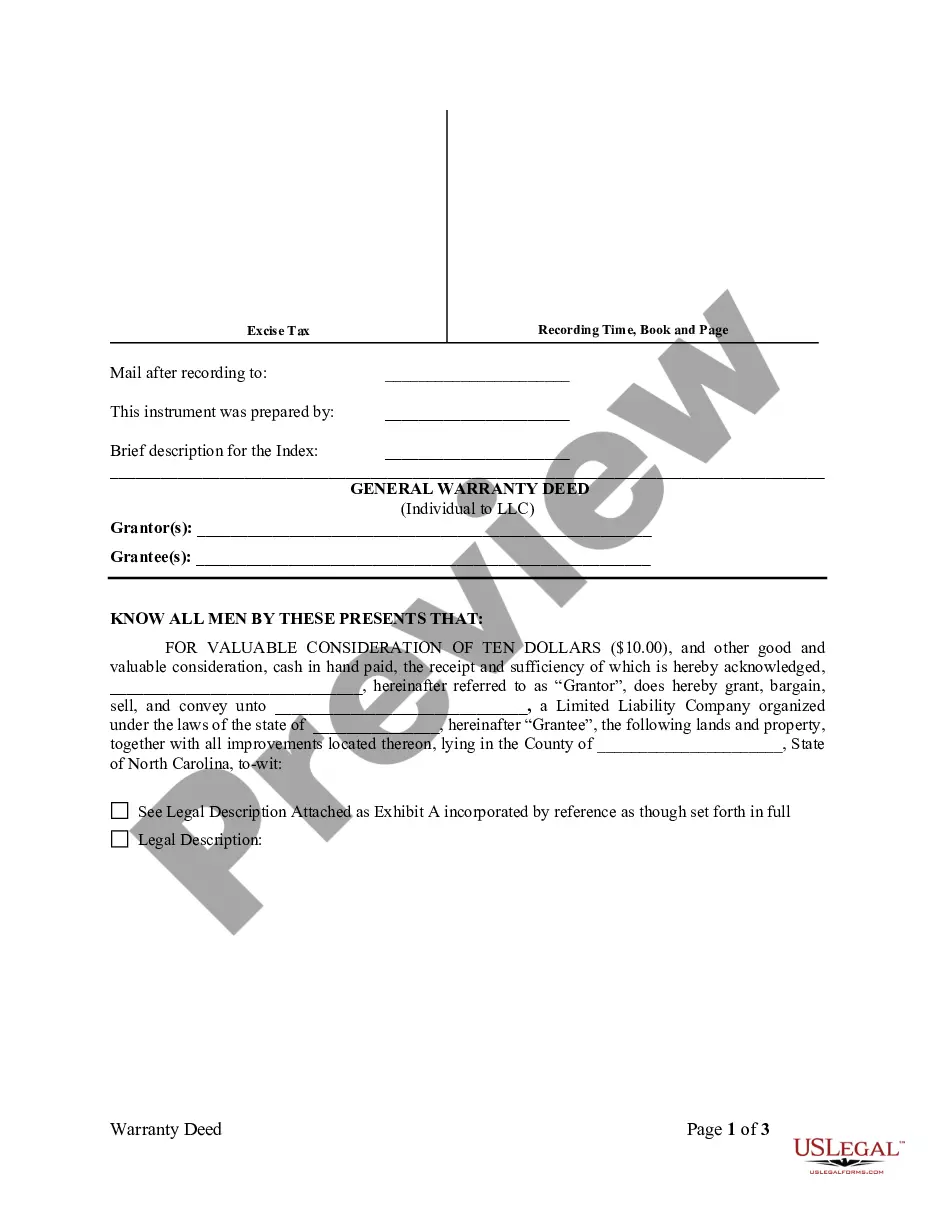

North Carolina General Warranty Deed from Individual to LLC

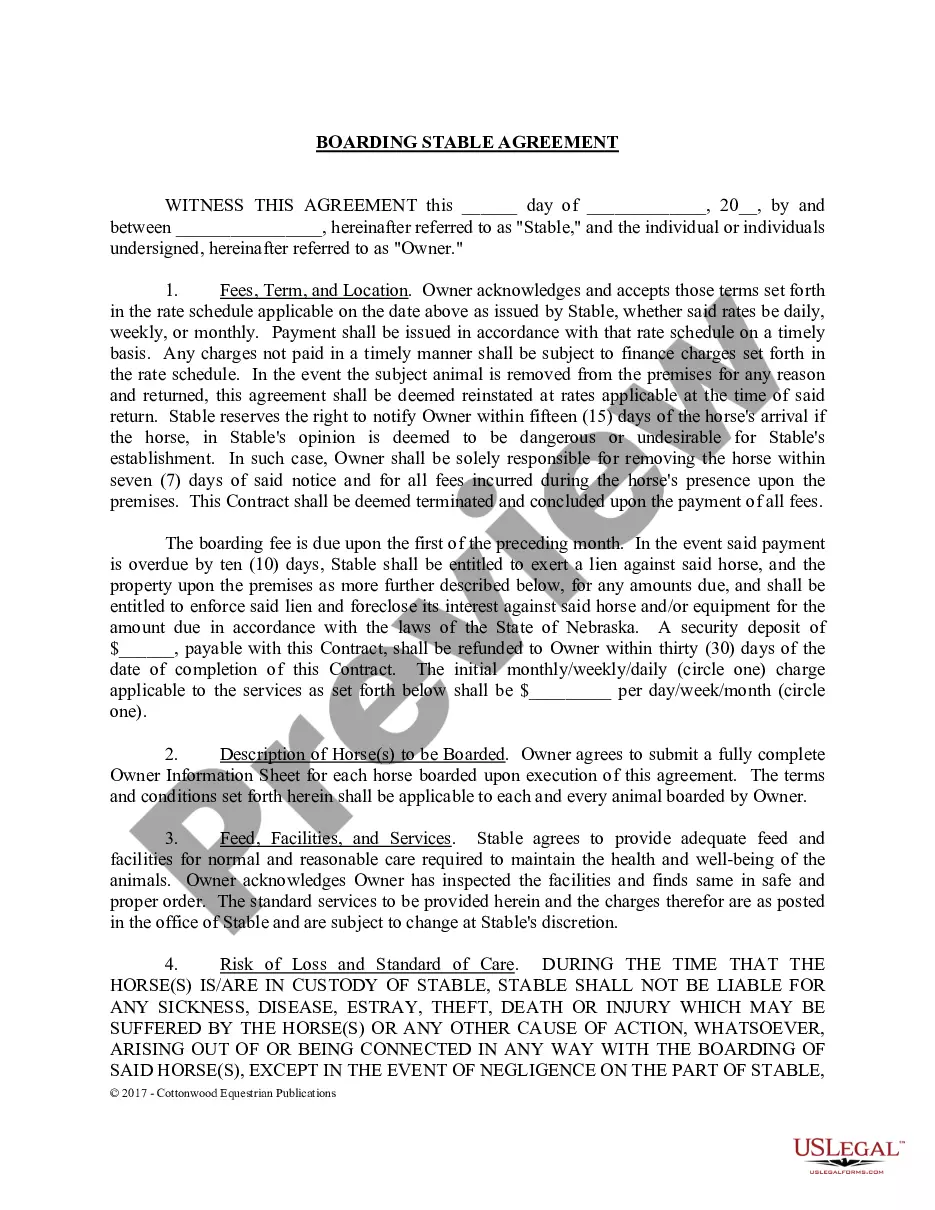

Description Llc Liability Company

How to fill out Special Warranty Deed North Carolina?

Avoid costly lawyers and find the North Carolina General Warranty Deed from Individual to LLC you need at a reasonable price on the US Legal Forms website. Use our simple groups functionality to find and obtain legal and tax documents. Read their descriptions and preview them prior to downloading. Additionally, US Legal Forms provides users with step-by-step instructions on how to obtain and fill out every form.

US Legal Forms clients basically have to log in and get the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet need to follow the tips below:

- Ensure the North Carolina General Warranty Deed from Individual to LLC is eligible for use where you live.

- If available, read the description and use the Preview option just before downloading the sample.

- If you are confident the template fits your needs, click Buy Now.

- In case the form is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to the gadget or print it out.

