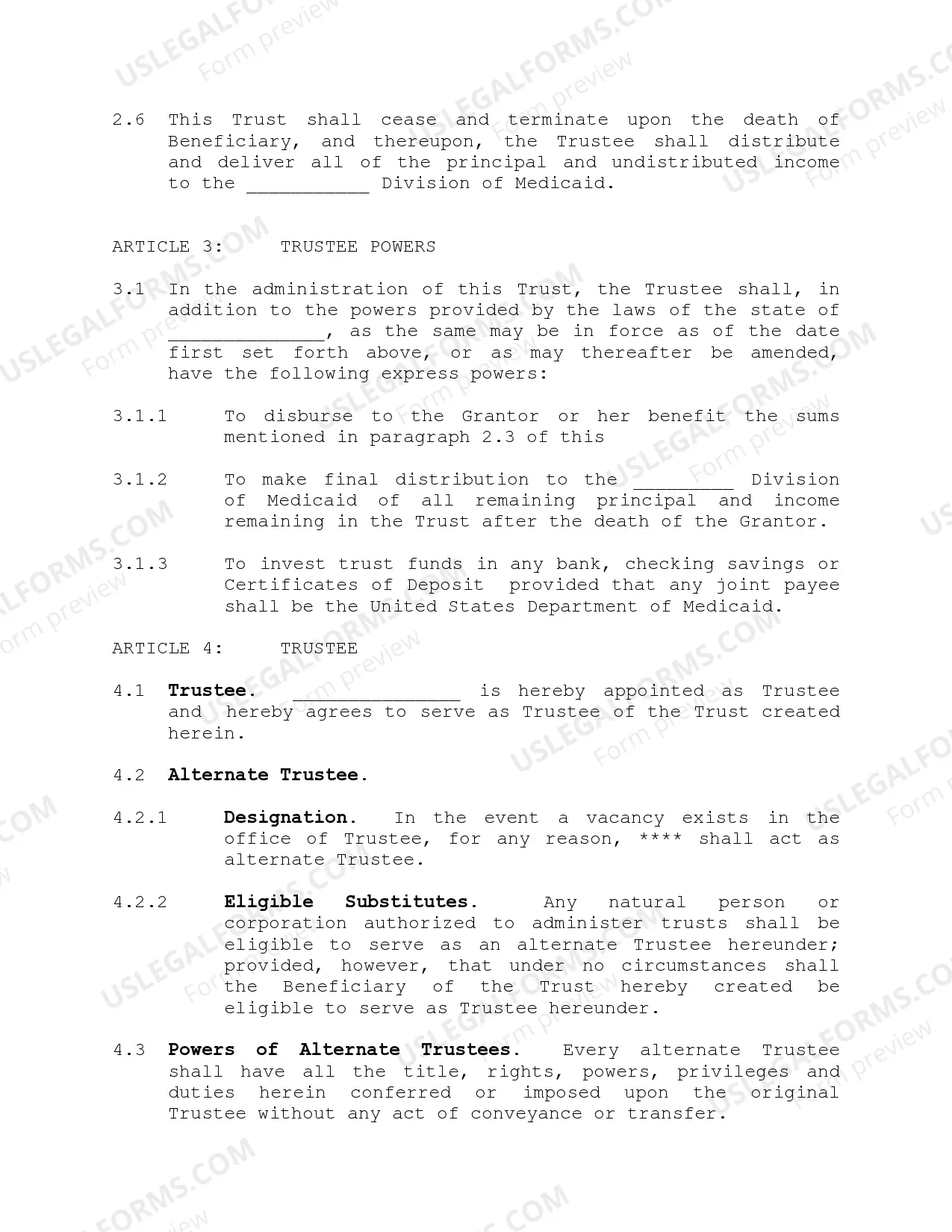

In this agreement, the grantor establishes an income trust and directs that the trustee shall receive unto to the trust all income due to grantor and the trustee will accept such property as the initial trust estate. Other provisions of the agreement include: additions to the trust, the management and disposition of the trust estate, trustee powers, and trust termination.

North Carolina Medicaid Income Trust Form

Description

How to fill out Medicaid Income Trust Form?

US Legal Forms - one of the top libraries of legal documents in the USA - offers a broad range of legal form templates you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the North Carolina Medicaid Income Trust Form in seconds.

If you already have a subscription, Log In and download the North Carolina Medicaid Income Trust Form from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents tab of your account.

