The North Carolina Increase Surplus Account — Resolution For— - Corporate Resolutions is a legal document used in the state of North Carolina to authorize the increase of surplus account for corporations. This form is important for maintaining accurate financial records and complying with state regulations. The purpose of the North Carolina Increase Surplus Account — Resolution For— - Corporate Resolutions is to provide a clear and formal resolution for the increase of surplus account. Surplus account refers to the excess funds or retained earnings that a corporation has accumulated over time. Increasing the surplus account allows corporations to strengthen their financial position, reinvest in their operations, or fulfill specific financial objectives. The form includes various sections and fields that require specific information. The relevant keywords in this form include: 1. Corporation: This refers to the legal entity conducting business activities, eligible to file for an increase in the surplus account. 2. Resolution: This term signifies a formal decision or action taken by a corporation's board of directors or shareholders. It authorizes the increase of the surplus account and outlines the specific details. 3. Increase in Surplus Account: This indicates the desired monetary amount or percentage by which the corporation plans to augment its surplus account. 4. Date: This field requires the specific date when the resolution is passed. 5. Board of Directors: This refers to the group of individuals responsible for overseeing the corporation's operations and making critical decisions. In this case, the board of directors is involved in passing the resolution to increase the surplus account. Types of North Carolina Increase Surplus Account — Resolution For— - Corporate Resolutions may include: 1. Annual Surplus Increase Resolution: This type of resolution form is used for yearly financial planning, enabling corporations to allocate surplus funds for various purposes such as expansion, research and development, or debt repayment. 2. Special Surplus Increase Resolution: This form is used when a corporation needs to increase its surplus account for specific financial objectives or in response to unexpected circumstances. This could include capitalizing on a new business opportunity, acquiring another company, or addressing financial emergencies. In conclusion, the North Carolina Increase Surplus Account — Resolution For— - Corporate Resolutions is a crucial document that allows corporations in North Carolina to formalize their decision to increase surplus accounts. By completing this form correctly and submitting it to the relevant authorities, corporations can stay compliant with state regulations and maintain accurate financial records.

North Carolina Increase Surplus Account - Resolution Form - Corporate Resolutions

