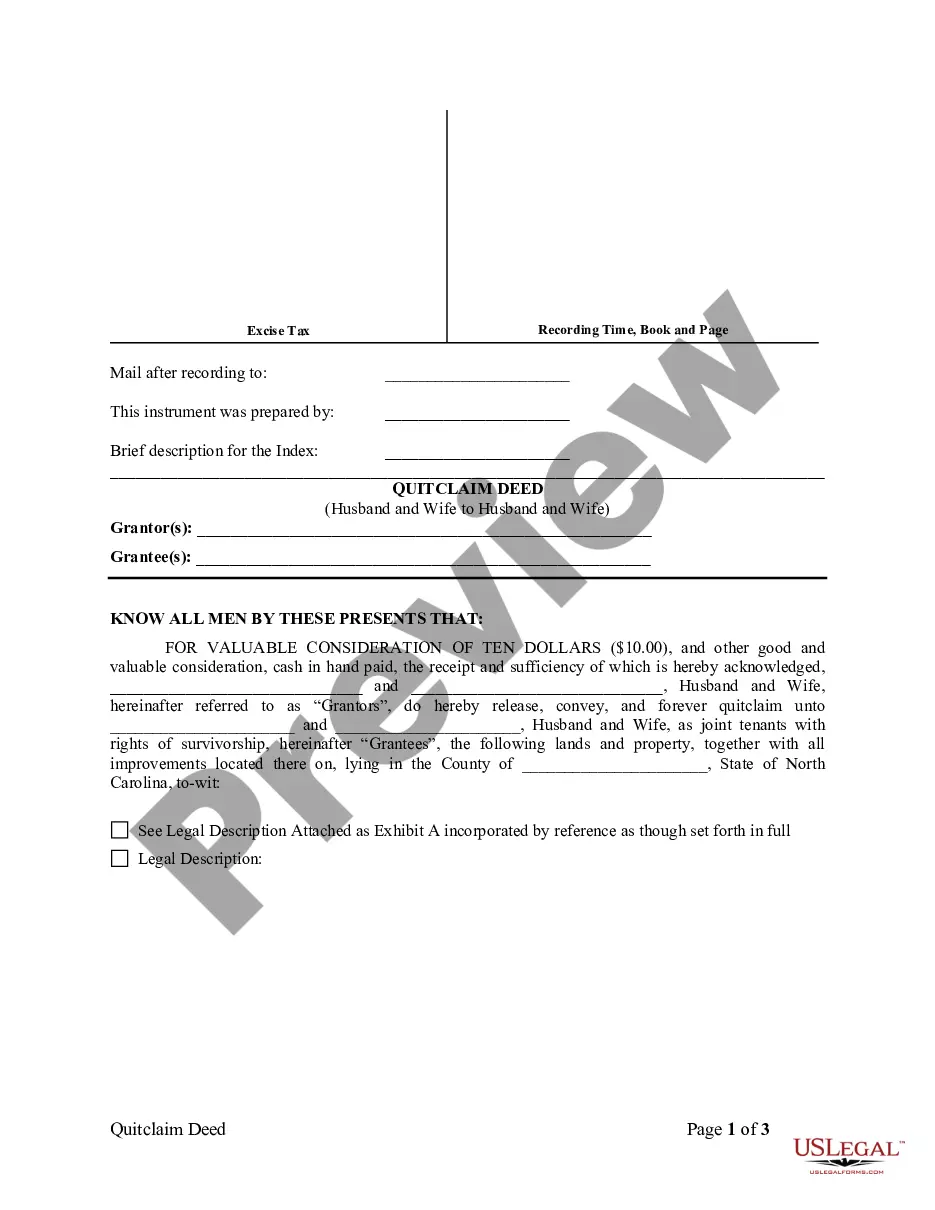

North Carolina Quitclaim Deed from Husband and Wife to Husband and Wife

Description North Carolina Quitclaim Deed Form

How to fill out What Does A Quit Claim Deed Look Like?

