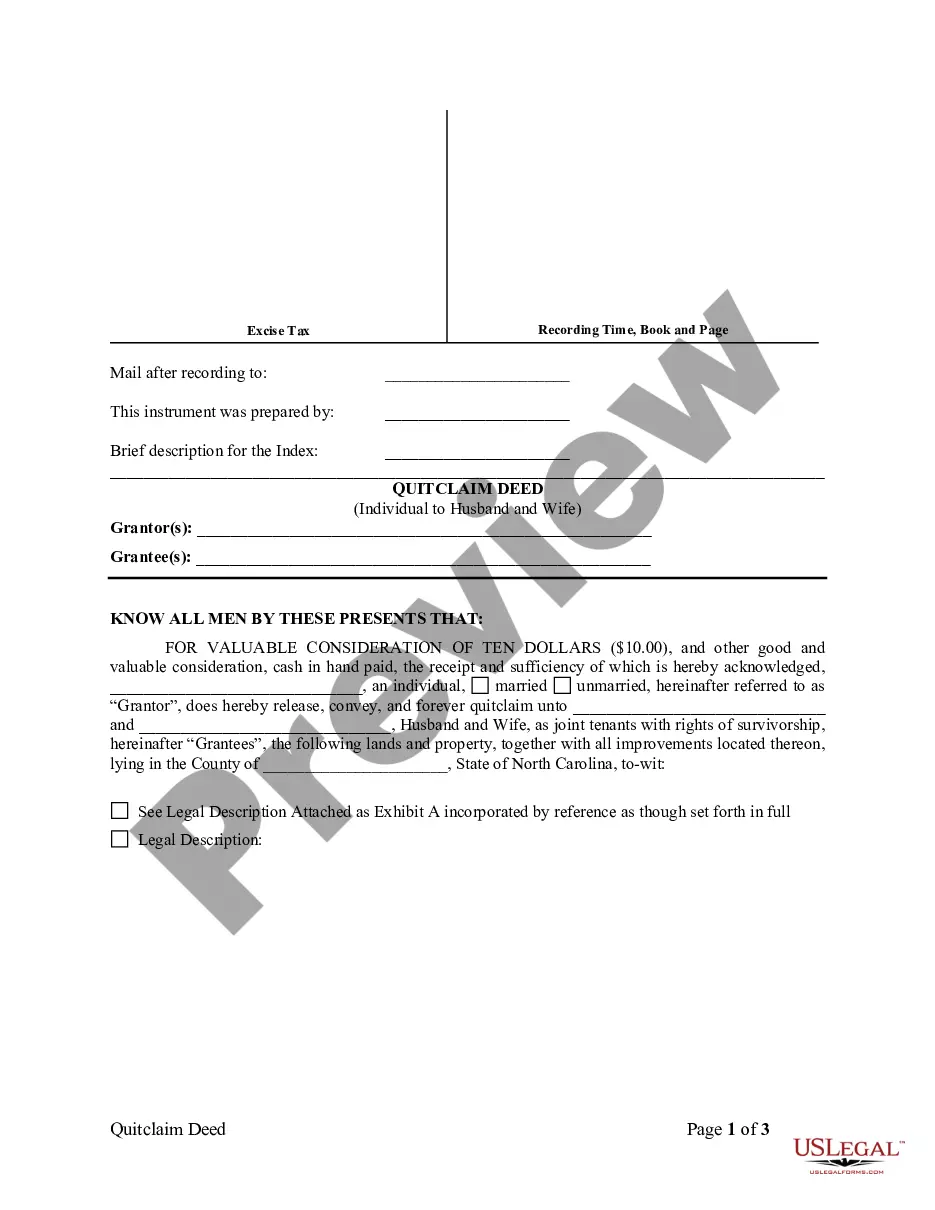

North Carolina Quitclaim Deed from Individual to Husband and Wife

Description Quit Claim Deed North Carolina

How to fill out North Carolina Quitclaim Deed Form?

Avoid expensive lawyers and find the North Carolina Quitclaim Deed from Individual to Husband and Wife you want at a affordable price on the US Legal Forms site. Use our simple groups function to search for and download legal and tax documents. Go through their descriptions and preview them before downloading. In addition, US Legal Forms provides customers with step-by-step tips on how to obtain and fill out every single template.

US Legal Forms customers basically need to log in and obtain the particular form they need to their My Forms tab. Those, who haven’t got a subscription yet must follow the guidelines below:

- Ensure the North Carolina Quitclaim Deed from Individual to Husband and Wife is eligible for use in your state.

- If available, read the description and make use of the Preview option before downloading the templates.

- If you’re sure the document fits your needs, click on Buy Now.

