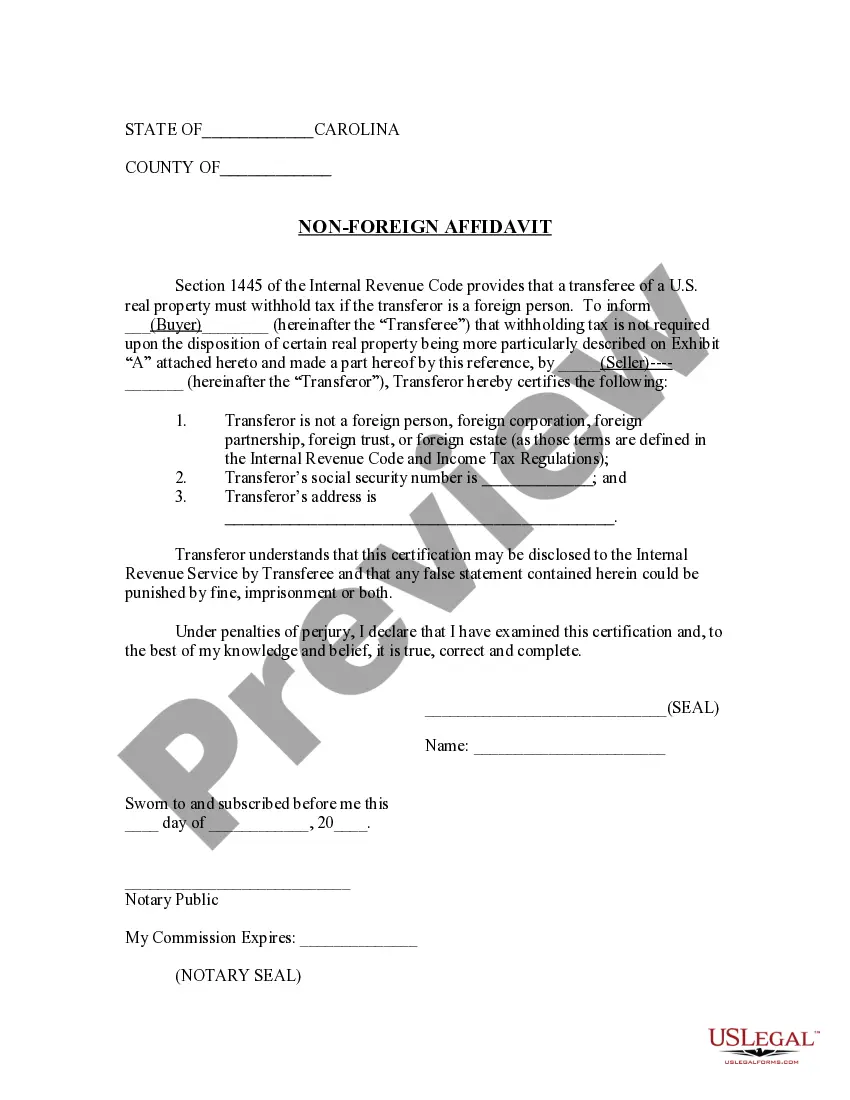

A North Carolina Non-Foreign Affidavit is a legal document used to prove that a business entity is not registered in any foreign country or jurisdiction. This document is required when a company applies for a Certificate of Authority to do business in North Carolina. It is also used for obtaining a Certificate of Good Standing and other certificates from the Secretary of State. There are three types of North Carolina Non-Foreign Affidavits: a Domestic Entity Non-Foreign Affidavit, a Foreign Entity Non-Foreign Affidavit, and a Foreign Limited Liability Company Non-Foreign Affidavit. The Domestic Entity Non-Foreign Affidavit is filed by domestic corporations, limited liability companies, limited partnerships, and limited liability partnerships. The Foreign Entity Non-Foreign Affidavit is filed by foreign corporations, foreign limited liability companies, foreign limited partnerships, and foreign limited liability partnerships. The Foreign Limited Liability Company Non-Foreign Affidavit is filed by foreign limited liability companies.

North Carolina Non- Foreign Affidavit

Description

How to fill out North Carolina Non- Foreign Affidavit?

US Legal Forms is the most simple and cost-effective way to locate appropriate formal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and verified by attorneys. Here, you can find printable and fillable templates that comply with federal and local laws - just like your North Carolina Non- Foreign Affidavit.

Obtaining your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted North Carolina Non- Foreign Affidavit if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make certain you’ve found the one corresponding to your needs, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you like most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your North Carolina Non- Foreign Affidavit and save it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more efficiently.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the corresponding official paperwork. Give it a try!

Form popularity

FAQ

The Affidavit is the form that is used by the seller to certify under Penalty of Perjury that the seller is not a foreign seller. Generally, the escrow company or agents involved in the underlying sale will be responsible for facilitating the signatures.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

The transferor gives the transferee a certification stating, under penalties of perjury, that the transferor is not a foreign person. The certification should contain the transferor's name, U.S. taxpayer identification number, and home address (or office address, in the case of an entity).

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an individual General Partner of the Company, by a responsible officer of a corporate General Partner of the Company (or of the Company, if the Company is a corporation), or by the trustee, executor, or equivalent fiduciary of

Certification of nonforeign status. The transferor provides a certification of nonforeign status signed under penalties of perjury that states that the transferor is not a foreign person, and provides the transferor's name, TIN, and address.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.