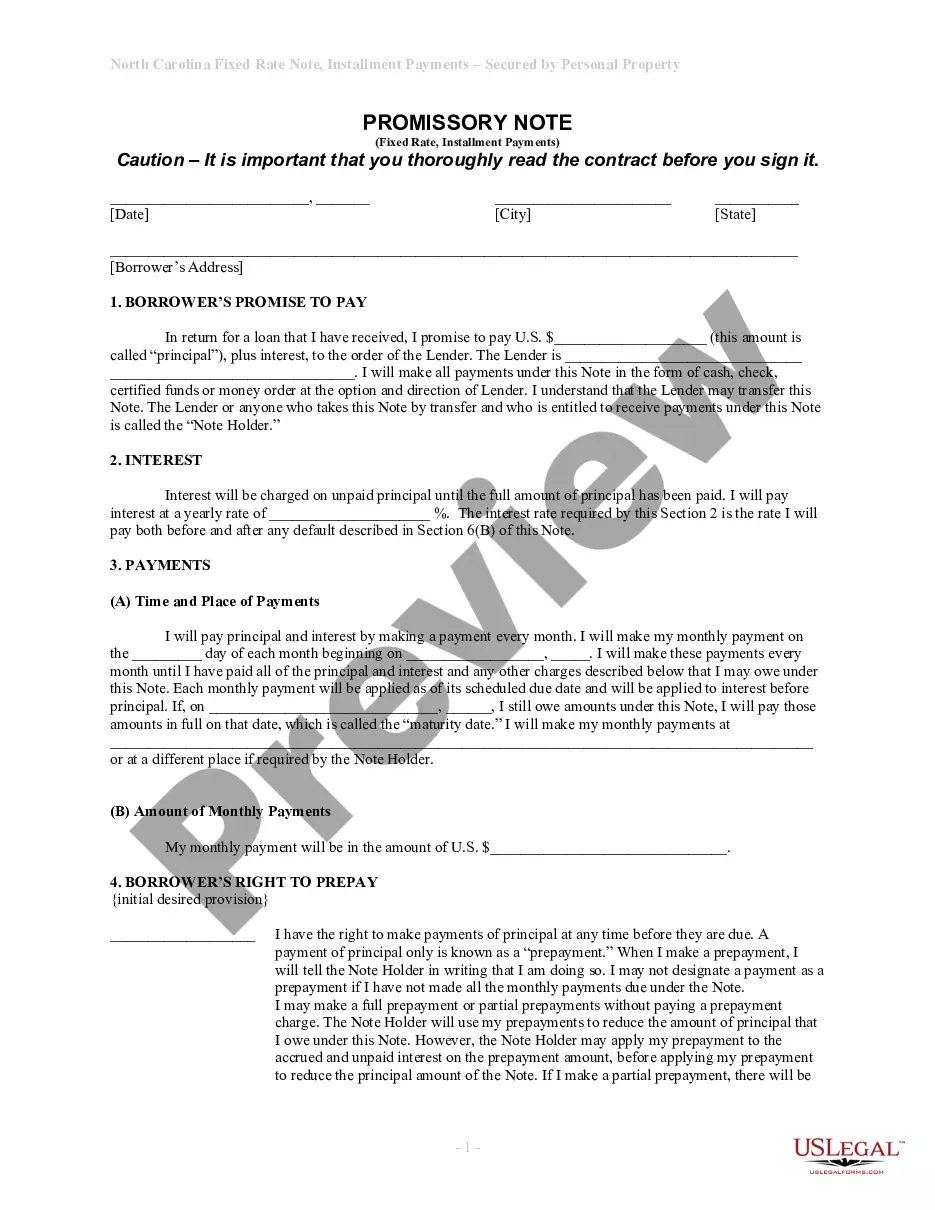

North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property

Description Promissory Note Property

How to fill out Fixed Note Personal?

