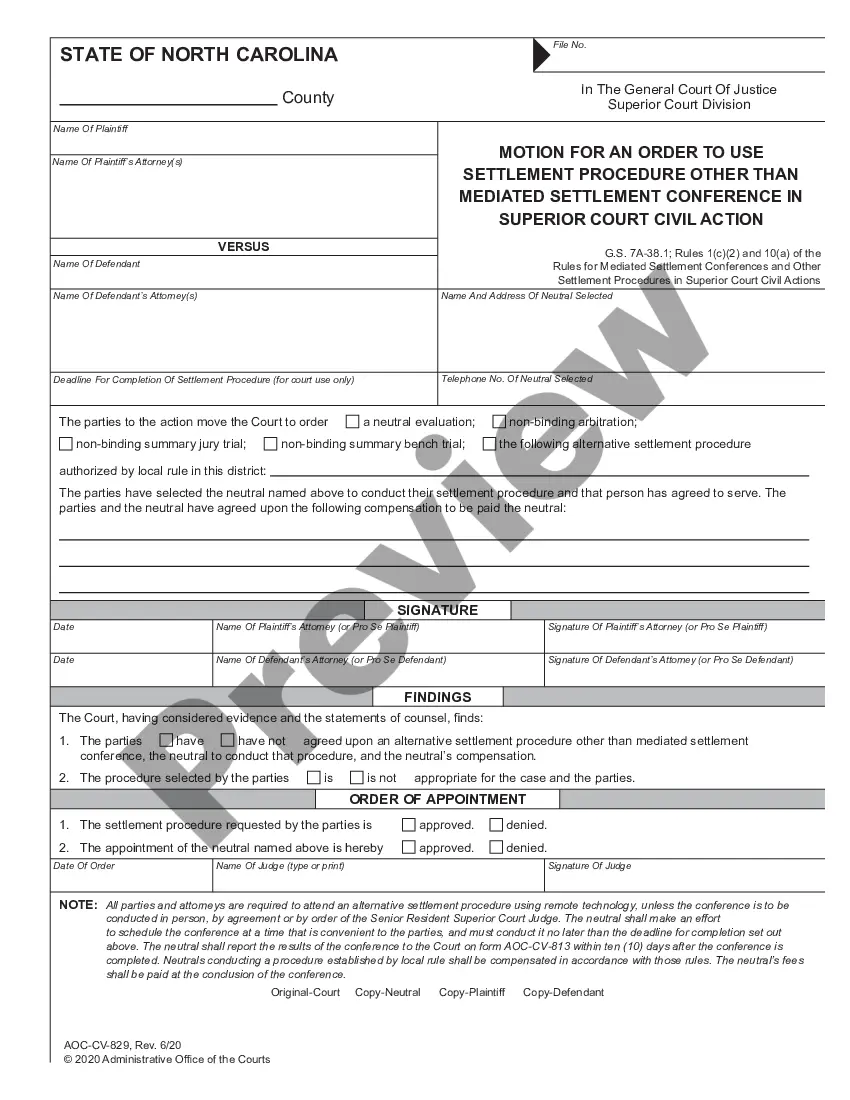

North Carolina Statement of Days Worked and Earnings for Workers' Compensation

Description

How to fill out North Carolina Statement Of Days Worked And Earnings For Workers' Compensation?

