North Carolina Business Credit Application

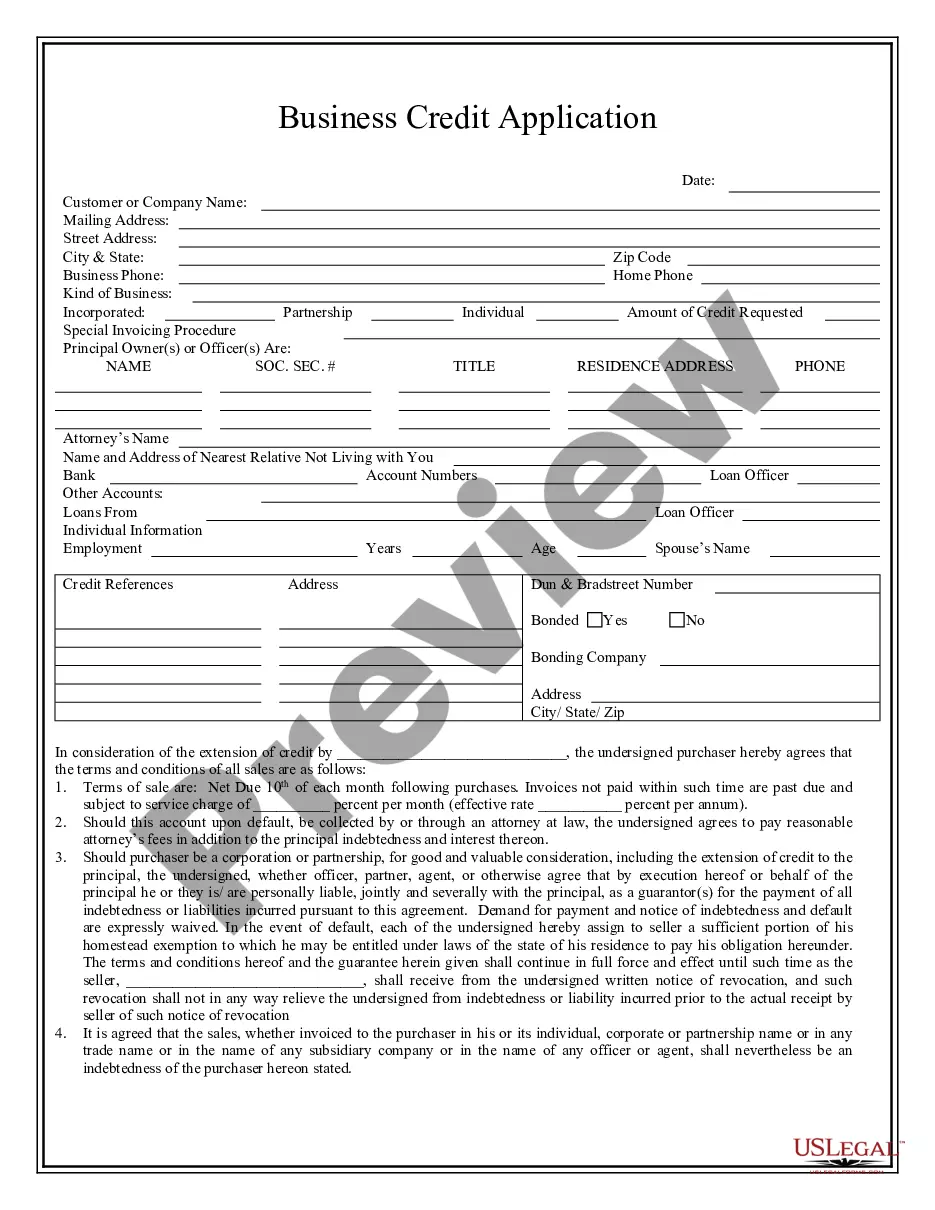

