A condominium is one of a group of housing units where each homeowner owns their individual unit space, and all the dwelling share ownership of areas of common use. The individual units normally share walls, but that isn't a requirement. The main difference in condos and regular single homes is that there is no individual ownership of a plot of land. All the land in the condominium project is owned in common by all the homeowners. Usually, the exterior maintenance is paid for out of homeowner dues collected and managed under strict rules. The exterior walls and roof are insured by the condominium association, while all interior walls and items are insured by the homeowner.

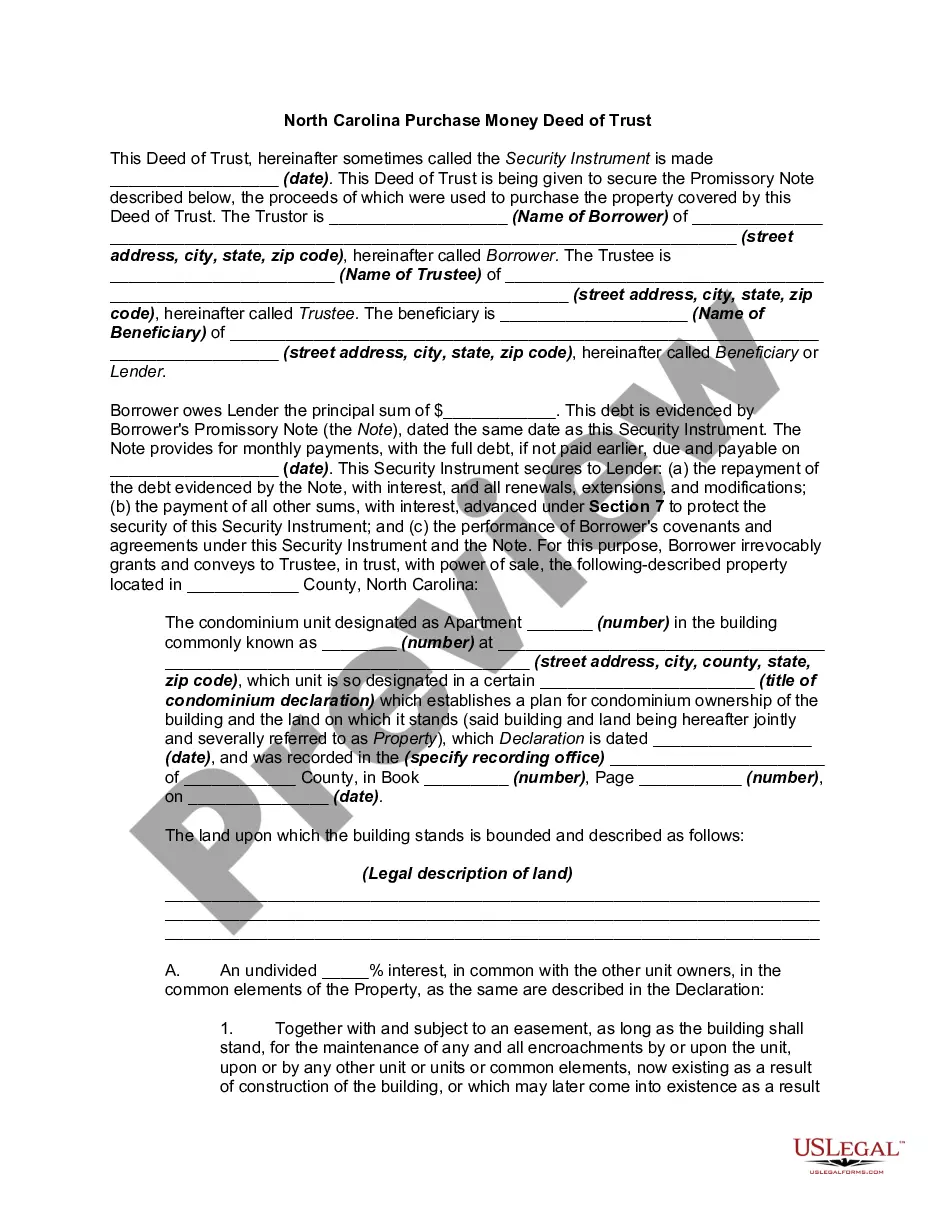

North Carolina Purchase Money Deed of Trust - Condominium

Description

Key Concepts & Definitions

North Carolina Purchase Money Deed of Trust is a legal document used to secure a mortgage loan by using the property being purchased as collateral. Commonly involved in real estate transactions within North Carolina, this deed of trust serves as protection for lenders by allowing the legal process of foreclosure if the borrower defaults on their loan.

