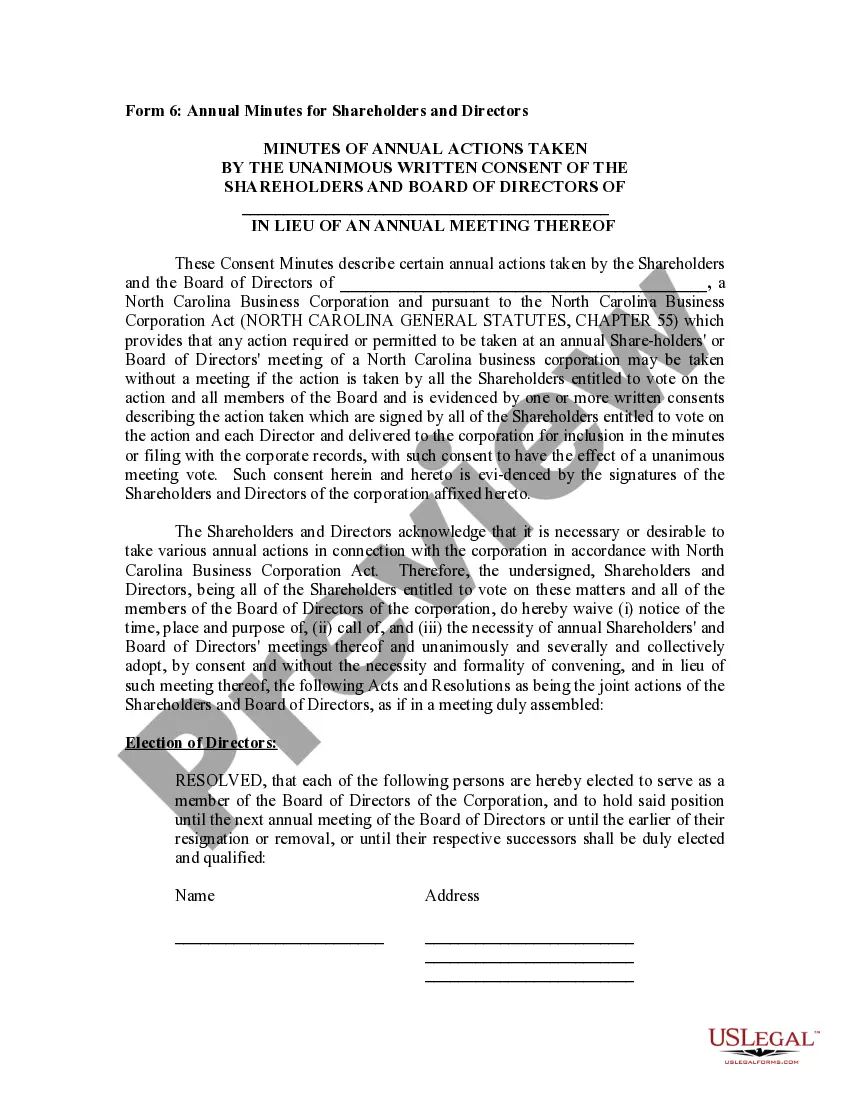

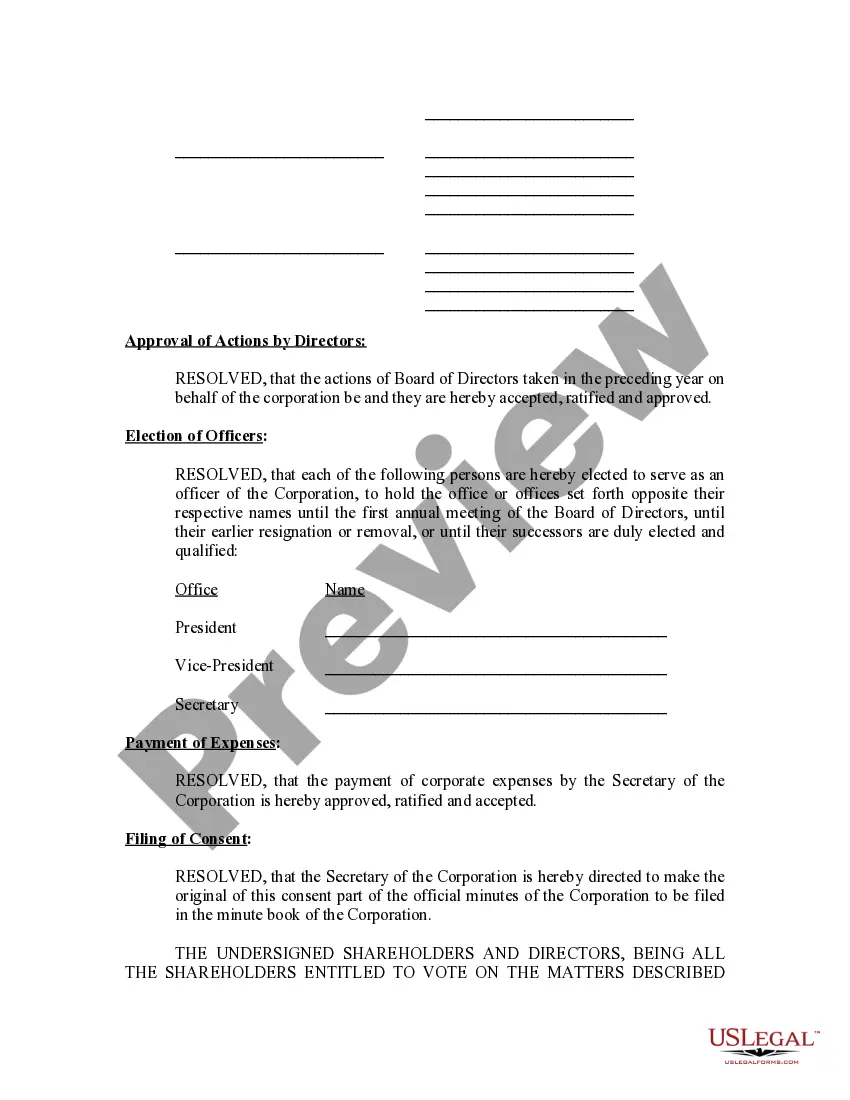

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

North Carolina Annual Minutes

Description Nc Annual Statement

How to fill out Nc Annual Draft?

Avoid pricey attorneys and find the Annual Minutes - North Carolina you want at a reasonable price on the US Legal Forms site. Use our simple groups functionality to search for and obtain legal and tax documents. Read their descriptions and preview them before downloading. Moreover, US Legal Forms provides users with step-by-step instructions on how to download and fill out each template.

US Legal Forms customers just have to log in and get the specific form they need to their My Forms tab. Those, who have not obtained a subscription yet must follow the guidelines listed below:

- Make sure the Annual Minutes - North Carolina is eligible for use where you live.

- If available, look through the description and make use of the Preview option just before downloading the templates.

- If you are sure the document meets your needs, click Buy Now.

- If the form is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

Right after downloading, you are able to fill out the Annual Minutes - North Carolina manually or an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Nc Annual Application Form popularity

Nc Annual Other Form Names

Nc Annual Agreement FAQ

What are corporate minutes? Corporate minutes are used to record the minutes spent in corporate or professional meetings. These minutes need to be recorded in order for a corporation to retain their legal status. This is especially true of non-profit or limited liability status organizations.

