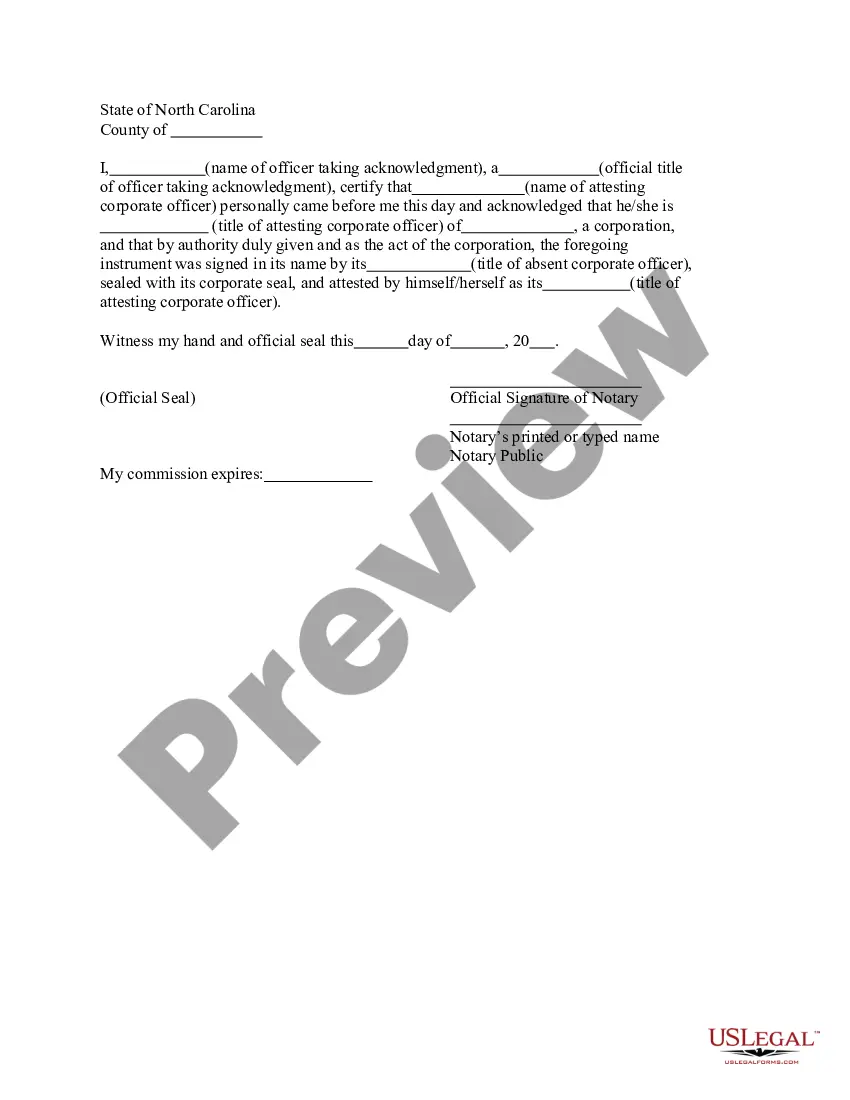

North Carolina Acknowledgment for other forms of probate for corporate conveyances