Right after downloading, it is possible to complete the North Carolina General Warranty Deed from Individual to LLC manually or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Warranty Limited Company Form popularity

Deed Llc Company Other Form Names

Limited Liability Company Agreement FAQ

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

The North Carolina general warranty deed is used to transfer property in North Carolina from one person to another legally. A warranty deed comes with a guarantee from the seller that the property has clear title.

The name and address of the seller (called the grantor) The name and address of the buyer (called the grantee) A legal description of the property (found on the previous deed) A statement that the grantor is transferring the property to the grantee.

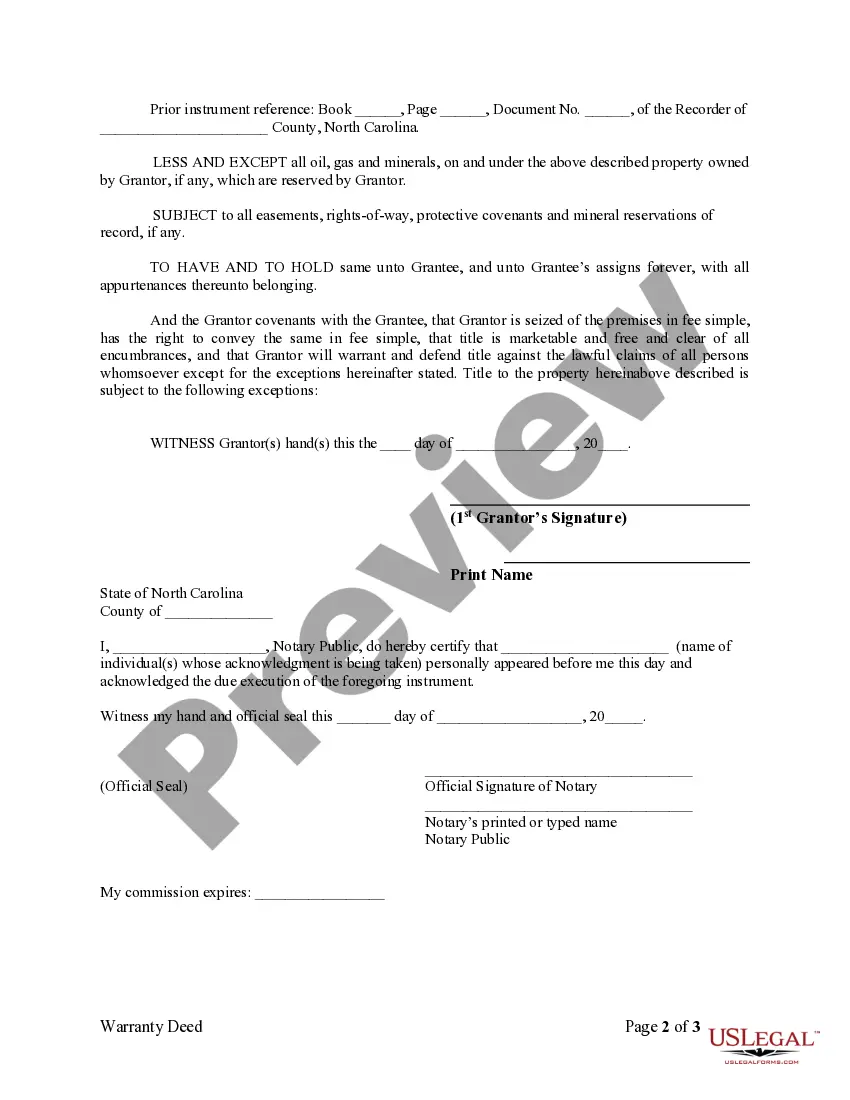

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

A general warranty deed covers the property's entire history. It guarantees the property is free-and-clear from defects or encumbrances, no matter when they happened or under whose ownership.With a special warranty deed, the guarantee covers only the period when the seller held title to the property.

They are (1) covenant for seisin; (2) covenant of the right to convey; (3) covenant against encumbrances; (4) covenant for QUIET ENJOYMENT; (5) covenant of general WARRANTY; and (6) covenant for further assurances.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

A special warranty deed to real estate offers protection to the buyer through the seller's guarantee that the title has been free and clear of encumbrances during their ownership of the property. It does not guarantee clear title beyond their ownership.