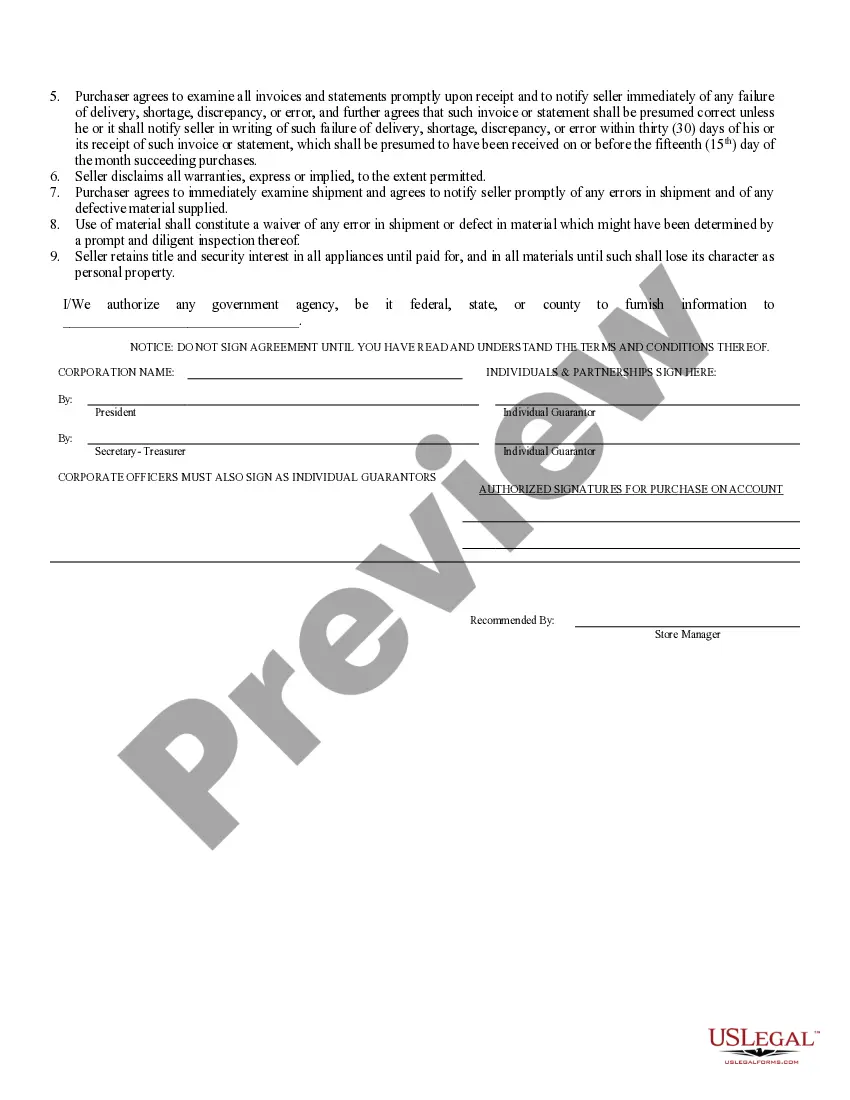

Description Credit Application