- If the form is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, you can fill out the North Carolina Quitclaim Deed from Individual to Husband and Wife manually or by using an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

North Carolina Quit Claim Deed Requirements Form popularity

Deed Husband Wife Other Form Names

North Carolina Deed FAQ

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

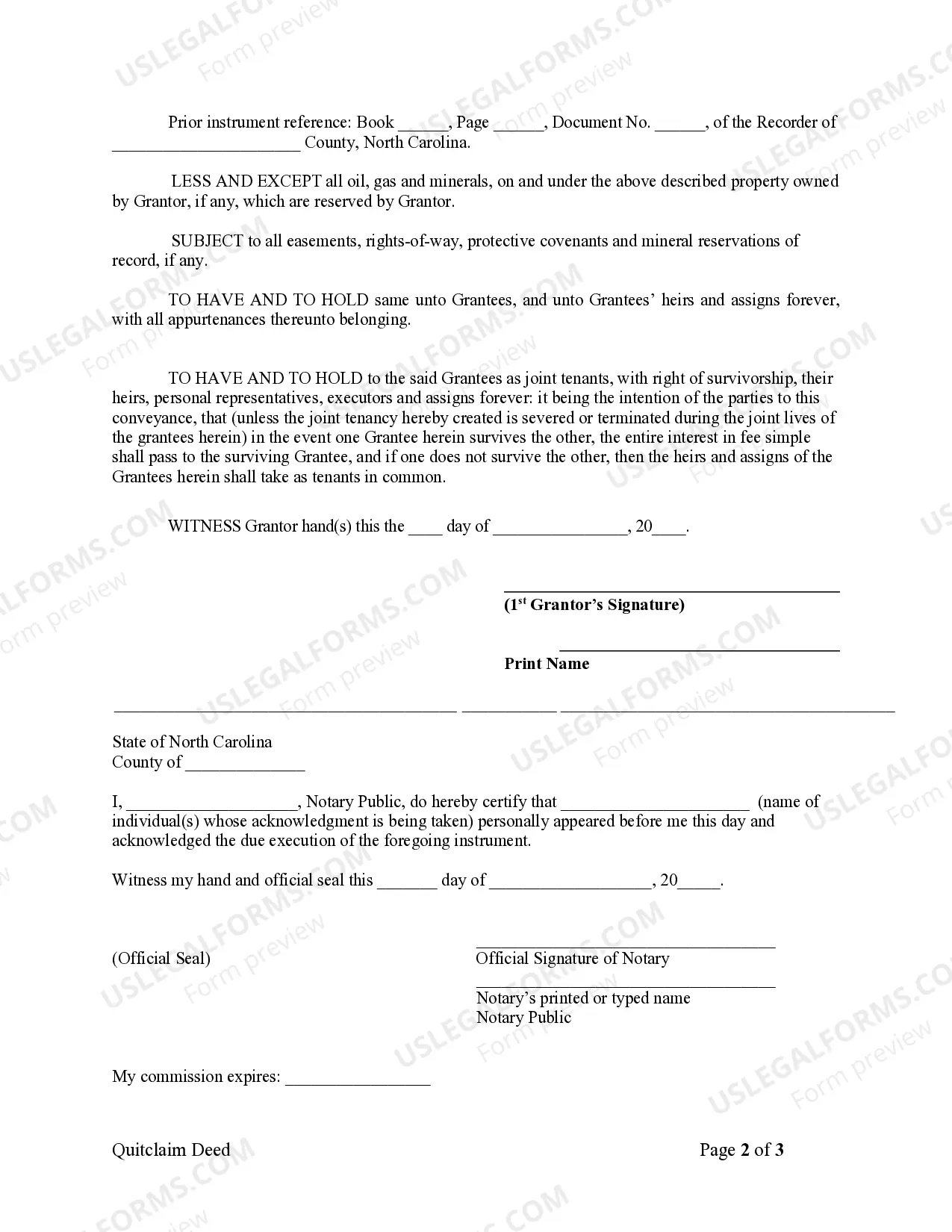

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

In North Carolina, the rule of thumb for married couples is that one spouse may purchase real property, but both spouses must sign the deed to sell property.If a married person can buy property in cash, with no deed of trust required, then he/she can buy the property without his/her spouse signing anything.

A married person buying property individually The owner needs to sign, but their spouse may not be required to sign documents at closing. North Carolina has a specific statute allowing a married buyer of real estate to sign their purchase-money Deed of Trust without requiring the signature of the buyer's spouse.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

Laws § 47B-8. Recording This form must be submitted, after completion and signature, to the Register of Deeds in the county where the real estate is located. Signing (A§ 47-38) All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

In divorces, states have two options for dividing property: community property division (where marital property belongs to both spouses equally, regardless of who bought it) or equitable division (where the court divides marital property equitably (justly.) North Carolina is not a community property state.