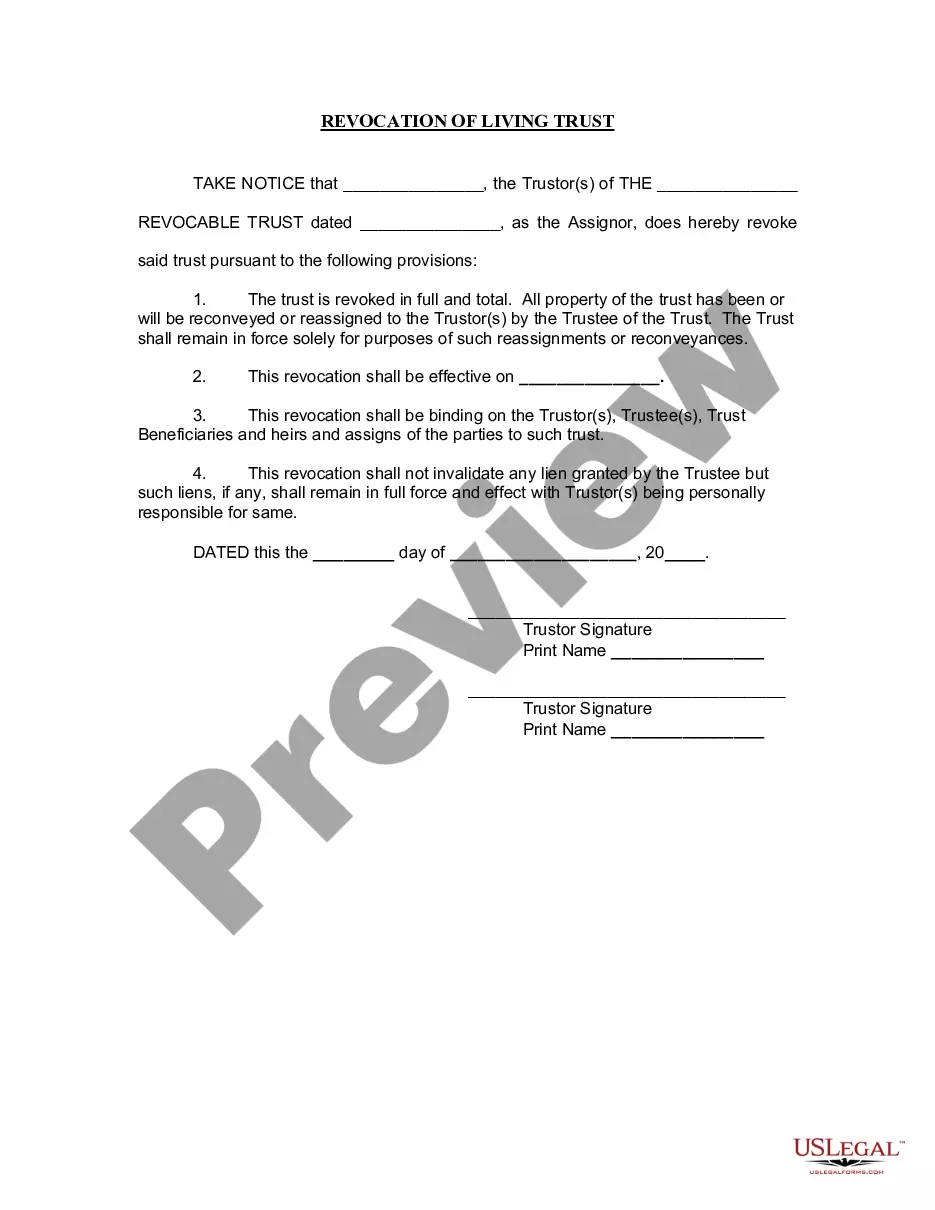

North Carolina Revocation of Living Trust

Description Revocation Living Trust Form

How to fill out North Carolina Revocation Of Living Trust?

Avoid expensive lawyers and find the North Carolina Revocation of Living Trust you want at a reasonable price on the US Legal Forms site. Use our simple categories function to look for and obtain legal and tax files. Go through their descriptions and preview them well before downloading. Moreover, US Legal Forms enables users with step-by-step instructions on how to obtain and fill out each and every form.

US Legal Forms customers simply have to log in and obtain the particular document they need to their My Forms tab. Those, who haven’t got a subscription yet should stick to the guidelines below:

- Ensure the North Carolina Revocation of Living Trust is eligible for use where you live.

- If available, read the description and make use of the Preview option well before downloading the templates.

- If you are confident the template is right for you, click Buy Now.

