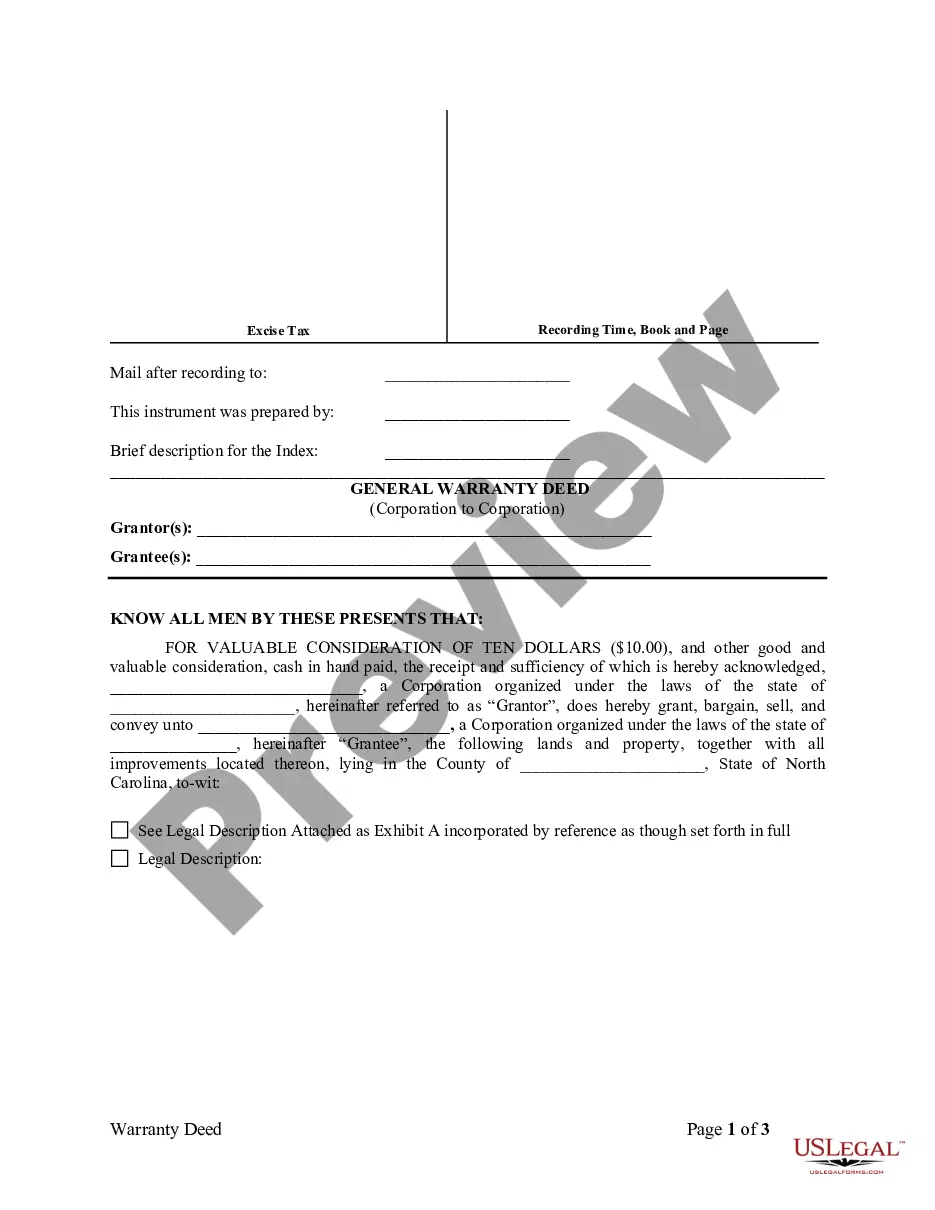

North Carolina General Warranty Deed from Corporation to Corporation

