Organizational Minutes for a North Carolina Professional Corporation

Description Nc Corporation Complete

How to fill out Nc Minutes Corporation?

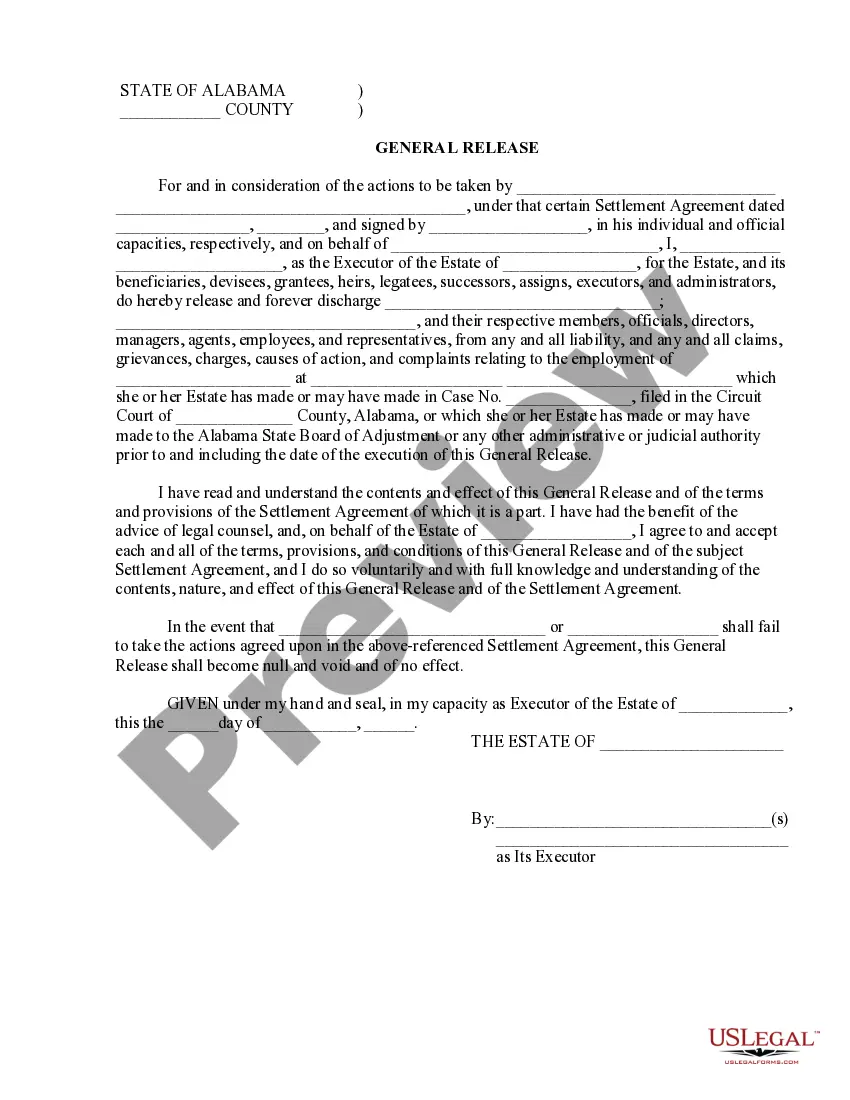

Avoid pricey lawyers and find the Organizational Minutes for a North Carolina Professional Corporation you want at a affordable price on the US Legal Forms website. Use our simple groups function to search for and download legal and tax documents. Read their descriptions and preview them prior to downloading. Moreover, US Legal Forms provides users with step-by-step instructions on how to download and fill out every single form.

US Legal Forms clients just have to log in and obtain the particular document they need to their My Forms tab. Those, who have not got a subscription yet should stick to the tips below:

- Ensure the Organizational Minutes for a North Carolina Professional Corporation is eligible for use in your state.

- If available, look through the description and use the Preview option well before downloading the sample.