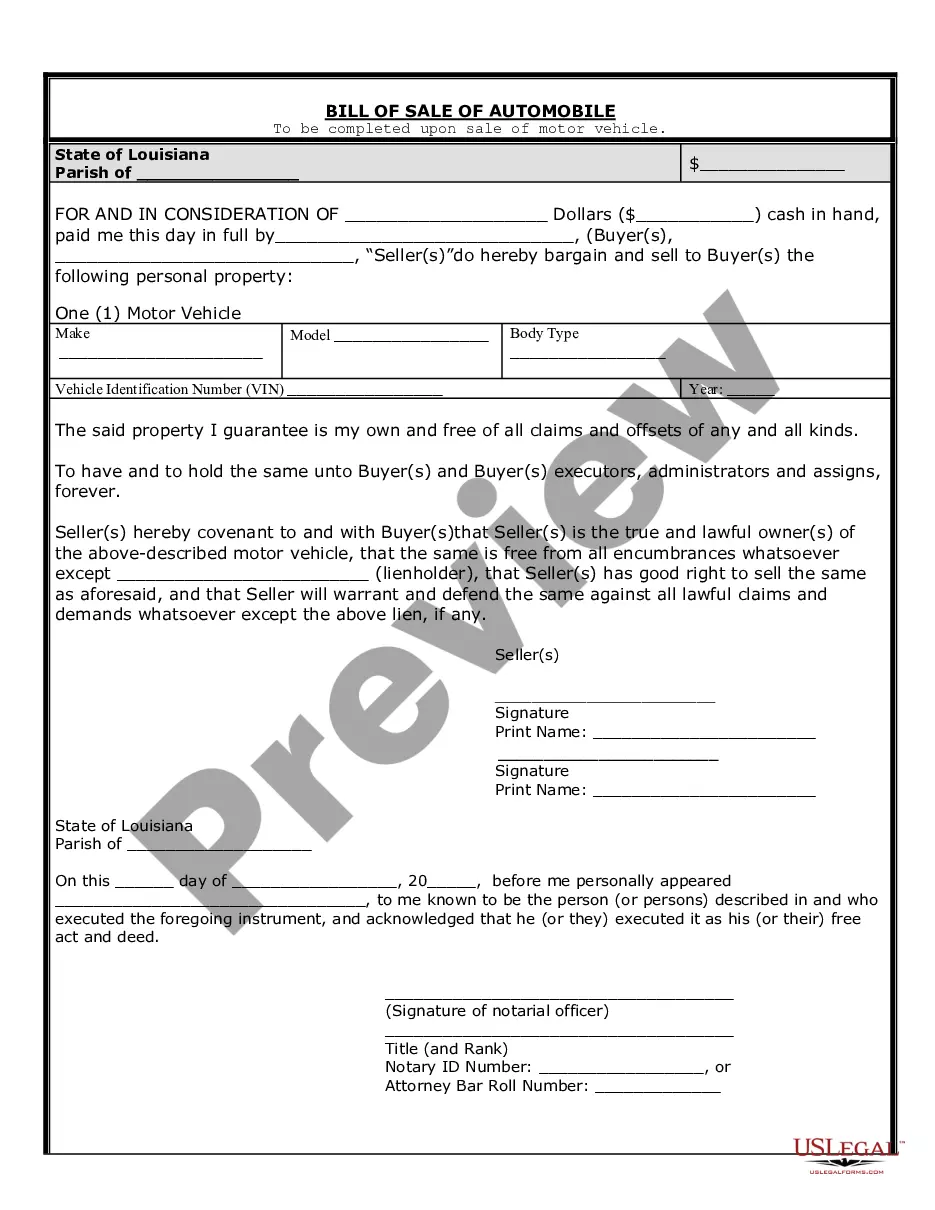

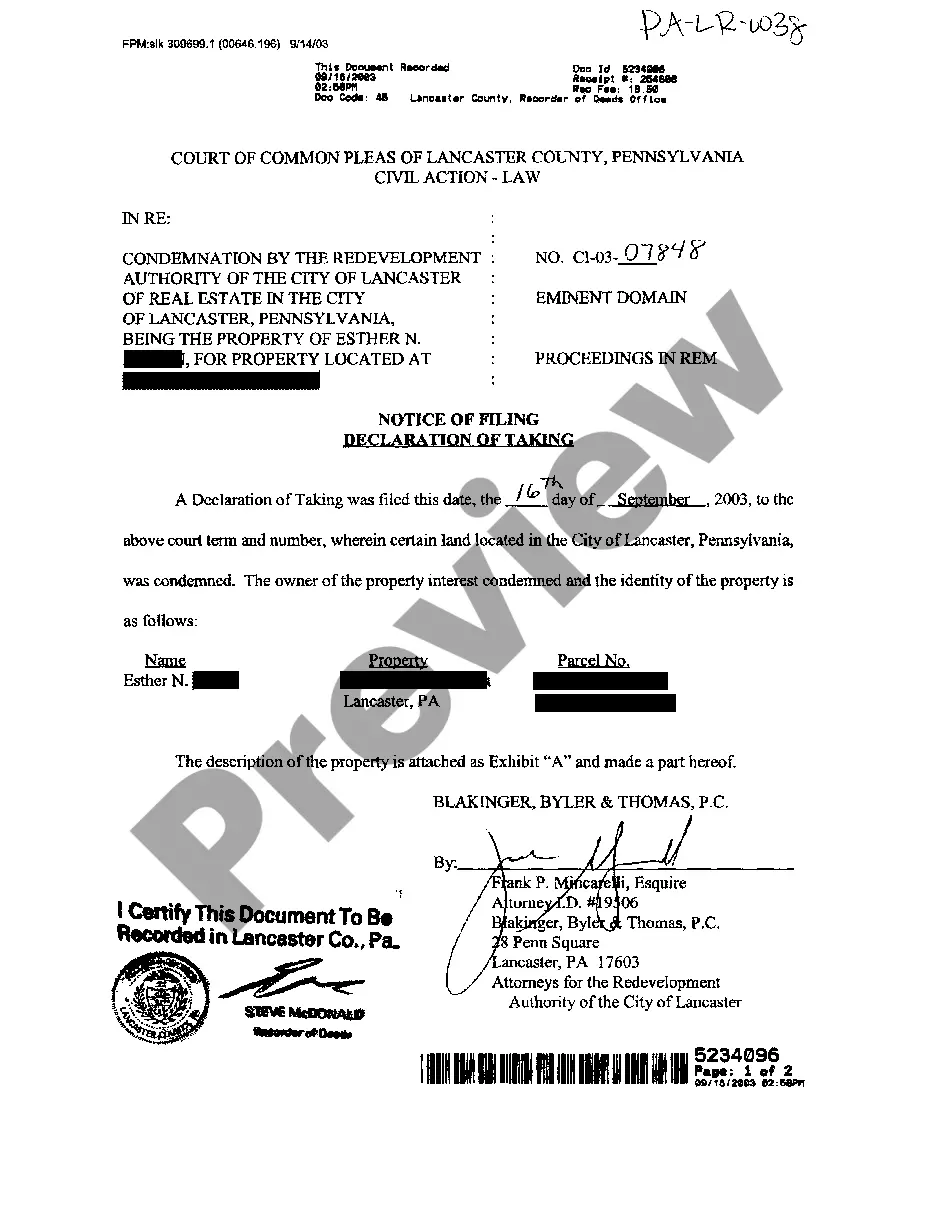

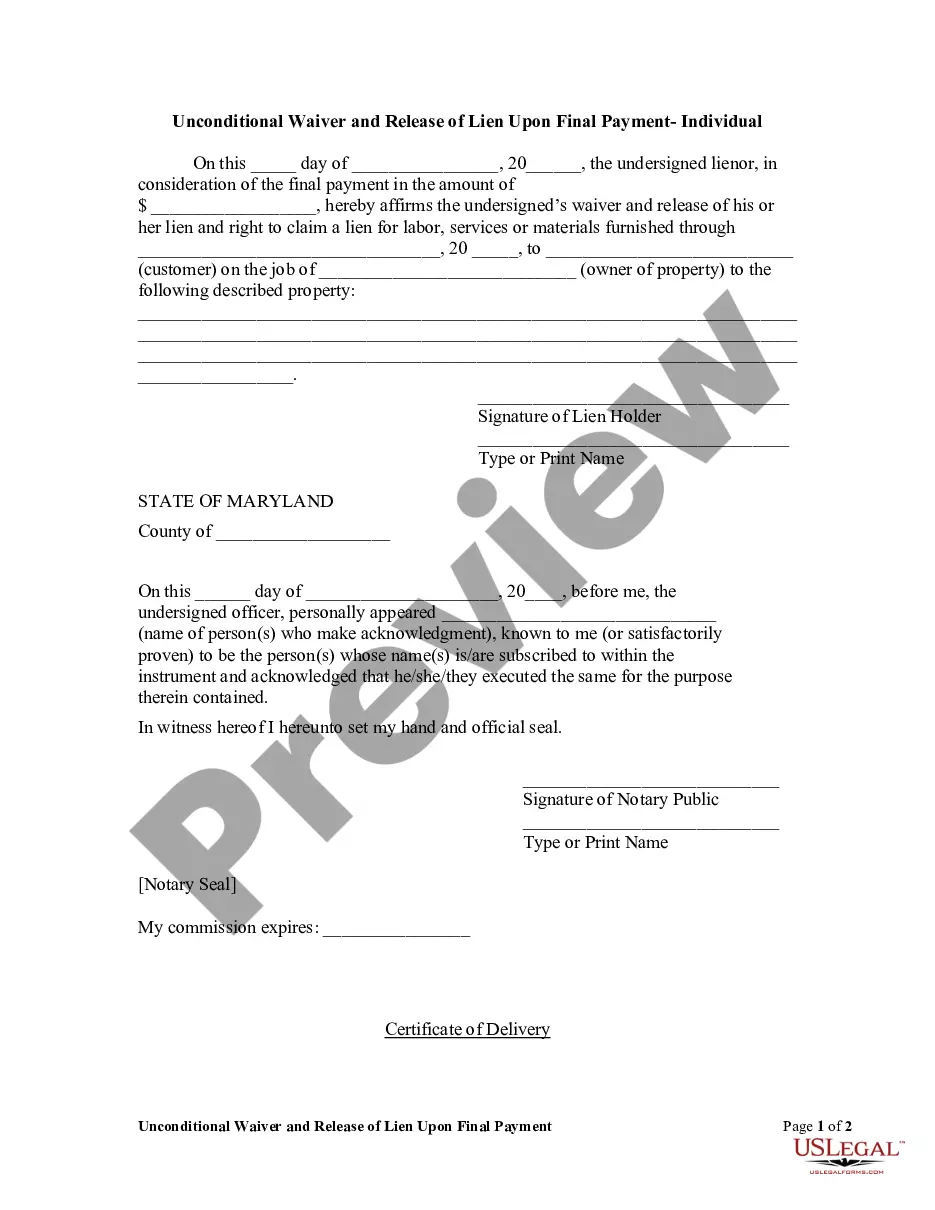

Avoid expensive attorneys and find the North Carolina Statement of Days Worked and Earnings for Workers' Compensation you want at a reasonable price on the US Legal Forms website. Use our simple categories function to find and download legal and tax documents. Go through their descriptions and preview them just before downloading. In addition, US Legal Forms provides customers with step-by-step instructions on how to download and fill out each template.

US Legal Forms clients simply must log in and get the specific document they need to their My Forms tab. Those, who have not got a subscription yet should follow the guidelines listed below:

- Make sure the North Carolina Statement of Days Worked and Earnings for Workers' Compensation is eligible for use in your state.