Description Special Warranty Deed

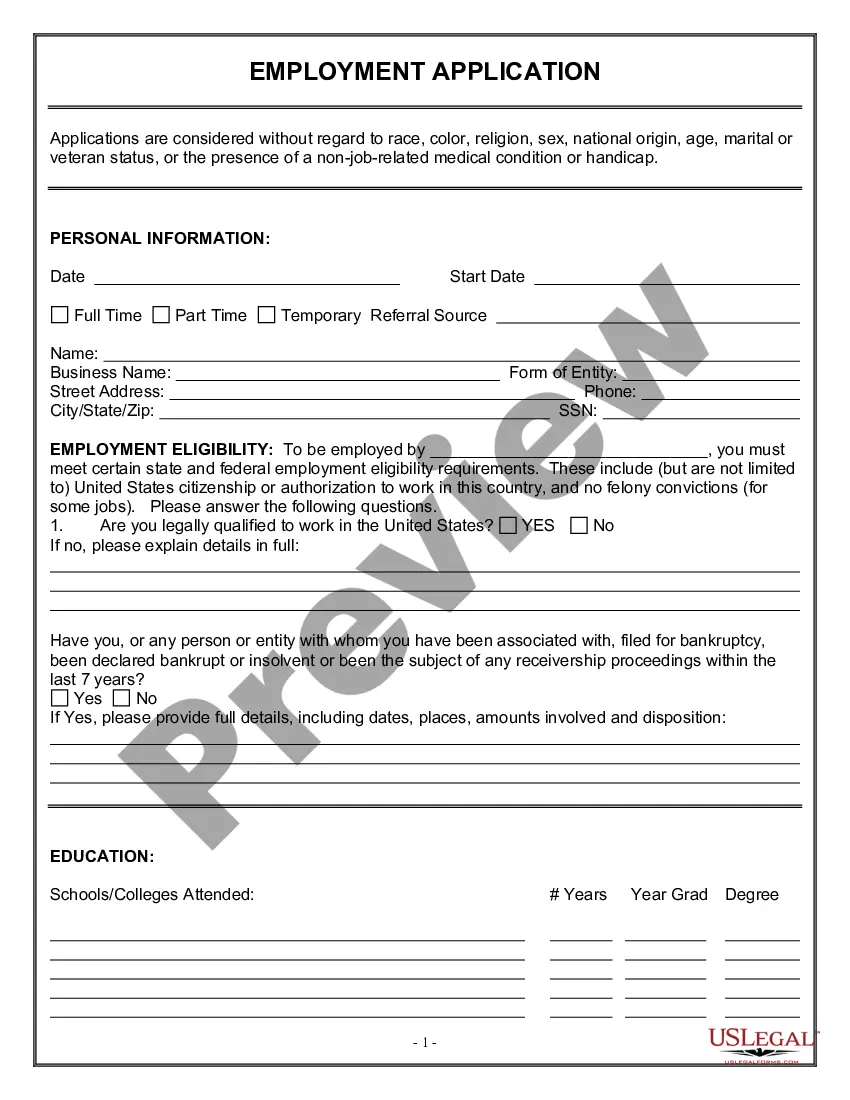

How to fill out Corporate Warranty Deed?

