Annual Minutes for a North Carolina Professional Corporation

Description Nc Annual File

How to fill out Annual Minutes For A North Carolina Professional Corporation?

Avoid expensive lawyers and find the Annual Minutes for a North Carolina Professional Corporation you need at a affordable price on the US Legal Forms website. Use our simple categories functionality to find and obtain legal and tax forms. Read their descriptions and preview them before downloading. Additionally, US Legal Forms enables users with step-by-step tips on how to download and complete each and every template.

US Legal Forms subscribers simply need to log in and obtain the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet should follow the tips below:

- Ensure the Annual Minutes for a North Carolina Professional Corporation is eligible for use where you live.

- If available, read the description and use the Preview option prior to downloading the templates.

- If you’re sure the document is right for you, click on Buy Now.

- If the form is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Select obtain the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the form to your device or print it out.

After downloading, you may fill out the Annual Minutes for a North Carolina Professional Corporation by hand or with the help of an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Annual reports are entity information updates due to the secretary of state each year. LLCs, corporations, and nonprofits are required to file annual reports to maintain good standing. Due dates, filing fees, and forms vary greatly by entity type and whether the entity is domestic or foreign to the state.

Professional corporations, professional LLCs, and nonprofit corporations do not have to file annual reports in North Carolina.

Determine If You Need To File an Annual Report. Every state has its own annual report requirements. Find Out When the Annual Report is Due. Complete the Annual Report Form. File Annual Report. Repeat the Process for Other States Where You're Registered to Do Business. Set Up Reminders for Your Next Annual Report Deadline.

If you've incorporated as a business As an LLC, LLP, S-Corp or C-Corp, you must file an annual report, normally with your state's Secretary of State. This applies no matter how big or small your business is. Typically, sole proprietors and partnerships do not have to file an annual report.

The State of North Carolina requires you to file an annual report for your LLC.The annual report must be filed each year by April 15 except that new LLCs don't need to file a report until the first year after they're created. The filing fee is $200.

Determine If You Need To File an Annual Report. Every state has its own annual report requirements. Find Out When the Annual Report is Due. Complete the Annual Report Form. File Annual Report. Repeat the Process for Other States Where You're Registered to Do Business. Set Up Reminders for Your Next Annual Report Deadline.

Background The North Carolina annual report must be filed by all domestic or foreign business corporations, limited liability companies (LLCs), limited liability partnerships (LLPs) and limited liability limited partnerships (LLLPs) that are registered with the Secretary of State to do business in North Carolina.

