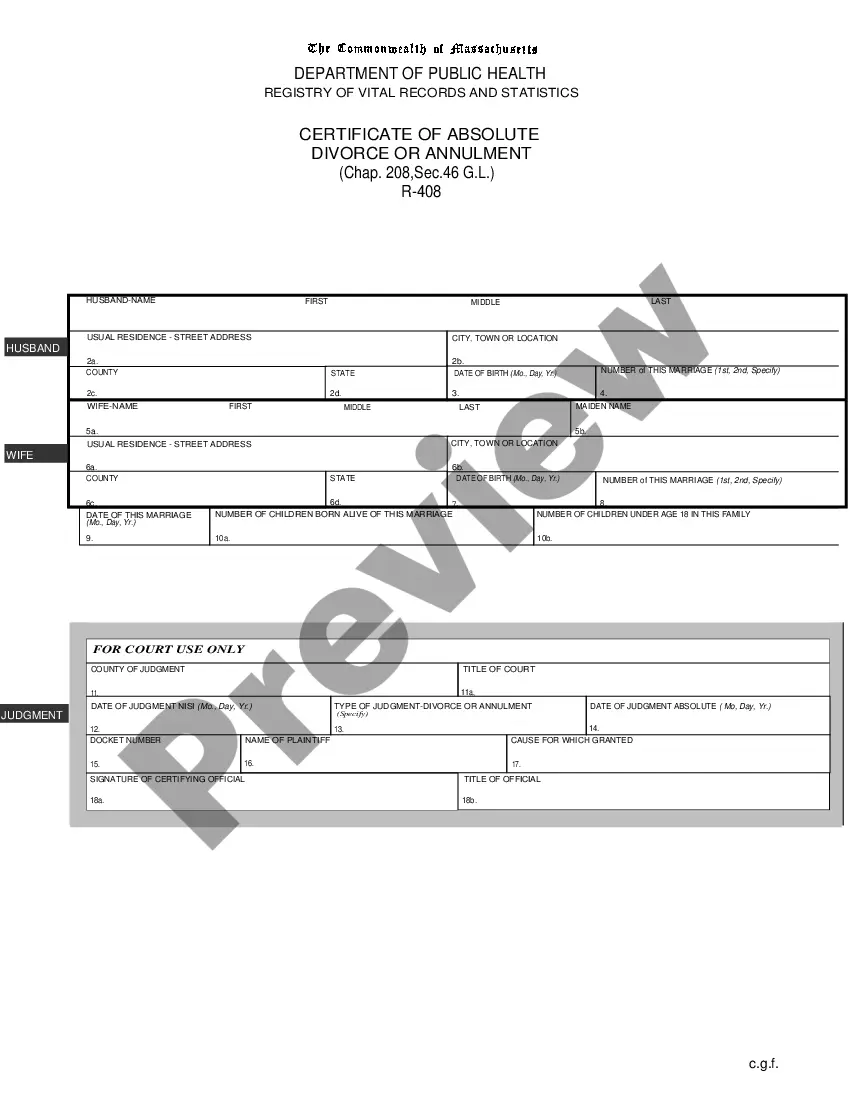

Motion to Join Employer as Party to Enforce Wage Withholding and Notice of Hearing: This is an official form from the North Carolina Administration of the Courts - AOC, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

North Carolina Motion to Join Employer as Party to Enforce Wage Withholding and Notice of Hearing

Description

How to fill out North Carolina Motion To Join Employer As Party To Enforce Wage Withholding And Notice Of Hearing?

Avoid expensive lawyers and find the North Carolina Motion to Join Employer as Party to Enforce Wage Withholding and Notice of Hearing you want at a affordable price on the US Legal Forms site. Use our simple categories functionality to search for and download legal and tax forms. Read their descriptions and preview them just before downloading. Moreover, US Legal Forms enables users with step-by-step instructions on how to download and complete every template.

US Legal Forms subscribers simply have to log in and download the specific form they need to their My Forms tab. Those, who have not obtained a subscription yet need to stick to the tips below:

- Ensure the North Carolina Motion to Join Employer as Party to Enforce Wage Withholding and Notice of Hearing is eligible for use in your state.

- If available, read the description and use the Preview option prior to downloading the sample.

- If you are confident the document fits your needs, click Buy Now.

- If the form is incorrect, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, you may complete the North Carolina Motion to Join Employer as Party to Enforce Wage Withholding and Notice of Hearing manually or an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

You are required to report your income regardless of whether your employer reports it to the IRS.You sue for damages and if you have reported your income you have no damages. Your employer reports your income on an information return. There are penalties if this is not done properly.

Provide a workplace free from serious recognized hazards and comply with standards, rules and regulations issued under the OSH Act. Examine workplace conditions to make sure they conform to applicable OSHA standards. Make sure employees have and use safe tools and equipment and properly maintain this equipment.

No, you can't sue the former employer for not sending you a W2, especially considering your employer has until January 31st. You may be able to sue them if they really didn't send your withholding to the IRS, but if that's the case, your...

