North Carolina Mediator's Declaration of Interest for Workers' Compensation

Description

How to fill out North Carolina Mediator's Declaration Of Interest For Workers' Compensation?

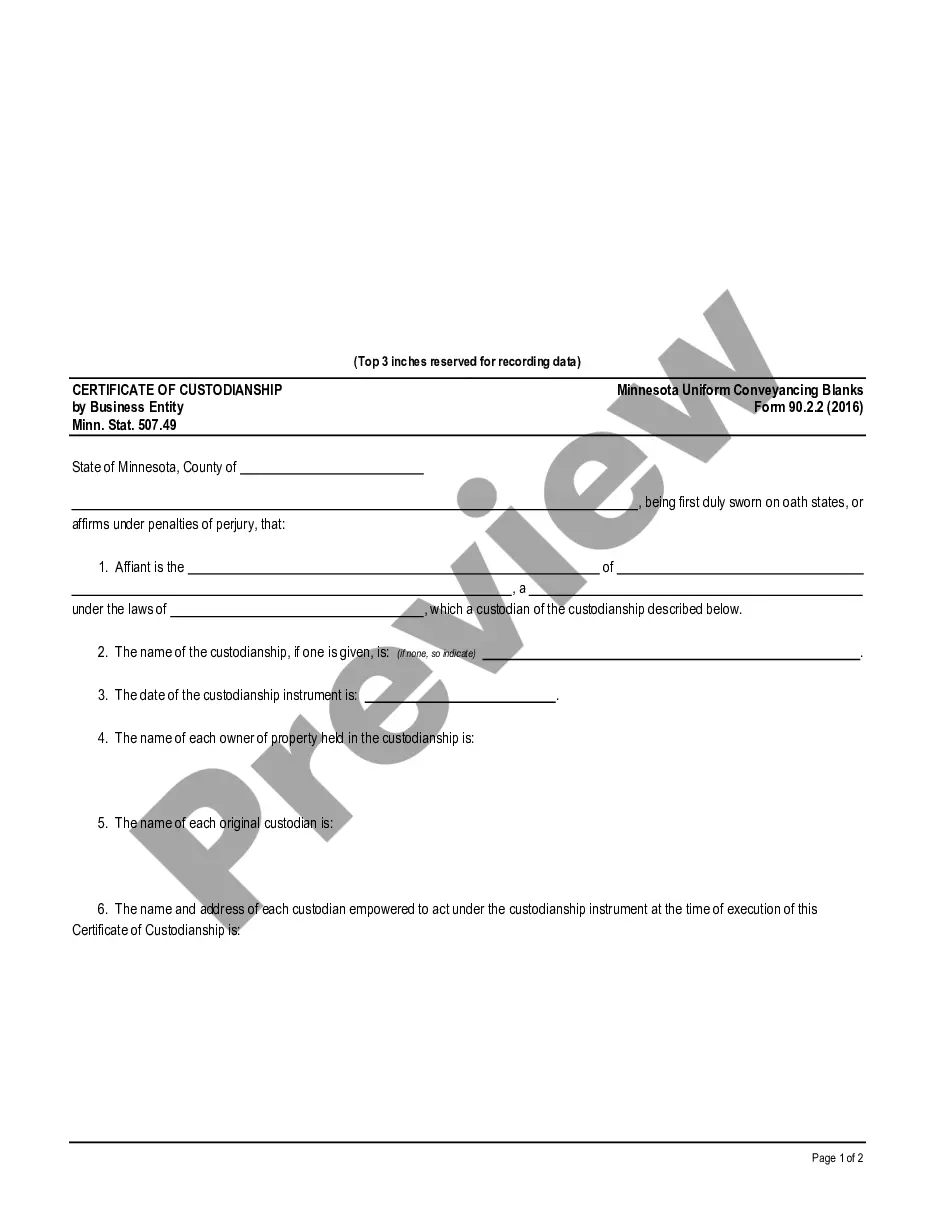

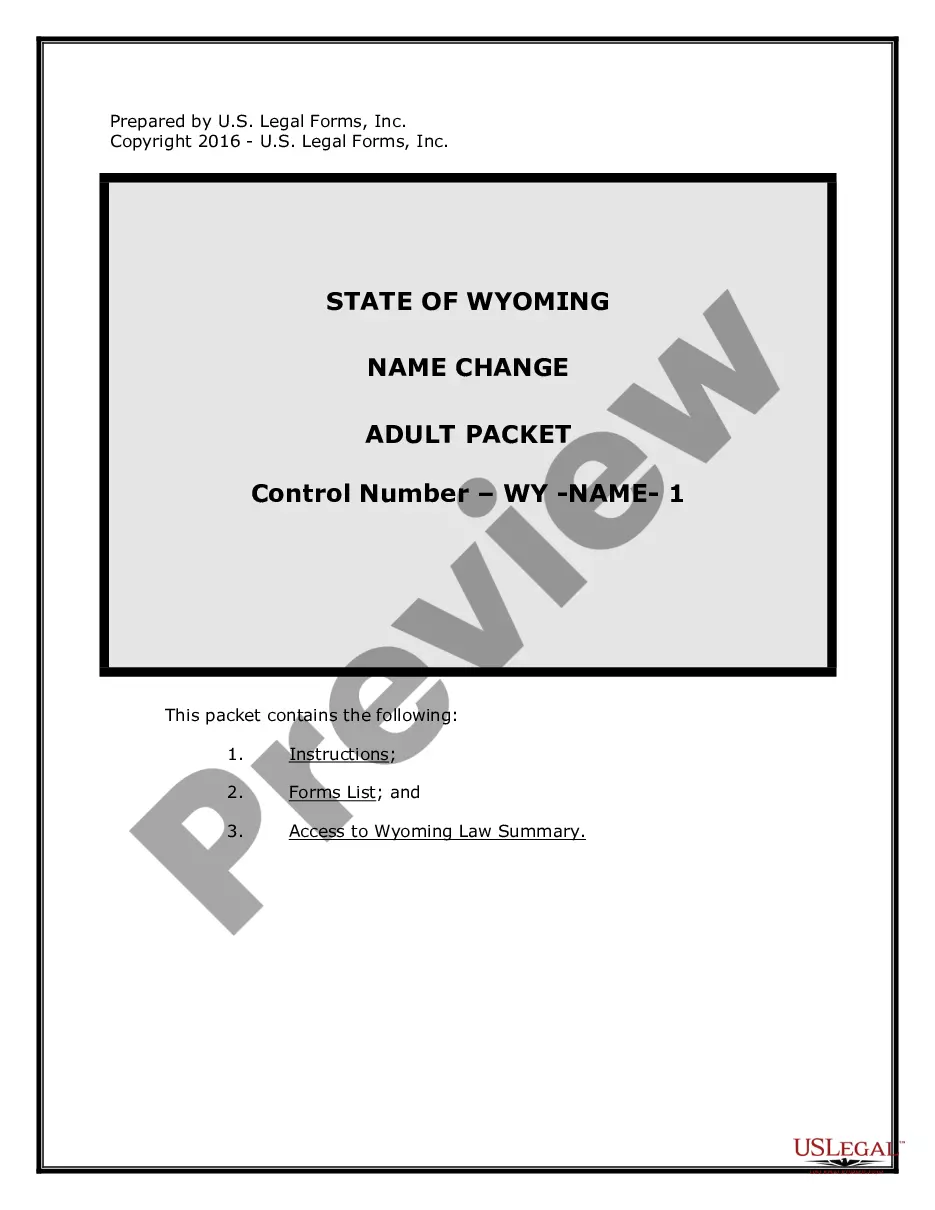

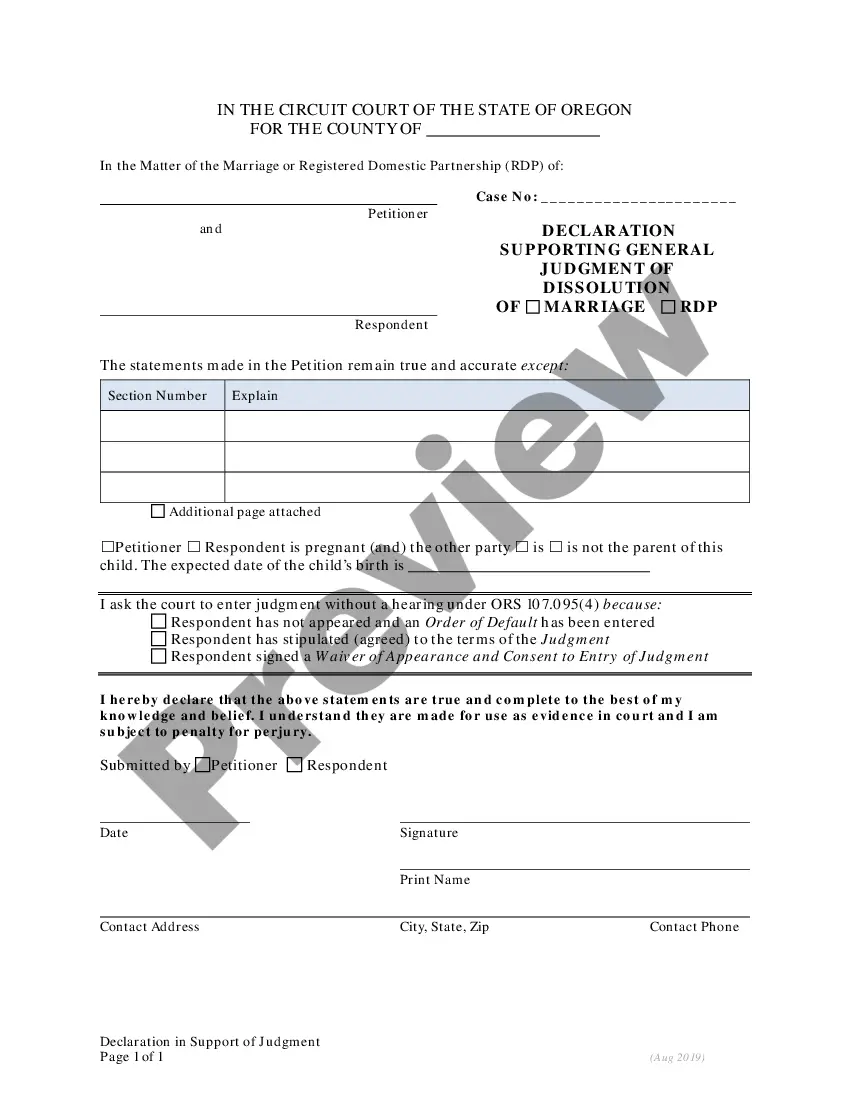

Avoid costly lawyers and find the North Carolina Mediator's Declaration of Interest for Workers' Compensation you need at a affordable price on the US Legal Forms site. Use our simple categories function to find and download legal and tax forms. Read their descriptions and preview them prior to downloading. Additionally, US Legal Forms enables users with step-by-step tips on how to obtain and complete every single template.

US Legal Forms subscribers just need to log in and get the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet must follow the guidelines below:

