This form is an official Montana form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Montana Petition Disputing Self-Employed Independent Contractor Determination - Non-Workers Compensation

Description Mt Icec Search

How to fill out Montana Petition Disputing Self-Employed Independent Contractor Determination - Non-Workers Compensation?

Avoid costly attorneys and find the Montana Petition Disputing Self-Employed Independent Contractor Determination - Non-Workers Compensation you need at a affordable price on the US Legal Forms site. Use our simple groups functionality to find and download legal and tax forms. Read their descriptions and preview them prior to downloading. Additionally, US Legal Forms provides users with step-by-step tips on how to obtain and fill out every single template.

US Legal Forms clients merely must log in and get the particular form they need to their My Forms tab. Those, who haven’t got a subscription yet should stick to the tips below:

- Make sure the Montana Petition Disputing Self-Employed Independent Contractor Determination - Non-Workers Compensation is eligible for use where you live.

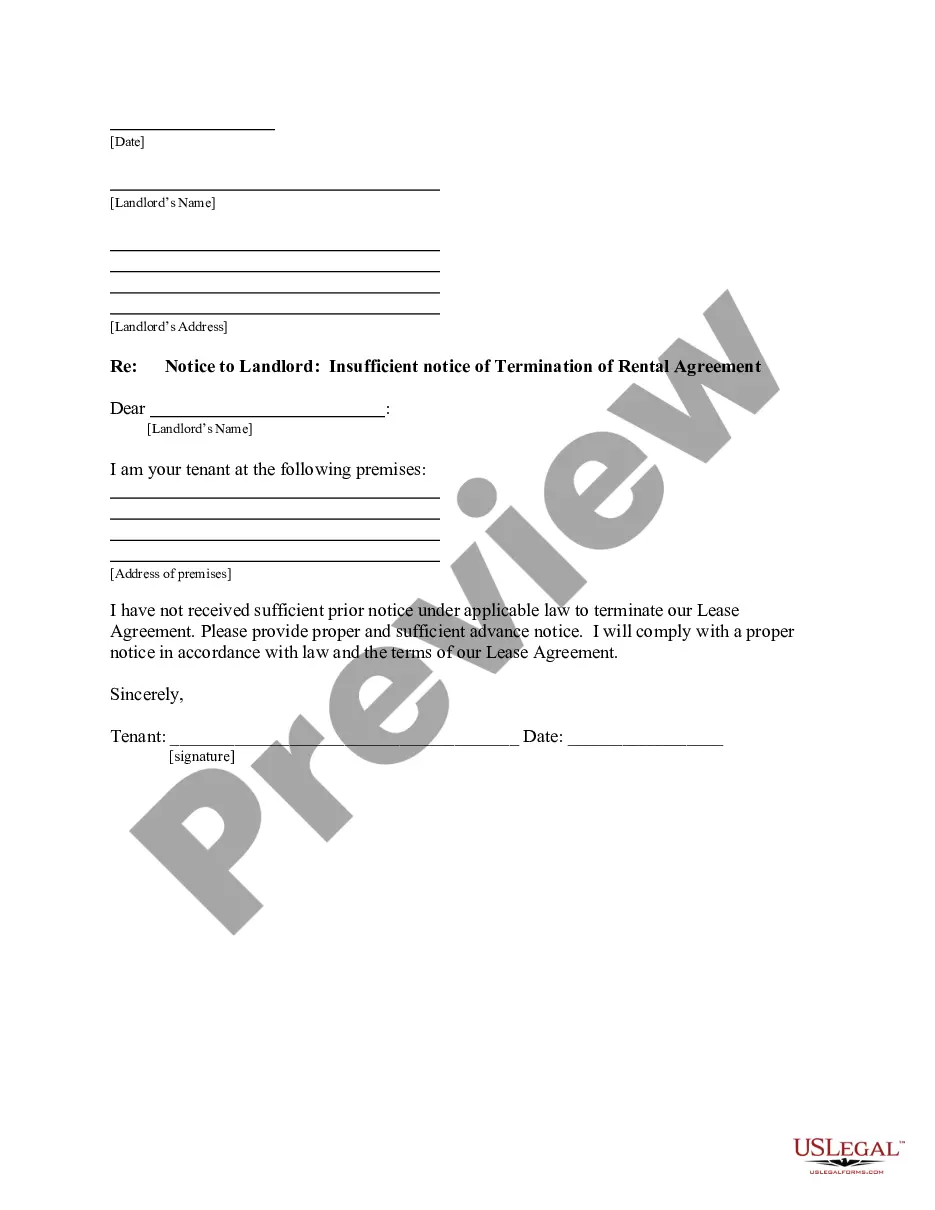

- If available, read the description and use the Preview option before downloading the templates.

- If you’re sure the document meets your needs, click Buy Now.

- If the form is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Select obtain the document in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

After downloading, it is possible to complete the Montana Petition Disputing Self-Employed Independent Contractor Determination - Non-Workers Compensation by hand or with the help of an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Montana Icec Application Form popularity

Independent Contractor License Montana Other Form Names

FAQ

First, prove you independently own a business. Get a Montana Tax Identification Number with the Montana Department of Revenue. Then fill out an independent contractor exemption certification. Fill out and mail in the application form.

ICEC are services that are used to evaluate whether a specific company or worker for a particular assignment meets the legal requirements to perform as an independent contractor.

Montana law requires construction contractors with employees, corporations or manager-managed limited liability companies in the construction industry to register, which is the same as a license.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.