Description

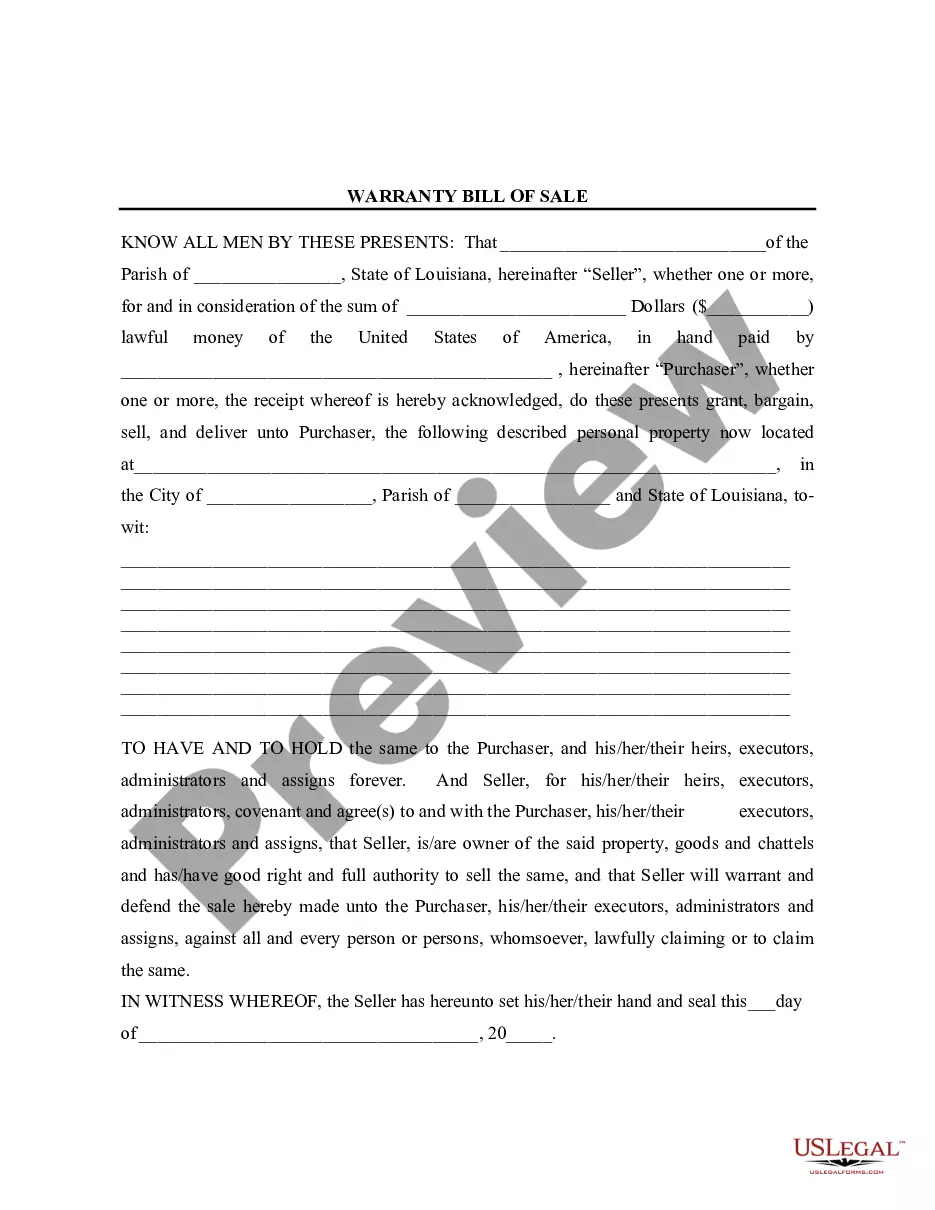

How to fill out North Carolina Acknowledgment For Other Forms Of Probate For Corporate Conveyances?

Avoid costly lawyers and find the North Carolina Acknowledgment for other forms of probate for corporate conveyances you need at a reasonable price on the US Legal Forms website. Use our simple categories functionality to search for and obtain legal and tax documents. Read their descriptions and preview them before downloading. In addition, US Legal Forms provides users with step-by-step tips on how to obtain and fill out every single form.

US Legal Forms subscribers merely must log in and download the specific form they need to their My Forms tab. Those, who have not obtained a subscription yet need to follow the tips listed below:

- Ensure the North Carolina Acknowledgment for other forms of probate for corporate conveyances is eligible for use in your state.

- If available, look through the description and use the Preview option just before downloading the sample.

- If you are confident the template meets your needs, click on Buy Now.

- In case the template is incorrect, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, it is possible to complete the North Carolina Acknowledgment for other forms of probate for corporate conveyances by hand or an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

The probate process begins at the Clerk of Superior Court in the deceased's county of residence. An application is submitted to the clerk by either the executor/executrix named in a will or, if there is no will or the person named in the will is not able or willing to serve, a person qualified to be an administrator.

Those fees will generally run between $2,000 and $10,000 depending on the size of the estate, and the nature of the assets and claims against the estate. Most lawyers perform that work on an hourly rate.

In North Carolina, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Probate is generally required in North Carolina only when a decedent owned property in their name alone. Assets that were owned with a spouse, for which beneficiaries were named outside of a will, or held in revocable living trusts, generally do not need to go through probate.

You should expect it to take a minimum of six months to a year to settle an estate because of the legal notice requirements and time that creditors have to submit claims against the estate. Creditors have 90 days from the first publication date of the notice of probate.

The amount of time it takes to get through formal probate can vary dramatically; however, it will take a minimum of about four months in North Carolina because creditors of the estate have 90 days from the date of publication of the notice of probate to file claims against the estate.