North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check

Description Notice Dishonored Application

How to fill out Civil Bounced?

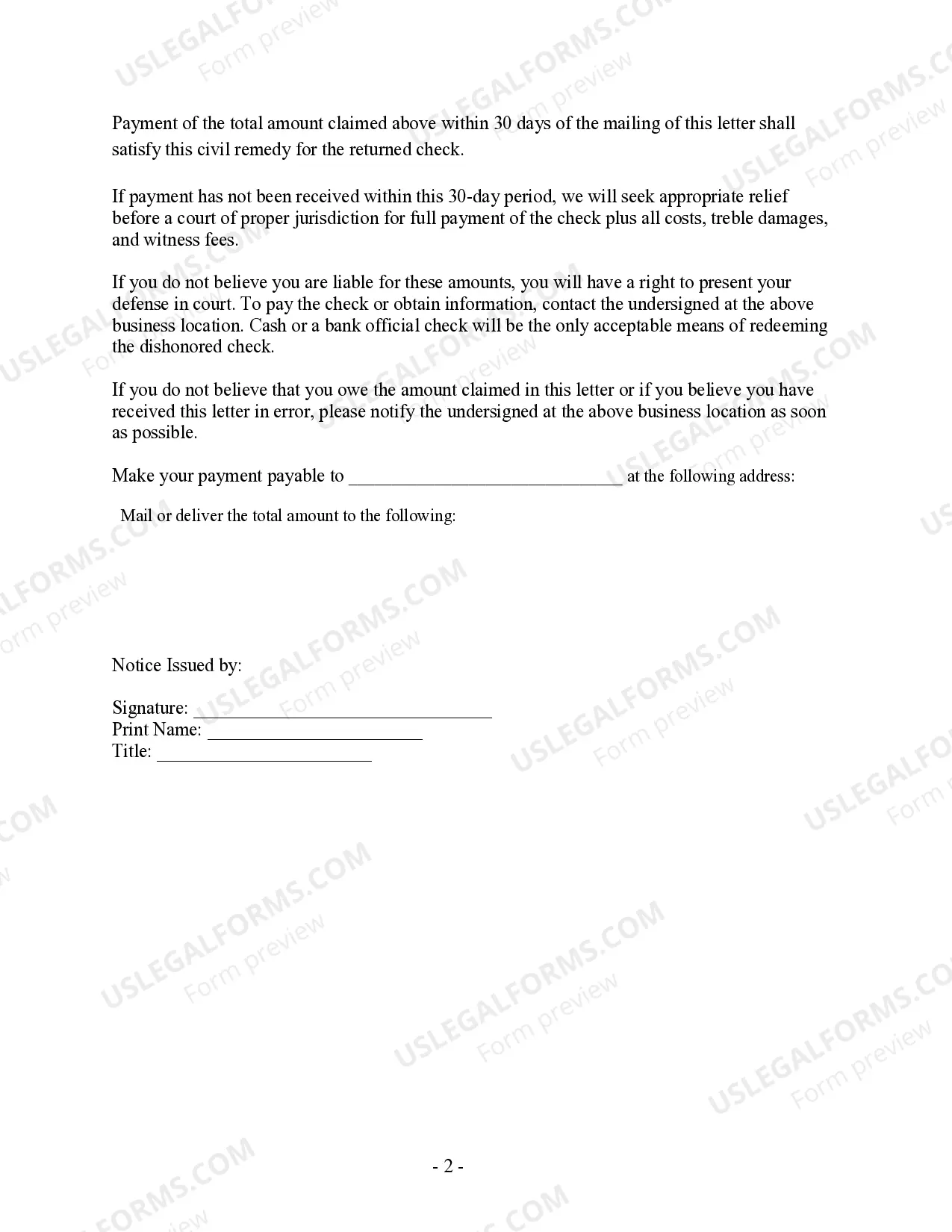

Avoid expensive lawyers and find the North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check you need at a affordable price on the US Legal Forms site. Use our simple categories function to search for and download legal and tax forms. Read their descriptions and preview them prior to downloading. Moreover, US Legal Forms enables customers with step-by-step instructions on how to obtain and complete each and every template.

US Legal Forms clients just must log in and obtain the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet should follow the guidelines listed below:

- Make sure the North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check is eligible for use in your state.

- If available, look through the description and make use of the Preview option well before downloading the templates.

- If you’re sure the template is right for you, click Buy Now.

- In case the template is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Choose to download the document in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to your device or print it out.