If the IRS decides your failure to pay your payroll taxes is tax evasion, you may face criminal penalties. Tax evasion penalties include a maximum fine of $500,000 and up to five years in prison. On top of that, you are still responsible for paying the Trust Fund Recovery Penalty and the unpaid tax.

No, you can't sue your previous employer for not withholding income taxes. The tax code itself provides the employer with immunity from being sued for that.

Here are just a few examples of unfair treatment at work: Passing up someone for a training opportunity or promotion because of someone's race, color, gender or other protected characteristic. Creating offensive comments, emails or social media posts about an employee.

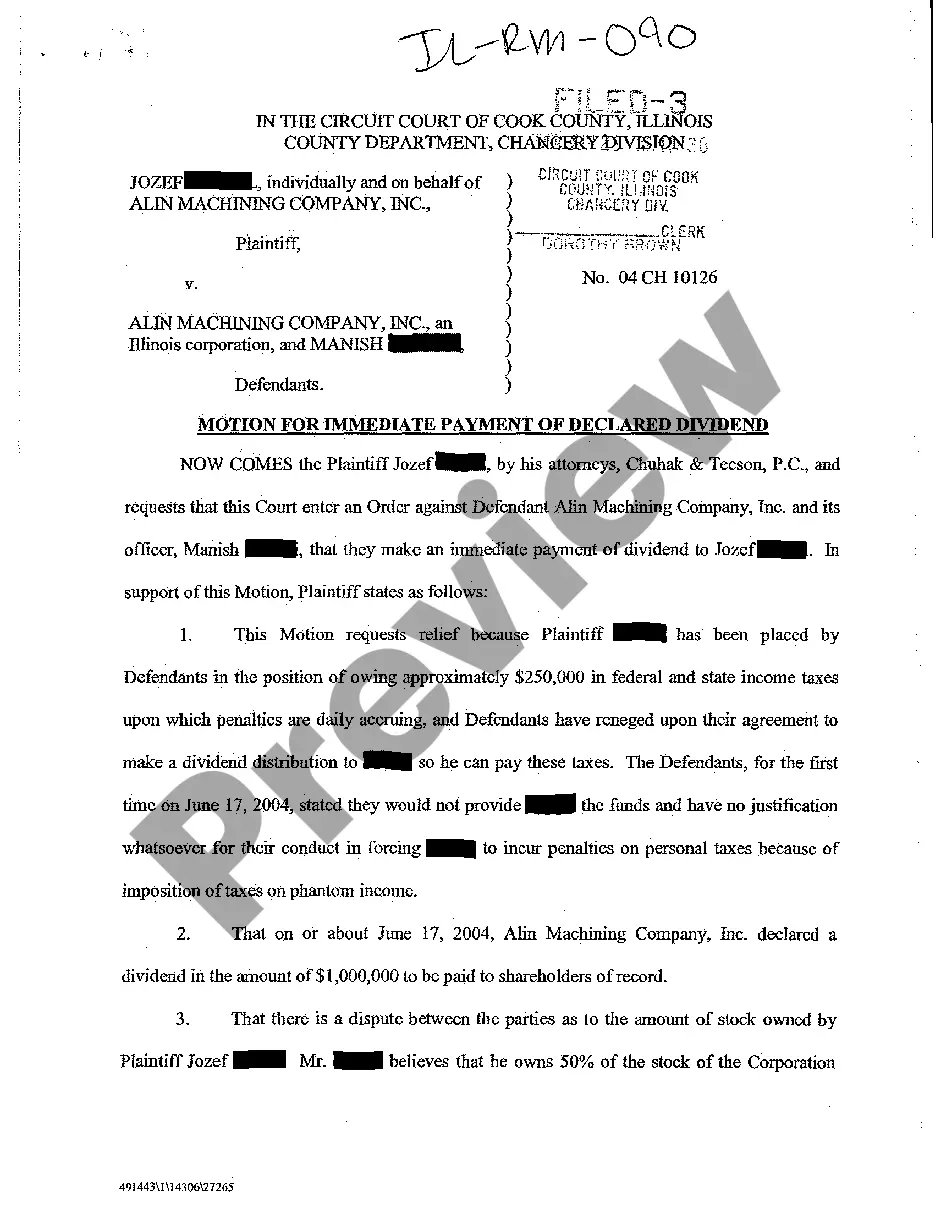

When an employer fails to pay an employee the applicable minimum wage or the agreed wage for all hours worked, the employee has a legal claim for damages against the employer. To recover the unpaid wages, the employee can either bring a lawsuit in court or file an administrative claim with the state's labor department.

California - Non-compete clauses are not enforceable under California law. However, LegalNature's non-compete agreement may still be used to prohibit the employee from soliciting customers and other employees away from the employer.Non-compete clauses are generally not enforceable.

If you wish to report a widespread violation of labor law by your employer or a violation affecting multiple employees, please contact LETF via phone, online lead referral form or email: Call the LETF Public hotline anytime: 855 297 5322. Complete the Online Form / Spanish Form. Email us at letf@dir.ca.gov.