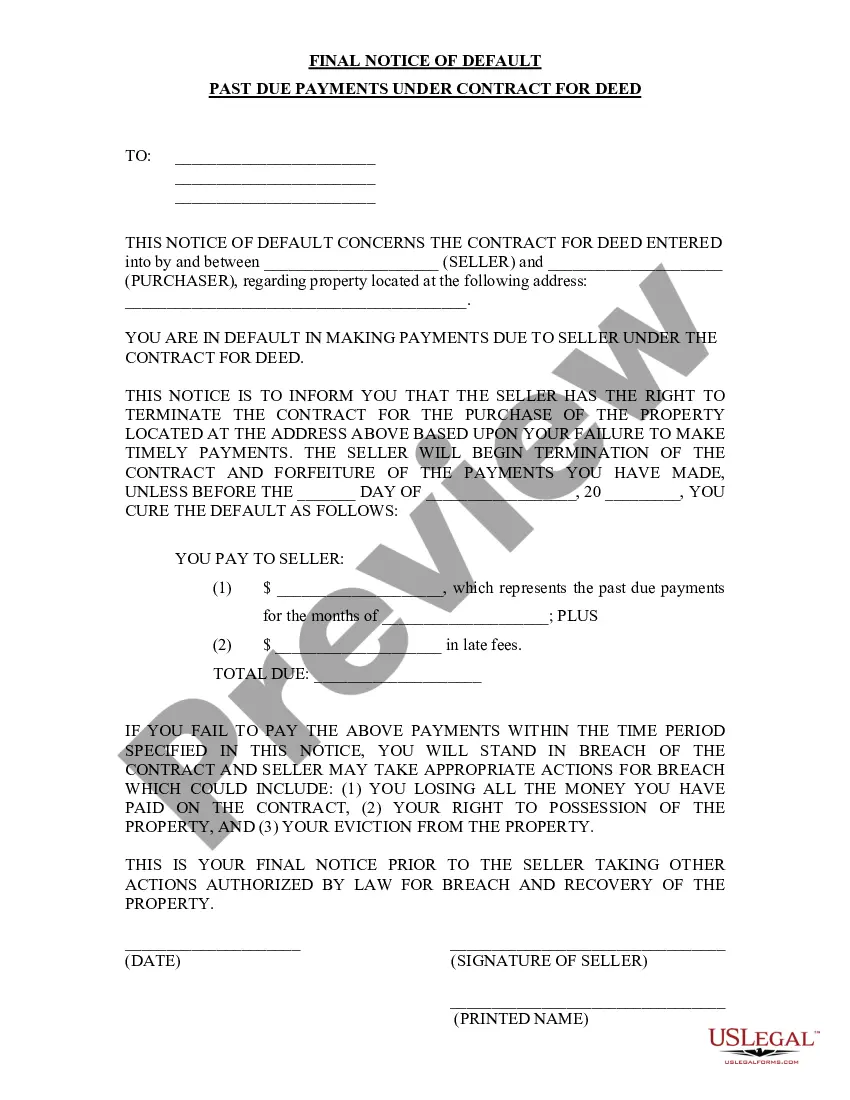

North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description Notice Payments With

How to fill out Nc Default Past?