After downloading, you can complete the North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check manually or an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Civil Bounced Order Form popularity

Civil Bounced Pdf Other Form Names

Nc Civil Form FAQ

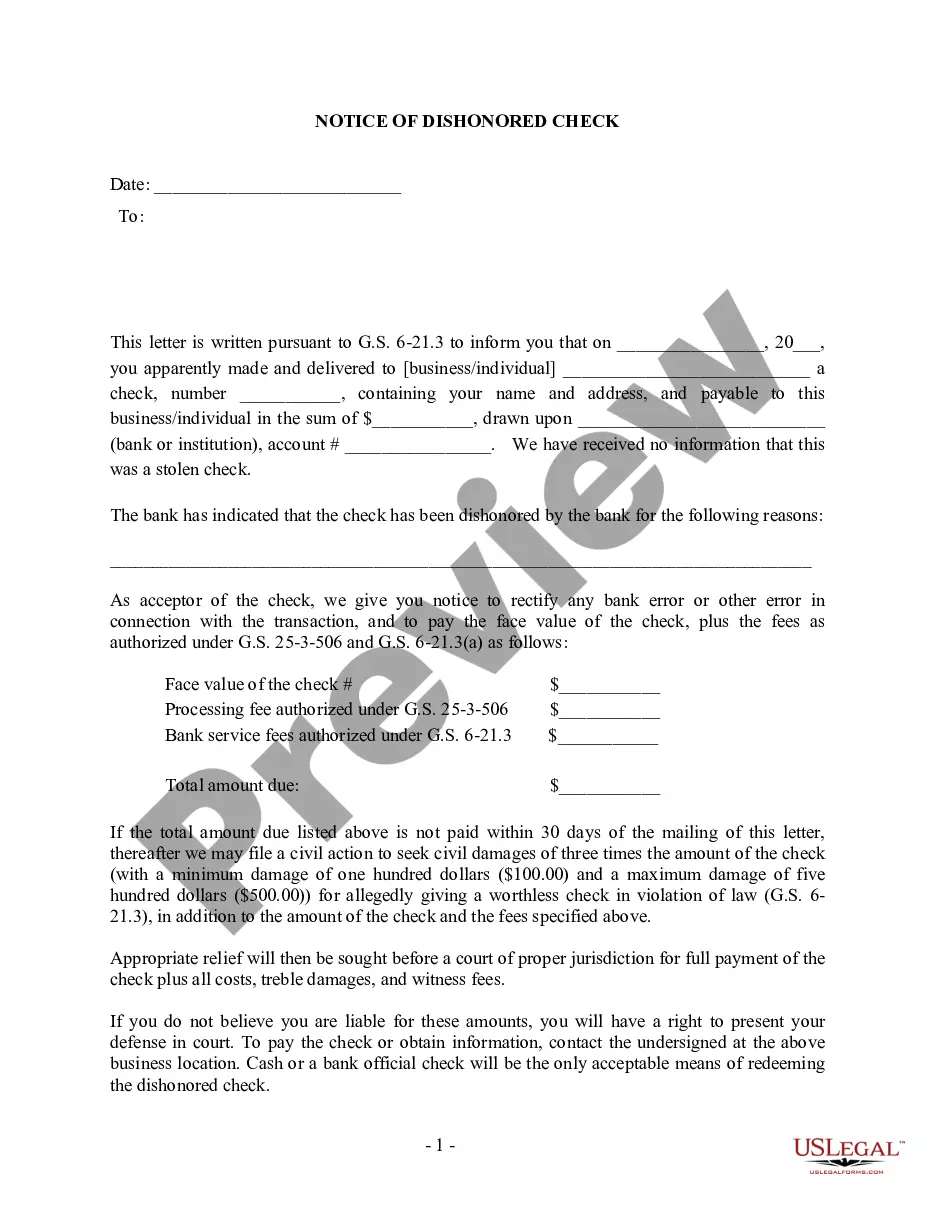

Typically, if a person violates the worthless check statue and the amount of the check is $2,000 or less, the person is guilty of a Class 3 misdemeanor. However, there are a few circumstances which can elevate the offense to a Class 1 misdemeanor. They are: the check is drawn upon a nonexistent account.

Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

Write a letter to the person who passed you the bad check. Inform him that they need to pay the check in full plus any resulting fees. Give them 7 to 10 days to pay the debt in full. Send the letter certified so you have proof it was received.

The statute of limitations for a worthless check is 2 years, but that doesn't mean the charges won't still get taken out (I really don't think the charges will be issued though)...

Most states have different limits for different kinds of crimes, but North Carolina is unique in this regard. North Carolina's criminal statute of limitations is two years for most misdemeanors, and there is no statute of limitations for felonies or crimes classified as "malicious" misdemeanors.

While you can never threaten to withhold filing criminal charges in return for payment (that can be considered extortion), you can let someone know that writing a bad check in North Carolina is a felony, and you are giving them one final chance to send payment before you decide to move forward with every available

Writing bad checks can lead to several theft charges, but with the help of a skilled defense attorney, you can work to reduce or even dismiss charges.