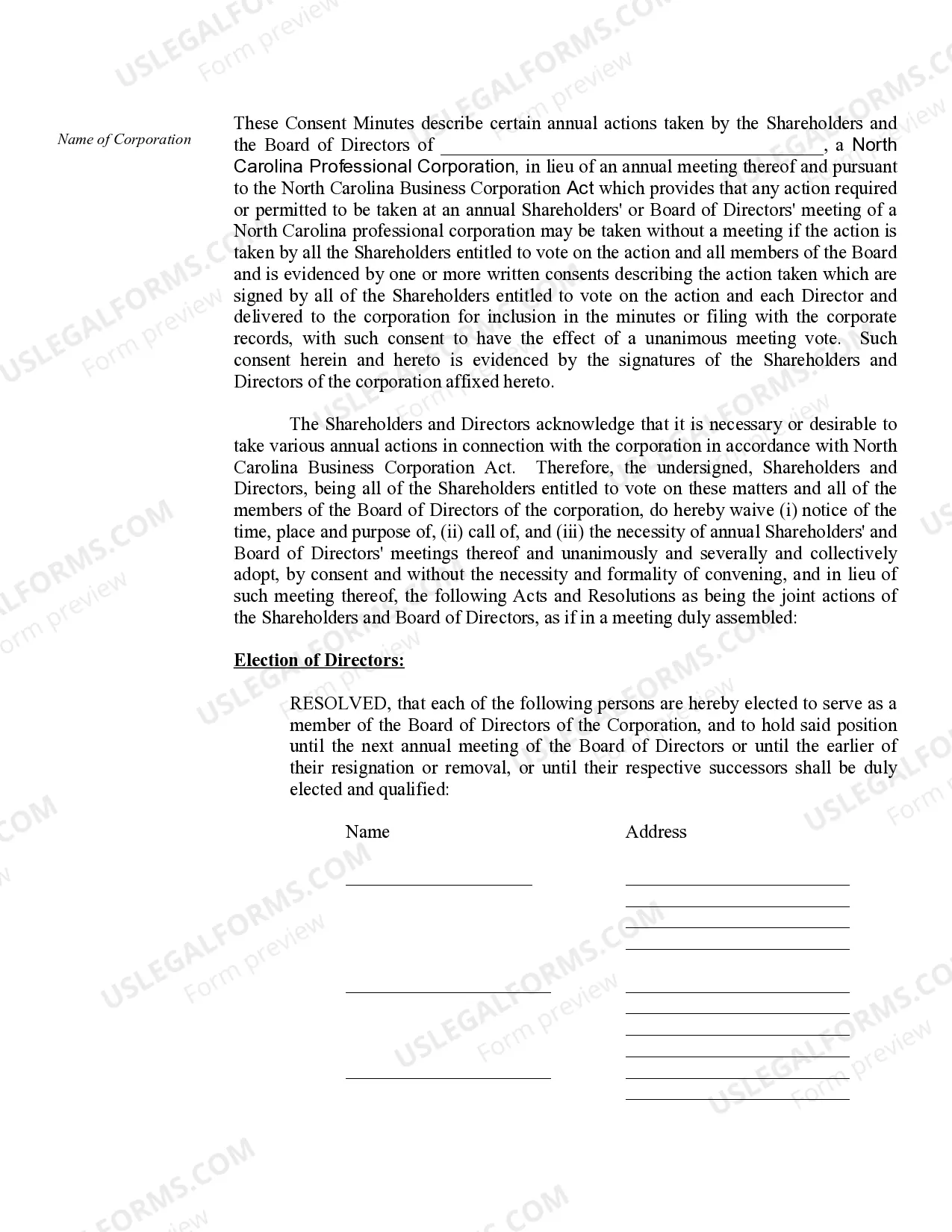

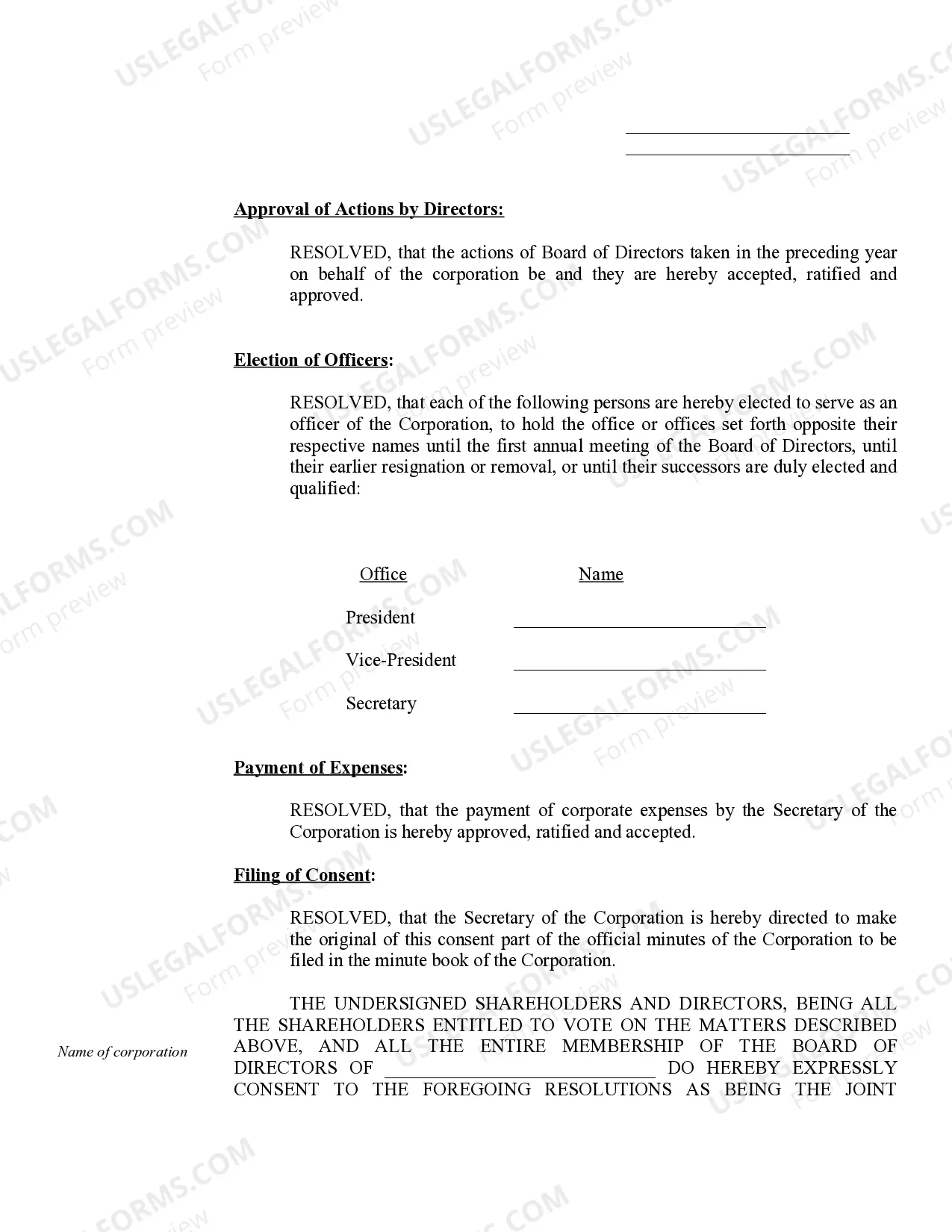

A business should keep its minutes for at least seven years, and make them available to members of the corporation (e.g., shareholders, directors, and officers) who make a reasonable request to review them. There is no requirement to file annual stockholder meeting minutes with the state or other government agency.