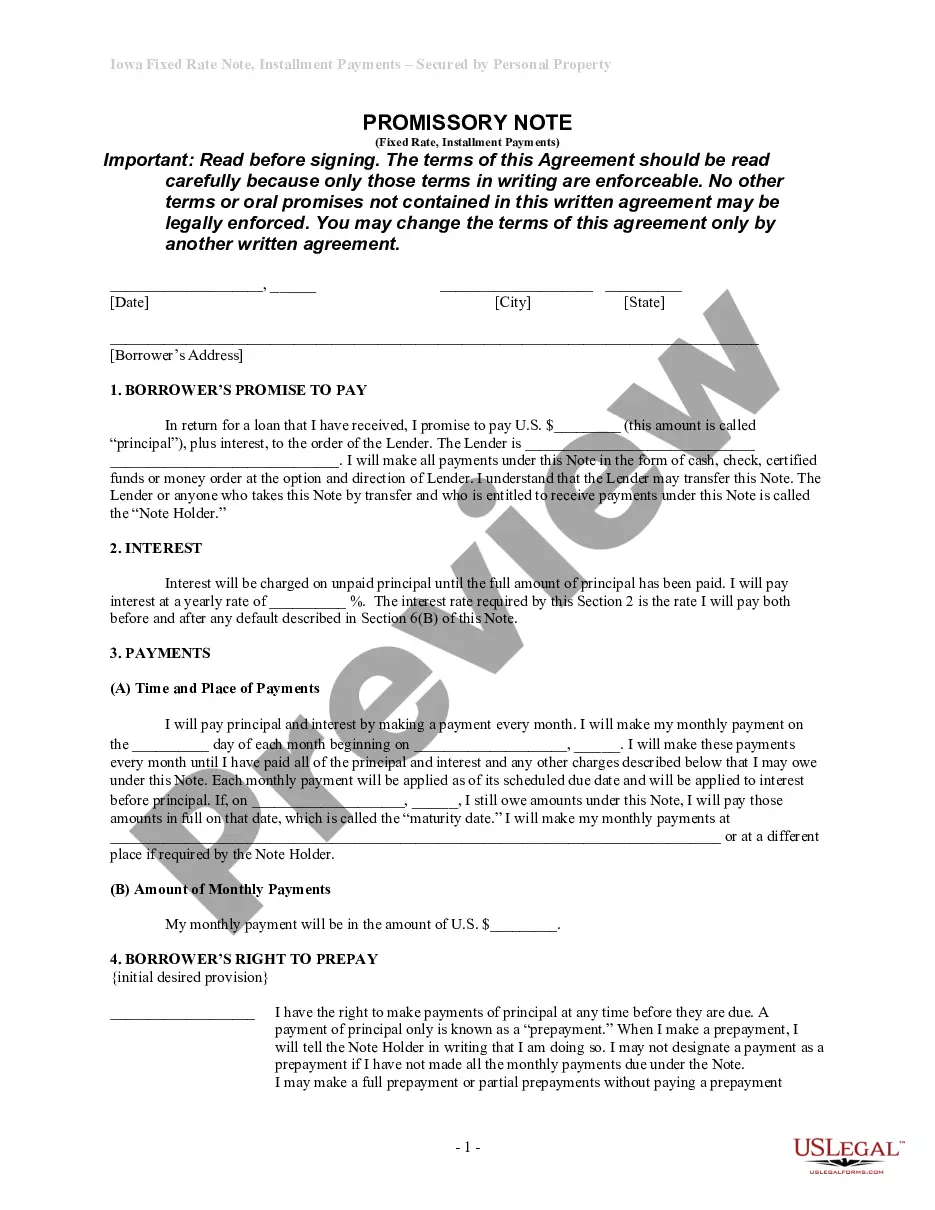

Avoid expensive attorneys and find the North Carolina General Warranty Deed from Corporation to Corporation you need at a reasonable price on the US Legal Forms website. Use our simple categories function to find and obtain legal and tax forms. Read their descriptions and preview them just before downloading. Moreover, US Legal Forms enables users with step-by-step instructions on how to download and fill out every single template.

US Legal Forms clients just need to log in and get the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet need to follow the guidelines below:

- Make sure the North Carolina General Warranty Deed from Corporation to Corporation is eligible for use where you live.

- If available, read the description and use the Preview option prior to downloading the sample.

- If you’re sure the template meets your needs, click Buy Now.

- If the template is incorrect, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Select obtain the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the template to the device or print it out.

After downloading, you may fill out the North Carolina General Warranty Deed from Corporation to Corporation by hand or an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