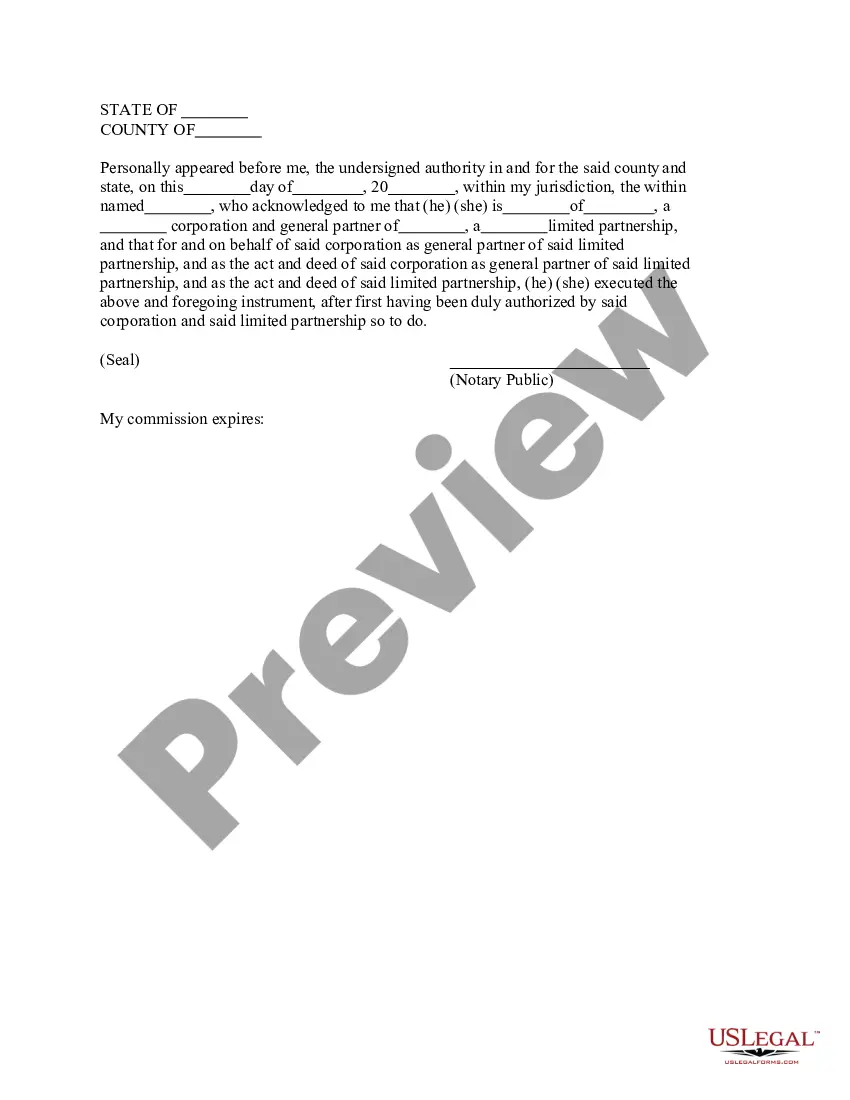

- If available, read the description and make use of the Preview option just before downloading the sample.

- If you are confident the document fits your needs, click on Buy Now.

- In case the form is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Select obtain the document in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to the device or print it out.

Right after downloading, it is possible to fill out the North Carolina Statement of Days Worked and Earnings for Workers' Compensation by hand or by using an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Calculating California Workers' Compensation Benefits In California, if you are injured on the job, you are entitled to receive two-thirds of your pretax gross wage.To calculate your regular weekly wage, you divide your annual salary by 52. If someone makes $52,000 a year, this would amount to $1,000 weekly.

A workers' compensation insurance policy is based on payroll, regardless of whether the employee is full-time, part-time, temporary or seasonal. Begin with the gross payroll for each employee. Tips for Calculating Payroll: Gross payroll for each employee can be rounded to the nearest $1,000.

For workers' compensation purposes, payroll or remuneration means money or substitutes for money. Your premium calculations include the following as remuneration: Wages or salaries including retroactive wages or salaries. Total cash received by employees for commissions and draws against commissions.

Temporary Total Disability: For example, if the medical provider has stated that the injured worker has temporary total disability ; it would not be advisable to partake in activities such as mowing the lawn, shoveling snow, or any recreational activity.

To be paid for your first 7 days of missed work, you need to be off of work and under a doctor's care for at least 14 consecutive work days. If your workers' compensation claim is approved, you may be able to receive the following payments: Medical Benefits.

The short answer is, no, your employer cannot fire you merely because of your workers' compensation claim.But your employer must be able to show there were reasons for firing you or laying you off that didn't have to do with your filing a workers' compensation claim.

Typically, if your new job pays you less than you were making prior to your injury, you can still receive payment for the difference in wages. You can also continue to receive medical benefits for all healthcare costs related to your injury. If you're disabled, you can still receive disability benefits.

If you are collecting workers' compensation benefits because you say that you are too injured to work, and then you get caught performing demanding work that you supposedly are unable to do, you may be accused of fraud and may have to pay a fine or restitution. You may even be sentenced to time in prison.

Workers' Comp laws in NC provide injured workers medical treatment for their injuries as well as wage replacement when they are disabled. Unlike the tort/negligence system which allows recovery for pain and suffering NC workers' compensation laws provide coverage primarily for economic losses.