Avoid expensive attorneys and find the North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property you need at a reasonable price on the US Legal Forms site. Use our simple groups function to search for and obtain legal and tax forms. Read their descriptions and preview them just before downloading. In addition, US Legal Forms provides customers with step-by-step tips on how to download and fill out every single form.

US Legal Forms clients merely must log in and download the particular form they need to their My Forms tab. Those, who haven’t got a subscription yet need to follow the tips below:

- Make sure the North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property is eligible for use where you live.

- If available, read the description and use the Preview option just before downloading the sample.

- If you’re confident the template is right for you, click Buy Now.

- If the template is wrong, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Select download the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to the device or print it out.

Right after downloading, it is possible to complete the North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property by hand or an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Promissory Personal Property Form popularity

Installments Promissory Note Other Form Names

North Carolina Promissory Note FAQ

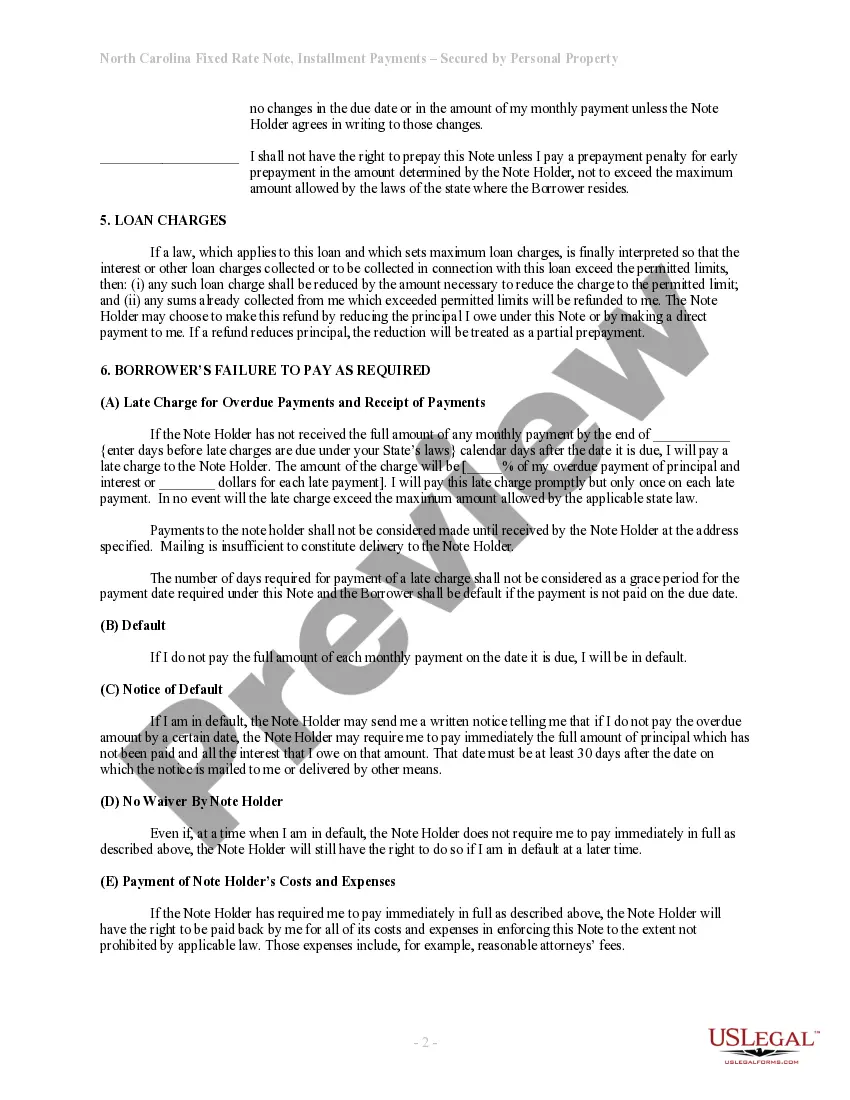

Date. The promissory note should include the date it was created at the top of the page. Amount. Loan terms. Interest rate. Collateral. Lender and borrower information. Signatures.

