This form is a Warranty Deed where the grantor is a trust and the grantee is also a trust. Grantor conveys and warrants the described property to trustee of the grantee. This deed complies with all state statutory laws.

North Carolina Warranty Deed - Trust to Trust

Description

How to fill out North Carolina Warranty Deed - Trust To Trust?

Avoid costly attorneys and find the North Carolina Warranty Deed - Trust to Trust you want at a affordable price on the US Legal Forms site. Use our simple groups function to look for and download legal and tax forms. Read their descriptions and preview them prior to downloading. Additionally, US Legal Forms enables customers with step-by-step tips on how to obtain and fill out every template.

US Legal Forms subscribers merely have to log in and download the specific document they need to their My Forms tab. Those, who haven’t got a subscription yet should follow the guidelines below:

- Ensure the North Carolina Warranty Deed - Trust to Trust is eligible for use where you live.

- If available, look through the description and use the Preview option before downloading the templates.

- If you’re confident the document fits your needs, click Buy Now.

- If the form is wrong, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, you can fill out the North Carolina Warranty Deed - Trust to Trust manually or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

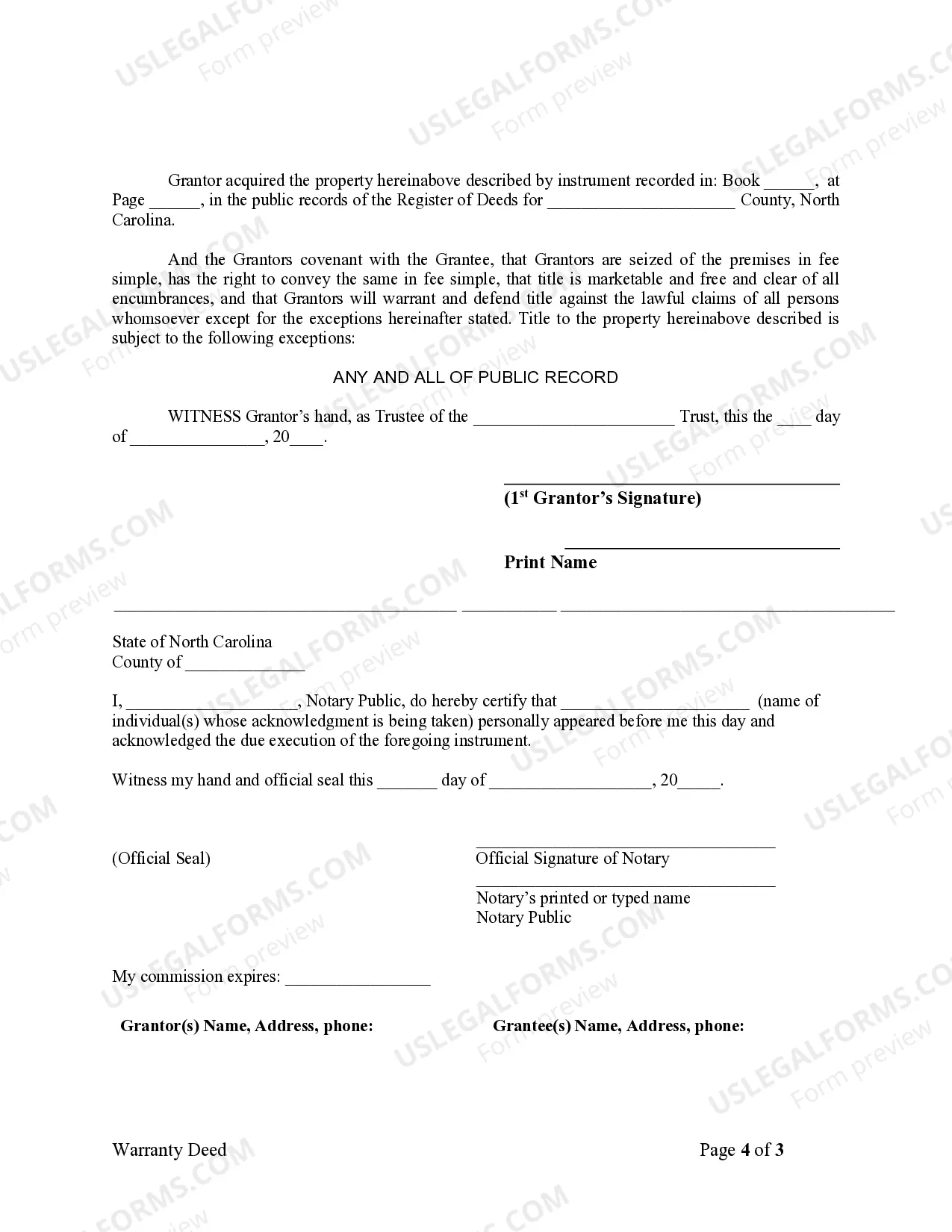

To make the form legally binding, you must sign it in front of a notary public. You must then file your signed and notarized deed with the county office that's in charge of recording property documents. Once the grantee signs the warranty deed, he/she legally has ownership and claim to the property.

