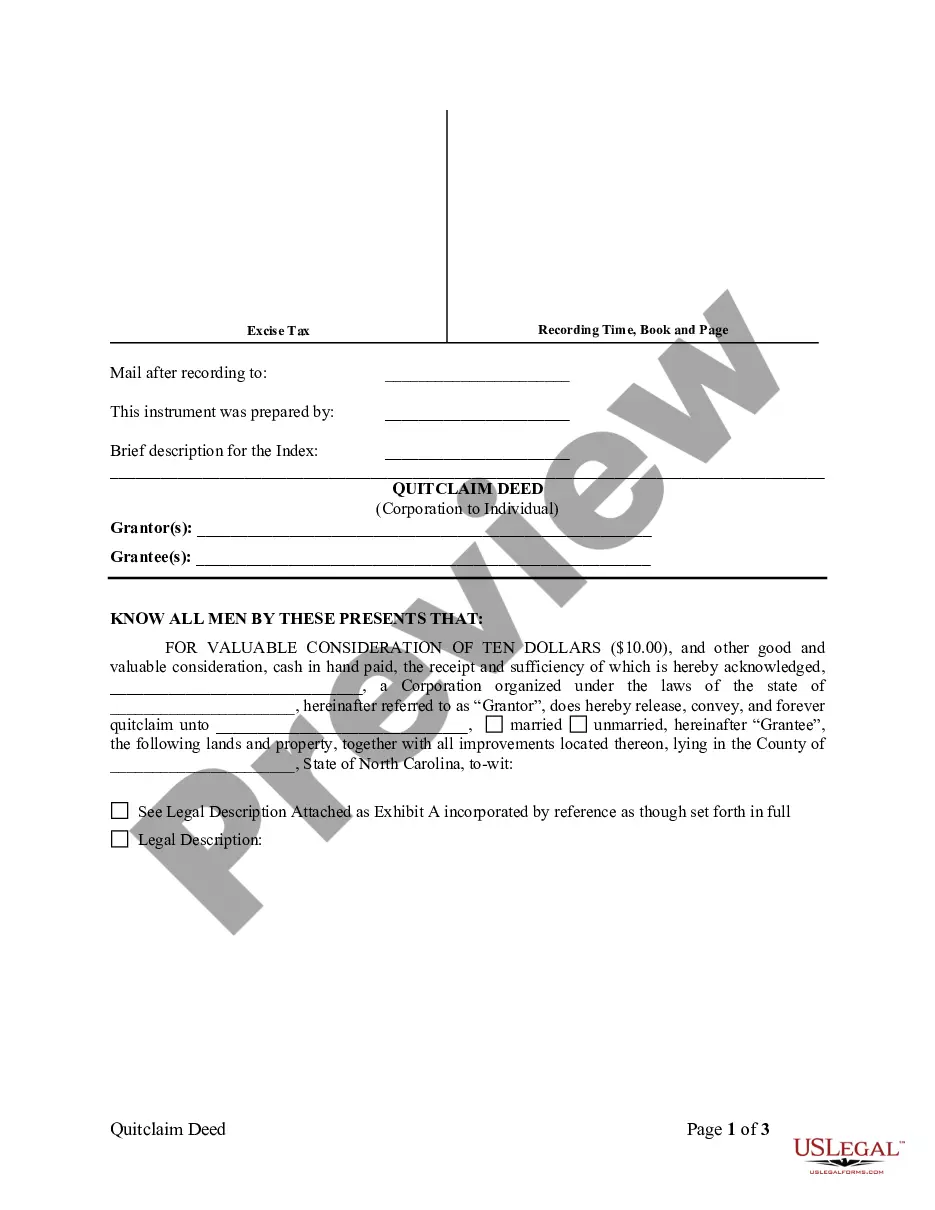

North Carolina Quitclaim Deed from Corporation to Individual

Description

How to fill out North Carolina Quitclaim Deed From Corporation To Individual?

Avoid costly lawyers and find the North Carolina Quitclaim Deed from Corporation to Individual you need at a affordable price on the US Legal Forms site. Use our simple groups function to find and download legal and tax documents. Read their descriptions and preview them just before downloading. Moreover, US Legal Forms provides customers with step-by-step tips on how to download and complete each form.

US Legal Forms clients just have to log in and obtain the specific form they need to their My Forms tab. Those, who haven’t obtained a subscription yet must follow the tips below:

- Make sure the North Carolina Quitclaim Deed from Corporation to Individual is eligible for use in your state.

- If available, look through the description and make use of the Preview option well before downloading the templates.

- If you’re sure the document is right for you, click on Buy Now.

- If the template is incorrect, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Select download the form in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the template to the gadget or print it out.

After downloading, you may complete the North Carolina Quitclaim Deed from Corporation to Individual manually or by using an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

Laws § 47B-8. Recording This form must be submitted, after completion and signature, to the Register of Deeds in the county where the real estate is located. Signing (A§ 47-38) All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Once you sign a quitclaim deed and it has been filed and recorded with the County Clerks Office, the title has been officially transferred and cannot be easily reversed. In order to reverse this type of transfer, it would require your spouse to cooperate and assist in adding your name back to the title.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.