- If the template is incorrect, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the template to the device or print it out.

After downloading, you are able to complete the North Carolina Revocation of Living Trust by hand or an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Trust Revocation Seal Form popularity

Nc Revocation Trust Other Form Names

Revocation Living Trust Agreement FAQ

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust.

This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer. How long it takes to settle a revocable living trust can depend on numerous factors.

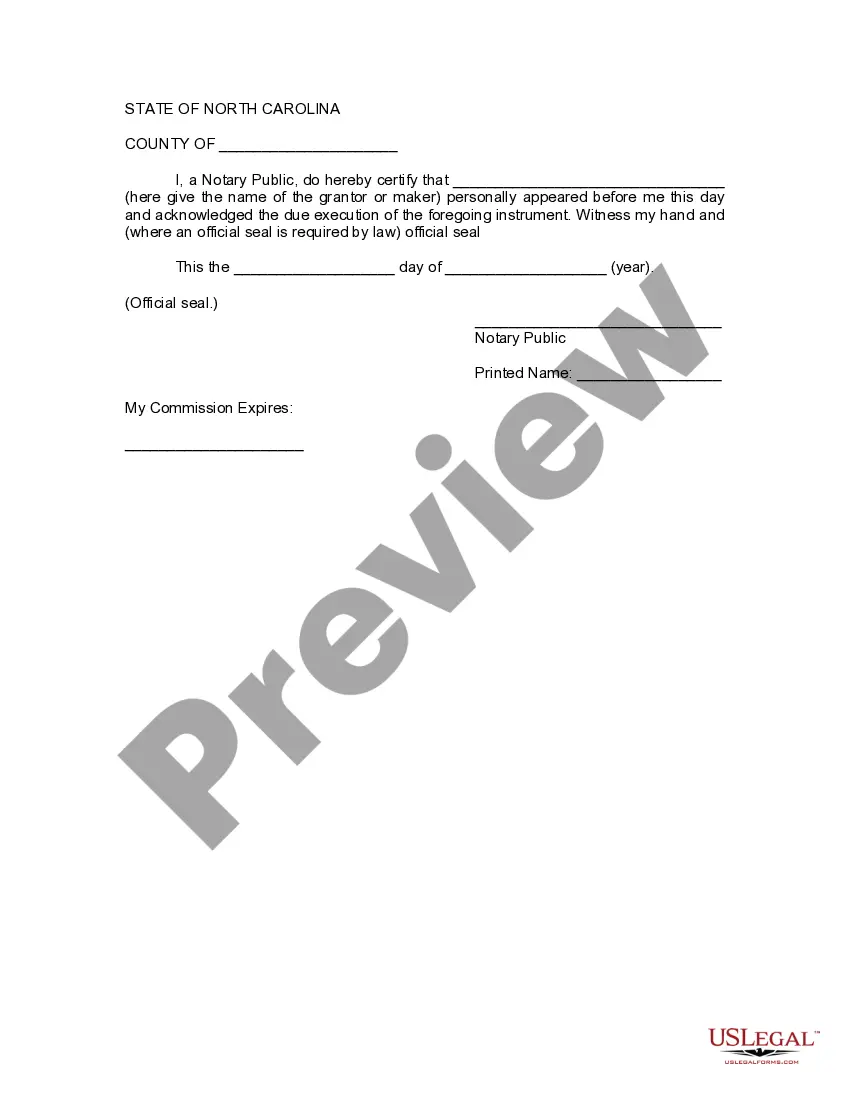

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

The terms of an irrevocable trust may give the trustee and beneficiaries the authority to break the trust. If the trust's agreement does not include provisions for revoking it, a court may order an end to the trust. Or the trustee and beneficiaries may choose to remove all assets, effectively ending the trust.

A revocable trust, or living trust, is a legal entity to transfer assets to heirs without the expense and time of probate.A living trust also can be revoked or dissolved if there is a divorce or other major change that can't be accommodated by amending the trust.

Termination by Trustee. If a trust has less than $50,000 in assets, the trustee may terminate the trust without getting court approval. Termination With Consent of Beneficiaries. Termination by the Court.

Whether your trust closes immediately after your death or lives on for a while to serve your intentions, it must eventually close. This typically involves payment of any outstanding debts or taxes before the trustee distributes the trust's assets and income to your named beneficiaries.

How can I dissolve my trust? You can dissolve a trust by bringing forward its final distribution date. This can be done by the trustees or settlor if the trust deed says they can, or by the combined consent of the beneficiaries.

Key Takeaways. Revocable trusts, as their name implies, can be altered or completely revoked at any time by their grantorthe person who established them. The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.