North Carolina Amendment to Living Trust

Description

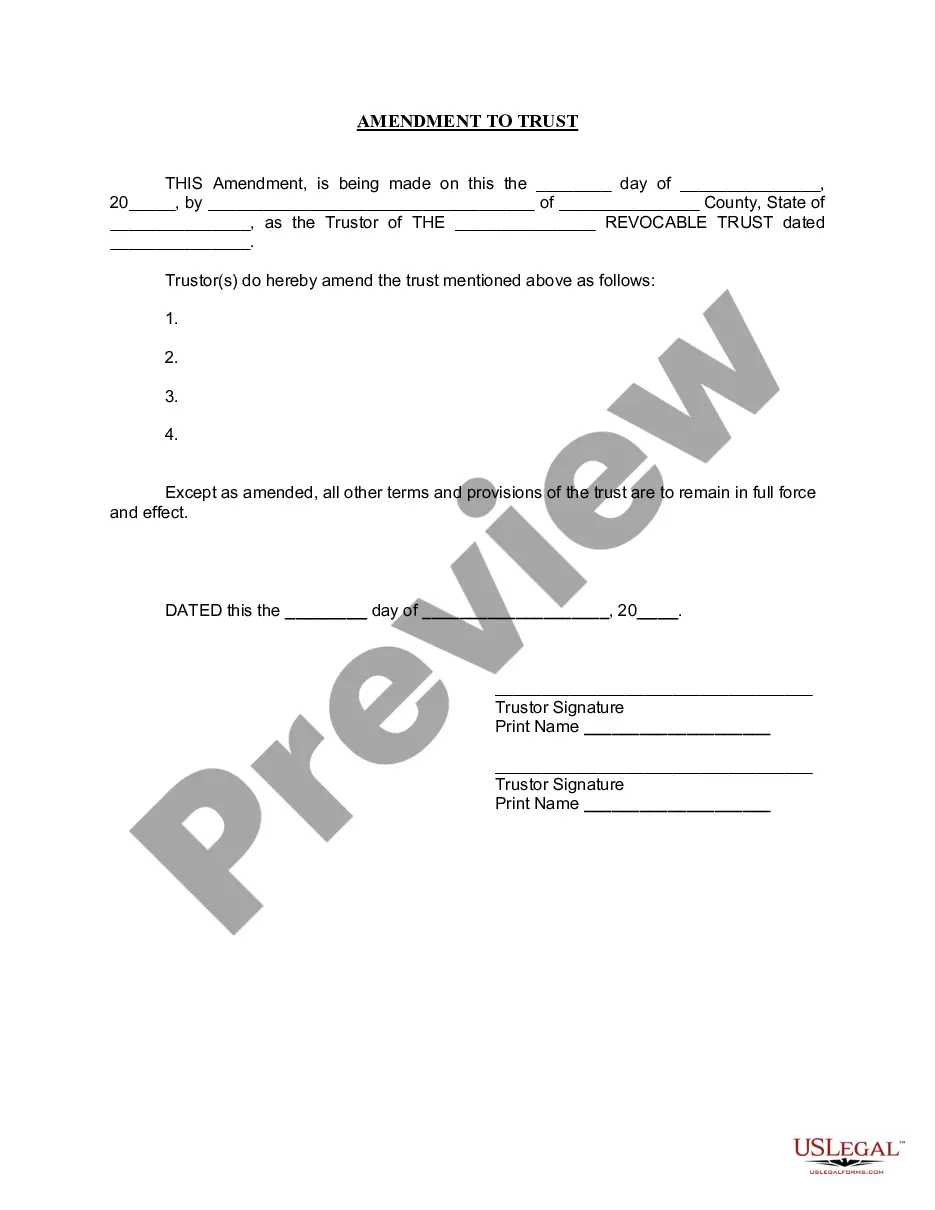

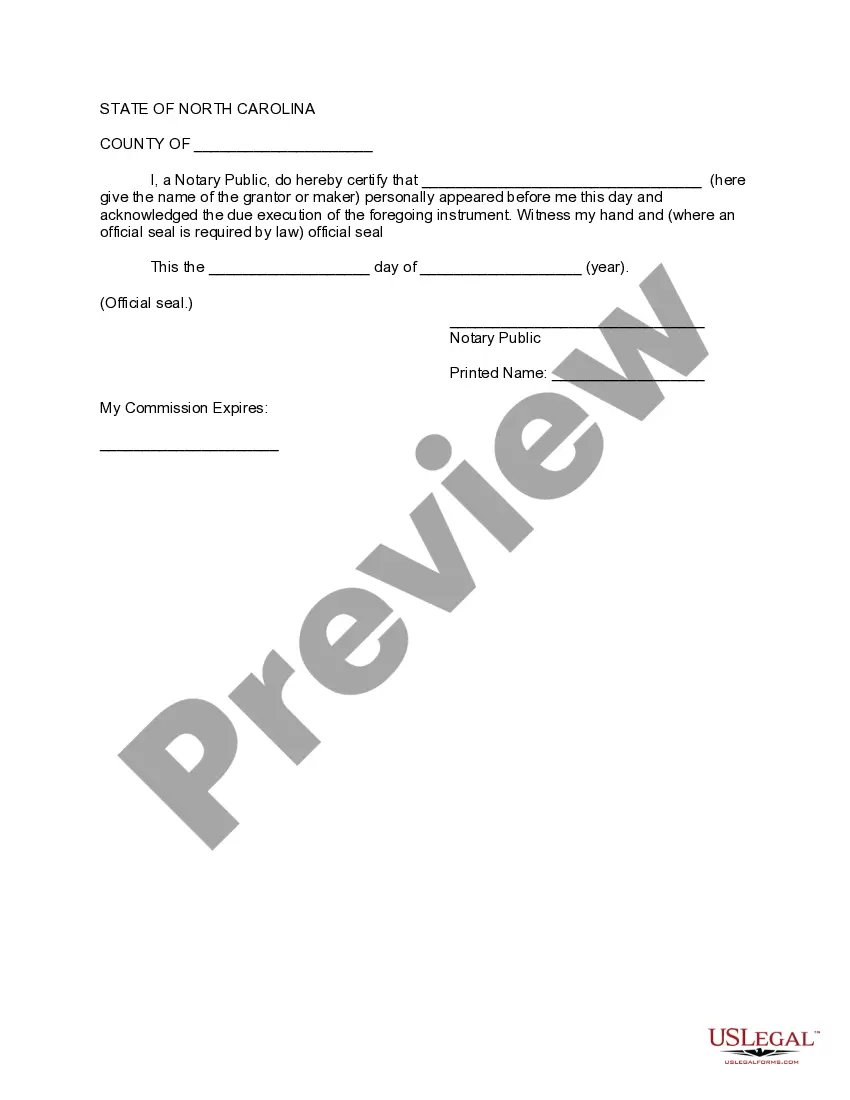

How to fill out North Carolina Amendment To Living Trust?

Steer clear of costly lawyers and discover the North Carolina Amendment to Living Trust you seek at an affordable rate on the US Legal Forms site.

Utilize our easy grouping feature to locate and download legal and tax documents. Review their descriptions and view them prior to downloading. Furthermore, US Legal Forms provides users with detailed instructions on how to download and complete each template.

After downloading, you can complete the North Carolina Amendment to Living Trust manually or with editing software. Print it out and reuse the form multiple times. Achieve more while spending less with US Legal Forms!

- Subscribers to US Legal Forms only need to Log In and retrieve the exact form they require from their My documents section.

- Those who haven't subscribed yet should adhere to the steps outlined below.

- Confirm that the North Carolina Amendment to Living Trust is suitable for utilization in your state.

- If possible, peruse the description and utilize the Preview feature before downloading the template.

- If you’re confident the document meets your requirements, click Buy Now.

- If the template is inaccurate, use the search box to locate the correct one.

- Then, create your account and select a subscription plan.

- Make a payment via credit card or PayPal.

- Decide to receive the document in PDF or DOCX format.

- Click Download and locate your template in the My documents section. You can either save the form to your device or print it out.

Form popularity

FAQ

Figure out the type of trust you'll need. Are you single? Take inventory of everything you own. Pick your trustee. Draw up the trust document, either by yourself or with a lawyer. Sign the trust document in front of a notary. Fund the trust this means putting your property into the trust.

A "living trust" (also called an "inter vivos" trust by lawyers who can't give up Latin) is simply a trust you create while you're alive, rather than one that is created at your death under the terms of your will. The beneficiaries you name in your living trust receive the trust property when you die.

It is true that in some states (such as California) probate administration can be lengthy and expensive. North Carolina is not one of those states. The maximum court cost that can be saved in North Carolina by using a funded living trust is $3,000, and those costs are generally much less in most estates.

In North Carolina, any person 18-years of age and older can make a will or living trust, and that will or trust will be recognized by law. Whatever debts you owe upon your death, whether it is a car loan or fees owed for personal services, this will come from the assets of your estate.