- Make sure the North Carolina Mediator's Declaration of Interest for Workers' Compensation is eligible for use in your state.

- If available, read the description and make use of the Preview option prior to downloading the templates.

- If you’re confident the template meets your needs, click Buy Now.

- In case the form is wrong, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Select obtain the document in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to your device or print it out.

After downloading, it is possible to complete the North Carolina Mediator's Declaration of Interest for Workers' Compensation manually or with the help of an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

North Carolina now ranks no higher than third in the three major categories of taxes. North Carolina went from having the highest top personal income tax rate in 2010 to third higher only than Tennessee, which doesn't tax earned income.

A. The Basic Rate: The California Constitution allows parties to contract for interest on a loan primarily for personal, family or household purposes at a rate not exceeding 10% per year.

What you may not know is that, on a federal level, there is no maximum interest a credit card company can charge. However, cardholders can find a bit of security in the CARD act and usury laws, which set limits on a state by state basis.

Usury laws control the amount if interest that can be charged when money is lent or credit extended. In California certain loans and consumer loans cannot have interest rates that exceed 10%.

As of Thursday, April 22, 2021, current rates in North Carolina are 3.10% for a 30-year fixed, 2.44% for a 15-year fixed, and 3.25% for a 5/1 adjustable-rate mortgage (ARM). Bankrate has offers for North Carolina mortgage and refinances from top partners that are well below the national average.