If you wish to use US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have chosen the correct form for your city/state. Click the Preview button to examine the form's content. Review the form description to ensure you have selected the appropriate form. If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred pricing plan and provide your credentials to register for an account. Process the payment. Use your credit card or PayPal account to complete the purchase. Choose the format and download the form to your device. Make changes. Fill out, edit, print, and sign the downloaded North Carolina Medicaid Income Trust Form. Every template you add to your account has no expiration date and belongs to you indefinitely. Thus, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Access the North Carolina Medicaid Income Trust Form with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

The maximum income limit for Medicaid eligibility in North Carolina can vary based on household size and specific program guidelines. Generally, individuals must have an income that falls below a certain threshold to qualify. If your income exceeds this limit, consider the North Carolina Medicaid Income Trust Form as a tool to potentially reduce your countable income. This form can help you navigate the complexities of income limits while securing necessary healthcare coverage.

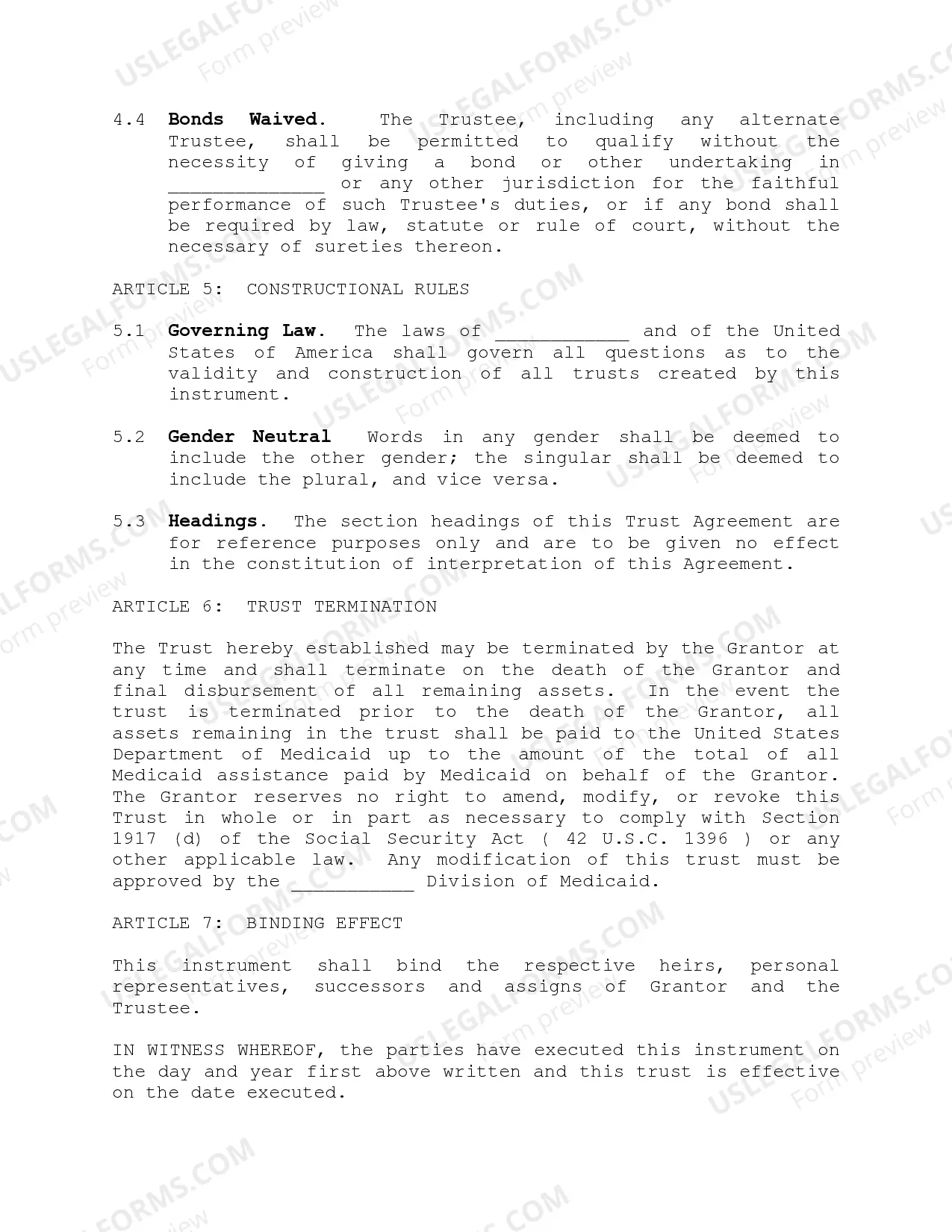

Yes, North Carolina Medicaid does review your financial accounts as part of the eligibility process. They will examine your bank statements, investments, and other assets to determine if you qualify. This is where a North Carolina Medicaid Income Trust Form can be beneficial, as it allows you to exclude certain income from your eligibility calculations. Utilizing this form can help you manage your assets more effectively.