Background The North Carolina annual report must be filed by all domestic or foreign business corporations, limited liability companies (LLCs), limited liability partnerships (LLPs) and limited liability limited partnerships (LLLPs) that are registered with the Secretary of State to do business in North Carolina.

North Carolina Annual Report Cost The North Carolina Annual Report filing fee for a Corporation is $20 and a Limited Liability Company is $200.

The annual meeting usually includes the following activities: Election of directors whose terms are up for renewal or to fill vacancies on the board of directors. Declaration of a dividend or changes in the dividend policy. Review of the corporation's annual report.

The meeting's date, time, and location. Who wrote the minutes. The names of the members in attendance. Brief description of the meeting agenda. Details about what the members discussed. Decisions made or voting actions taken. The time that the meeting adjourned.

What Are Annual Meeting Minutes? Corporate annual meeting minutes serve as a record of a business's annual meeting. Most states except for Delaware, Kansas, Nevada, North Dakota, and Oklahomarequire corporations to keep meeting minutes (this applies to the Board of Directors meetings, too).

This is a business scheme and not necessary. Businesses are not required to order a Certificate of Existence as a step in the formation process.This company is using public information on the records of the Secretary of State's office to solicit North Carolina businesses.

The State of North Carolina requires you to file an annual report for your LLC. You can mail in the report or complete it online at the Secretary of State website.

Even though states do not legally require LLCs to submit meeting minutes, holding annual meetings and keeping a record of what was discussed demonstrate that an entity is abiding by its business compliance formalities.