North Carolina Chattel Mortgage on Mobile Home — A Comprehensive Description In North Carolina, a Chattel Mortgage on a mobile home refers to a legal agreement that allows a lender to claim a security interest in a mobile home until the loan is fully repaid. This type of mortgage is specifically designed for mobile homes instead of traditional immovable properties. It provides a structured method for individuals or businesses to finance the purchase or refinance of a mobile home, while allowing the lender to seize the property in case of default. Keywords: North Carolina Chattel Mortgage, mobile home, legal agreement, security interest, loan repayment, finance purchase, refinance, seize property, default. Types of North Carolina Chattel Mortgage on Mobile Home: 1. Traditional Chattel Mortgage: This is the most common type of chattel mortgage, where the mobile home serves as collateral for the loan. Under this arrangement, the lender has the legal right to repossess the mobile home if the borrower fails to repay the loan as agreed. The lender's security interest is recorded on the mobile home's title, ensuring their claim is legally protected. 2. Chattel Mortgage Refinance: This type of chattel mortgage allows mobile homeowners in North Carolina to refinance an existing loan with better terms, such as lower interest rates or extended repayment periods. Refinancing helps borrowers reduce monthly payments and potentially save money throughout the loan term. 3. Manufactured Home Community Chattel Mortgage: In certain cases, mobile homes are located in manufactured home communities where the land is leased by the homeowner. In such instances, a chattel mortgage serves as a financing tool for both the mobile home and its placement within the community. This type of mortgage allows homeowners to secure financing directly from the community owner or external lenders, ensuring the legal transfer of the lease agreement alongside the loan. 4. Chattel Mortgage Title Elimination: Some mobile homes in North Carolina may still have a traditional mortgage tied to the land they were initially placed on, even if they were later moved. In these cases, a chattel mortgage can be used to eliminate the traditional mortgage lien and replace it with a chattel mortgage on the mobile home alone, making it easier to finance or refinance. 5. Chattel Mortgage with Land Purchase: This variant of a chattel mortgage involves the purchase of both the mobile home and the land it sits on. In North Carolina, some mobile homes are permanently affixed to the land they occupy, converting the property into real estate. A chattel mortgage with a land purchase enables borrowers to secure financing for both the mobile home and the underlying land. It is important for individuals seeking a North Carolina Chattel Mortgage on a mobile home to research and consult with lenders or legal professionals to fully understand the available options, terms, and legal implications associated with each type of mortgage.

North Carolina Chattel Mortgage on Mobile Home

Description

How to fill out North Carolina Chattel Mortgage On Mobile Home?

Are you currently within a situation that you need to have files for sometimes enterprise or individual purposes nearly every day time? There are plenty of legal document templates available on the net, but finding kinds you can depend on isn`t effortless. US Legal Forms gives thousands of kind templates, just like the North Carolina Chattel Mortgage on Mobile Home, which are composed to meet state and federal specifications.

If you are presently acquainted with US Legal Forms site and possess a free account, basically log in. Following that, you can obtain the North Carolina Chattel Mortgage on Mobile Home web template.

If you do not offer an profile and wish to begin using US Legal Forms, abide by these steps:

- Get the kind you will need and ensure it is for the proper metropolis/state.

