An AB trust is a trust created by a married couple to avoid probate and minimize federal estate tax. An AB trust is created by each spouse placing property into a trust and naming someone other than his or her spouse as the final beneficiary of that trust. Upon the death of the first spouse, the surviving spouse does not own the assets in that spouse's trust outright, but has a limited power over the assets in accordance with the terms of the trust. Such powers may include the right to receive interest or income earned by the trust, to use the trust property during his or her lifetime, e.g. to live in a house, and/or to use the trust principal for his or her health, education, or support. Upon the death of the second spouse, the trust passes to the final beneficiary of the trust. For estate tax purposes, the trust is included in the first, but not the second, spouse's estate and therefore, avoids double taxation.

North Carolina Marital Deduction Trust – Trust A and Bypass Trust B

Description North Carolina Trust A

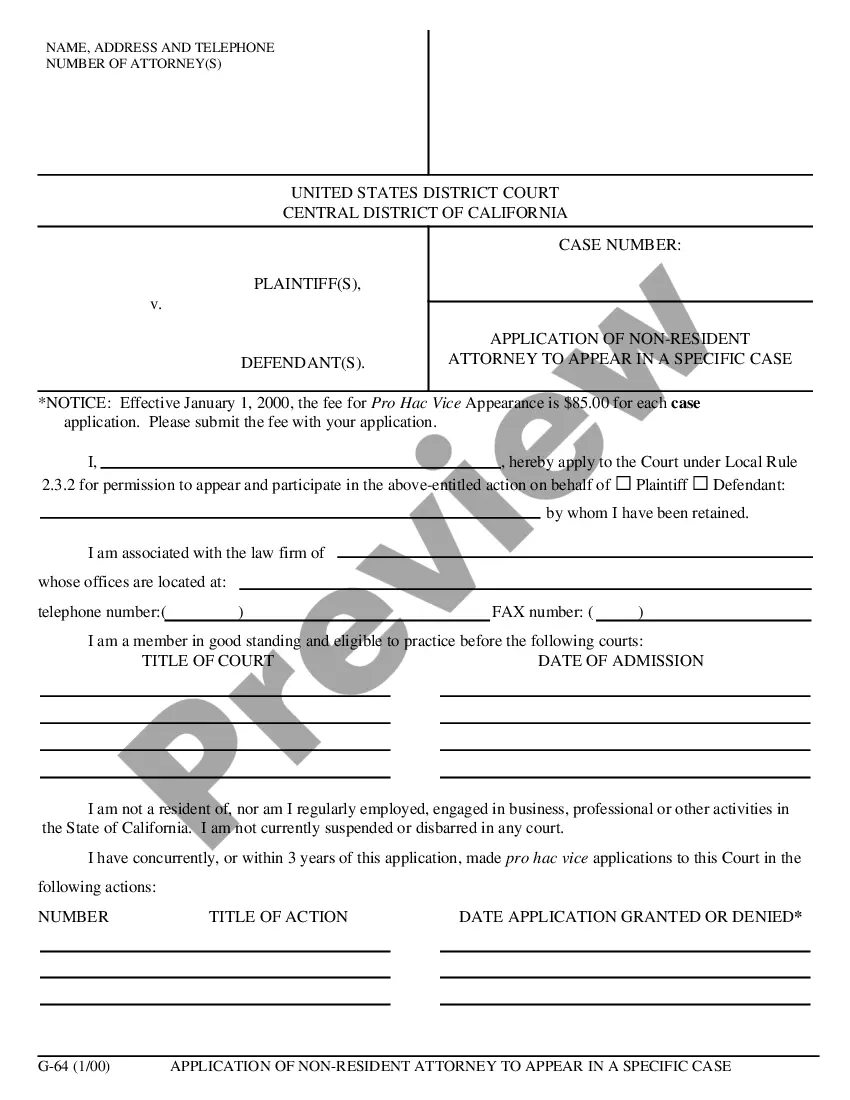

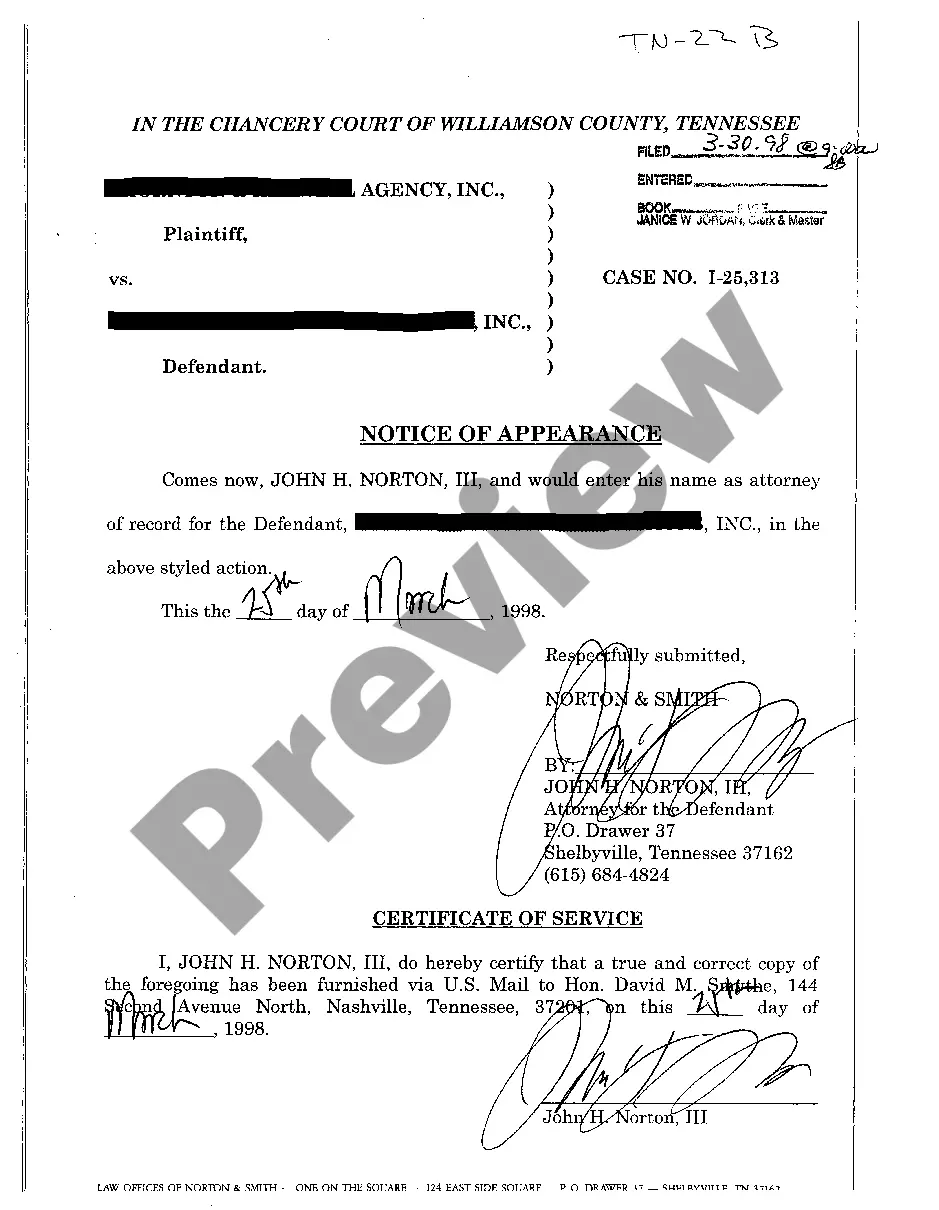

How to fill out Trust A Form Printable?

Avoid costly lawyers and find the North Carolina Marital Deduction Trust Trust A and Bypass Trust B you want at a reasonable price on the US Legal Forms site. Use our simple categories function to look for and obtain legal and tax files. Read their descriptions and preview them before downloading. In addition, US Legal Forms provides customers with step-by-step instructions on how to download and fill out every form.

US Legal Forms customers merely must log in and download the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet should follow the tips listed below:

- Ensure the North Carolina Marital Deduction Trust Trust A and Bypass Trust B is eligible for use where you live.

- If available, read the description and use the Preview option just before downloading the templates.

- If you are sure the document is right for you, click Buy Now.

- In case the form is wrong, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Select download the document in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the template to the gadget or print it out.

Right after downloading, you are able to fill out the North Carolina Marital Deduction Trust Trust A and Bypass Trust B by hand or an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Nc Marital North Carolina Form popularity