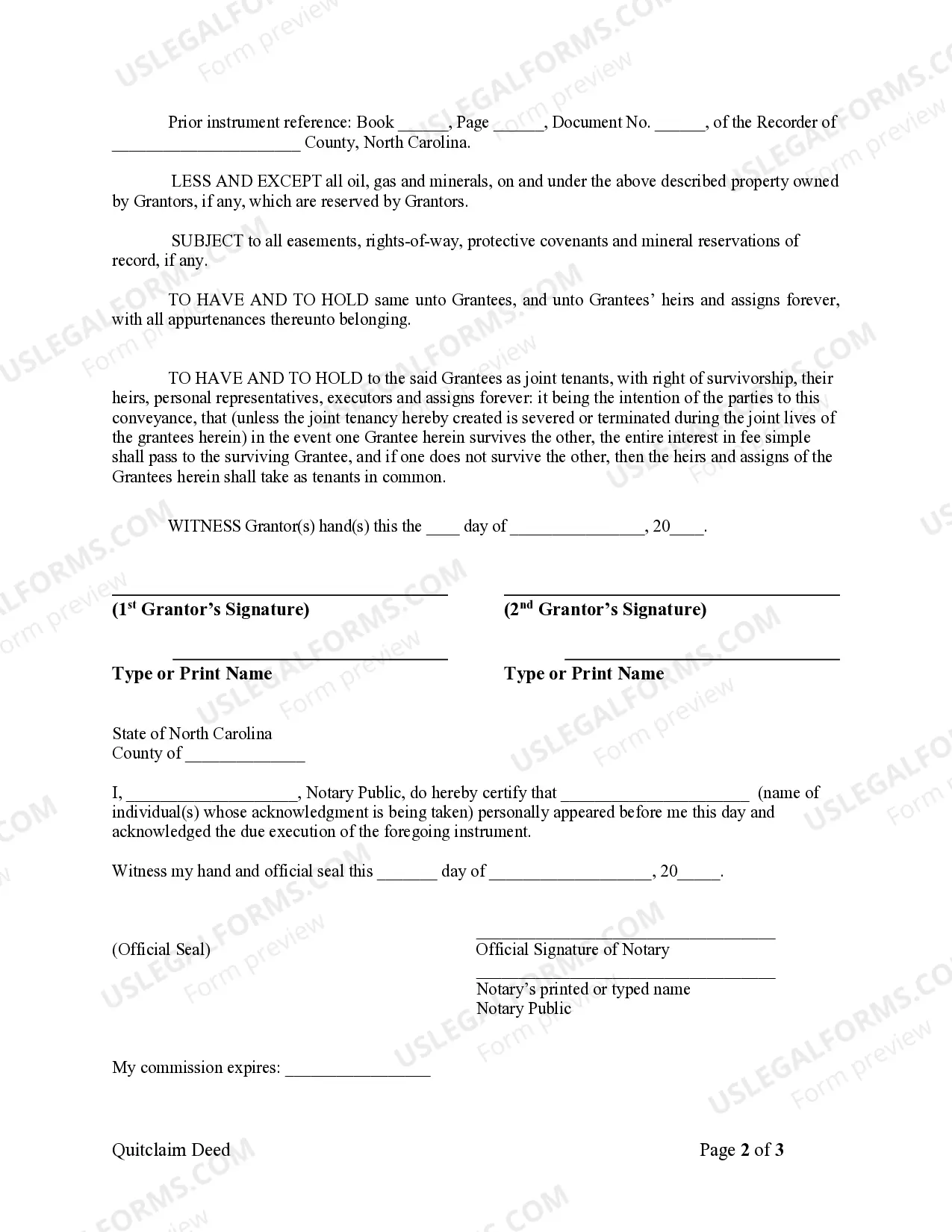

Avoid pricey lawyers and find the North Carolina Quitclaim Deed from Husband and Wife to Husband and Wife you need at a reasonable price on the US Legal Forms website. Use our simple groups functionality to find and obtain legal and tax documents. Go through their descriptions and preview them before downloading. Moreover, US Legal Forms enables users with step-by-step instructions on how to download and fill out each template.

US Legal Forms customers simply have to log in and get the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet should follow the tips below:

- Make sure the North Carolina Quitclaim Deed from Husband and Wife to Husband and Wife is eligible for use where you live.

- If available, look through the description and make use of the Preview option prior to downloading the sample.

- If you are sure the template fits your needs, click Buy Now.

- In case the form is incorrect, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Select download the document in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the form to your device or print it out.

Right after downloading, you may complete the North Carolina Quitclaim Deed from Husband and Wife to Husband and Wife manually or an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

North Carolina Husband Form popularity

Who Can Do A Quitclaim Deed Other Form Names

Quitclaim FAQ

California married couples generally have three options to take title to their community (vs separate) property real estate: community property, joint tenancy or Community Property with Right of Survivorship. The latter coming into play in California July of 2001.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.