Form Online

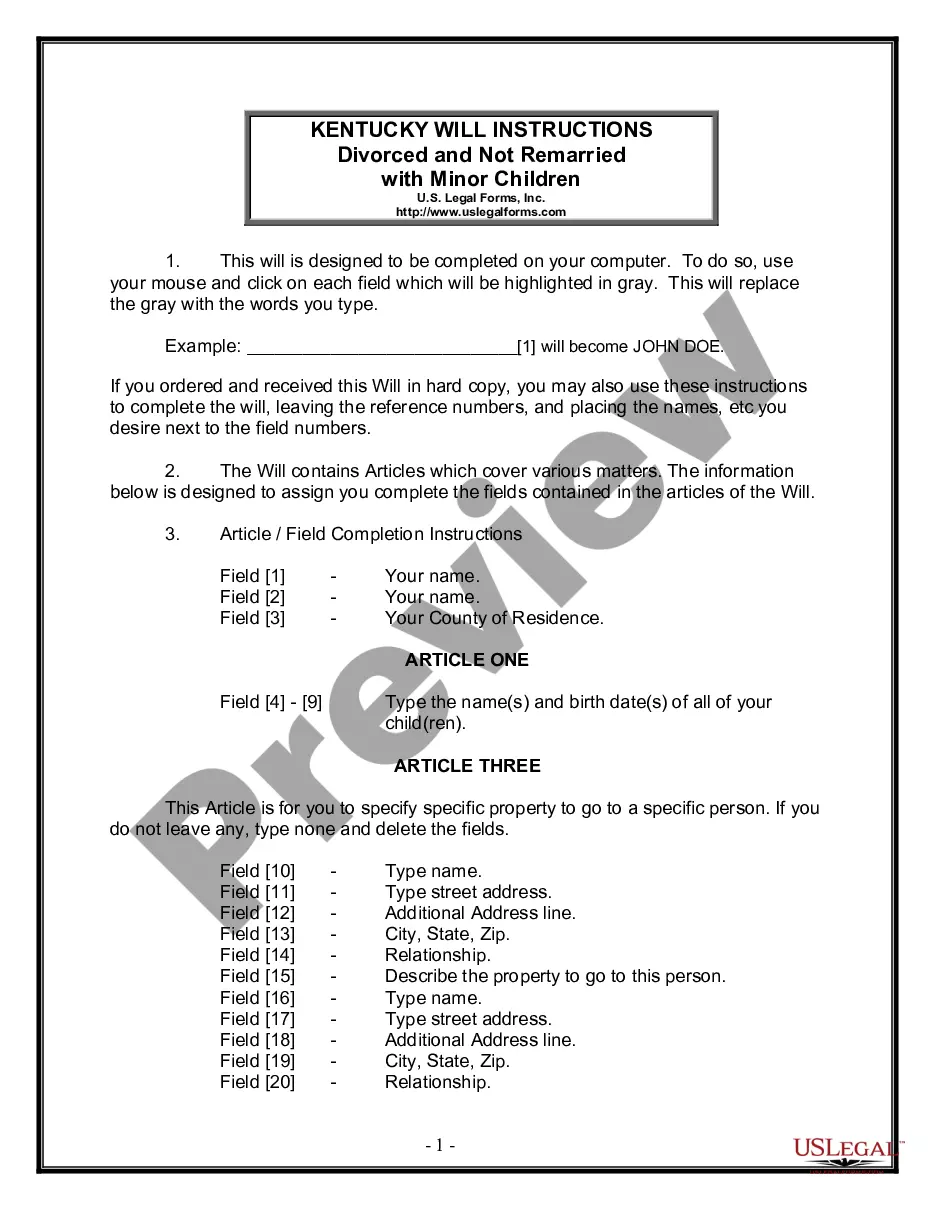

