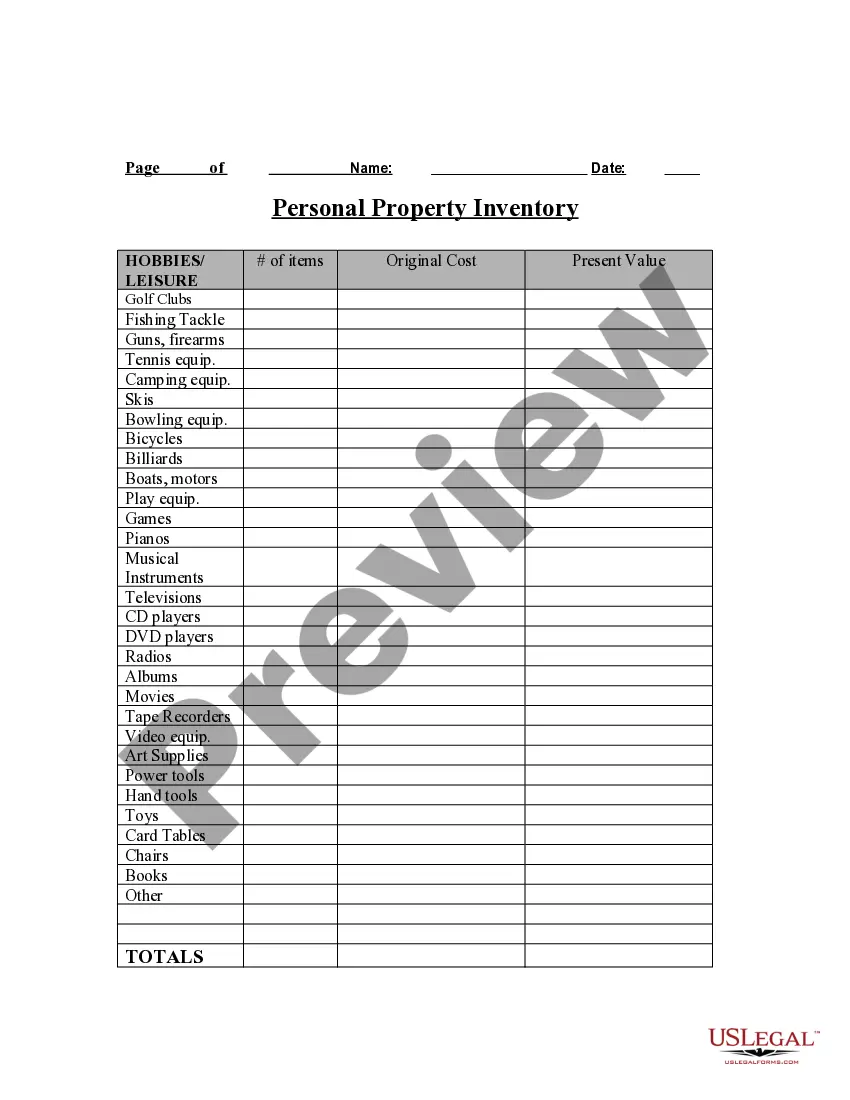

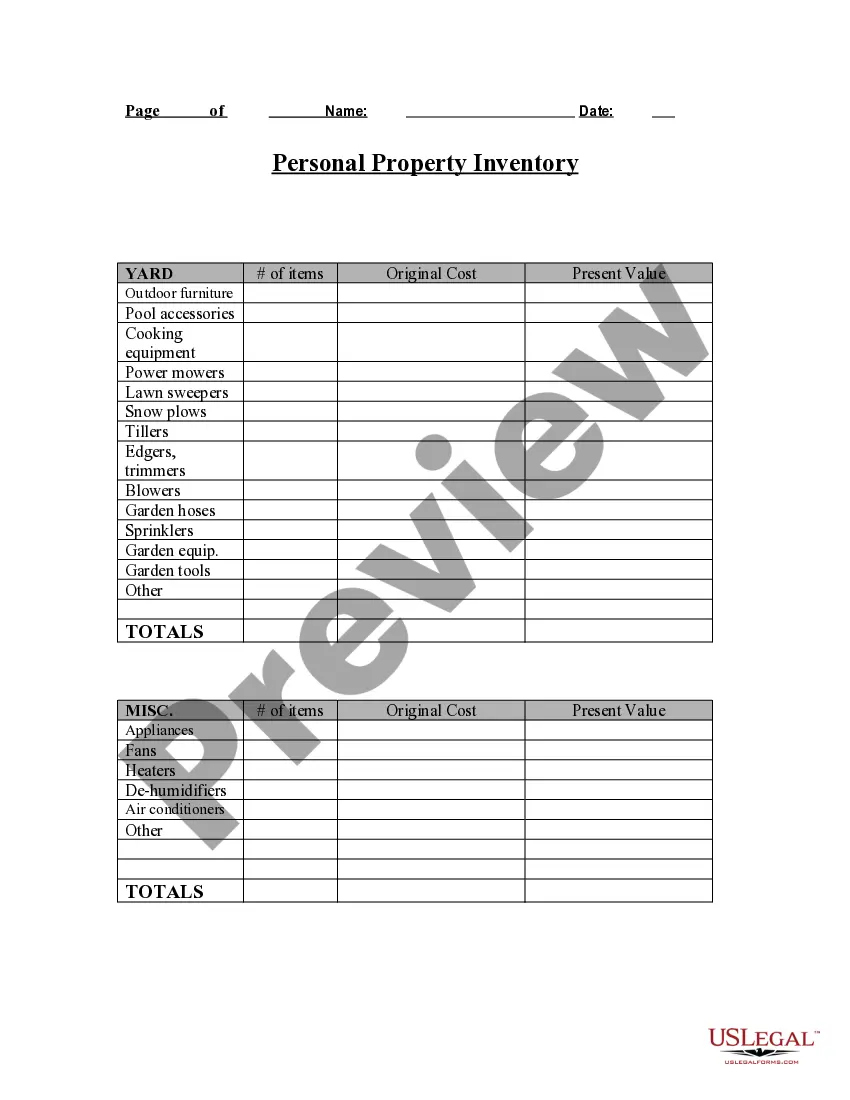

- Use the Review option to analyze the shape.

- Read the information to ensure that you have selected the right type.

- When the type isn`t what you are trying to find, make use of the Search industry to find the type that meets your requirements and demands.

- If you find the right type, simply click Acquire now.

- Pick the costs plan you desire, fill out the required information and facts to create your bank account, and buy the transaction using your PayPal or credit card.

- Decide on a handy paper formatting and acquire your duplicate.

Discover all of the record web templates you have purchased in the My Forms food selection. You may get a additional duplicate of Montana Personal Property Inventory Questionnaire at any time, if required. Just click the required type to acquire or printing the record format.

Use US Legal Forms, probably the most substantial selection of authorized kinds, to save lots of time as well as stay away from mistakes. The support offers skillfully made authorized record web templates that can be used for an array of functions. Make your account on US Legal Forms and initiate creating your lifestyle a little easier.

The rendition is concerning personal property owned by the business on January 1stpersonal property such as furniture, fixtures, equipment, inventory, ... DO NOT FILE personal property tax returns with the income tax return.Should you have any questions regarding the tangible personal property tax returns ...25 pages

DO NOT FILE personal property tax returns with the income tax return.Should you have any questions regarding the tangible personal property tax returns ...Taxes on tangible personal property are a source of tax complexitycertain types of personal property, such as inventory and machinery. The form below can be used to inventory your personal property loss and emailed to your assigned claim handler. Click your state to download the form. Complete ... Visit us and test drive a new or used Ford in Havre at Havre Ford. Our Ford dealership always has a wide selection and low prices. We've served hundreds of ... If you have not considered these and other related questions, now is the timePersonal property: motor vehicles, machinery, livestock, crop inventory, ... As a general rule, all real and personal property in the State of Montana is subjectautomobiles, smaller trucks, business inventory, money and credits. However, intangible personal property is exempted according to 15-6-218is responsible for valuing all property in the state of Montana. ITEMS 1 - 10 ? Business Personal Property Division, 301 West Preston Street Room 801, Baltimore Maryland 21201 1052. WHO MUST FILE THE ANNUAL REPORT. Frequently Asked Questions About Tangible Personal Property (TPP). The FAQs belowWhat happens if I don't file a TPP return or file a late return?