Description

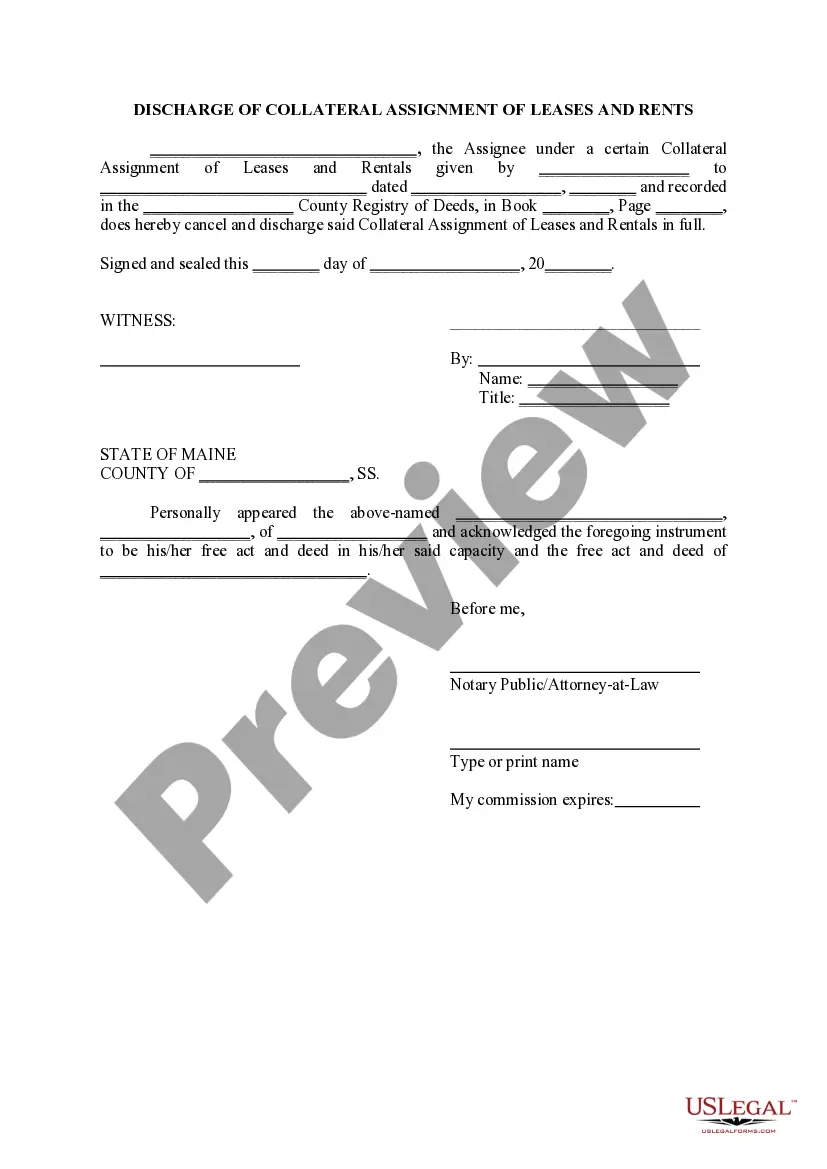

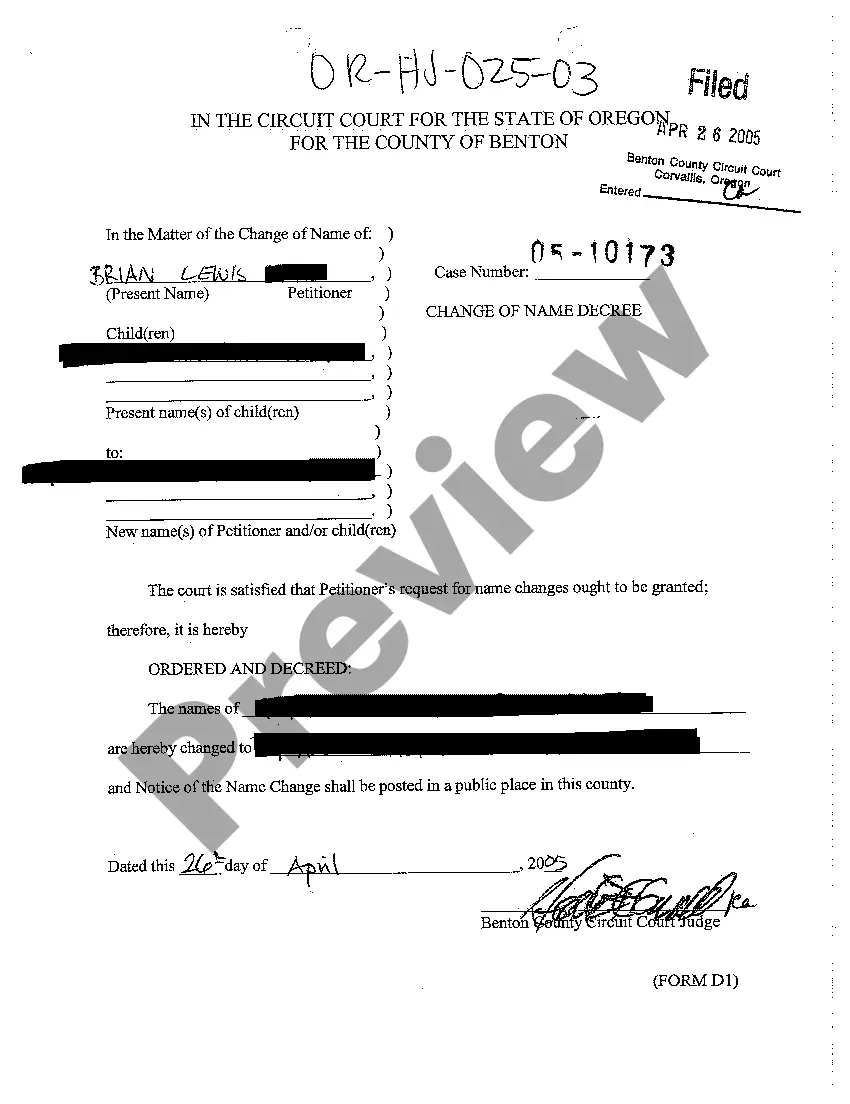

How to fill out North Carolina Increase Surplus Account - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the North Carolina Increase Surplus Account - Resolution Form - Corporate Resolutions in just a few minutes.

Read the form description to confirm that you have picked the correct form.

If the form does not meet your needs, utilize the Search section at the top of the screen to find one that does.

- If you already have an account, login and retrieve the North Carolina Increase Surplus Account - Resolution Form - Corporate Resolutions from the US Legal Forms library.

- The Download button will be displayed on every form you browse.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you have selected the appropriate form for your city/state.

- Click the Review button to examine the form's details.

Form popularity

FAQ

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.

What to Include in a Corporate Resolution FormThe date of the resolution.The state in which the corporation is formed and under whose laws it is acting.Signatures of officers designated to sign corporate resolutionsusually the board chairperson or the corporate secretary.Title the document with its purpose.More items...?

A Corporate Resolution a written statement made by the board of directors detailing which officers are authorized to act on behalf of the corporation. It is also a record of any major decision made by shareholders or a board of directors during a meeting.

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers.Acceptance of the corporate bylaws.Creation of a corporate bank account.Designating which board members and officers can access the bank account.Documentation of a shareholder decision.Approval of hiring or firing employees.More items...

A corporate resolution form is used when a corporation wants to document major decisions made during the year. It is especially important when decisions made by a corporation's directors or shareholders are in written form.

Such processes can be laid out in a corporate resolution form, usually known as the operating agreement. The agreement can also specify whether or not the decision-making is to be agreed upon by all members or a majority of members.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.