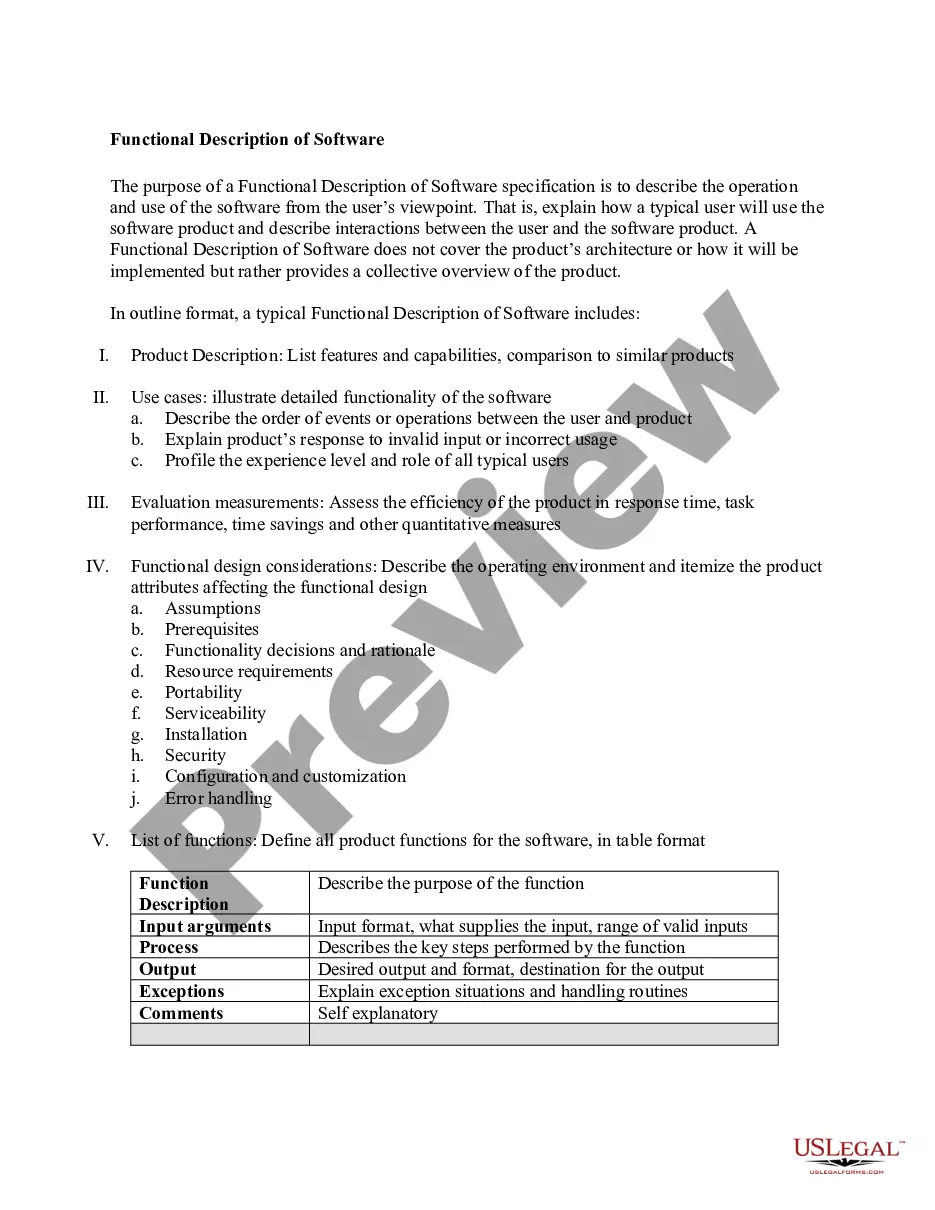

- Use the Review key to examine the shape.

- Browse the information to actually have chosen the correct kind.

- If the kind isn`t what you`re searching for, take advantage of the Lookup industry to discover the kind that meets your requirements and specifications.

- Whenever you obtain the proper kind, simply click Acquire now.

- Pick the rates prepare you need, fill out the required information and facts to make your bank account, and pay money for the transaction with your PayPal or credit card.

- Pick a convenient file format and obtain your copy.

Locate all of the document templates you might have purchased in the My Forms food list. You can obtain a more copy of North Carolina Chattel Mortgage on Mobile Home any time, if possible. Just click on the essential kind to obtain or printing the document web template.

Use US Legal Forms, the most substantial selection of legal varieties, to save lots of time as well as prevent errors. The support gives skillfully manufactured legal document templates which you can use for a selection of purposes. Generate a free account on US Legal Forms and initiate creating your lifestyle a little easier.