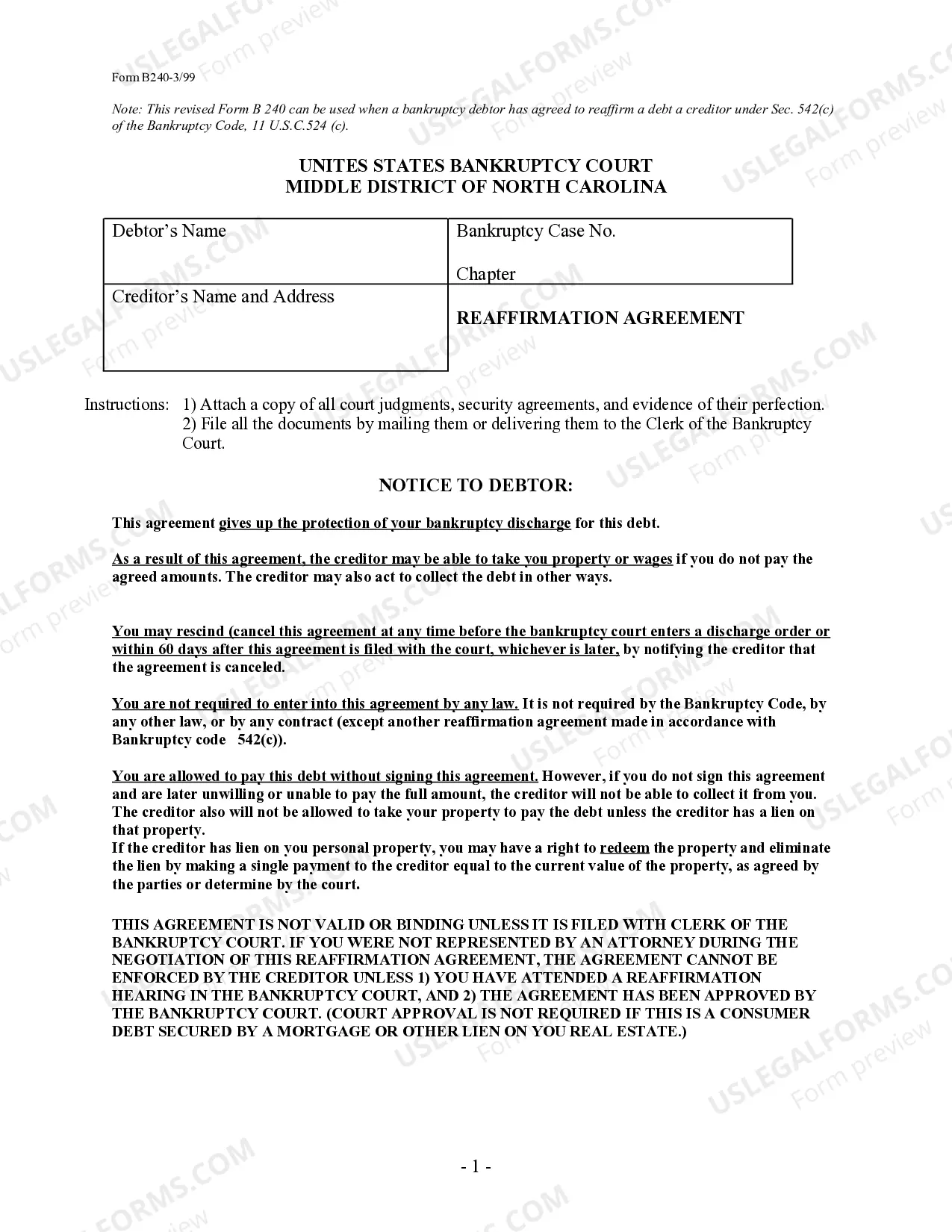

North Carolina Reaffirmation Agreement

Description

How to fill out North Carolina Reaffirmation Agreement?

Avoid costly attorneys and find the North Carolina Reaffirmation Agreement you want at a reasonable price on the US Legal Forms site. Use our simple groups function to look for and download legal and tax files. Read their descriptions and preview them prior to downloading. In addition, US Legal Forms enables users with step-by-step instructions on how to download and fill out each and every form.

US Legal Forms customers merely must log in and obtain the particular document they need to their My Forms tab. Those, who have not obtained a subscription yet need to follow the tips listed below:

- Ensure the North Carolina Reaffirmation Agreement is eligible for use where you live.

- If available, read the description and make use of the Preview option just before downloading the templates.

- If you’re sure the template meets your needs, click on Buy Now.

- If the template is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Select obtain the form in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, you are able to complete the North Carolina Reaffirmation Agreement by hand or with the help of an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

By contrast, a reaffirmation agreement is a new contract. It's often on the same terms as the prior contract, but you can try to negotiate a new payment amount, interest rate, or some other provision.

If you don't sign a reaffirmation agreement, the lender can repossess your car after your case closes and the automatic stay lifts. Some car lenders are known to repossess the car immediately, even if you are current on payments.

Reaffirmation agreements are strictly voluntary. A debtor is not required to reaffirm any of his or her debts. If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.

Reaffirmation is the process wherein you agree to remain responsible for a debt so that you can keep the property securing the debt (collateral). You and the lender enter into a new contractusually on the same termsand submit it to the bankruptcy court.