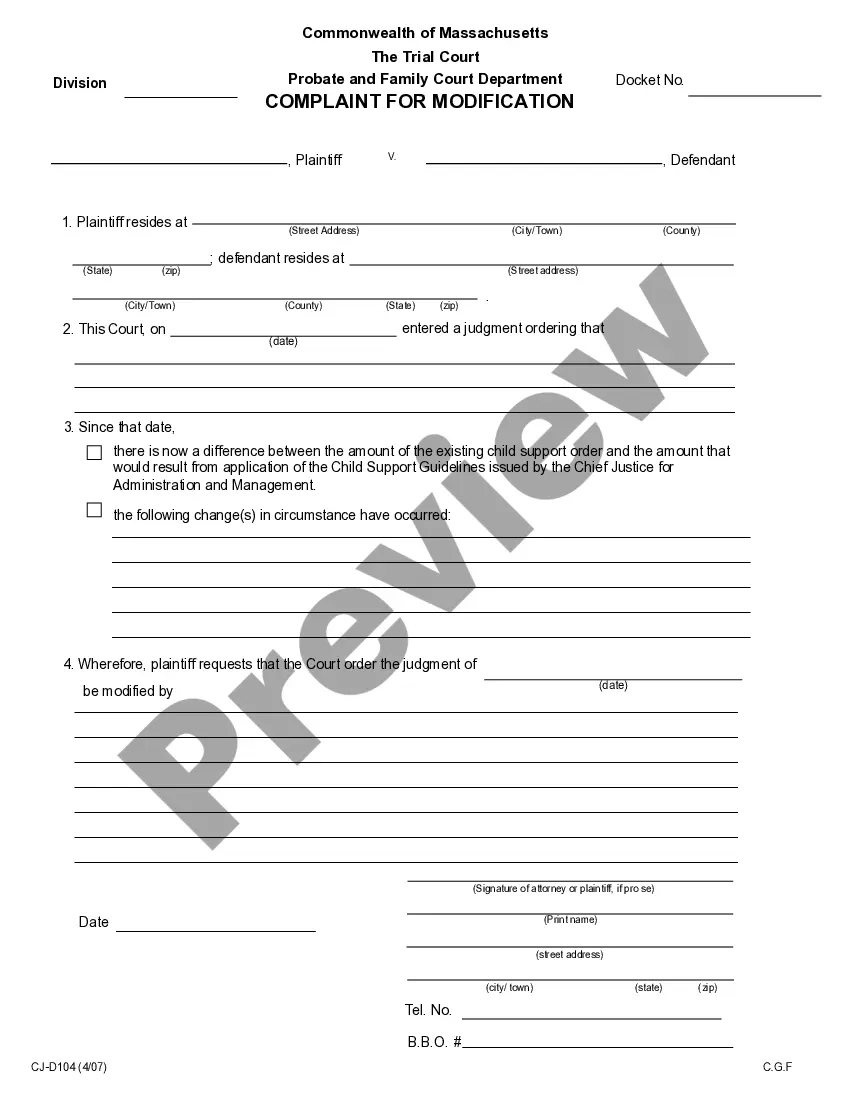

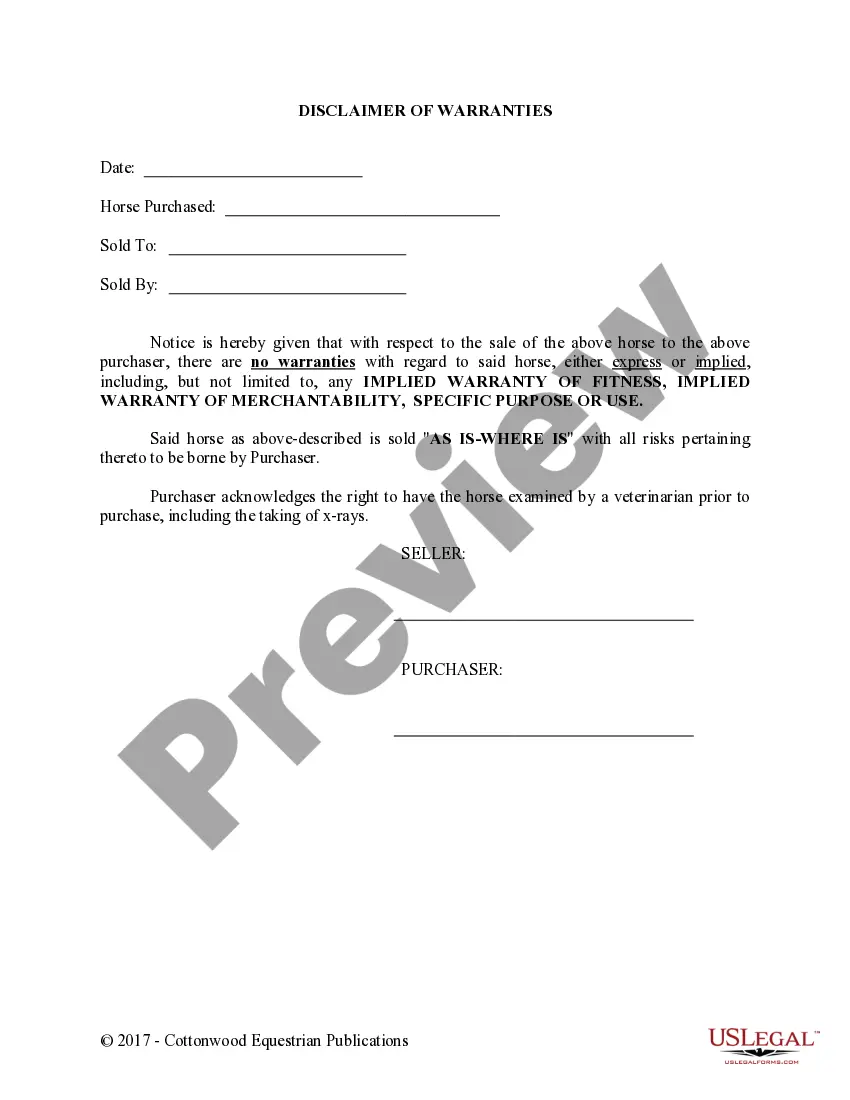

Order on Hearing to Contest Levy on Financial Institution Account(s): This is an official form from the North Carolina Administration of the Courts - AOC, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

North Carolina Order on Hearing to Contest Levy on Financial Institution Accounts

Description

How to fill out North Carolina Order On Hearing To Contest Levy On Financial Institution Accounts?

Avoid costly attorneys and find the North Carolina Order on Hearing to Contest Levy on Financial Institution Accounts you need at a reasonable price on the US Legal Forms website. Use our simple groups functionality to find and download legal and tax files. Read their descriptions and preview them before downloading. Additionally, US Legal Forms provides customers with step-by-step tips on how to download and fill out each and every template.

US Legal Forms subscribers basically need to log in and download the particular document they need to their My Forms tab. Those, who have not obtained a subscription yet need to follow the guidelines listed below:

- Ensure the North Carolina Order on Hearing to Contest Levy on Financial Institution Accounts is eligible for use in your state.

- If available, read the description and make use of the Preview option just before downloading the templates.

- If you’re sure the template meets your needs, click Buy Now.

- In case the template is incorrect, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to your device or print it out.

Right after downloading, you may fill out the North Carolina Order on Hearing to Contest Levy on Financial Institution Accounts manually or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

With simple payment agreements, the IRS will release the levy immediately. That's assuming you haven't already gotten a payment extension. Normally, when you request an extension, you can get up to 120 days.