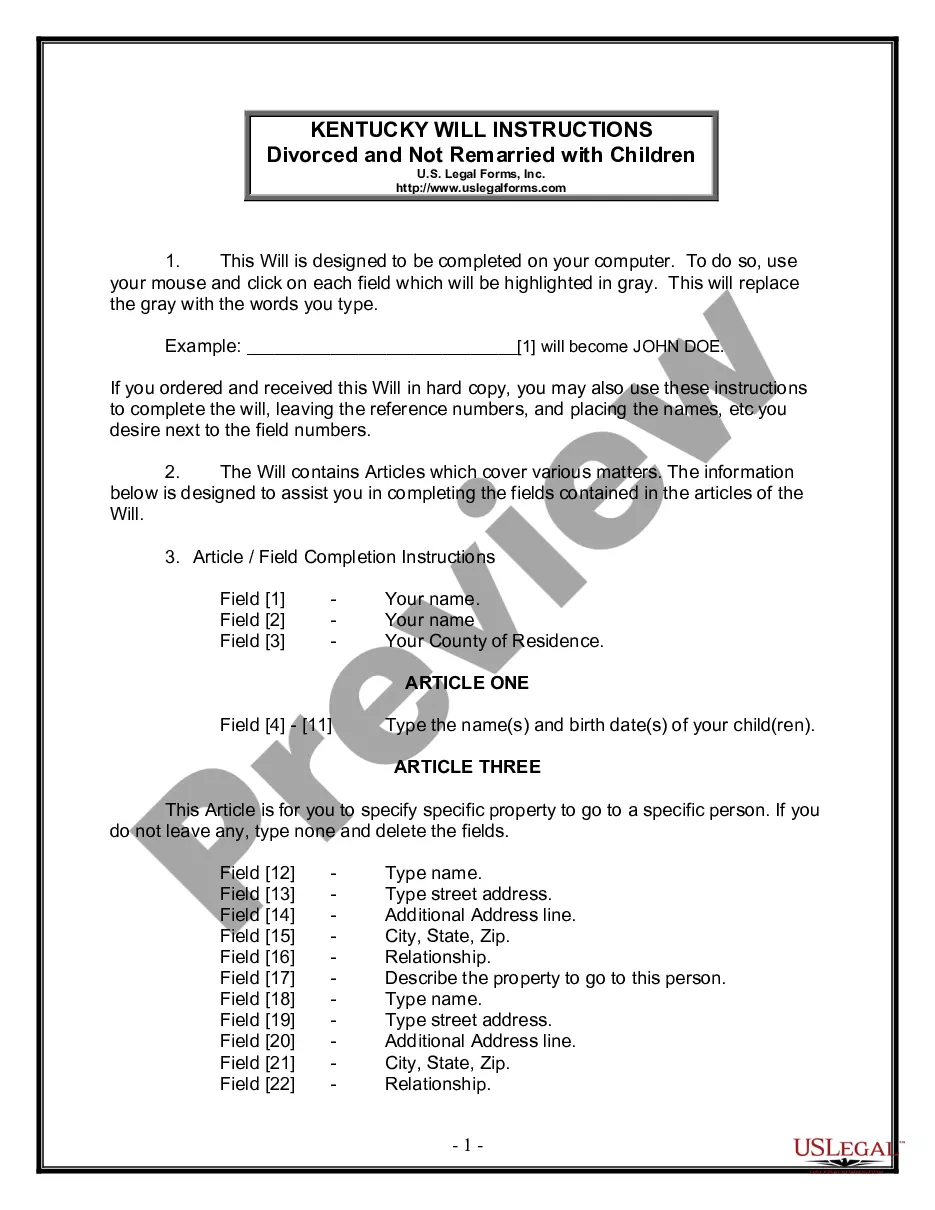

How to fill out Business Credit Application Form?