The answer is yes. Parties to a transaction are always free to prepare their own deeds. If you do so, be sure your deed measures up to your state's legal regulations, to help avert any legal challenge to the deed later.

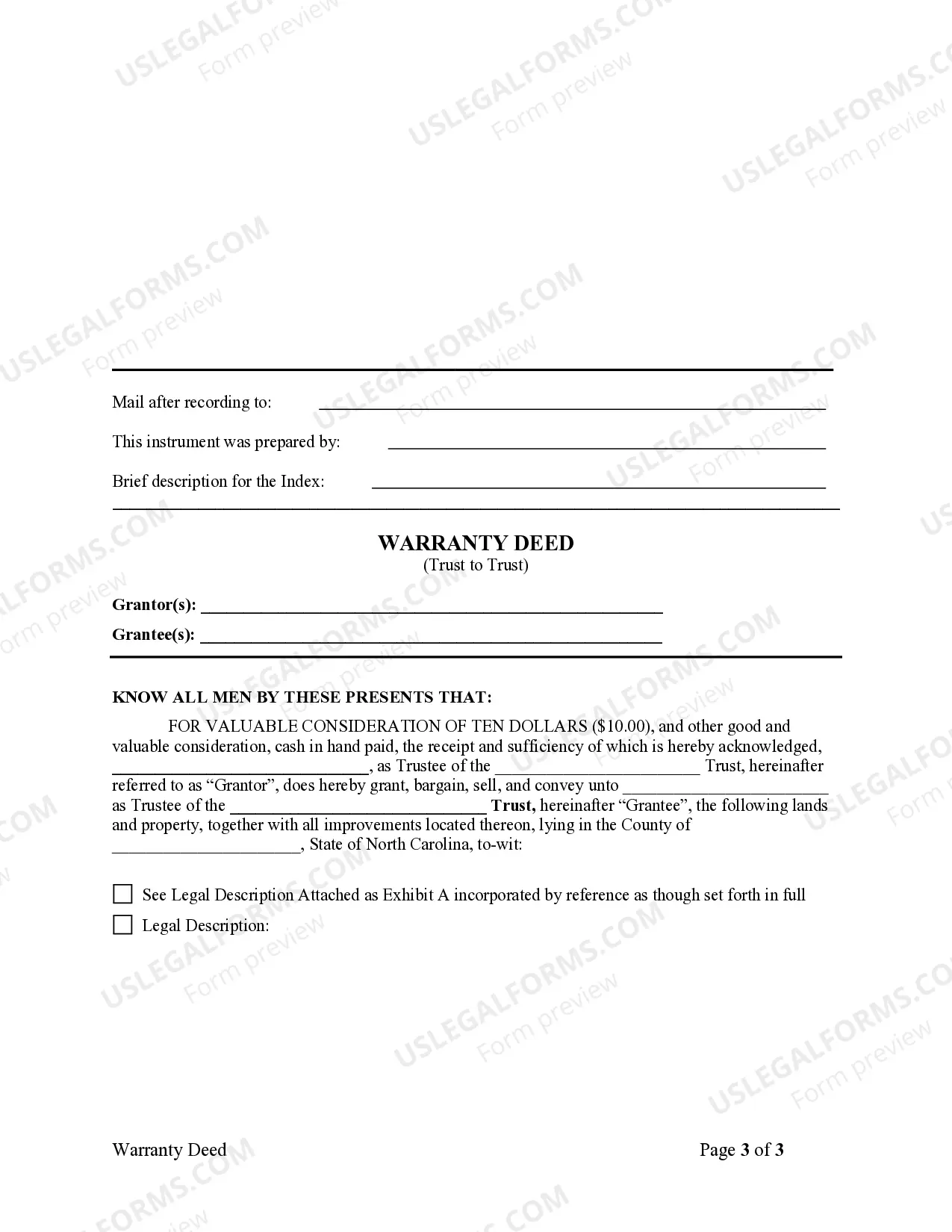

Under the Grantor section of the deed, write the name of the person transferring title. Under Grantee, write the name of the person receiving title. Describe the parcel of land. Use the street address and include the North Carolina County where the land is located.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

The name and address of the seller (called the grantor) The name and address of the buyer (called the grantee) A legal description of the property (found on the previous deed) A statement that the grantor is transferring the property to the grantee.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)