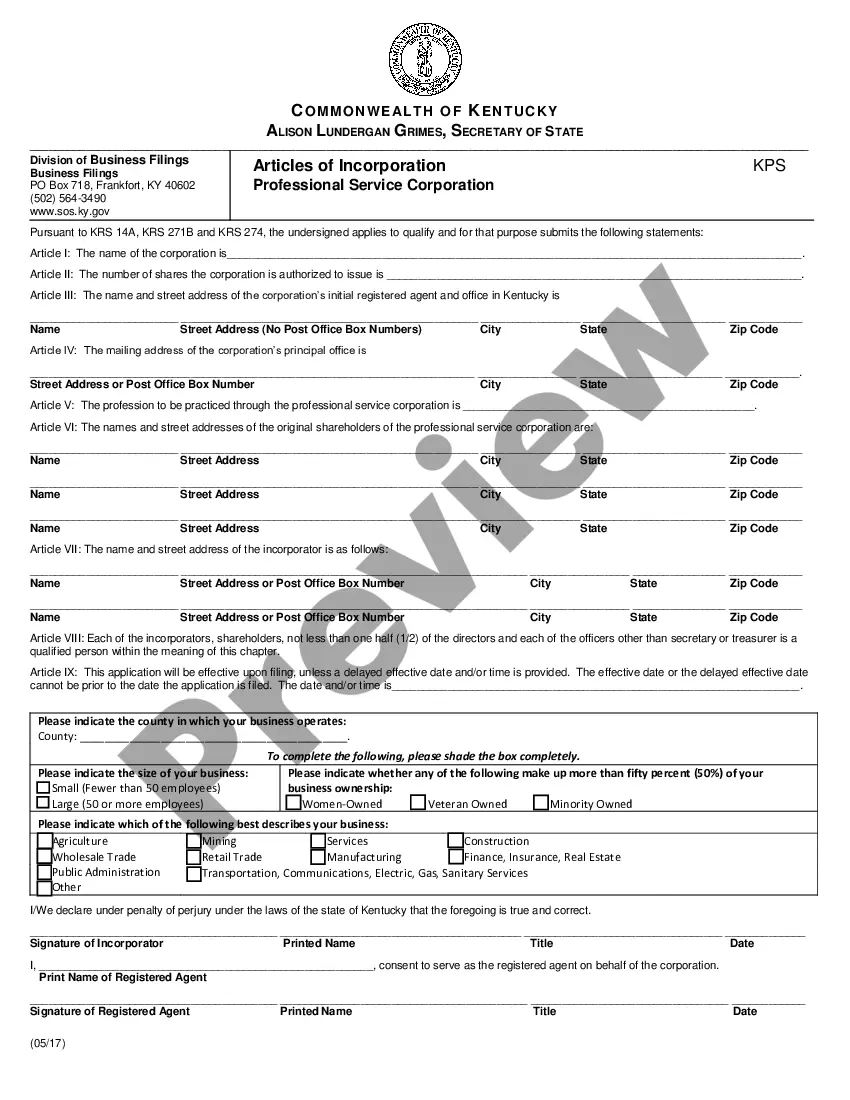

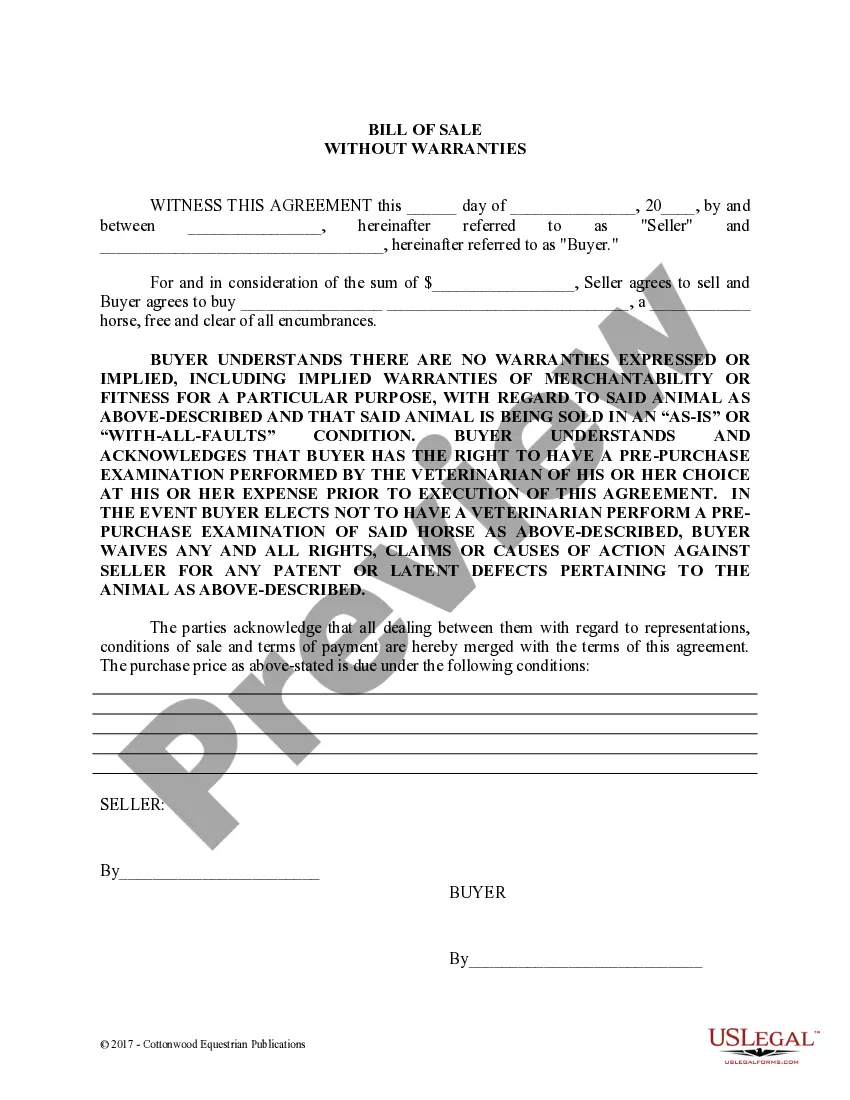

Use US Legal Forms to get a printable North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms catalogue on the web and provides cost-effective and accurate samples for customers and lawyers, and SMBs. The templates are categorized into state-based categories and many of them might be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For those who don’t have a subscription, follow the tips below to easily find and download North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed:

- Check to make sure you get the right template with regards to the state it is needed in.

- Review the document by looking through the description and using the Preview feature.

- Hit Buy Now if it is the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Make use of the Search engine if you need to get another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed. Over three million users already have utilized our service successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Notice Contract Deed Form popularity

Final Default With Other Form Names

North Carolina Notice FAQ

Does a default notice affect your credit rating? The notice of default doesn't affect your credit file, but when the account defaults this will be recorded. After the marker for the missed payment or default is added to your credit file, your credit score will be updated by the credit reference agencies.

The term notice of default refers to a public notice filed with a court that states that the borrower of a mortgage is in default on a loan. The lender may file a notice of default when a mortgagor falls behind on their mortgage payments.A notice of default is often considered the first step toward foreclosure.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

The term notice of default refers to a public notice filed with a court that states that the borrower of a mortgage is in default on a loan. The lender may file a notice of default when a mortgagor falls behind on their mortgage payments.

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

Write to the agency making the claim. Present evidence of why the NOD was improperly issued or why you legitimately cannot make payments. Ask the agency in the letter if they will take a lower monthly payment, total settlement or a payment plan. Send a copy of your letter by certified mail.

When a loan defaults, it is sent to a debt collection agency whose job is to contact the borrower and receive the unpaid funds. Defaulting will drastically reduce your credit score, impact your ability to receive future credit, and can lead to the seizure of personal property.

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.

If a borrower falls behind on his mortgage payments, the mortgage lender might file a notice of default, which is an official public notice that the borrower is in arrears. It is one of the initial steps in the foreclosure process.