To write a promissory note for a personal loan, you will need to include the names of both parties, the principal balance, the APR, and any fees that are part of the agreement. The promissory note should also clearly explain what will happen if the borrower pays late or does not pay the loan back at all.

What Is a Promissory Note? A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

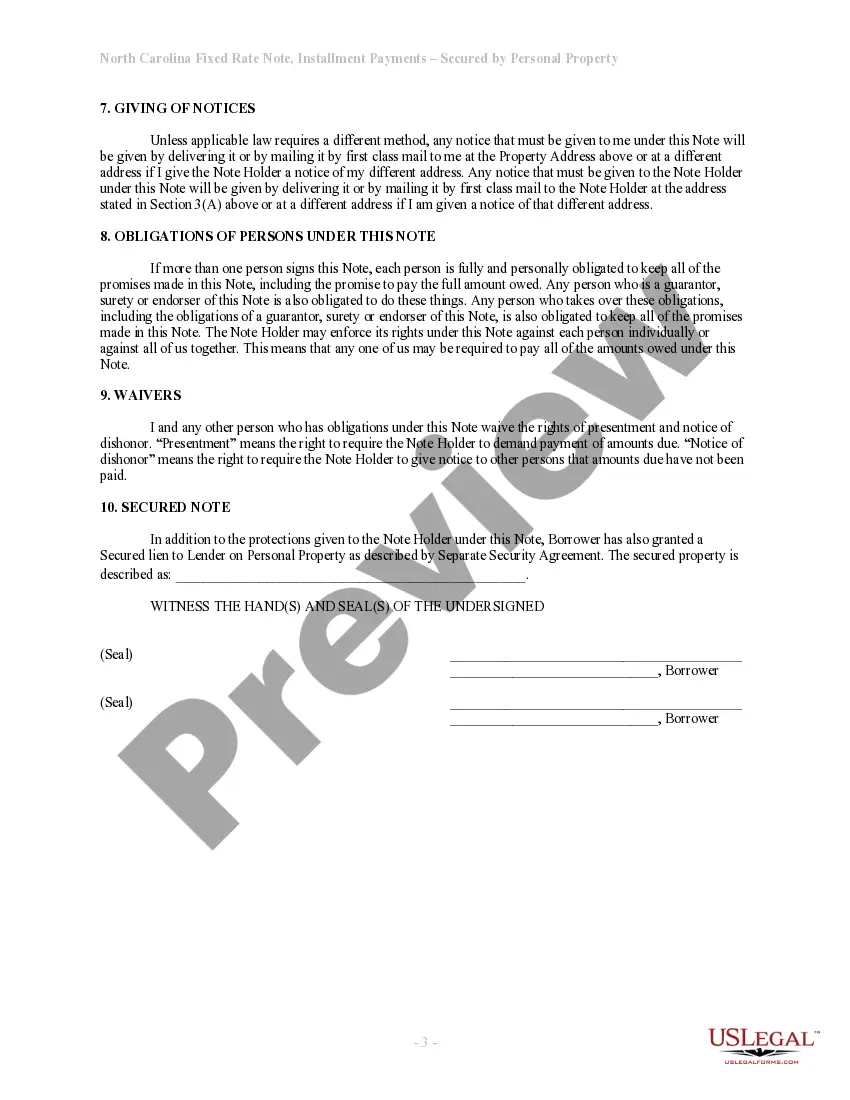

The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.

A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

When a loan changes hands, the promissory note is endorsed (signed over) to the new owner of the loan. In some cases, the note is endorsed in blank which makes it a bearer instrument under Article 3 of the Uniform Commercial Code. So, any party that possesses the note has the legal authority to enforce it.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

What is the difference between a Promissory Note and a Loan Agreement? Both contracts evidence a debt owed from the Borrower to the Lender, but the Loan Agreement contains more extensive clauses than the Promissory Note. Further, only the Borrower signs the promissory note while both parties sign a loan agreement.