- If you are sure the template fits your needs, click on Buy Now.

- If the template is incorrect, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Select obtain the document in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, you can complete the Organizational Minutes for a North Carolina Professional Corporation manually or by using an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Nc Corporation Download Form popularity

A Professional Corporation Other Form Names

Nc Corporation Paper FAQ

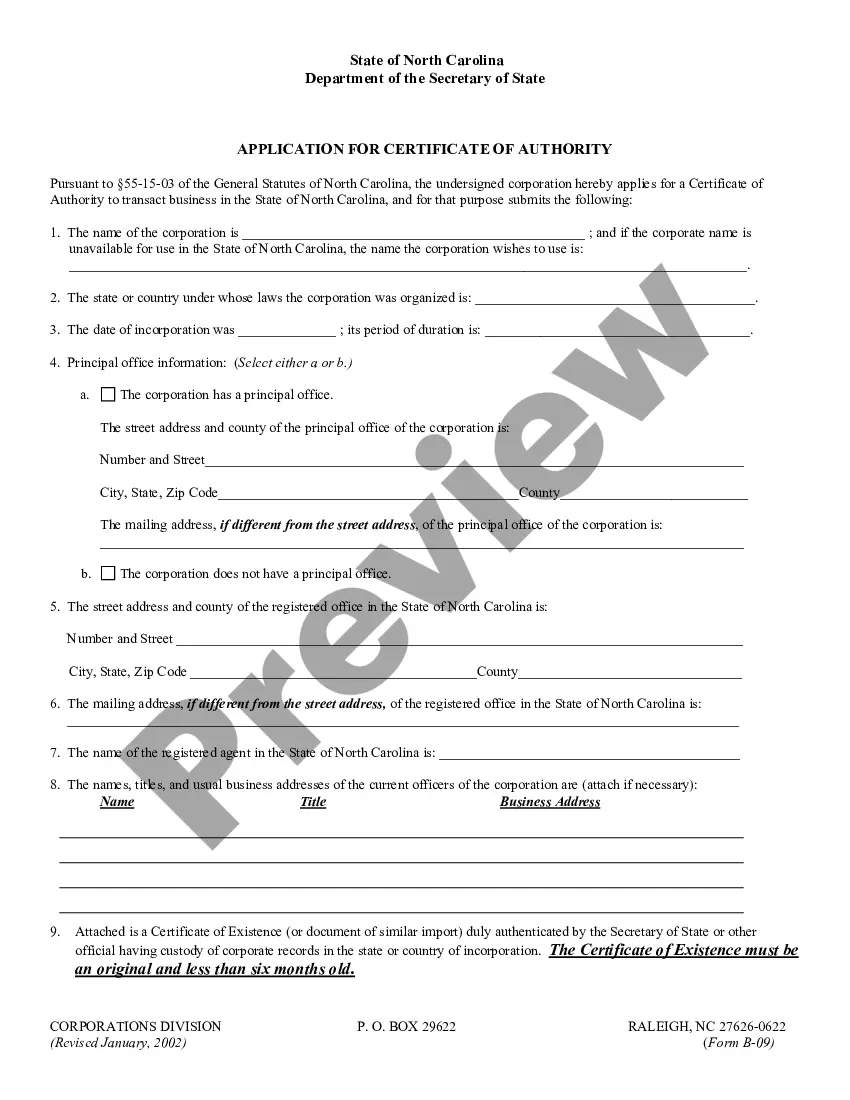

A company seal is required by law and must be used on all official documents. A company seal or common seal is a requirement of the law and must contain the company's tax registration number. A corporate or company seal and stamp is a legal requirement.