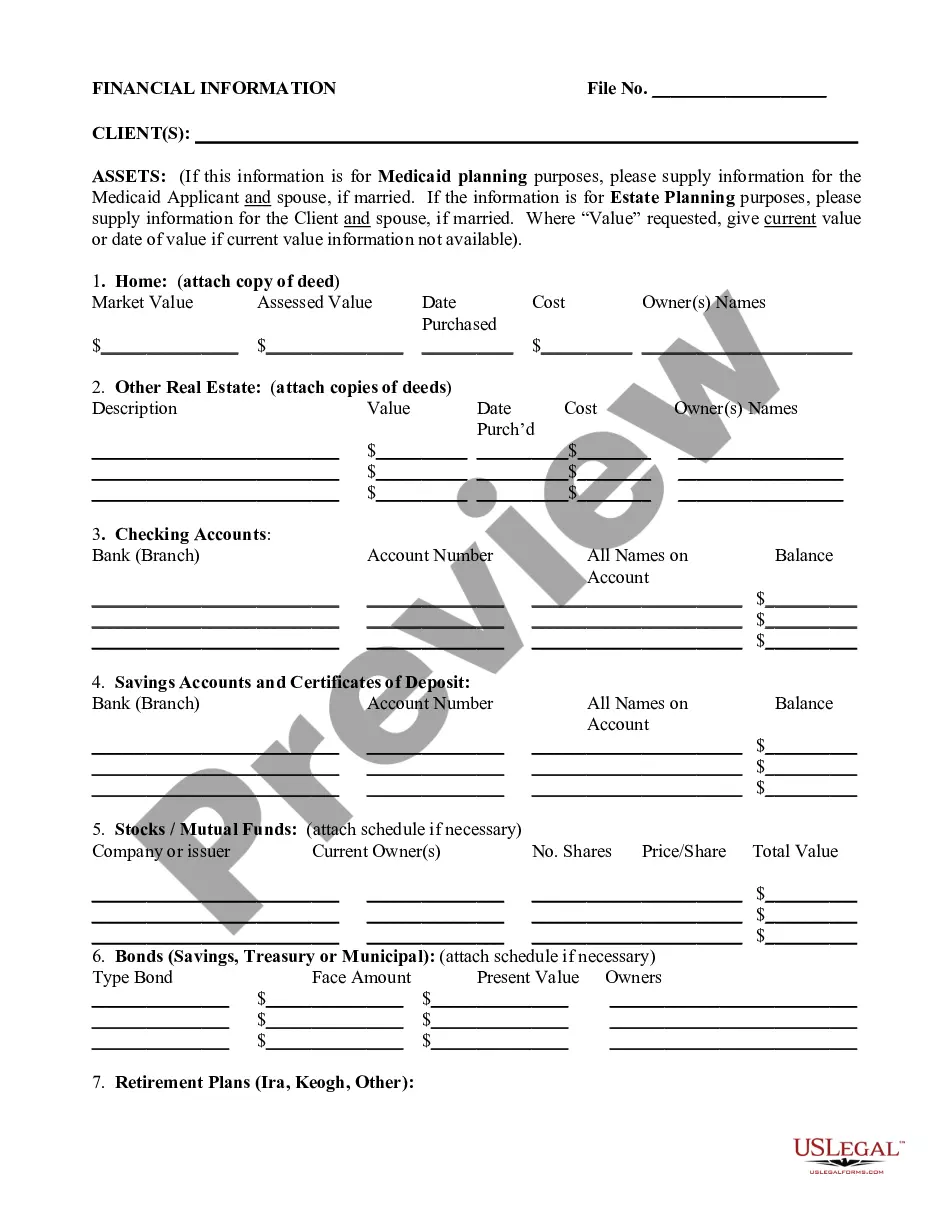

You or a family member might be eligible if you: Live in North Carolina and are a U.S. citizen or documented non-U.S. citizen. Meet income and resource guidelines. Are in one of these groups: Pregnant women. Children under age 21. Low-income individuals and families. Adults age 65 or older. Individuals with disabilities.