North Carolina Marital Nc Other Form Names

Nc Marital Sample FAQ

The trust qualifies for the marital deduction. In a QTIP trust, the surviving spouse must receive all income generated by the trust property for life, paid at least annually.After the surviving spouse's death, the property passes to the remainder beneficiaries of the trust, who usually are the children of the couple.

In the case of a marital trust, the IRS subjects the remaining trust assets to federal estate taxes when the surviving spouse passes. However, a couple can take advantage of the federal gift and estate tax exemption. This is the amount that you can pass on to heirs before you'd ever owe an actual estate tax.

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.

An estate trust is a type of marital deduction trust requiring that when the surviving spouse dies, all remaining trust principal must go into his/her estate. This means the surviving spouse gets to choose the final beneficiaries, by will or within a living trust.

Assets in a Bypass Trust Do Not Receive a Step Up In Income Tax Basis at the Surviving Spouse's Death. Assets transferred to a bypass trust at the first spouse's death receive a step-up in income tax basis on the first spouse to die's death but not again on the death of the surviving spouse.

A bypass trust can still be useful in some circumstances. If your estate is greater than the current estate tax exemption, a bypass trust is still a good way to protect your assets from the estate tax.

Bypass trusts are suddenly no longer necessary, as a surviving spouse can inherit the deceased spouse's exemption along with his/her assets!

The effect of the marital deduction trust is that it shields both spouse's assets and estates from federal estate taxes because when the first spouse dies, the assets indicated by the settlor (the spouse who created the trust) pass to the marital trust free and clear of any and all federal estate taxes.

A bypass trust, or AB trust, is a legal arrangement that allows married couples to avoid estate tax on certain assets when one spouse passes away.The first part is the marital trust, or A trust. The second is a bypass, family or B trust. The marital trust is a revocable trust that belongs to the surviving spouse.