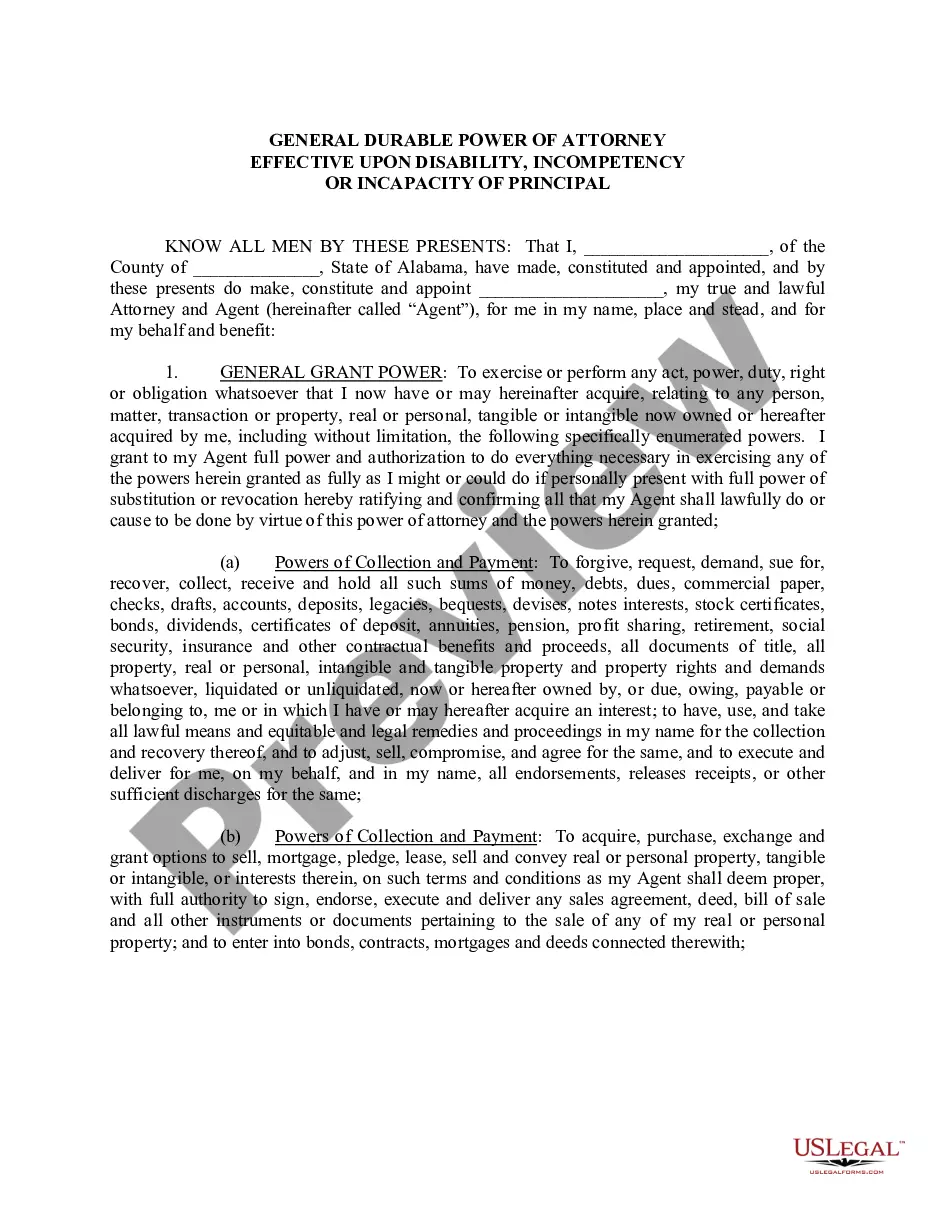

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

In divorces, states have two options for dividing property: community property division (where marital property belongs to both spouses equally, regardless of who bought it) or equitable division (where the court divides marital property equitably (justly.) North Carolina is not a community property state.

A married person buying property individually The owner needs to sign, but their spouse may not be required to sign documents at closing. North Carolina has a specific statute allowing a married buyer of real estate to sign their purchase-money Deed of Trust without requiring the signature of the buyer's spouse.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

The names on the mortgage show who's responsible for paying back the loan, while the title shows who owns the property. You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

In cases where a couple shares a home but only one spouse's name is on it, the home will not automatically pass to the surviving pass, if his or her name is not on the title.