North Carolina is expanding who can get Medicaid starting December 1, 2023. Adults ages 19 through 64 earning up to 138% of the federal poverty line (e.g., singles earning about $20,000/year or families of three earning about $34,000/year) may be eligible.

The application processing time standard for Medicaid Assistance to the Disabled (MAD) is 90 calendar days. Application processing time standard is 45 calendar days for all other Medicaid programs, including NCHC. Medicaid applications may be submitted: In-person.

Submitting Requests for Prior Approval The preferred method to submit prior approval requests is online using the NCTracks Provider Portal. However, providers can also submit paper forms via mail or fax. PA forms are available on NCTracks.

Who is eligible for North Carolina Medicaid Program? Household Size*Maximum Income Level (Per Year)5$46,7376$53,5737$60,4098$67,2454 more rows

For Medicaid eligibility, there are also many assets that are considered non-countable (exempt). Exemptions include personal belongings, household furnishings, an automobile, irrevocable burial trusts up to $15,000, and generally one's primary home.

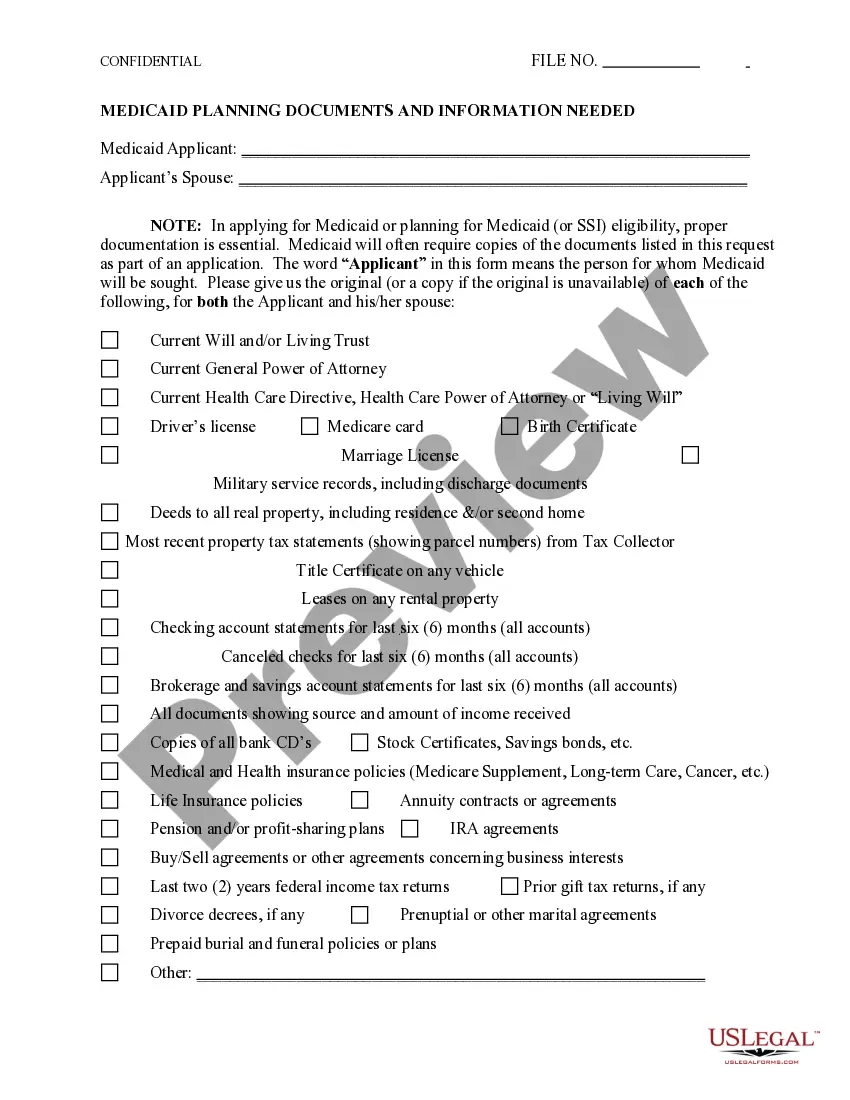

When applying for Medicaid, provide the following information: Birth certificate. Social Security card. Valid photo ID. Proof of citizenship or immigration status (valid US passport, USCIS green card, employment authorization card)

A valid North Carolina drivers' license or other identification card issued by the North Carolina Division of Motor Vehicles. b. A current North Carolina rent, lease, or mortgage payment receipt, or current utility bill in the name of the applicant or the applicant's legal spouse, showing a North Carolina address.