Step-by-Step Guide: How to Execute a Purchase Money Deed of Trust in North Carolina

- Identify the Property: Confirm the real estate in question and agree on a purchase price.

- Secure a Mortgage Loan: Apply and get approval for a mortgage loan to finance the purchase.

- Legal Representation: Engage with legal counsel familiar with North Carolina real estate laws to oversee the transaction and draft the deed of trust.

- Document Drafting: Have a deed of trust created, stating the terms agreed by both parties.

- Signing the Deed: Both buyer and lender sign the deed of trust in the presence of a notary.

- Recording the Deed: File the signed deed with the appropriate county office to make it a public record.

- Contact Administrator: Ensure all necessary administrative actions, like setting up email delivery systems for payment notifications, are handled.

Risk Analysis

- Foreclosure Process: The primary risk involves potential foreclosure if the borrower defaults on the mortgage loan. This can lead to loss of the property.

- Legal Disputes: Errors in the deed's terms or failure to follow state-specific legal protocols might lead to legal disputes or invalidation of the deed.

- Market Risks: Fluctuations in the real estate market could affect the property's value, impacting the security of the loan.

Best Practices

- Ensure Accurate Documentation: Verify all details in the deed of trust are correct to prevent legal issues.

- Secure Reliable Legal Representation: Employ a lawyer experienced in North Carolina real estate to guide the process and ensure compliance with state laws.

- Understand Foreclosure Implications: Both lender and borrower should understand the procedures and consequences in case of default.

- Regular Communication: Maintain open lines of communication between all parties to quickly address any concerns or changes.

Common Mistakes & How to Avoid Them

- Ignoring Legal Representation: Failing to hire a qualified attorney can lead to compliance issues. Always seek expert legal advice.

- Underestimating the Importance of Documentation: Overlooking the need for detailed and correct documentation can result in disputes. Always double-check and confirm the accuracy of every document.

- Not Understanding the Full Scope of Terms: Neglecting to thoroughly review the terms of the mortgage and the deed of trust can lead to unexpected obligations. Fully understand all terms before signing.

How to fill out North Carolina Purchase Money Deed Of Trust - Condominium?

Avoid expensive lawyers and find the North Carolina Purchase Money Deed of Trust - Condominium you need at a affordable price on the US Legal Forms website. Use our simple categories function to find and download legal and tax forms. Go through their descriptions and preview them well before downloading. Moreover, US Legal Forms provides users with step-by-step instructions on how to obtain and fill out every single form.

US Legal Forms clients simply need to log in and download the specific form they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to follow the guidelines listed below:

- Make sure the North Carolina Purchase Money Deed of Trust - Condominium is eligible for use in your state.

- If available, look through the description and make use of the Preview option well before downloading the sample.

- If you are confident the document fits your needs, click on Buy Now.

- If the form is wrong, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to your gadget or print it out.

After downloading, you are able to complete the North Carolina Purchase Money Deed of Trust - Condominium by hand or with the help of an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

In North Carolina, a deed of trust or mortgage acts as a conveyance of the real estate.Under a deed of trust, the borrower (called the "grantor") conveys legal title to the real estate to a third party (called the "trustee") to hold for the benefit of the lender (called the "beneficiary") until the loan is repaid.

A deed of trust includes most of the same information as a mortgage, including: The original loan amount. A legal description of the property that's used as security or collateral for the mortgage. The names of parties: trustee, trustor, and beneficiary.

A deed of trust is normally recorded with the recorder or county clerk for the county where the property is located as evidence of and security for the debt. The act of recording provides constructive notice to the world that the property has been encumbered.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.