The IRS generally has ten years to collect tax debt, but this period can be extended in some situations. If you are experiencing an economic hardship, you may also be able to get the levy released. You may also be able to apply for currently not collectible status to avoid other collections.

Transitive verb. 1a : to impose or collect by legal authority levy a tax. b : to require by authority. 2 : to enlist or conscript for military service.

More In File The IRS can also release a levy if it determines that the levy is causing an immediate economic hardship. If the IRS denies your request to release the levy, you may appeal this decision. You may appeal before or after the IRS places a levy on your wages, bank account, or other property.

How Many Times Can the IRS Levy Your Bank Account? The IRS can levy it a bank account more than once. When the IRS levy's you, it is not a standing levy, which means you can deposit money the next day. An IRS bank levy attaches to funds once the bank processes the tax levy.

How to Request an Appeal for a Tax Levy. If you do not agree with the notice, you can file an appeal. To do that, you need to fill out and submit IRS Form 12153 (Request for a Collection Due Process or Equivalent Hearing) or request the CAP procedure (Collection Appeals Program).

Once a levy is in place, the creditor may keep withdrawing funds from your bank account until the entire debt is repaid. You may be able to get the levy lifted by taking care of the obligation, making a payment arrangement, or settling the debt.

A levy is a legal seizure of your property to satisfy a tax debt. Levies are different from liens. A lien is a legal claim against property to secure payment of the tax debt, while a levy actually takes the property to satisfy the tax debt.

Pay the Tax Debt in Full. Appeal the Levy. Request an Installment Agreement. Make an Offer in Compromise. Apply for the Fresh Start Program. Wait Out the Statute of Limitations. Make a Case for Financial Hardship. Prove Your Assets Have No Equity.