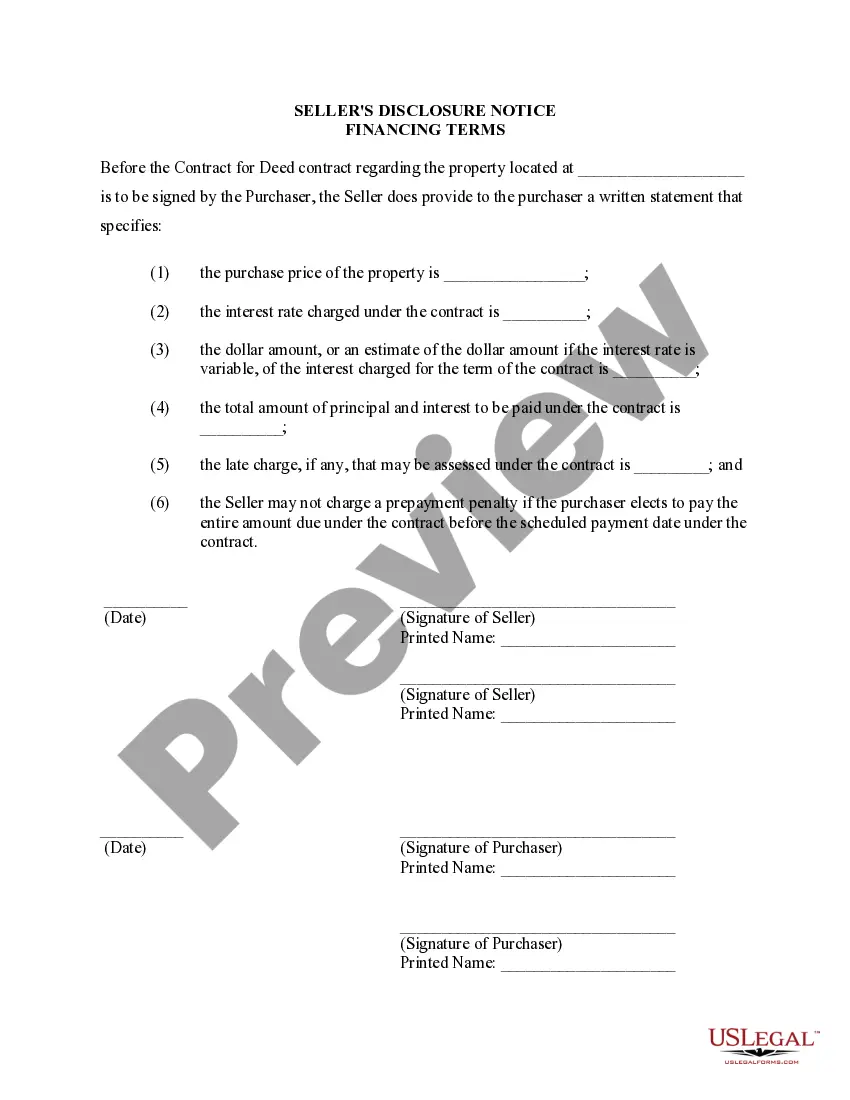

North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description Disclosure Property Contract

How to fill out North Carolina Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Use US Legal Forms to get a printable North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms library on the internet and offers reasonably priced and accurate samples for customers and legal professionals, and SMBs. The templates are categorized into state-based categories and some of them can be previewed before being downloaded.

To download samples, users must have a subscription and to log in to their account. Click Download next to any template you need and find it in My Forms.

For people who do not have a subscription, follow the following guidelines to easily find and download North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract:

- Check to ensure that you get the proper template with regards to the state it is needed in.

- Review the document by looking through the description and by using the Preview feature.

- Press Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Make use of the Search field if you want to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Over three million users have already used our platform successfully. Choose your subscription plan and get high-quality documents in a few clicks.

Form popularity

FAQ

If a seller fails to disclose, or actively conceals, problems that affect the value of the property; they are violating the law, and may be subject to a lawsuit for recovery of damages based on claims of fraud and deceit, misrepresentation and/or breach of contract.

As a last resort, a homeowner may file a lawsuit against the seller within a limited amount of time, known as a statute of limitations. Statutes of limitations are typically two to 10 years after closing. Lawsuits may be filed in small claims court relatively quickly and inexpensively, and without an attorney.

In general, a disclosure document is supposed to provide details about a property's condition that might negatively affect its value. Sellers who willfully conceal information can be sued and potentially convicted of a crime. Selling a property As Is will usually not exempt a seller from disclosures.

Under Ohio law, in fact, sellers must disclose any material defect about which they are aware before the sale is complete. If you discover a significant defect with your home following the closing, you might be able to seek recovery from the seller in court.

Sellers should disclose anything that required a permit in their home. These are usually significant items that should be disclosed. Examples include the heating system, air conditioning, the roof, or anything related to the plumbing or electrical systems.

If a seller fails to disclose, or actively conceals, problems that affect the value of the property; they are violating the law, and may be subject to a lawsuit for recovery of damages based on claims of fraud and deceit, misrepresentation and/or breach of contract.

In general, if the defect existed before you bought the home and the seller failed to disclose the defect, and you incurred monetary damages as a result, you can sue the seller or another party for breach of contract. A successful lawsuit could result in payment for the cost of repairs.

Sellers have to disclose any occupants (ie boyfriend, grandparent), who should also sign the contract. Sellers must disclose any official letters that have been received. And it is advisable to disclose any planning matters relating to the house or the neighbourhood.

If a seller fails to disclose, or actively conceals, problems that affect the value of the property; they are violating the law, and may be subject to a lawsuit for recovery of damages based on claims of fraud and deceit, misrepresentation and/or breach of contract.