North Carolina Special Warranty Deed Form Form popularity

Warranty Deed Nc Other Form Names

Warranty Deed FAQ

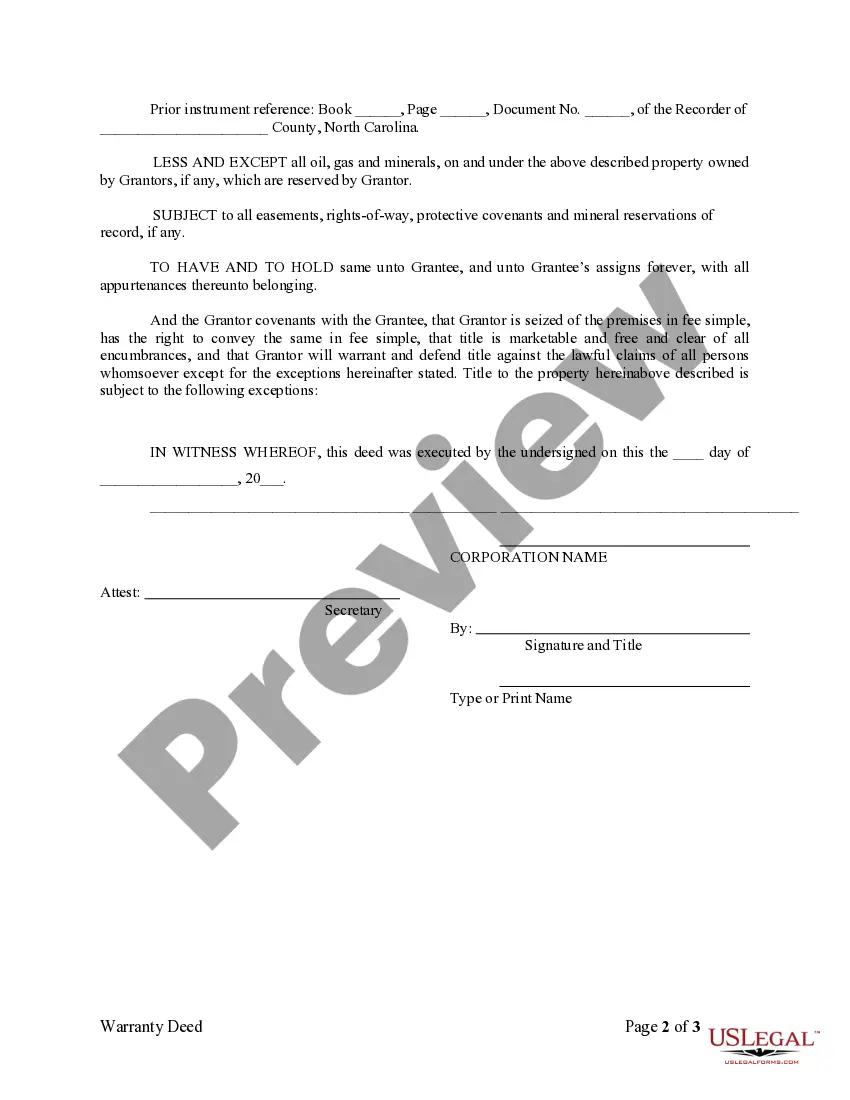

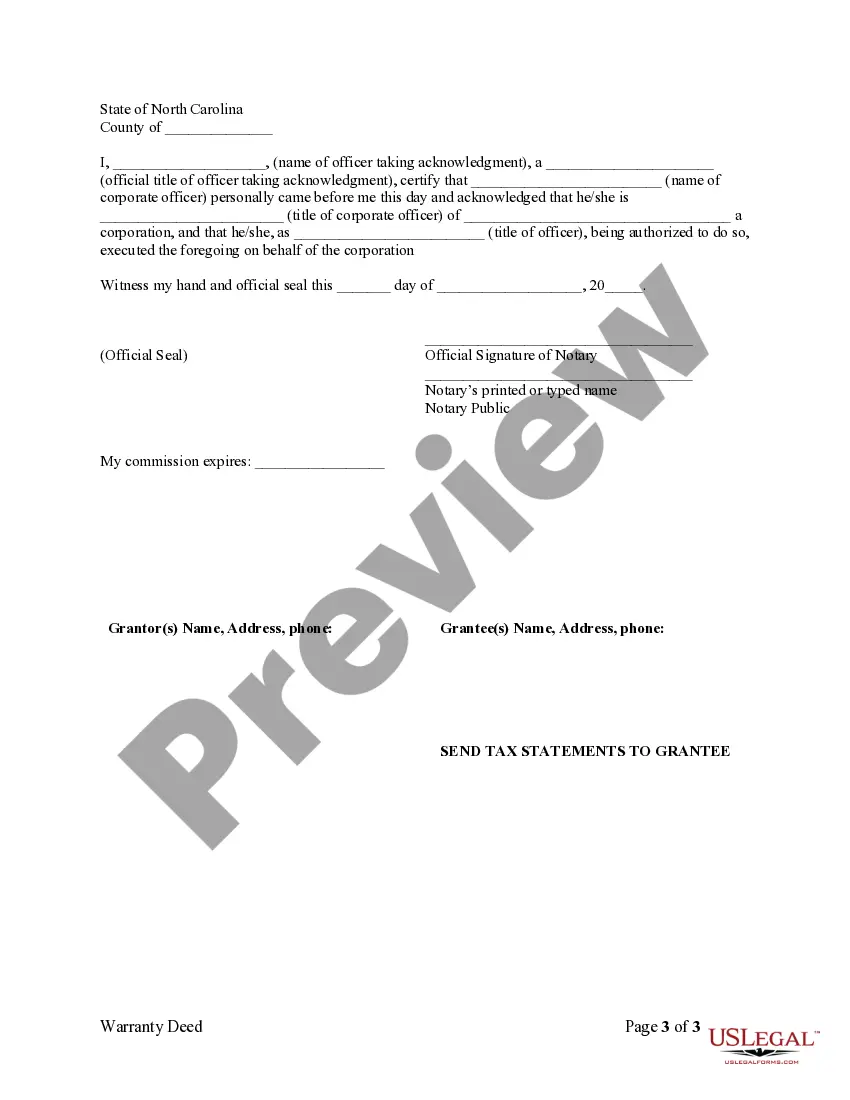

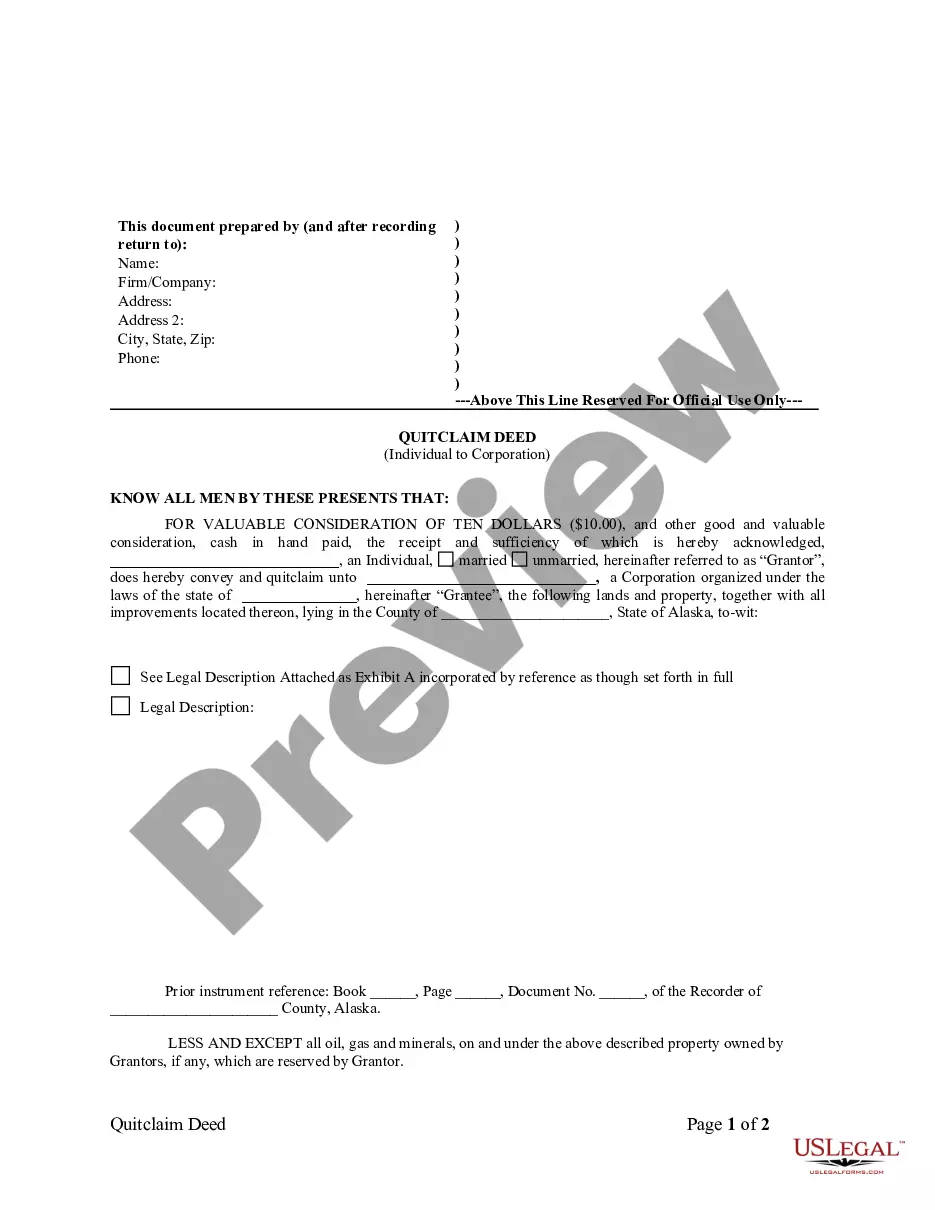

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

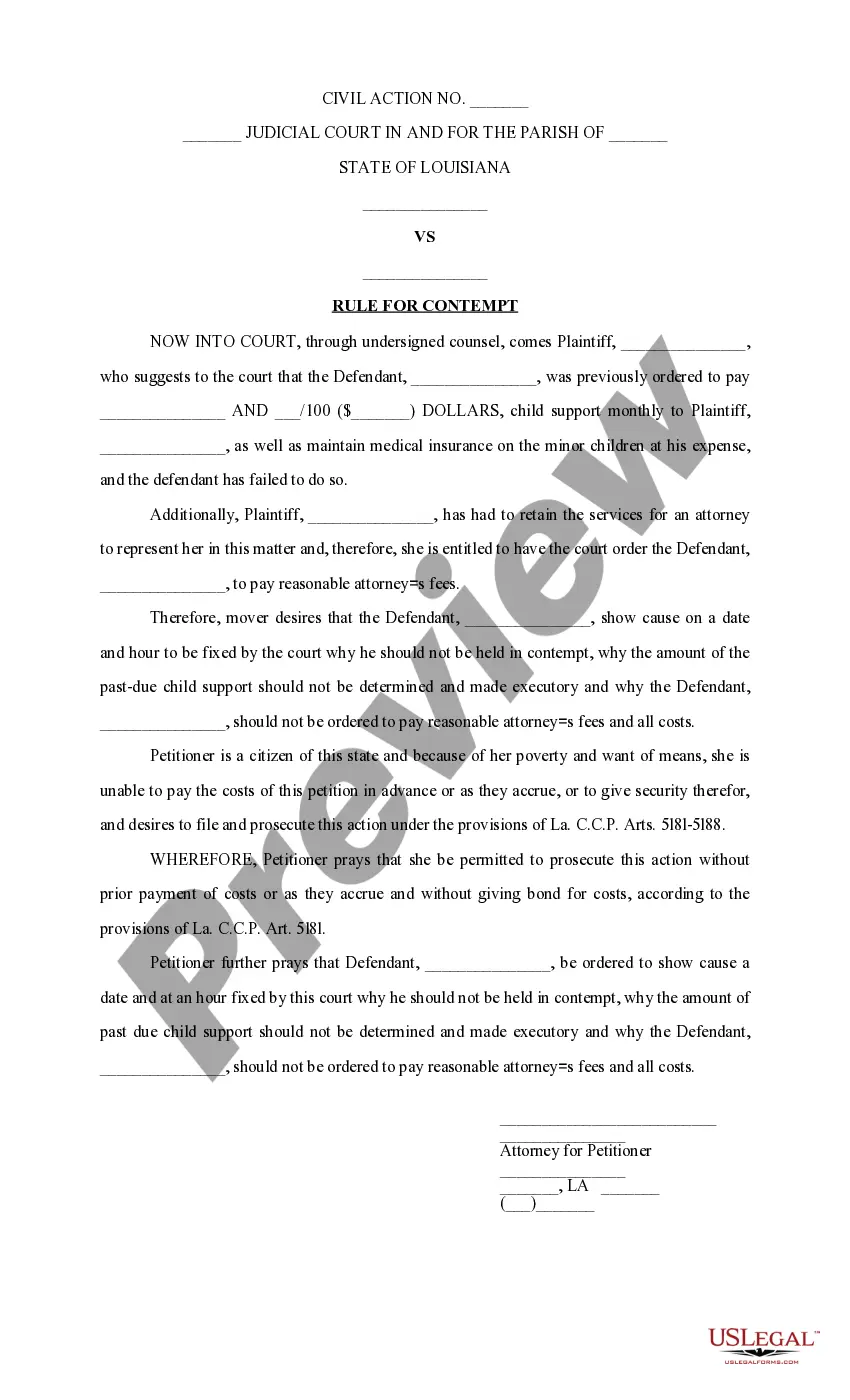

The North Carolina general warranty deed is used to transfer property in North Carolina from one person to another legally.In other words, the seller is liable to the buyer if the buyer finds out there was an undisclosed claim against the property.

Under the Grantor section of the deed, write the name of the person transferring title. Under Grantee, write the name of the person receiving title. Describe the parcel of land. Use the street address and include the North Carolina County where the land is located.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

When ownership in North Carolina real estate is transferred, an excise tax of $1 per $500 is levied on the value of the property. For example, a $600 transfer tax would be imposed on the sale of a $300,000 home. Transfer taxes in North Carolina are typically paid by the seller.

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

Basically it is exactly the same document. Title Deed is just a more common name that is used. The legal documentation submitted when transferring a property is called a Deed of Transfer.Next time you order a Title Deed and receive a Deed of Transfer, don't be alarmed, they are the same document.

Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.