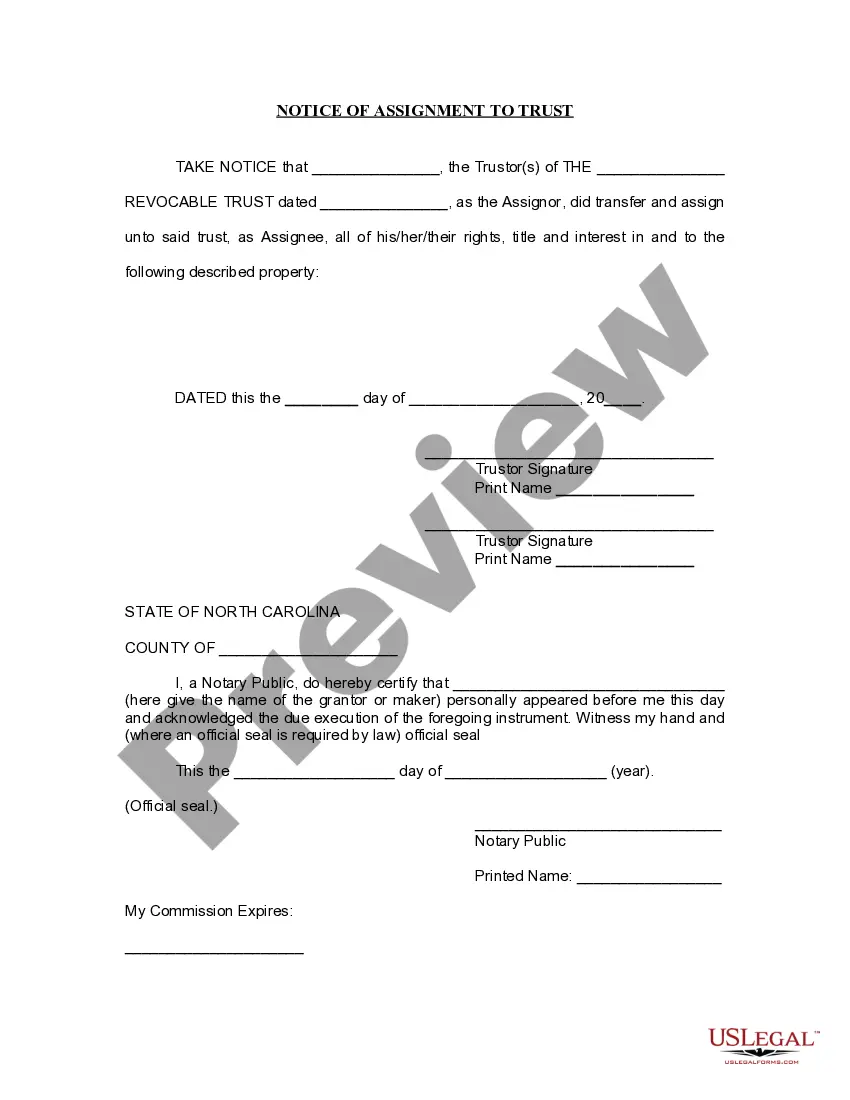

North Carolina Notice of Assignment to Living Trust

Description North Carolina Living Trust

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out North Carolina Notice Of Assignment To Living Trust?

Avoid costly lawyers and find the North Carolina Notice of Assignment to Living Trust you want at a affordable price on the US Legal Forms site. Use our simple categories function to search for and download legal and tax documents. Go through their descriptions and preview them before downloading. In addition, US Legal Forms provides customers with step-by-step instructions on how to obtain and fill out every single template.

US Legal Forms subscribers simply must log in and obtain the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet must follow the guidelines listed below:

- Ensure the North Carolina Notice of Assignment to Living Trust is eligible for use where you live.

- If available, read the description and make use of the Preview option well before downloading the templates.

- If you are sure the document fits your needs, click on Buy Now.

- If the form is incorrect, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the form to your device or print it out.

Right after downloading, you are able to fill out the North Carolina Notice of Assignment to Living Trust manually or with the help of an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

North Carolina Notice Form popularity

Trust Assign Official Other Form Names

Trust Day Notice FAQ

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

A "living trust" (also called an "inter vivos" trust by lawyers who can't give up Latin) is simply a trust you create while you're alive, rather than one that is created at your death under the terms of your will. The beneficiaries you name in your living trust receive the trust property when you die.

Figure out the type of trust you'll need. Are you single? Take inventory of everything you own. Pick your trustee. Draw up the trust document, either by yourself or with a lawyer. Sign the trust document in front of a notary. Fund the trust this means putting your property into the trust.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

It is true that in some states (such as California) probate administration can be lengthy and expensive. North Carolina is not one of those states. The maximum court cost that can be saved in North Carolina by using a funded living trust is $3,000, and those costs are generally much less in most estates.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.