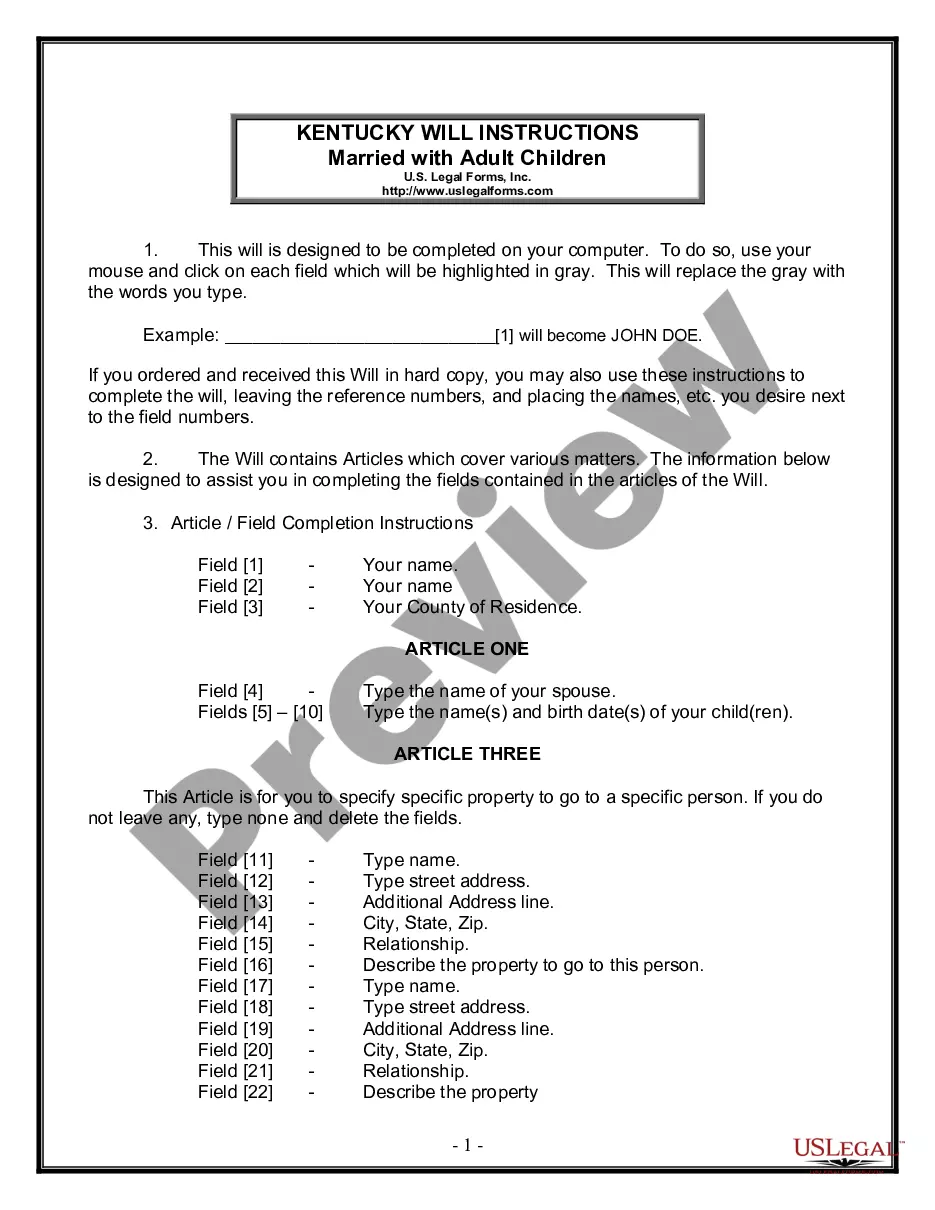

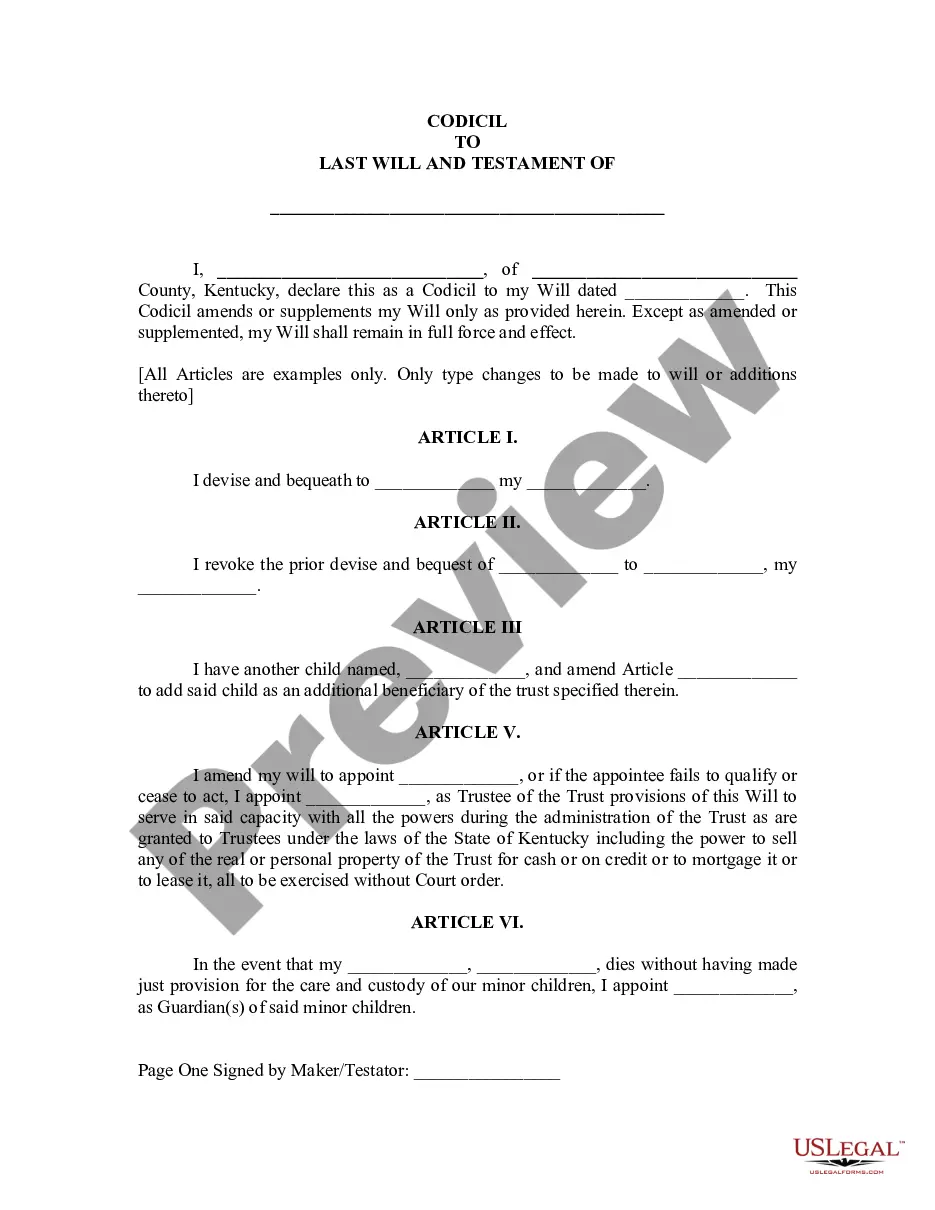

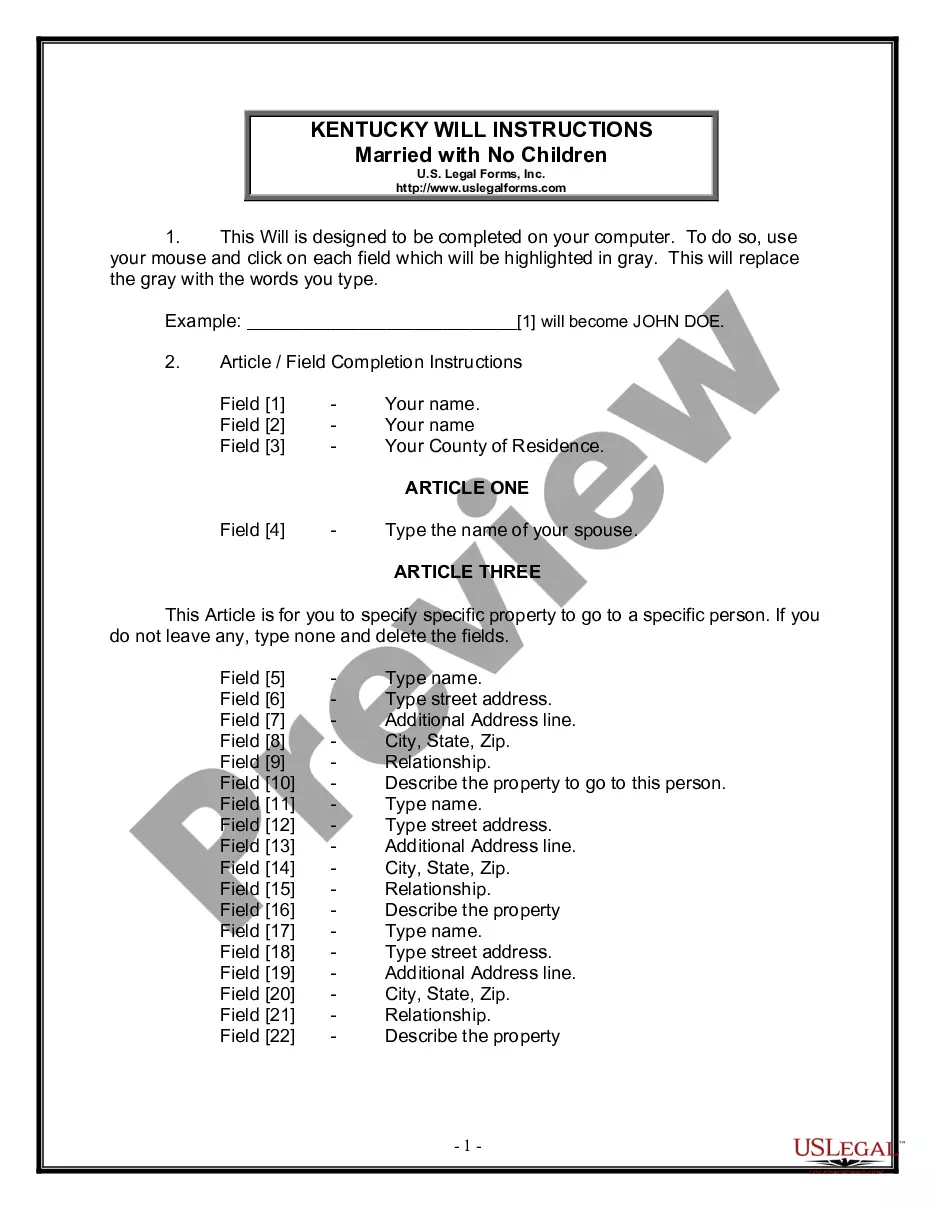

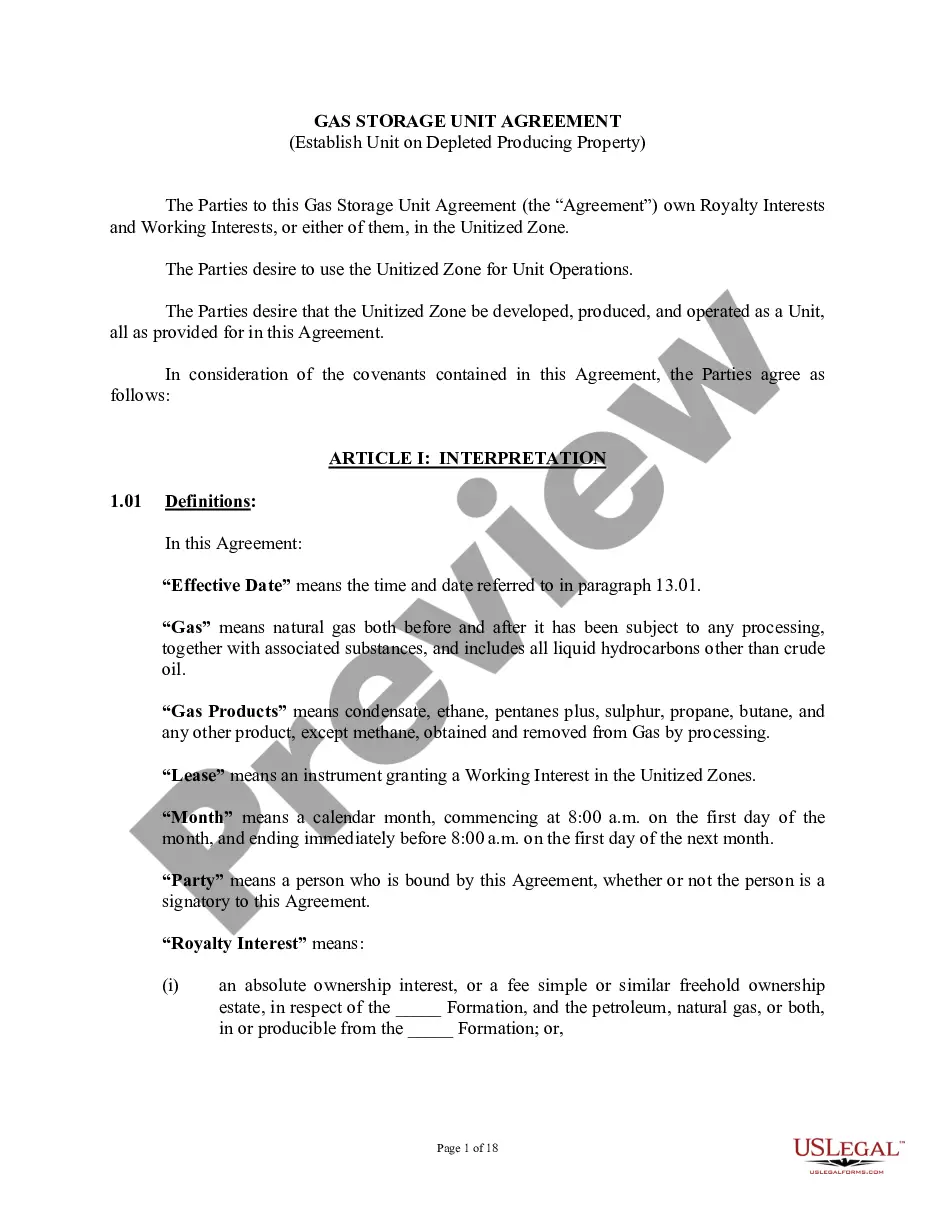

Avoid expensive lawyers and find the North Carolina Business Credit Application you want at a affordable price on the US Legal Forms website. Use our simple groups function to look for and obtain legal and tax forms. Read their descriptions and preview them before downloading. Additionally, US Legal Forms enables customers with step-by-step instructions on how to download and complete each and every form.

US Legal Forms customers basically have to log in and get the particular form they need to their My Forms tab. Those, who haven’t got a subscription yet must follow the guidelines listed below:

- Make sure the North Carolina Business Credit Application is eligible for use in your state.

- If available, look through the description and make use of the Preview option prior to downloading the sample.