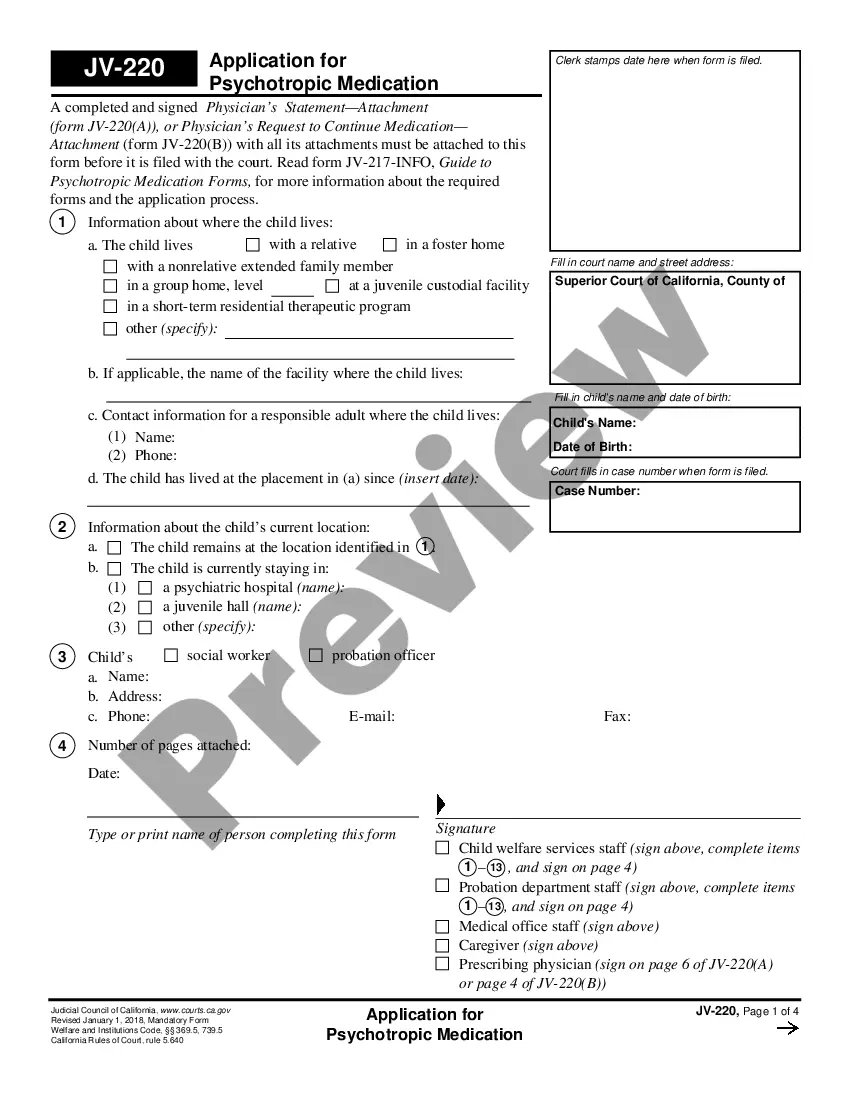

Professional corporations, professional LLCs, and nonprofit corporations do not have to file annual reports in North Carolina.

Most importantly, a professional corporation is classified as a regular or "C" corporation by the Internal Revenue Service. The corporation is considered a taxpayer under Subchapter C of the tax code and must file an annual federal income tax return and pay taxes on net income at a corporate tax rate.

