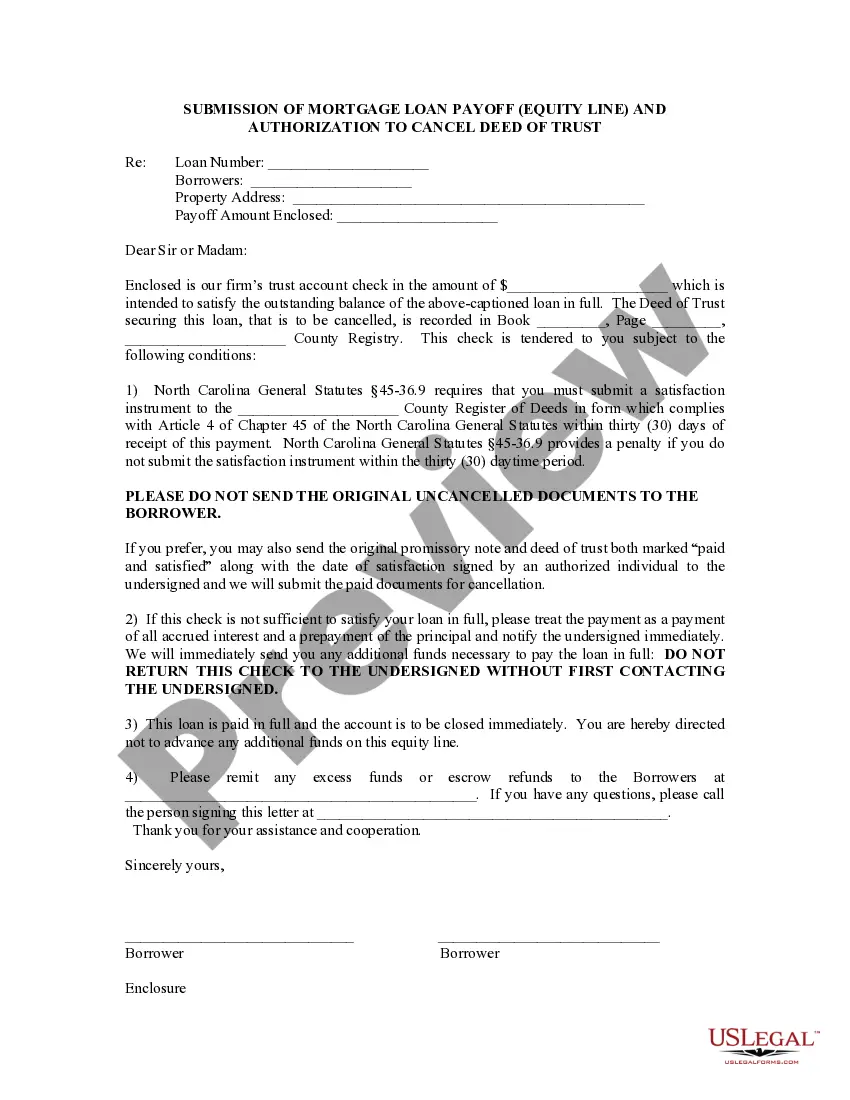

North Carolina Submission of Equity Line Mortgage Loan Payoff and Authorization to Cancel Deed of Trust is a document used when a homeowner pays off the entire balance of their home equity line of credit (HELOT). This document is typically signed by the borrower and submitted to the lender along with the full payoff amount. It authorizes the lender to release the lien on the property and cancel the Deed of Trust that was used to secure the loan. There are two types of North Carolina Submission of Equity Line Mortgage Loan Payoff and Authorization to Cancel Deed of Trust: Type 1 and Type 2. Type 1 is used when the HELOT is in the borrower’s name only, and Type 2 is used when the HELOT is in the borrower’s name and the name of a co-borrower. The document includes various information including the borrower’s name, address, loan account number, and the full payoff amount. The lender must review the document and approve the request before the lien can be released and the Deed of Trust canceled.

North Carolina Submission of Equity Line Mortgage Loan Payoff and Authorization to Cancel Deed of Trust

Description

How to fill out North Carolina Submission Of Equity Line Mortgage Loan Payoff And Authorization To Cancel Deed Of Trust?

How much time and resources do you usually spend on drafting formal paperwork? There’s a greater way to get such forms than hiring legal experts or spending hours searching the web for a proper blank. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the North Carolina Submission of Equity Line Mortgage Loan Payoff and Authorization to Cancel Deed of Trust.

To get and prepare an appropriate North Carolina Submission of Equity Line Mortgage Loan Payoff and Authorization to Cancel Deed of Trust blank, adhere to these easy steps:

- Look through the form content to make sure it meets your state requirements. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, locate another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the North Carolina Submission of Equity Line Mortgage Loan Payoff and Authorization to Cancel Deed of Trust. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely reliable for that.

- Download your North Carolina Submission of Equity Line Mortgage Loan Payoff and Authorization to Cancel Deed of Trust on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you safely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trusted web solutions. Sign up for us now!

Form popularity

FAQ

A deed of trust is a legal agreement used in real estate transactions that establishes a piece of property as collateral for a loan, much like a traditional mortgage. The deed of trust is signed by the borrowing party and recorded with the register of deeds where the property is located.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

The statute applies the ten year period tothe foreclosure of a mortgage, or deed in trust for creditors with a power of sale,of real property, where the mortgagor or grantor has been in possession of the property, within ten years after the forfeiture of the mortgage, or after the power of sale became absolute, or

A deed of release indicates that the homeowner has completed the terms of the mortgage loan repayment while the deed of reconveyance formally transfers full ownership to the homeowner. Depending on the laws of your state, a homeowner might need both documents to remove the mortgage lien from their home.

A Deed of Trust is commonly used in North Carolina to secure a loan. Foreclosure can be done non-judicially, saving time and expense.

It is the responsibility of the owner or noteholder to cancel the Deed of Trust in the county where it was recorded. There is NO FEE to cancel a note. The borrower can contact the Register of deeds office to verify that the loan has been marked satisfied or canceled before requesting a copy of the record.

North Carolina's criminal statute of limitations is two years for most misdemeanors, and there is no statute of limitations for felonies or crimes classified as "malicious" misdemeanors.

North Carolina has what is known as a ?statute of repose? on polluters, meaning that a lawsuit against a company or government body must be brought within 10 years of the contaminating activity.