- If you’re confident the template is right for you, click on Buy Now.

- If the template is wrong, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to your device or print it out.

Right after downloading, you are able to complete the North Carolina Business Credit Application by hand or by using an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Business Credit Application Form Sample Form popularity

Credit Application Form Other Form Names

Credit Application Form Print FAQ

Choose a business name. File an assumed name certificate with the county register of deeds office. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

To choose corporate tax treatment for your LLC, file IRS Form 2553. This requires the LLC to file a separate federal income tax return each year. Corporations are also taxed by North Carolina at a rate of 5 percent of annual income and must pay a franchise tax each year. File Form CD-405 with the Department of Revenue.

An LLC that is not considered a separate entity from its owner is taxed as a sole proprietor. Therefore, the LLC's income and expenses are reported as self-employment income on Schedule C of the owner's personal tax return. A taxpayer is required to file Schedule C if the LLC's income exceeds $400 for the tax year.

The IRS treats one-member LLCs as sole proprietorships for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS. As the sole owner of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your 1040 tax return.

You can only file your personal and business taxes separately if your company it is a corporation, according to the IRS.Corporations file their taxes using Form 1120. Limited liability companies (LLCs) can also choose to be treated as a corporation by the IRS, whether they have one or multiple owners.

North Carolina families with qualifying children who were 16 or younger at the end of 2019 who did not already receive the $335 check from the NC Department of Revenue. Qualifying individuals who were not required to file a 2019 state tax return and have NOT already received the $335 grant.

To form an LLC in North Carolina you will need to file the Articles of Organization with the North Carolina Secretary of State, which costs $125. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your North Carolina limited liability company.

The State of North Carolina requires you to file an annual report for your LLC.The annual report must be filed each year by April 15 except that new LLCs don't need to file a report until the first year after they're created. The filing fee is $200.

You can register your business with the North Carolina Department of Revenue by completing and submitting Form NC-BR, or by registering online. When you register, you will be issued an account ID number for such tax purposes as income tax withholding, sales and use tax, and machinery and equipment tax.