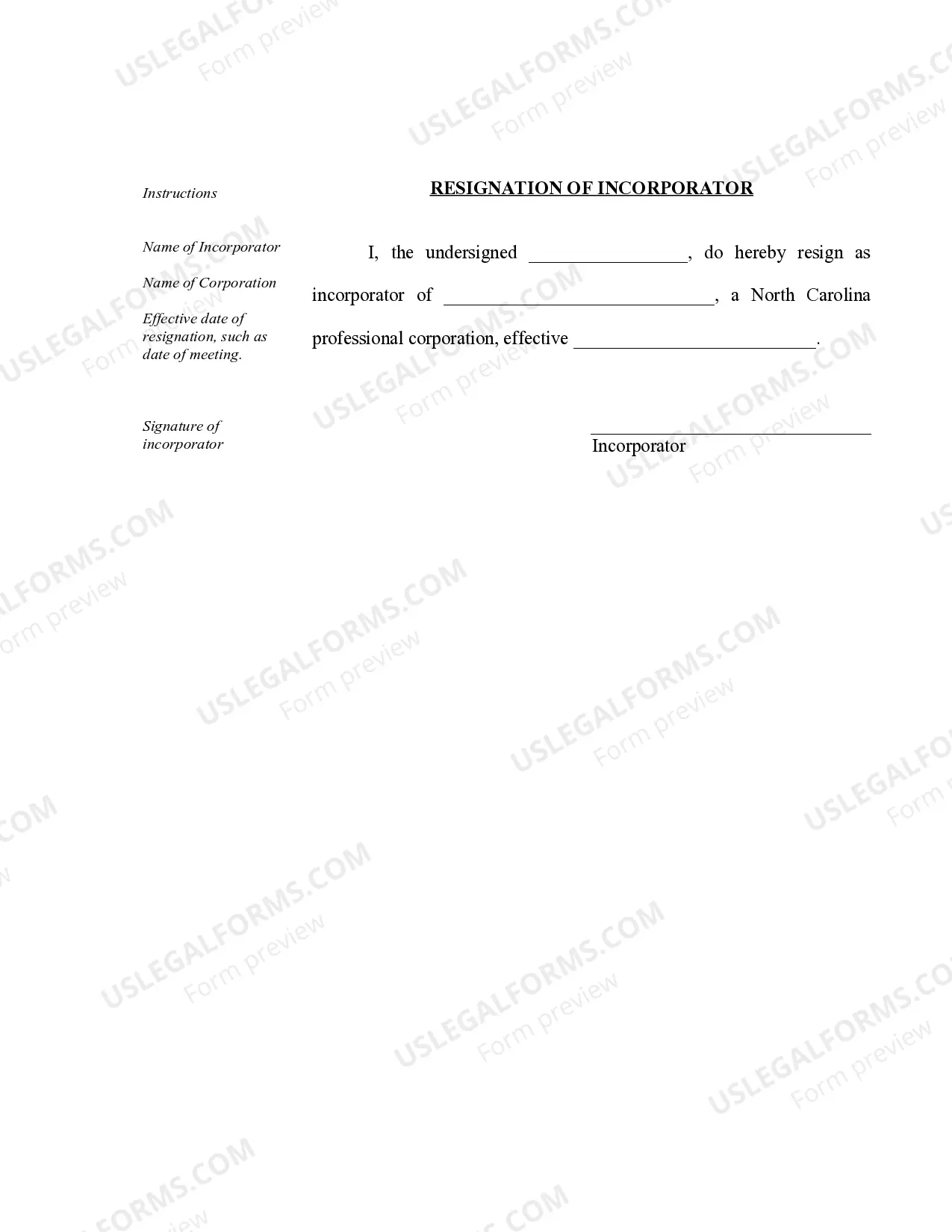

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.

The company seal, sometimes called a corporate seal, is a tool used to stamp or emboss your company's important documents in order to show the document is certified by, and agreed upon by, the Board of Directors of the company.

The use of a corporate seal is permissible, but it is not required. d83ddc49California Corporations Code section 207(a) it authorizes a corporation to adopt, use and alter a corporate seal at will, but FAILURE TO AFFIX A SEAL on a document DOES NOT AFFECT the document's VALIDITY.

All documents, including but not limited to deeds, deeds of trust, and mortgages, required or permitted by law to be executed by corporations, shall be legally valid and binding when a legible corporate stamp which is a facsimile of its seal is used in lieu of an imprinted or embossed corporate seal.

When company documents are signed the stamp is affixed near the signatures on the document. Therefore, it is used on a variety of corporate documents (e.g. contracts, agreements, minutes of meetings, etc.).